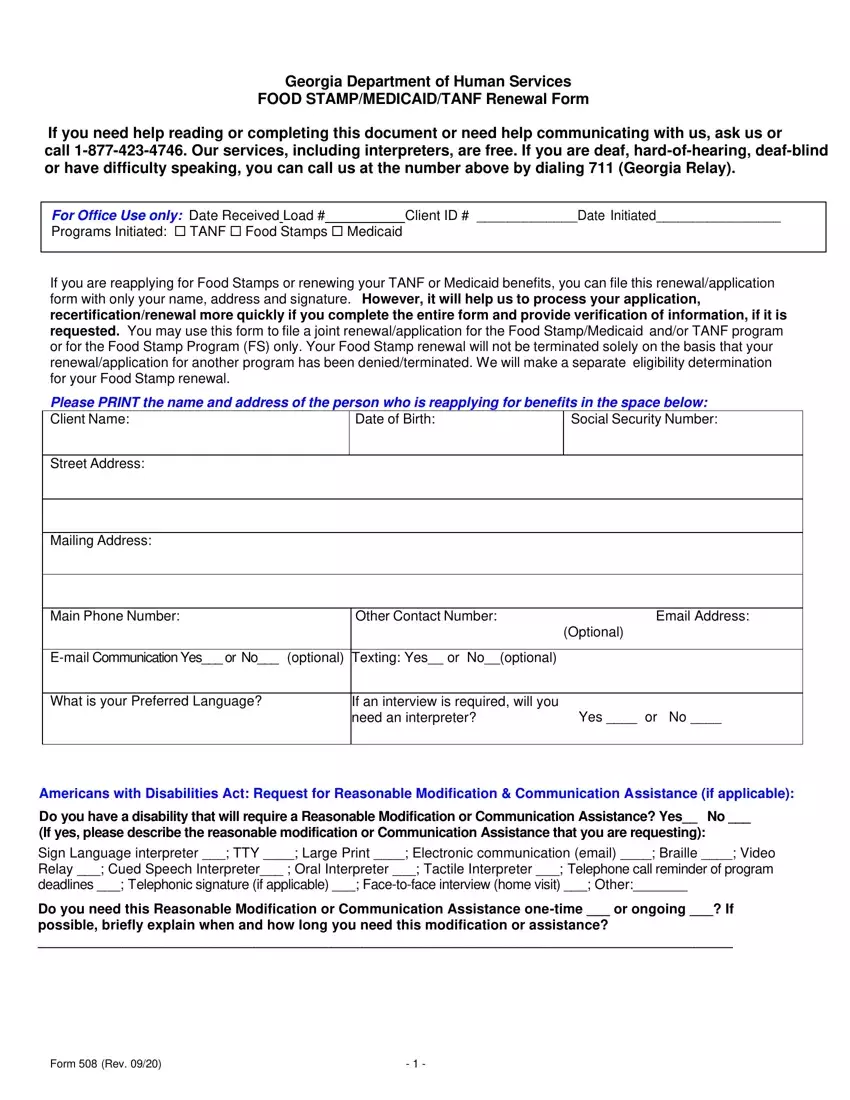

Georgia Department of Human Services

FOOD STAMP/MEDICAID/TANF Renewal Form

If you need help reading or completing this document or need help communicating with us, ask us or

call 1-877-423-4746. Our services, including interpreters, are free. If you are deaf, hard-of-hearing, deaf-blind or have difficulty speaking, you can call us at the number above by dialing 711 (Georgia Relay).

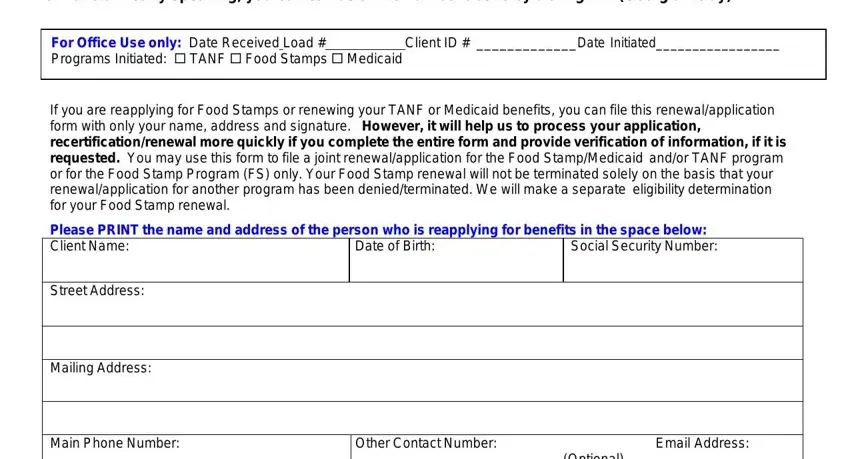

For Office Use only: Date Received Load # |

|

Client ID # _____________Date Initiated_________________ |

Programs Initiated: TANF Food Stamps Medicaid |

|

If you are reapplying for Food Stamps or renewing your TANF or Medicaid benefits, you can file this renewal/application form with only your name, address and signature. However, it will help us to process your application, recertification/renewal more quickly if you complete the entire form and provide verification of information, if it is requested. You may use this form to file a joint renewal/application for the Food Stamp/Medicaid and/or TANF program or for the Food Stamp Program (FS) only. Your Food Stamp renewal will not be terminated solely on the basis that your renewal/application for another program has been denied/terminated. We will make a separate eligibility determination for your Food Stamp renewal.

Please PRINT the name and address of the person who is reapplying for benefits in the space below:

Client Name: |

|

Date of Birth: |

Social Security Number: |

|

|

|

|

Street Address: |

|

|

|

|

|

|

|

|

|

|

|

Mailing Address: |

|

|

|

|

|

|

|

|

|

|

|

Main Phone Number: |

|

Other Contact Number: |

Email Address: |

|

|

|

(Optional) |

|

|

|

|

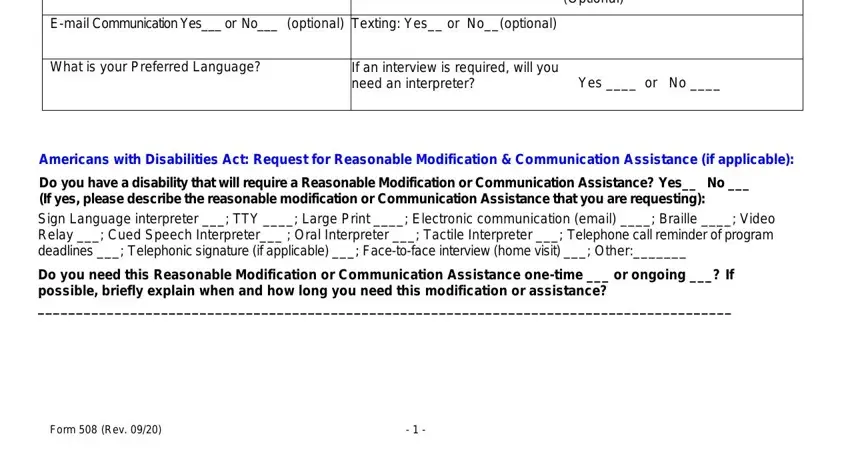

E-mail Communication Yes___ or No___ |

(optional) |

Texting: Yes__ or No__(optional) |

|

|

|

|

|

What is your Preferred Language? |

|

If an interview is required, will you |

|

|

|

need an interpreter? |

Yes ____ or No ____ |

|

|

|

|

Americans with Disabilities Act: Request for Reasonable Modification & Communication Assistance (if applicable):

Do you have a disability that will require a Reasonable Modification or Communication Assistance? Yes__ No ___

(If yes, please describe the reasonable modification or Communication Assistance that you are requesting):

Sign Language interpreter ___; TTY ____; Large Print ____; Electronic communication (email) ____; Braille ____; Video

Relay ___; Cued Speech Interpreter___ ; Oral Interpreter ___; Tactile Interpreter ___; Telephone call reminder of program deadlines ___; Telephonic signature (if applicable) ___; Face-to-face interview (home visit) ___; Other:_______

Do you need this Reasonable Modification or Communication Assistance one-time ___ or ongoing ___? If possible, briefly explain when and how long you need this modification or assistance?

__________________________________________________________________________________________

Form 508 (Rev. 09/20) |

- 1 - |

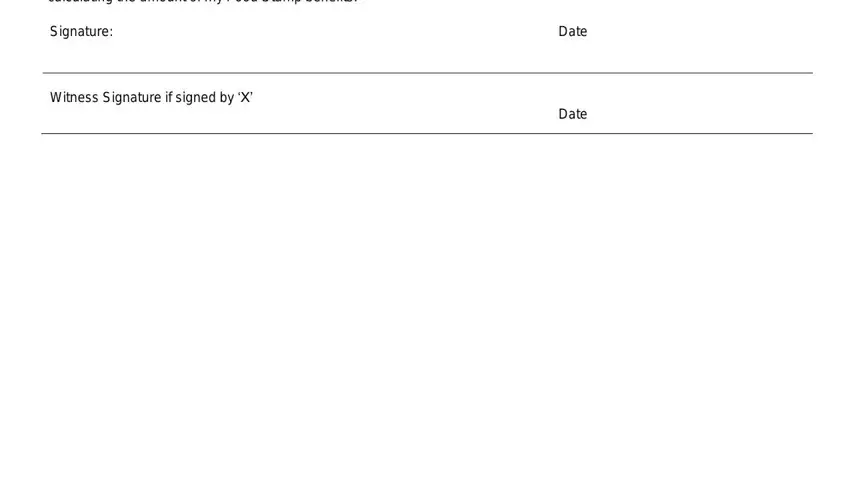

I declare under penalty of perjury to the best of my knowledge and belief that the person(s) for whom I am applying for benefits is/are U.S. citizen(s) or are noncitizen(s) lawfully present in the United States. I further certify that all of the information provided on this application is true and correct to the best of my knowledge. I understand and agree that DHS-DFCS, DCH and authorized Federal Agencies may verify the information I give on this application. Information may be obtained from past or present employers. I understand that my information will be used to track wage information and my participation in work activities.

I will report any change in my situation according to Food Stamp/Medicaid and/or TANF program requirements. I will also report If anyone in my household receives lottery or gambling winnings, gross amount of $3500 or more (before taxes or other amounts are withheld). I will report these winnings within 10 days from the end of the month in which my household receives the winnings. I understand if any information is incorrect, my benefits may be reduced or denied, and I may be subject to criminal prosecution or disqualified from DHS-DFCS programs for knowingly providing incorrect information. I understand that I can be prosecuted if I provide false information or hide information. I understand that if I fail to tell DHS-DFCS about some of my expenses at my application or renewal interview and/or fail to verify them that DHS-DFCS will not budget that expense in calculating the amount of my Food Stamp benefits.

Witness Signature if signed by ‘X’

Date

Form 508 (Rev. 09/20) |

- 2 - |

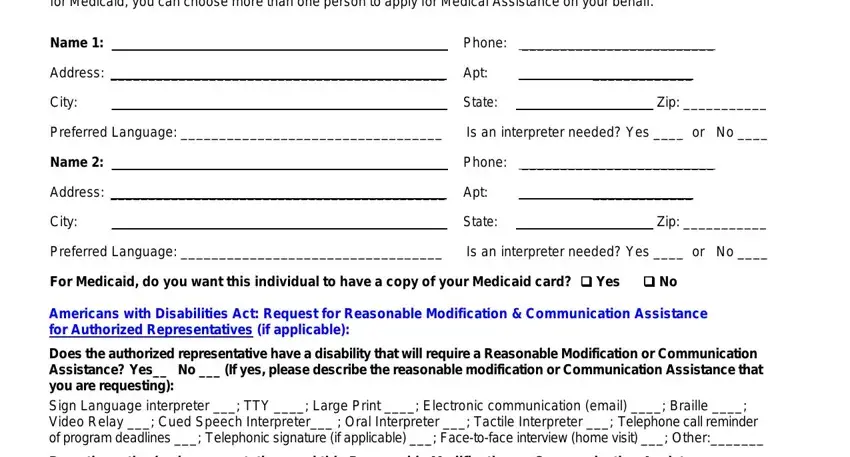

Authorized Representative:

Complete this section only if you want someone to fill out your application/renewal, complete your interview for Food Stamps or TANF, and/or use your Food Stamp EBT card to buy food when you cannot go to the store. If you are applying for Medicaid, you can choose more than one person to apply for Medical Assistance on your behalf.

|

|

|

|

|

|

|

|

Name 1: ____________________________________________ |

Phone: |

_________________________ |

|

Address: ____________________________________________ |

Apt: |

_____________ |

|

|

City: |

____________________________________________ |

State: |

|

______________ Zip: ___________ |

|

|

|

|

|

Preferred Language: __________________________________ |

Is an interpreter needed? Yes ____ or |

No ____ |

Name 2: ____________________________________________ |

Phone: |

_________________________ |

|

Address: ____________________________________________ |

Apt: |

_____________ |

|

|

City: |

____________________________________________ |

State: |

|

______________ Zip: ___________ |

|

|

|

|

|

Preferred Language: __________________________________ |

Is an interpreter needed? Yes ____ or |

No ____ |

For Medicaid, do you want this individual to have a copy of your Medicaid card? ❑ Yes ❑ No |

|

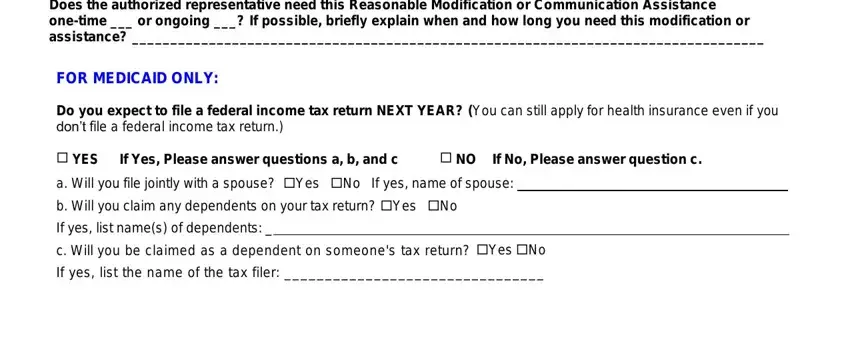

Americans with Disabilities Act: Request for Reasonable Modification & Communication Assistance for Authorized Representatives (if applicable):

Does the authorized representative have a disability that will require a Reasonable Modification or Communication Assistance? Yes__ No ___ (If yes, please describe the reasonable modification or Communication Assistance that you are requesting):

Sign Language interpreter ___; TTY ____; Large Print ____; Electronic communication (email) ____; Braille ____;

Video Relay ___; Cued Speech Interpreter___ ; Oral Interpreter ___; Tactile Interpreter ___; Telephone call reminder of program deadlines ___; Telephonic signature (if applicable) ___; Face-to-face interview (home visit) ___; Other:_______

Does the authorized representative need this Reasonable Modification or Communication Assistance one-time ___ or ongoing ___? If possible, briefly explain when and how long you need this modification or assistance? __________________________________________________________________________________

FOR MEDICAID ONLY:

Do you expect to file a federal income tax return NEXT YEAR? (You can still apply for health insurance even if you don’t file a federal income tax return.)

YES If Yes, Please answer questions a, b, and c |

NO If No, Please answer question c. |

a. Will you file jointly with a spouse? Yes No If yes, name of spouse: |

|

b. Will you claim any dependents on your tax return? Yes |

No |

If yes, list name(s) of dependents: _ |

|

|

|

c. Will you be claimed as a dependent on someone's tax return? Yes No If yes, list the name of the tax filer: ________________________________

Form 508 (Rev. 09/20) |

- 3 - |

If you need help reading or completing this document or need help communicating with us, ask us or call 1-877-423-4746. Our services, including interpreters, are free. If you are deaf, hard-of-hearing, deaf-blind or have difficulty speaking, you can call us at the number above by dialing 711 (Georgia Relay).

COMMUNITY OUTREACH SERVICES:

For more information about other DHS services, please visit our website at www.dfcs.georgia.gov or call 1-877-423- 4746.

Please answer all questions and provide proof of all income and any expenses as requested.

CITIZENSHIP IMMIGRATION STATUS AND SOCIAL SECURITY NUMBERS:

Please fill out the chart below about the applicant and all household members. The following federal laws and regulations: The Food and Nutrition Act of 2008, 7 U.S.C. § 2011-2036, 7. C.F.R. § 273.2, 45 C.F.R.

§205.52, 42 C.F.R. § 435.910, and 42 C.F.R. § 435.920, authorize DFCS to request you and your household members social security number(s). Anyone who is living in your household and is not applying for benefits may be treated as a non-applicant. Non-applicants do not have to give us information about their social security number, citizenship, or immigration status and are not eligible for benefits. Other household members may still be able to receive benefits, if they are otherwise eligible. If you want us to decide whether any household members are

eligible for benefits, you will still need to tell us about their citizenship or immigration status and give us their social |

|

security number (SSN). You will still need to tell us about their income and resources to determine the eligibility and |

|

benefit level of the household. We will not report any non-applicant household members to the United States |

|

|

|

Citizenship and Immigration Services (USCIS) Systematic Alien Verification for Entitlements (SAVE) system if they |

|

do not give us their citizenship or immigration status. However, if immigration status information has been submitted |

|

on your application, this information may be subject to verification through the SAVE system and may affect the |

|

household’s eligibility and benefit level. We will match your information with other Federal, state, and local agencies |

|

to verify your income and eligibility. This information may also be given to law enforcement officials to use to catch |

|

people who are running from the law. If your household has a Food Stamp claim, the information on this application, |

|

including SSN, may be given to Federal and State agencies and private claims collection agencies for them to use in |

|

collecting the claim. We will not deny benefits to |

applicant household members because other household members |

|

fail to provide their SSN, citizenship, or immigration status. If you are applying for emergency medical services only, |

|

you do not have to provide your SSN or information about your immigration status. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ethnicity |

|

|

|

|

|

|

youArea U.S citizen, immigrantqualified or in satisfactorya immigrationstatus? (Applicantsonly) (Y/N) |

theDoesmother of this livechildin the home? (Y/N) |

theDoesfather of this livechildin the home? (Y/N) |

|

wantyouDo Medicaid? (Y/N) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hispanic |

|

|

|

|

|

Social |

|

|

|

|

|

|

|

|

or |

|

|

|

|

|

Security |

|

|

|

|

|

|

M |

|

Latino? |

Race |

Sex |

|

Date |

Relationship |

Number |

|

|

|

|

|

First Name |

I |

Last Name |

(Optional) |

(Optional) |

M/F |

|

Of Birth |

To You |

(Applicants only) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Y/N |

|

|

|

|

SELF |

|

Y/N |

Y/N |

Y/N |

|

Y/N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Y/N |

|

|

|

|

|

|

Y/N |

Y/N |

Y/N |

|

Y/N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Y/N |

|

|

|

|

|

|

Y/N |

Y/N |

Y/N |

|

Y/N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Y/N |

|

|

|

|

|

|

Y/N |

Y/N |

Y/N |

|

Y/N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Y/N |

|

|

|

|

|

|

Y/N |

Y/N |

Y/N |

|

Y/N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Y/N |

|

|

|

|

|

|

Y/N |

Y/N |

Y/N |

|

Y/N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Y/N |

|

|

|

|

|

|

Y/N |

Y/N |

Y/N |

|

Y/N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Race Codes (Choose all that apply): |

|

|

AI – American Indian or Alaska Native |

AS – Asian |

BL – Black or African American |

HP – Native Hawaiian or Other Pacific Islander |

WH – White |

|

By providing Race/Ethnicity information, you will assist us in administering our programs in a non-discriminatory manner. Your household is not required to give us this information, and it will not affect your eligibility or benefit level. However, if you do not provide this information, visual identification of race and ethnicity will be made during the first face-to-face interview.

Form 508 (Rev. 09/20) |

- 4 - |

For Medicaid only:

Was anyone in your household in Foster Care at age 18? ☐Yes ☐No

|

|

|

|

|

|

|

|

|

|

|

|

If you have tax dependents that do not live in the home with you, please list below. |

|

|

Name: |

|

|

|

Social Security Number_ |

|

|

Sex: M F (please circle |

|

|

|

|

|

one) |

Date of Birth: |

|

|

Citizenship: |

|

|

|

|

|

|

|

|

|

|

|

Relationship to you: |

|

|

|

(Please add additional pages as needed) |

|

|

For Food Stamp Program only - DISQUALIFICATIONS:

(1)Have you or any household member been convicted of giving false information about where they live and who they

are to get multiple FS benefits in more than one area after 8/22/96? |

Yes No |

If yes, Who: |

|

Where: |

|

When: |

|

|

|

|

|

|

(2)Do you or any household member have a felony conviction because of behavior related to the possession, use or distribution of a controlled substance after 8/22/96? Yes No

|

|

|

|

|

|

|

|

If yes, Who: |

|

|

When: |

|

Date of offense: |

|

Date of Conviction: |

|

|

Does this person have 1st Offender Status? |

Yes No |

a)Are you in compliance with any terms of probation related to any sentence received as a result of a drug felony conviction? (For Food Stamps only) ❑Yes ❑ No

b)Are you in compliance with the terms of parole related to any sentence received as a result of a drug felony conviction? (For Food Stamps only) ❑Yes ❑ No

c)Have you successfully completed all the terms of probation or parole related to any drug related conviction? (For Food Stamps only) ❑Yes ❑ No

(3) Is anyone trying to avoid prosecution or jail for a felony?Yes |

No |

If yes, who |

|

|

(4) Is anyone violating conditions of probation or parole? |

Yes No |

If yes, who |

|

|

(5)Have you or any household member been convicted of trading SNAP benefits for drugs after 8/22/96? Yes No

(6)Have you or any household member been convicted of buying or selling SNAP benefits over $500 after 8/22/96?

Yes No |

|

If yes, who; |

when: |

(7)Have you or any household member been convicted of trading SNAP benefits for guns, ammunition or explosives after 8/22/96? Yes No

If yes, who; |

|

when: |

|

|

(8) Have you or any household member received lottery or gambling winnings? |

❑ Yes ❑ No |

If yes, who: _____________________________________when: ___________________________________

Amount received: ________________________________

For the TANF Program only - DISQUALIFICATIONS

(1) Has anyone been convicted of a violent felony? |

Yes No |

If yes, who: |

|

|

(2)Has anyone been convicted on or after January 1997 of misrepresenting their residency in order to receive TANF

benefits in multiple states? |

Yes No |

If yes, who: |

|

|

Form 508 (Rev. 09/20) |

- 5 - |