If you are a Georgia taxpayer, you may be eligible to file Form 4506 to request a copy of your federal income tax return from the IRS. This form can be used to request copies of any federal return that you have filed in the past, including returns for multiple years. The form is available on the IRS website, and can be submitted online, by mail, or by fax. Note that there is a fee associated with requesting copies of your returns, and that processing time can vary depending on the nature of your request. For more information, visit the IRS website or speak with an accountant or tax specialist.

| Question | Answer |

|---|---|

| Form Name | Georgia Form 4506 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | preparer, New_York, Colusa, 1995 |

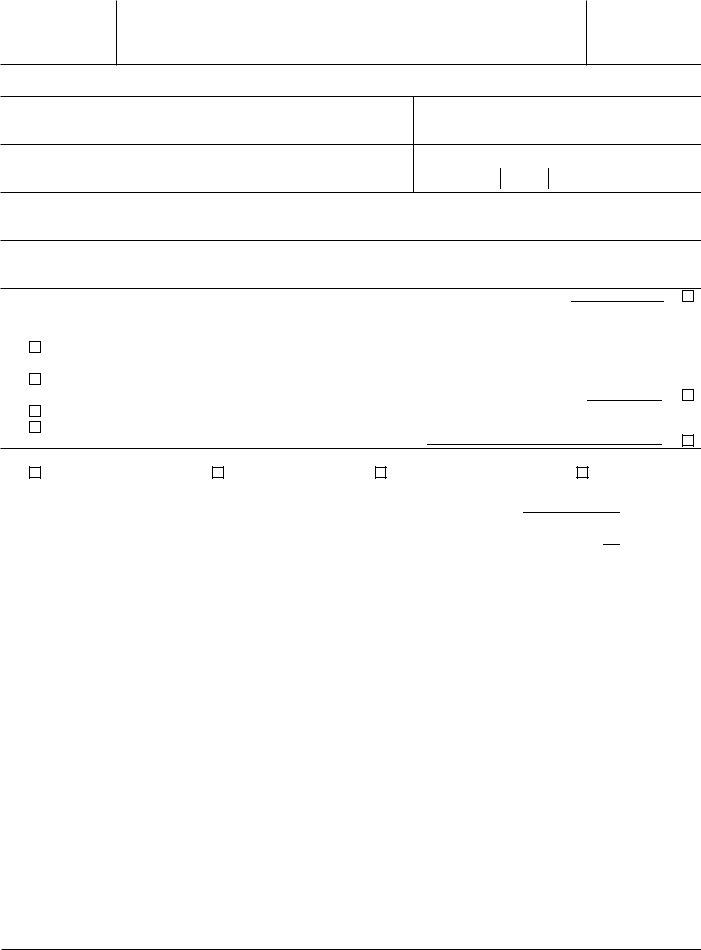

Form 4 5 0 6

(Rev. October 1994)

Department of the Treasury Internal Revenue Service

Request for Copy or Transcript of Tax Form

▶Please read instructions before completing this form.

▶Please type or print clearly.

OMB No.

Note: Do not use this for m to get tax account information. Instead, see instructions below.

1a Name shown on tax form

1b First social security number on tax form or employer identification number (See instructions.)

2a If a joint return, spouse’s name shown on tax form

2b Second social security number on tax form

3Current name, address (including apt., room, or suite no.), city, state, and ZIP code (See instructions.)

4If copy of form or a tax return transcript is to be mailed to someone else, show the third party’s name and address.

5 |

If we cannot find a record of your tax form and you want the payment refunded to the third party, check here |

▶ |

6 |

If name in third party’s records differs from line 1a above, show name here. (See instructions.) ▶ |

|

7Check only one box to show what you want:

a |

Tax return transcript of Form 1040 series filed during the current calendar year and the 2 preceding calendar years. (See instructions.) (The |

|

transcript gives most lines from the original return and schedule(s).) There is no charge for a transcript request made before October 1, 1995. |

b

c d

Copy of tax form and all attachments (including Form(s)

Note: If these copies must be certified for court or administrative proceedings, see instructions and check here |

▶ |

Verification of nonfiling. There is no charge for this. |

|

Copy of Form(s)

Note: If the copy of Form |

▶ |

8If this request is to meet a requirement of one of the following, check all boxes that apply.

|

Small Business Administration |

Department of Education |

Department of Veterans Affairs |

|

Financial institution |

|||||||

9 Tax form number (Form 1040, 1040A, 941, etc.) |

11 |

Amount due for copy of tax form: |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

a |

Cost for each period |

|

|

$ |

14.00 |

|

|

|

|

|

|

|

b Number of tax periods requested on line 10 |

|

|

||||

10 Tax period(s) (year or period ended date). If more than four, see |

c |

Total cost. Multiply line 11a by line 11b |

$ |

|

||||||||

instructions. |

|

|

|

Full payment must accompany your request. Make check |

|

|||||||

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

or money order payable to “Internal Revenue Service.” |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Telephone number of requester |

|||

Please ▶ |

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|||||||

Signature. See instructions. If other than taxpayer, attach authorization document. |

|

Date |

Best time to call |

|

|

|||||||

Sign |

▶ |

|

|

|

|

|

|

|

|

|

|

|

Here |

|

|

|

|

|

|

|

|

||||

Title (if line 1a above is a corporation, partnership, estate, or trust) |

|

|

|

|

|

|

|

|||||

Instructions

A Change To

Purpose of

Do not use this form to request Forms 1099 or tax account information. If you need a copy of a Form 1099, contact the payer. However, Form 1099 information is available by calling or visiting your local IRS office.

Note: If you had your tax form filled in by a paid preparer, check first to see if you can get a copy from the preparer. This may save you both time and money.

If you are requesting a copy of a tax form, please allow up to 60 days for delivery. However, if your request is for a tax return transcript, please allow 10 workdays after we receive your request. To avoid any delay, be sure to furnish all the information asked for on this form. You must allow 6 weeks after a tax form is filed before requesting a copy of it or a transcript.

Tax Account Information

To request tax account information, do not complete this form. Instead, write or visit an IRS office or call the IRS

If you want your tax account information sent to a third party, complete Form 8821, Tax Information Authorization. You may get this form by calling

Line

Line

Note: If you do not complete line 1b and, if applicable, line 2b, there may be a delay in processing your request.

Line 3.— For a tax return transcript, a copy of Form

For Privacy Act and Paperwork Reduction Act Notice, see back of form. |

Cat. No. 41721E |

Form 4506 (Rev. |

Form 4506 (Rev. |

Page 2 |

|

|

●A copy of two pieces of identification that have your signature, or

●An original notarized statement affirming your identity.

Line

Line

Line

A tax return transcript shows most lines from the original return (including accompanying forms and schedules). It does not reflect any changes you or the IRS made to the original return. If you have changes to your tax return and want a statement of your tax account with the changes, see Tax Account Information Only on the front. A tax return transcript is available for any returns of the 1040 series (such as Form 1040, 1040A, or 1040EZ) filed during the current calendar year and the 2 preceding calendar years.

In many cases, a tax return transcript will meet the requirement of any lending institution such as a financial institution, the Department of Education, or the Small Business Administration. It may also be used to verify that you did not claim any itemized deductions for a residence.

Line

Line

Line

Forms

If you are requesting a copy of your spouse’s Form

Line

Line

Copies of tax forms or tax return transcripts for a jointly filed return may be furnished to either the husband or the wife. Only one signature is required. Sign Form 4506 exactly as your name appeared on the original tax form. If you changed your name, also sign your current name.

For a corporation, the signature of the president of the corporation, or any principal officer and the secretary, or the principal officer and another officer are generally required. For more details on who may obtain tax information on corporations, partnerships, estates, and trusts, see Internal Revenue Code section 6103.

If you are not the taxpayer shown on line 1a, you must attach your authorization to receive a copy of the requested tax form or tax return transcript. You may attach a copy of the authorization document if the original has already been filed with the IRS. This will generally be a power of attorney (Form 2848), or other authorization, such as Form 8821, or evidence of entitlement (for Title 11 Bankruptcy or Receivership Proceedings). If the taxpayer is deceased, you must send Letters Testamentary or other evidence to establish that you are authorized to act for the taxpayer’s estate.

Note: Form 4506 must be received by the IRS within 60 days after the date you signed and dated the request.

Where To

Note: You must use a separate form for each service center from which you are requesting a copy of your tax form or tax return transcript.

If you lived in: |

Use this address: |

|

|

New Jersey, New York |

1040 Waverly Ave. |

(New York City and |

Photocopy Unit |

counties of Nassau, |

Stop 532 |

Rockland, Suffolk, and |

Holtsville, NY 11742 |

Westchester) |

|

|

|

New York (all other |

310 Lowell St. |

counties), Connecticut, |

Photocopy Unit |

Maine, Massachusetts, |

Stop 679 |

New Hampshire, |

Andover, MA 01810 |

Rhode Island, Vermont |

|

|

|

Florida, Georgia, |

4800 Buford Hwy. |

South Carolina |

Photocopy Unit |

|

Stop 91 |

|

Doraville, GA 30362 |

Indiana, Kentucky, |

P.O. Box 145500 |

|

Michigan, Ohio, |

Photocopy Unit |

|

West Virginia |

Stop 524 |

|

|

Cincinnati, OH 45250 |

|

|

|

|

Kansas, New Mexico, |

3651 South Interregional |

|

Oklahoma, Texas |

Hwy. |

|

|

Photocopy Unit |

|

|

Stop 6716 |

|

|

Austin, TX 73301 |

|

|

|

|

Alaska, Arizona, California |

|

|

(counties of Alpine, |

|

|

Amador, Butte, |

|

|

Calaveras, Colusa, |

|

|

Contra Costa, Del Norte, |

|

|

El Dorado, Glenn, |

|

|

Humboldt, Lake, Lassen, |

|

|

Marin, Mendocino, |

|

|

Modoc, Napa, Nevada, |

P.O. Box 9953 |

|

Placer, Plumas, |

||

Photocopy Unit |

||

Sacramento, San Joaquin, |

||

Stop 6734 |

||

Shasta, Sierra, Siskiyou, |

||

Ogden, UT 84409 |

||

Solano, Sonoma, Sutter, |

||

|

||

Tehama, Trinity, Yolo, |

|

|

and Yuba), Colorado, |

|

|

Idaho, Montana, |

|

|

Nebraska, Nevada, |

|

|

North Dakota, Oregon, |

|

|

South Dakota, Utah, |

|

|

Washington, Wyoming |

|

|

|

|

|

California (all other |

5045 E. Butler Avenue |

|

counties), Hawaii |

Photocopy Unit |

|

|

Stop 52180 |

|

|

Fresno, CA 93888 |

|

|

|

|

Illinois, Iowa, Minnesota, |

2306 E. Bannister Road |

|

Missouri, Wisconsin |

Photocopy Unit |

|

|

Stop 57A |

|

|

Kansas City, MO 64999 |

|

|

|

|

Alabama, Arkansas, |

P.O. Box 30309 |

|

Louisiana, Mississippi, |

Photocopy Unit |

|

North Carolina, |

Stop 46 |

|

Tennessee |

Memphis, TN 38130 |

|

|

|

|

Delaware, |

|

|

District of Columbia, |

11601 Roosevelt Blvd. |

|

Maryland, Pennsylvania, |

||

Photocopy Unit |

||

Virginia, a foreign |

||

DP 536 |

||

country, or A.P.O. or |

||

Philadelphia, PA 19255 |

||

F.P.O address |

||

|

||

|

|

Privacy Act and Paperwork Reduction Act

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is:

Recordkeeping |

13 min. |

Learning about the law or the form |

7 min. |

Preparing the form |

25 min. |

Copying, assembling, and |

|

sending the form to the IRS |

17 min. |

If you have comments concerning the accuracy of these time estimates or suggestions for making this form more simple, we would be happy to hear from you. You can write to both the Internal Revenue Service, Attention: Reports Clearance Officer, PC:FP, Washington, DC 20224; and the Office of Management and Budget, Paperwork Reduction Project

Printed on recycled paper