Working with PDF files online is certainly quite easy with our PDF tool. Anyone can fill in ga 500 nol here effortlessly. Our tool is constantly developing to give the best user experience possible, and that's due to our dedication to continual development and listening closely to feedback from customers. With some simple steps, you can begin your PDF journey:

Step 1: Hit the "Get Form" button above on this page to access our PDF editor.

Step 2: With the help of our state-of-the-art PDF editing tool, you are able to accomplish more than just fill out forms. Try all of the features and make your docs seem professional with customized textual content added in, or adjust the file's original content to excellence - all that supported by an ability to add any type of images and sign the document off.

It's an easy task to fill out the form with this detailed tutorial! Here is what you need to do:

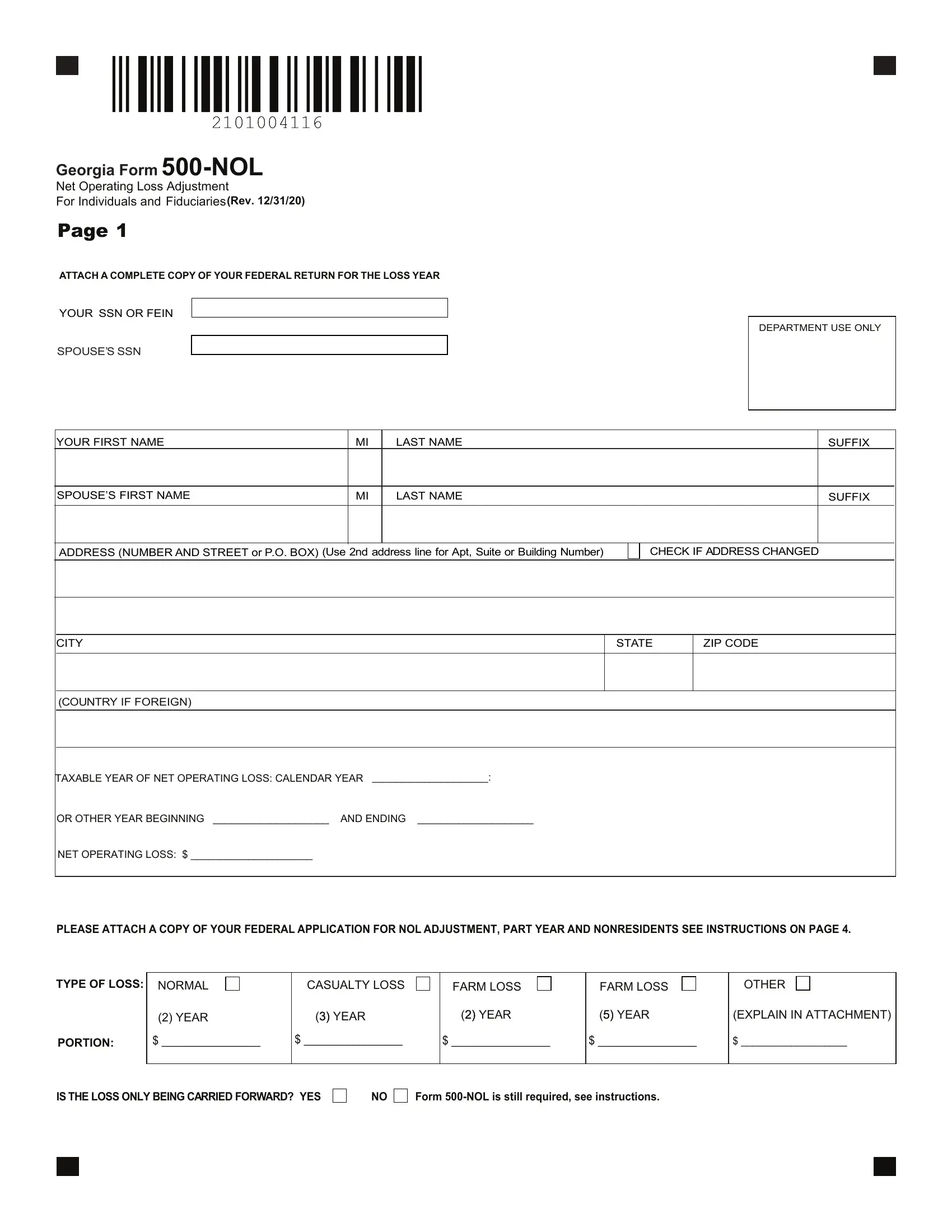

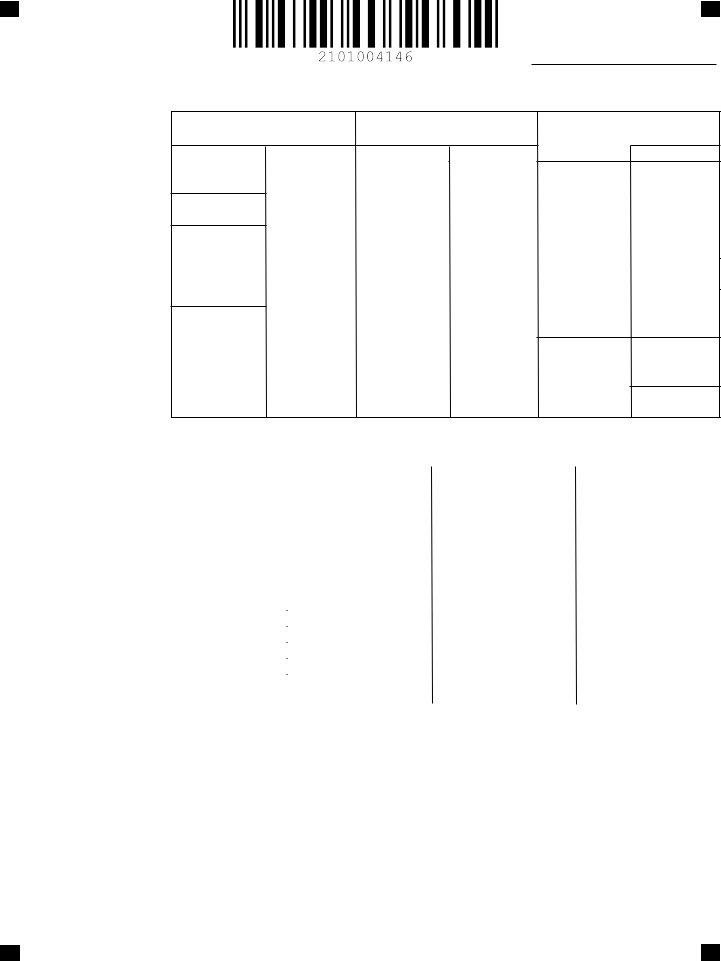

1. It's essential to complete the ga 500 nol correctly, so pay close attention while filling in the areas including these particular blank fields:

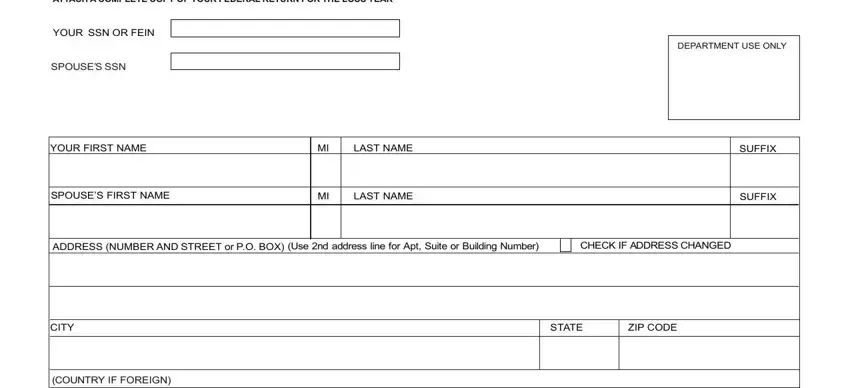

2. Just after completing the last step, go to the next part and fill in all required details in these blanks - TAXABLE YEAR OF NET OPERATING LOSS, OR OTHER YEAR BEGINNING AND, NET OPERATING LOSS, PLEASE ATTACH A COPY OF YOUR, TYPE OF LOSS NORMAL, CASUALTY LOSS, FARM LOSS, FARM LOSS, OTHER, YEAR, RAEY, RAEY, RAEY, EXPLAIN IN ATTACHMENT, and PORTION.

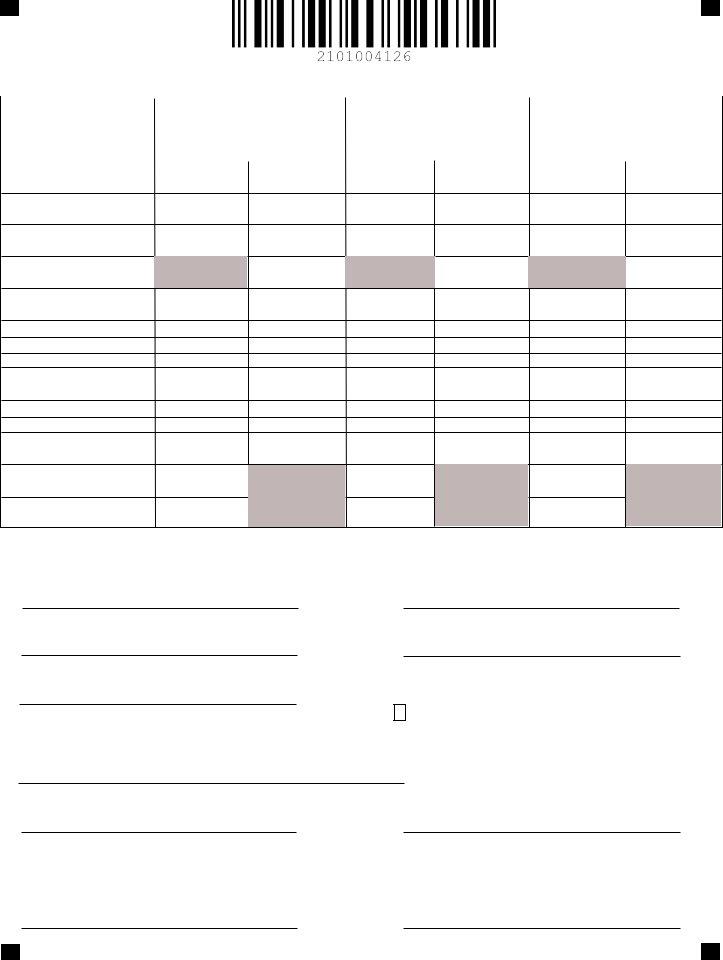

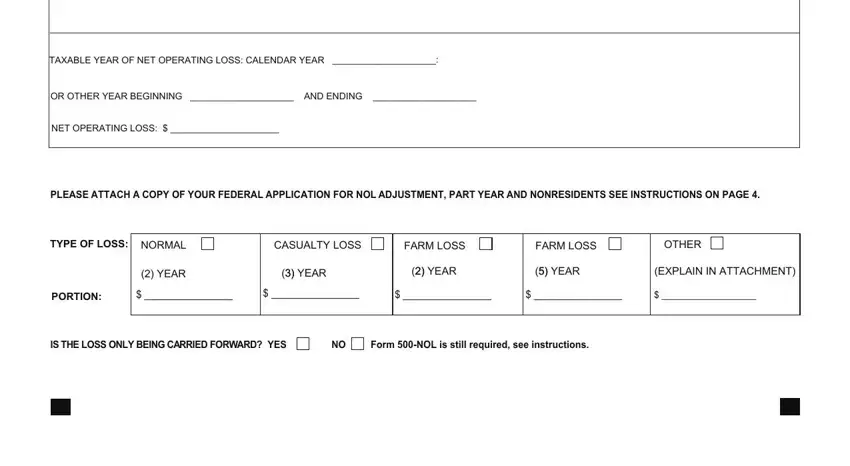

3. In this specific stage, examine NOL, m roF aigroeG Net Operating Loss, TAXPAYERS FEIN, PRECEDING TAX, PRECEDING TAX, YEAR ENDED, YEAR ENDED, PRECEDIN G TAX YEAR ENDE, a Return as filed or, liability as last, determined, b Liability after, application of, carryback, and c Return as filed or. These have to be filled out with utmost accuracy.

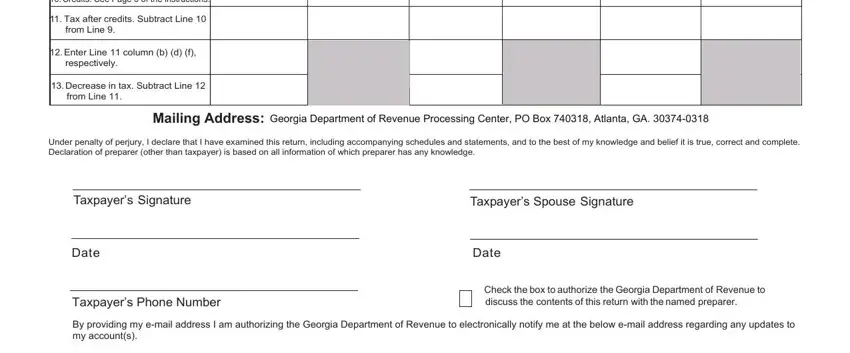

4. To go forward, your next part involves completing a couple of empty form fields. Examples include Credits See Page of the, Tax after credits Subtract Line, from Line, Enter Line column b d f, respectively, Decrease in tax Subtract Line, from Line, Mailing Address Georgia Department, Under penalty of perjury I declare, and belief it is true correct and, Taxpayers Signature, Taxpayers Spouse Signature, Date, Date, and Taxpayers Phone Number, which are key to carrying on with this particular form.

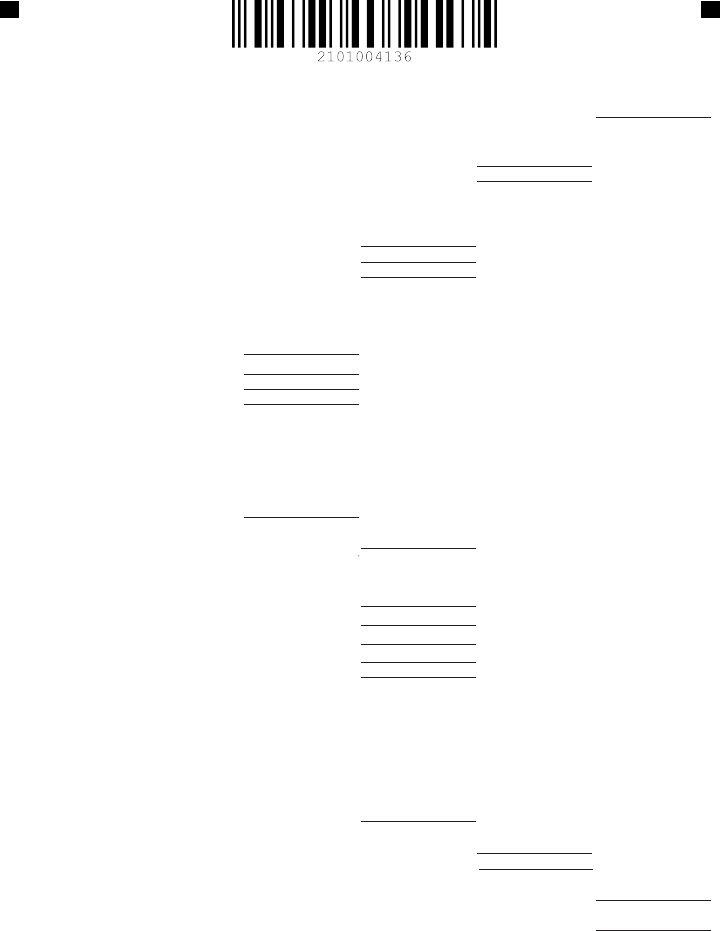

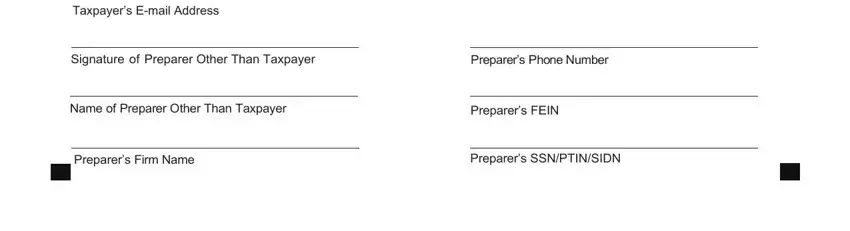

5. This pdf has to be finished within this part. Below you can find an extensive list of blanks that need to be filled in with specific details for your document submission to be faultless: Taxpayers Email Address, Signature of Preparer Other Than, Preparers Phone Number, Name of Preparer Other Than, Preparers FEIN, Preparers Firm Name, and Preparers SSNPTINSIDN.

It is easy to make errors when filling out the Preparers SSNPTINSIDN, thus ensure that you take another look before you'll submit it.

Step 3: Make certain your information is right and just click "Done" to conclude the task. Make a 7-day free trial plan with us and get immediate access to ga 500 nol - readily available in your personal account. FormsPal guarantees safe form editor devoid of personal information record-keeping or sharing. Be assured that your information is safe here!