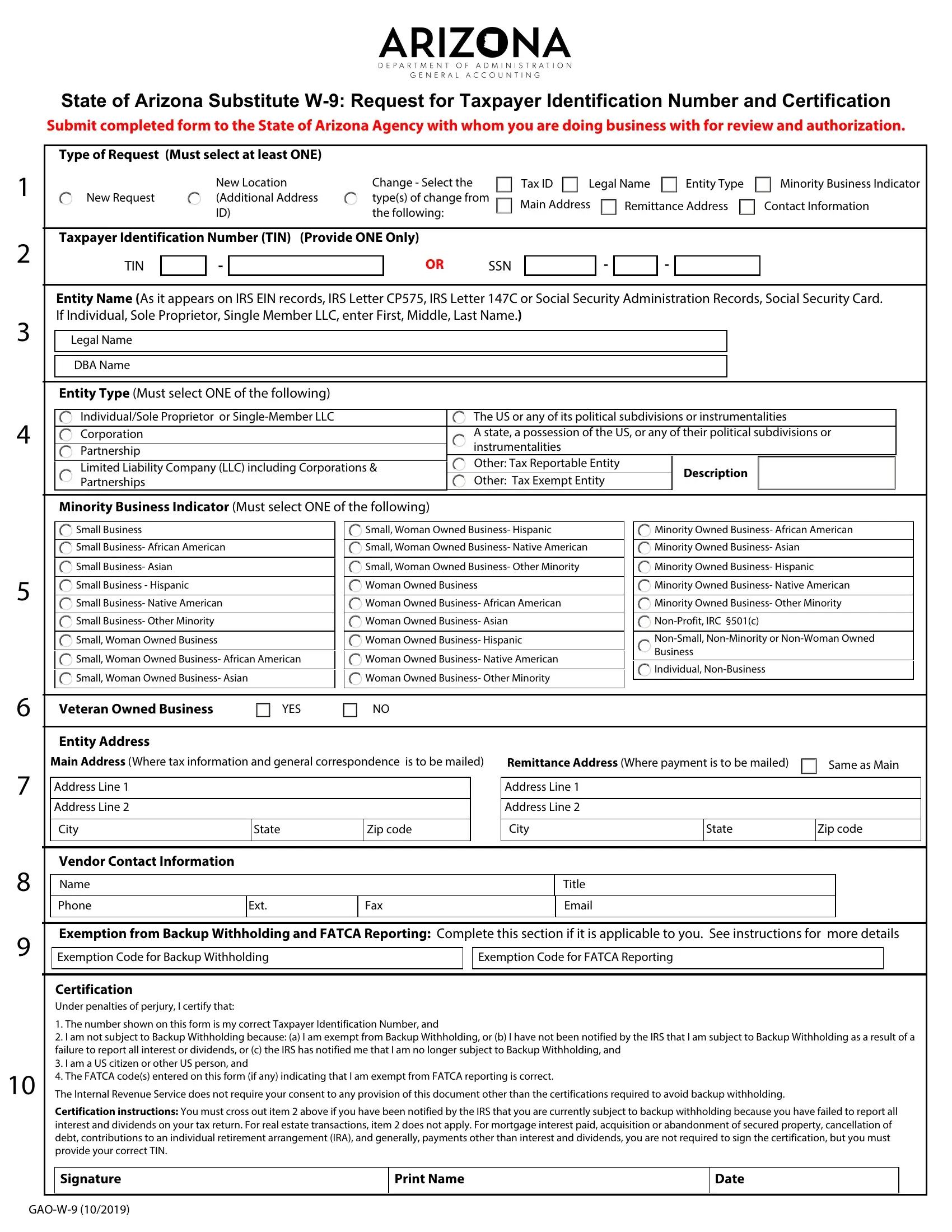

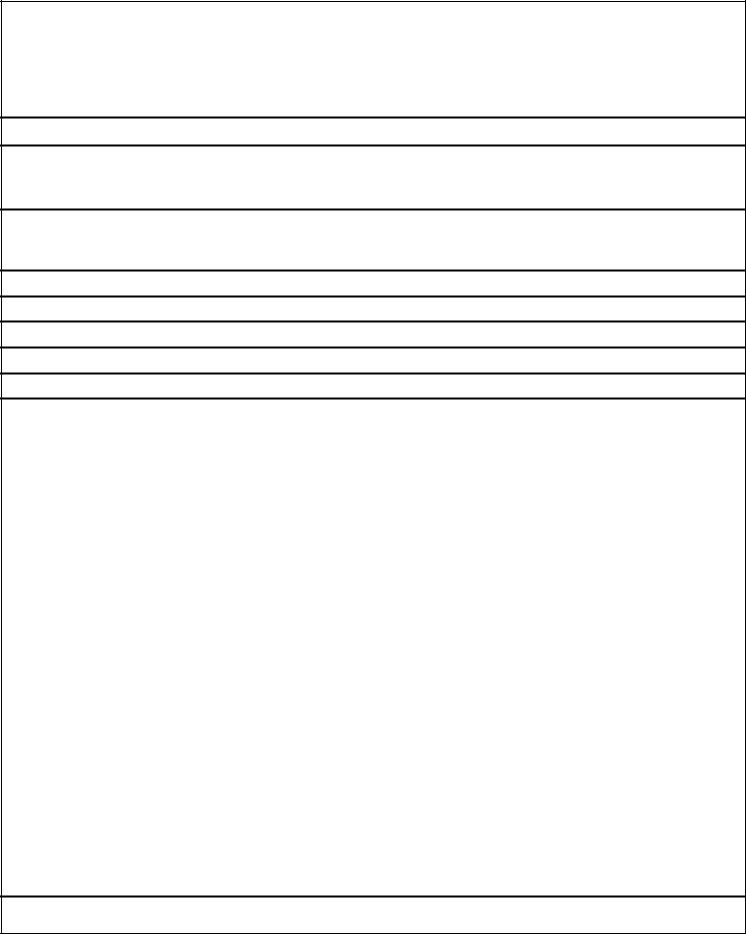

The State of Arizona Substitute W-9 Form Instructions

The State of Arizona (State), like all organizations that file an information return with the IRS, must obtain your correct Taxpayer Identification Number (TIN) to report income paid to you or your organization. The State uses the Substitute W-9 Form to obtain certification of your TIN in order to ensure accuracy of information contained in its payee/vendor system and to avoid Backup Withholding as mandated by the IRS. According to IRS regulations, the State must withhold 28% of all payments if a vendor/payee fails to provide the State its certified TIN. The Substitute Form W-9 certifies a vendor/payee's TIN. Any vendor/payee who wishes to do business with the State must complete the Substitute W-9 Form.

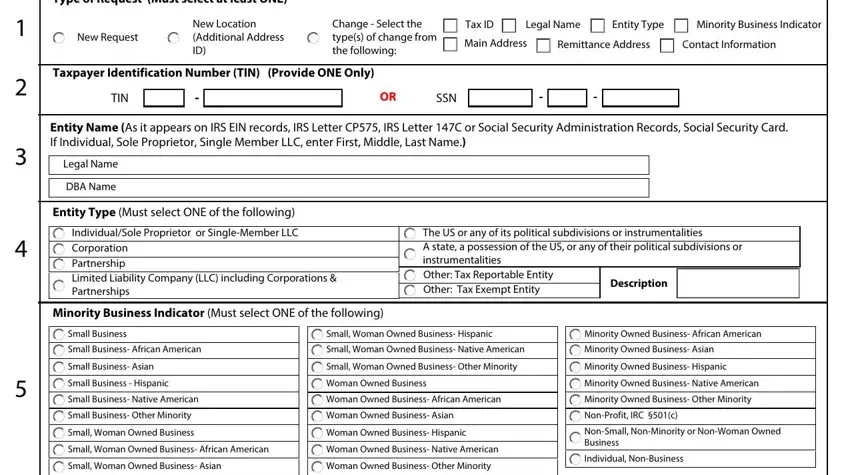

Part 1 - Type of Request: Select only one.

Part 2 - Taxpayer Identification Number (TIN): Enter your nine-digit TIN. The TIN is either your nine-digit Social Security Number (SSN) assigned by the Social Security Administration (SSA) or Employer Identification Number (EIN) assigned by the Internal Revenue Service (IRS).

Part 3 - Entity Name: Enter the legal name as it appears on IRS EIN records, IRS Letter CP575, IRS Letter 147C or Social Security Administration Records, Social Security Card. If Individual, Sole Proprietor, Single Member LLC, enter First, Middle, Last Name. Enter your DBA in the designated line if applicable.

Part 4 - Entity Type: Select only one for TIN given.

Part 5 - Minority Business Indicator: Select only one for TIN given.

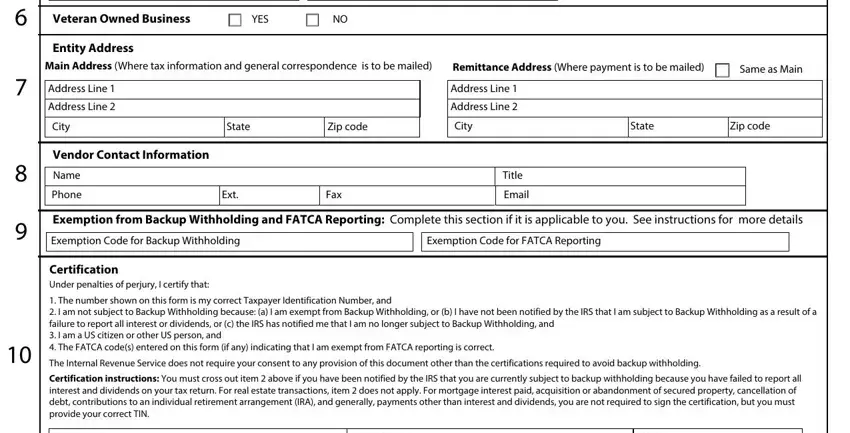

Part 6 - Veteran Owned Business: Select only one for TIN given.

Part 7 - Entity Address: List the locations for tax reporting purposes and where payments should be mailed.

Part 8 - Entity Contact Information: List the contact information.

Part 9 - Backup Withholding and FATCA Exemptions: If you are exempt from Backup Withholding and/or FATCA reporting, enter in the Exemptions box, any code(s) that may apply to you.

Backup Withholding Exemption Codes: Generally, Individuals (including Sole Proprietors) are not exempt from Backup Withholding. Additionally, Corporations are not exempt from Backup Withholding when supplying legal or medical services. If you do not fall under the categories below, leave this field blank. The following codes identify payees that are exempt from Backup Withholding:

Code 1: An organization exempt from tax under section 501(a), any IRA, or a custodial account under section 403(b) (7) if the account satisfies the requirements of section 401(f) (2)

Code 2: The United States or any of its agencies or instrumentalities

Code 3: A state, the District of Columbia, a possession of the United States, or any of their political subdivisions or Instrumentalities

Code 4: A foreign government or any of its political subdivisions, agencies, or instrumentalities

Code 5: A corporation

Code 6: A dealer in securities or commodities required to register in the United States, the District of Columbia, or a possession of the United States Code 7: A futures commission merchant registered with the Commodity Futures Trading Commission

Code 8: A real estate investment trust

Code 9: An entity registered at all times during the tax year under the Investment Company Act of 1940

Code 10: A common trust fund operated by a bank under section 584(a)

Code 11: A financial institution

Code 12: A middleman known in the investment community as a nominee or custodian

Code 13: A trust exempt from tax under section 664 or described in section 4947

FATCA Exemption Codes: The following codes identify payees that are exempt from reporting under FATCA. These codes apply to persons submitting this form for accounts maintained outside of the United States by certain foreign financial institutions. If you are only submitting this form for an account you hold in the United States, leave this field blank. The following codes identify payees that are exempt from FATCA Reporting:

Code A: An organization exempt from tax under section 501(a) or any individual retirement plan as defined in section 7701(a) (37)

Code B: The United States or any of its agencies or instrumentalities

Code C: A state, the District of Columbia, a possession of the United States, or any of their political subdivisions or instrumentalities

Code D: A corporation the stock of which is regularly traded on one or more established securities markets, as described in Reg. section 1.1472-1(c)(1)(i)

Code E: A corporation that is a member of the same expanded affiliated group as a corporation described in Reg. section 1.1472-1(c) (1) (i)

Code F: A dealer in securities, commodities, or derivative financial instruments (including notional principal contracts, futures, forwards, and options) that is registered as such under the laws of the United States or any state

Code G: A real estate investment trust

Code H: A regulated investment company as defined in section 851 or an entity registered at all times during the tax year under the Investment Company Act of 1940

Code I: A common trust fund as defined in section 584(a)

Code J: A bank as defined in section 581 Code K: A broker

Code L: A trust exempt from tax under section 664 or described in section 4947(a) (1)

Code M: A tax-exempt trust under a section 403(b) plan or section 457(g) plan

Part 10 - Certification: Please sign, date and provide preparer's name in appropriate space.