Form 4A is one of the many forms that GCT utilizes in order to provide efficient and quality service to their clients. This form is a registration form for new customers, and requires basic information such as name, address, phone number, and email address. The form also asks for information about the customer's business, such as the type of business and its annual sales. This information allows GCT to better understand the customer's needs and provide tailored service. Completing this form is the first step in becoming a GCT customer!

| Question | Answer |

|---|---|

| Form Name | Gct 4A Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | how to fill out a gct form, form 4a gct jamaica, gct form, gct application form 4a |

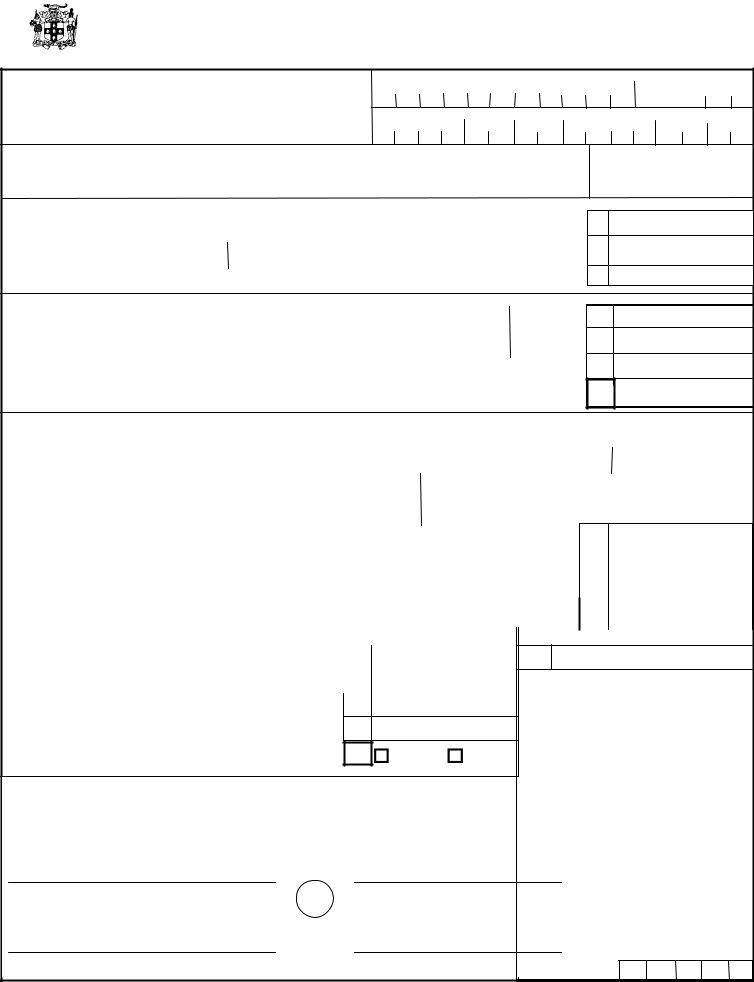

JAMAICA

THEGENERAL CONSUMPTION TAX ACT |

|

GENERAL CONSUMPTION TAX RETURN |

FORM 4A |

Please Read Instructions Overleaf before completing this Return

Section A: GENERAL INFORMATION |

2. Taxpayer Registration Number (TRN) |

|||||||||

1. Name of Business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. Return Period

Year

Month

to

Day Year

Month

Day

4.Address of Business (Apt. No., Street No. & Name, Postal Zone, Parish)

Section B: SUPPLIES (Goods & Services)

Total Supplies made during Period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

|

Exempt Supplies |

Export Supplies |

||||||

|

|

+ |

|

|

+ |

|

|

= |

7 |

|

8 |

|

9 |

|

|||

|

|

|

|

|

|

|

|

|

5. Tick appropriate box

New Address Revised Return

6

10

11

Supplies at Standard Rate |

12 |

Rate |

|

= |

|

% |

|||||

Supplies at Other Rate(s) |

. . . . . . . . . . . . . . |

14 |

% |

= |

|

|

|

|

|

|

|

GCT Due on Goods for Exempt Activities, Personal Use & other Adjustments. . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

15

16

17

Total Local Purchases & Expenses that Qualify for Credit |

|

18 |

|

|

|

|

GCT on Local Purchases & Expenses that Qualify for Credit |

. . . . . . . . . . . . . . . . . |

|

19 |

|||

GCT on Imports that Qualify for Credit |

|

|

|

|

|

|

|

|

20 |

|

|

|

|

GCT Deferred on Imports |

|

|

|

|

|

|

|

|

21 |

|

|

|

|

|

|

|

|

|

|

|

GCT Paid on Imports (Subtract Line 21 from Line 20). . . . . . . . . . . . . . . . . . . . . . . . . . . 22 |

||||||

|

|

|

|

|

|

|

GCT on Capital Goods that Qualify for Credit this Period |

23 |

|

||||

|

|

|

|

|

|

|

Adjustments - Specify: |

|

24 |

|

|||

|

|

|

|

|

||

|

|

|

|

|

|

|

Total Input Tax (Add Lines 19, 22, 23 & 24) |

|

. 25 |

|

|||

|

|

|

|

|

|

|

Section E: GCT PAYABLE / CREDITABLE

GCT Payable/Creditable |

(Subtract Line 25 from Line 17 ) |

26 |

|

||

Balance Brought Forward: Payable/Creditable/Zero |

27 |

|

|

|

|

Total (Add Lines 26 & 27) |

28 |

|

|

GCT Being Paid this Period |

29 |

|

|

If amount at Line 26 is negative, tick appropriate box at Line |

30 |

1)Refund |

2)Credit |

30 |

|

||

|

|

|

I declare that to the best of my knowledge and belief this is a

true and correct statement of the information and particulars given on this form.

OFFICIAL USE

29

Name of Responsible Officer |

Official |

Title |

Stamp

Signature |

Date |

OFFICE CODE:

Form No. 4A (Issued 2002/04) |

Tax Administration Jamaica |

INSTRUCTIONS

This form is to be completed by Registered taxpayers who are not using the Quick Method.

Taxpayers carrying out Tourism Activities prescribed in Part II of the Second Schedule of the General Consumption Tax Regulations, Item 12(1) should complete FORM 4D (PINK FORM). Taxpayers carrying out General Insurance Activities should complete FORM 4E(YELLOW FORM).

Please TYPEor PRINT the required information. Use blue or black ink pen only. Do not use a pencil. All dollar value amounts should be rounded to the nearest whole number.

Section A: GENERAL INFORMATION

Box 1 : Name and Address of Business

Enter information as stated on the GCT Certificate of Registration.

Box 2 : Taxpayer Registration Number (TRN)

Enter number (TRN) commencing with the first box on the left.

Box 3 : Return Period

Monthly Returns e.g. October 2000 enter:

Box 5

New Address : Please tick box if address is a New Address.

Revised Returns : Please tick box if return is a Revised Return

Section B: SUPPLIES (Goods & Services)

Include all activities relating to supplies (sales) during the Return Period. Value of sales must include for business enterprises in the services sector, the amount for Revenue/Fees.

Section C: OUTPUT TAX

Calculate tax on supplies (sales) during the Return Period.

Section D: INPUT TAX/TAX CREDIT

Report tax paid on goods and services in carrying on the taxable activity during the period. Deferment received should not be claimed as a credit as this was never paid.

Section E: GCT PAYABLE/ CREDITABLE

Calculate the result of activities during the period in respect of the tax. Line 27 should include penalty, interest and surcharge. If the amount of output tax exceeds the amount of input tax, then this should be remitted to the Collector of Taxes plus any penalties, etc., imposed for previous periods. If the input tax exceeds the output tax, please clearly indicate whether you are requesting that amount to be credited to your account or refunded. This is achieved by ticking the appropriate box at Line 30.

NOTE : If a refund is requested and has not been received by the time the next Return is filed, do not take a credit against the tax due.