If you're a resident of New York, you'll need to fill out a GA 4 form to claim your exemption from paying New York State income taxes. This form can be downloaded from the New York State Department of Taxation and Finance website, and must be filed by April 15th each year. There are several exemptions available, so make sure you carefully read the instructions and fill out the form correctly. Failing to file your GA 4 form on time can result in penalties and interest charges, so it's important to submit your form as soon as possible. For more information on the GA 4 form and other tax-related matters, please visit the New York State Department of Taxation and Finance website. Thank you for your time!

| Question | Answer |

|---|---|

| Form Name | Ga 4 Form New York |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | ga 4 form, quarterly unified employer assessment ga 4, quarterly unified employer assessment ga 4 2020, ga 4 4 18 quarterly unified employer assessment |

QUARTERLY UNIFIED EMPLOYER ASSESSMENT

Municipal

State of New York - Workers' Compensation Board

A. Municipal

1. |

WCB Identification |

|

2. Name of Municipal |

|

|

|

Number: |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

"W Number" |

|

|

|

|

|

|

|

Note: Additional employers covered under the W number shown must be reported on the |

|||

|

|

|

Quarterly Unified Employer Assessment Municipal |

|||

3. |

FEIN: |

|

|

FEIN Addendum |

|

|

4. |

Mailing Address: |

|

|

|

|

|

|

|

|

|

|

||

|

|

Number and Street |

City |

State |

Zip Code |

|

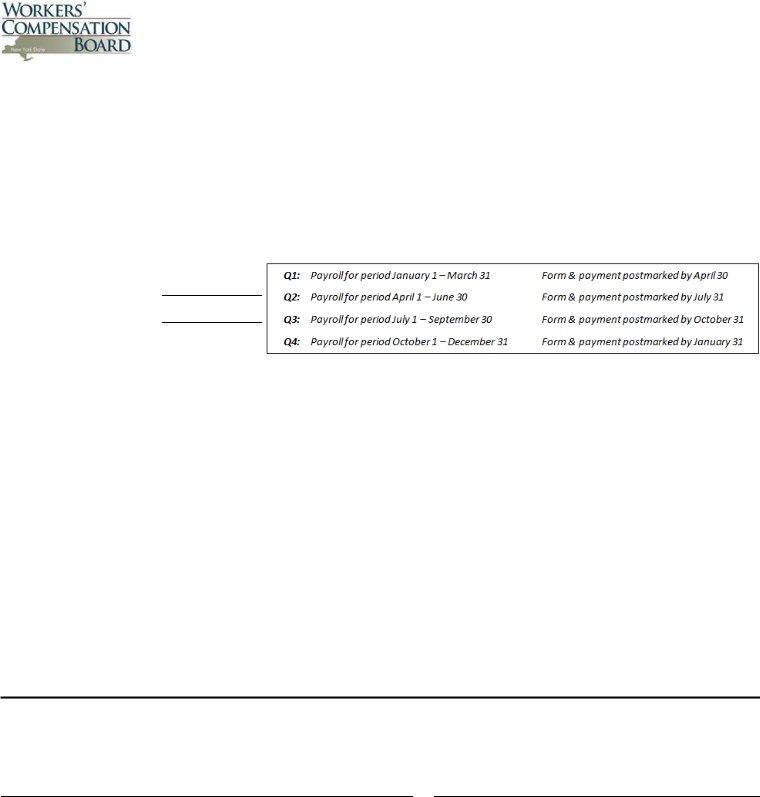

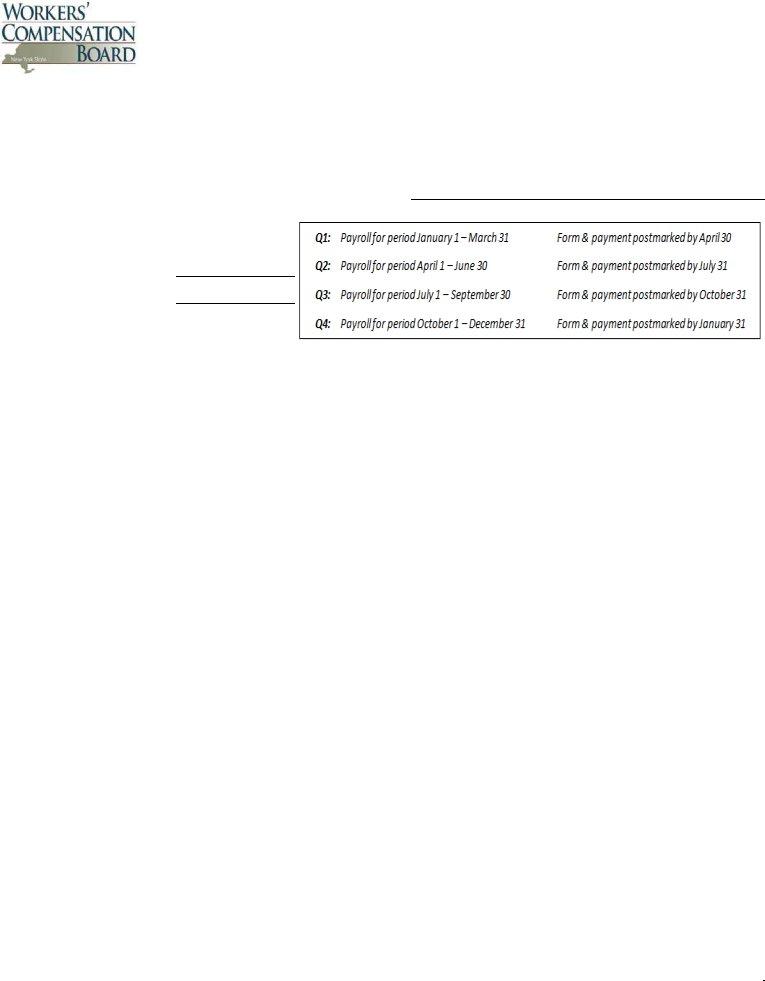

B.Reporting Period

1.Calendar Year:

2.Quarter Ending:

C.Basis for Assessment

|

|

|

|

(5) Total Loss |

|

|

|

(4) Loss Cost Per |

Cost |

|

|

(3) Quarterly |

|

|

(1) Payroll Class |

|

Hundred Dollars |

(3) x (4) divided |

|

Code |

(2) Description |

Payroll Dollars |

of Payroll |

by $100 |

Various |

School District - All Employees |

|

$0.50 |

|

Various |

All Other Municipal Employees |

|

$1.80 |

|

|

(6) Subtotal Payroll |

$0 |

|

|

(7) Excluded Payroll Not Subject to Assessment (if applicable) |

|

|

|

|

|

(8) Total Payroll = (6) + (7) |

$0 |

|

|

|

|

|

(9) Total Loss Cost |

|

|

|

(10) Assessment Rate |

13.8% |

|

|

|

(11) Total Assessment Due |

|

|

|

|

|

|

|

D. Certification

The undersigned certifies that the information presented herein, including all applicable addendums, has been examined

and is a true, correct and complete report made in good faith.

Signature |

|

Title |

|

|

|

Type or Print Name |

|

Date |

|

|

|

Phone Number |

|

(Instructions on Reverse Side) |

Instructions for Completing Quarterly Unified Employer Assessment

Municipal

General Instructions

1.The Quarterly Unified Employer Assessment Municipal

2.Additional municipal employers covered under the W number shown must be reported on the Quarterly Unified Employer Assessment Municipal Self- Insurers Remittance Form - Payroll by FEIN Addendum

3.Questions about the form or process should be directed to WCBFinanceOffice@wcb.ny.gov.

4.Checks are to be made payable to the Chair, NYS Workers' Compensation Board.

5.To ensure the proper application of payment please include W Number and applicable quarter on check.

6.This report and corresponding payment, along with applicable addendum, must be submitted quarterly by every municipal employer actively self- insured for workers' compensation. Employers that discontinued their

Submit completed form via

WCBFinanceOffice@wcb.ny.gov

and mail check to address below

Or mail completed form and check to:

New York State Workers’ Compensation Board

328 State Street

Finance Unit, Room 331

Schenectady, NY

Municipal

1.The WCB Identification Number or "W Number" as assigned to the municipal

2.The Name of the Municipal

3.The FEIN, or Federal Employer Identification Number, must be reported for the municipal

4.The full mailing address of the municipal

Basis for Assessment

1.A blended rate for municipal payroll will be used and there is no need to breakout by class.

2.Payroll must be broken out between employers which are school districts and all other municipal employers.

3.Total quarterly payroll associated with either the school district and/or all other types of municipal

4.The loss cost per hundred dollars of payroll for municipal employers and school districts is set annually by the Chair. The rates are shown on the Quarterly Unified Employer Assessment Municipal

5.The total loss cost is determined by multiplying the payroll by the loss cost shown and dividing by $100.

6.Subtotal of payroll reported on the Quarterly Unified Employer Assessment Municipal

7.Excluded payroll not subject to assessment.

8.With limited exception, total payroll should agree with that reported on the Quarterly Combined Withholding, Wage Reporting and Unemployment

|

Insurance Return |

|

please provide reconciliation. No payroll caps are to be applied. |

9. |

Equal to the sum of all of the loss cost by payroll class shown. |

10. |

The assessment rate for the rating period established by the Chair pursuant to WCL Section 151. This can be found on the WCB's website |

|

www.wcb.ny.gov. |

11. |

The total assessment due is equal to the total loss cost multipled by the assessment rate. |

Certification

In accordance with WCL Section 151 the Chair may conduct periodic audits of any

QUARTERLY UNIFIED EMPLOYER ASSESSMENT

Municipal

Payroll by FEIN Addendum

State of New York - Workers' Compensation Board

A. Municipal

|

|

2. Name of |

1. WCB Identification |

|

Municipal Self- |

Number: |

|

Insured Employer: |

|

|

|

|

"W Number" |

|

B.Reporting Period

1.Calendar Year:

2.Quarter Ending:

C.Municipal Employers Covered Under the W Number Shown Above

|

|

|

(4) Excluded |

|

|

(3) Quarterly |

Payroll (if |

(1) FEIN |

(2) Municipal |

Payroll |

applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(5) Subtotal Payroll |

|

|

|

(6) Subtotal Excluded Payroll (if applicable) |

|

|

|

(7) Total Payroll = (5) + (6) |

|

$0 |

|

|

|

|

Instructions for Completing Quarterly Unified Employer Assessment

Municipal

Payroll by FEIN Addendum

General Instructions

1.The Quarterly Unified Employer Assessment Municipal

2.The Quarterly Unified Employer Assessment Municipal

3.The payroll by class code reported on the Quarterly Unified Employer Assessment Municipal

4.Questions about the form or process should be directed to WCBFinanceOffice@wcb.ny.gov.

5.This addendum, if applicable, must be sent quarterly with the Quarterly Unified Employer Assessment Municipal

Municipal

1.The WCB Identification Number or "W number" as assigned to the municipal

2.The Name of the Municipal

Municipal Employers Covered Under the W Number

1.The FEIN, or Federal Employer Identification Number, must be reported for the municipal

2.The municipal

3.Total quarterly payroll associated with the FEIN number.

4.Excluded payroll not subject to assessment.

5.Subtotal of payroll subject to assessment of the Quarterly Unified Employer Assessment Municipal

6.Subtotal of excluded payroll not subject to the assessment of the Quarterly Unified Employer Assessment Municipal

7.Total payroll and excluded payroll if applicable. With limited exception, total payroll should agree with that reported on the Quarterly Combined

Withholding, Wage Reporting and Unemployment Insurance Return