The Georgia Form 600, revised as of November 2010, serves as a critical document for corporations operating within the state, outlining the necessary steps for filing both the Corporation Tax Return and Net Worth Tax Return. Managed by the Georgia Department of Revenue, this form accommodates various filing requirements including original and amended returns, consolidated returns, and instances necessitating an address or name change. The form intricately details the procedure for computing Georgia Taxable Income and Tax, alongside calculations for the Net Worth Tax, adhering to the state's specific guidelines. Such comprehensive computation sections require the submission of the federal return and supporting schedules, underlining the importance of accuracy and completeness in reporting. The form additionally provides space for reporting adjustments to federal taxable income, claiming tax credits, and detailing assignments of such credits among affiliated entities, emphasizing the potential financial implications for the corporation's tax liabilities. The inclusion of a Net Operating Loss (NOL) Carry Forward Worksheet exemplifies the form's role in facilitating longer-term tax planning and management. Furthermore, adherence to payment instructions and the declaration section underscores the legal obligation of corporate officers to ensure the return's veracity. Essentially, Georgia Form 600 encapsulates a crucial aspect of corporate fiscal responsibility within the state, requiring meticulous attention to detail and comprehensive financial reporting.

| Question | Answer |

|---|---|

| Form Name | Georgia Form 600 |

| Form Length | 5 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 15 sec |

| Other names | 600_Blank in ga corp net worth calculation what is g2 a g 2lp andor g 2rp form |

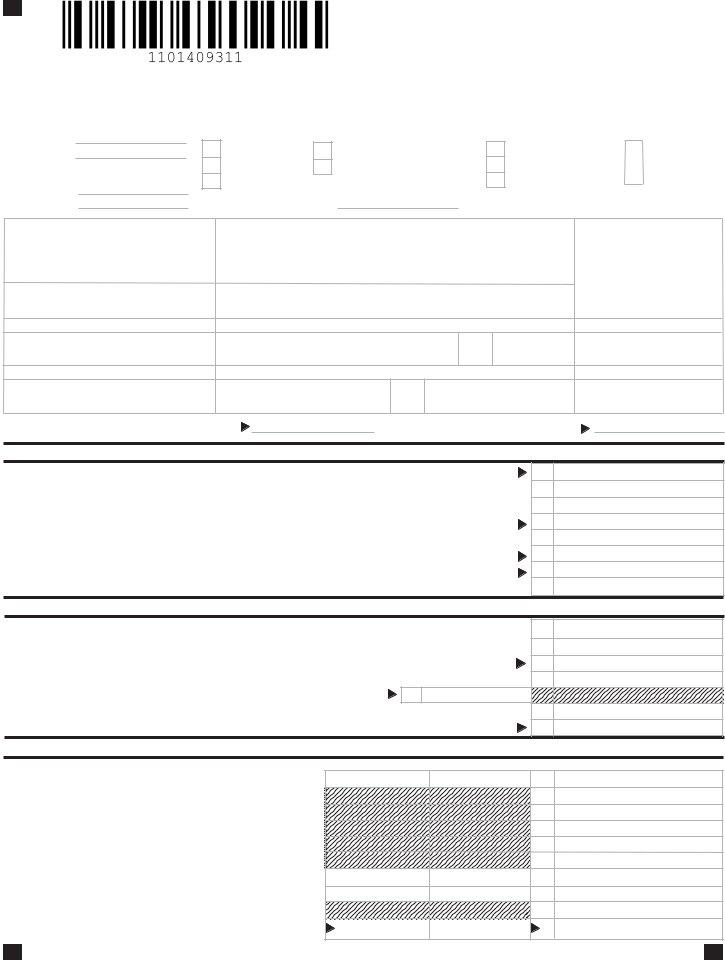

Georgia Form 600 (Rev. 11/10)

Corporation Tax Return

Georgia Department of Revenue (Approved booklet version)

2010 Income Tax Return

Beginning

Ending

2011 Net Worth Tax Return

Beginning

Ending

Original Return

Initial Net Worth

Amended Return

Consolidated GA Parent Return

(attach approval)

GA Consolidated Subsidiary Consolidated Parent FEIN

|

|

|

UET Annualization |

Address Change |

|

|

Exception attached |

Name Change |

|

||

|

|||

Final (attach explanation) |

|

Extension attached |

|

|

|

||

A. Federal Employer I.D. Number |

Name (Corporate title) Please include former name if applicable. |

E. Date of Incorporation |

|

|

|

|

|

B. GA. Withholding Tax Account Number |

Business Address (Number and Street) |

F. Incorporated under laws |

|

|

|

of what state |

|

C. GA. Sales Tax Registration Number

City or Town |

State |

Zip Code |

G. Date admitted into GA

D. NAICS Code

Location of Books for Audit (city) &(sta te ) |

Telephone Number |

H. Kind of Business

Indicate latest taxable year adjusted by IRS |

|

|

And when reported to Georgia |

||

|

COMPUTATION OF GEORGIA TAXABLE INCOME AND TAX |

(ROUND TO NEAREST DOLLAR) |

SCHEDULE 1 |

||

1. |

Federal Taxable Income (Copy of Federal return and supporting schedules must be attached) .... |

1. |

|||

2. |

Additions to Federal Income (from Schedule 4) |

|

|

2. |

|

3. |

Total (add Lines 1 and 2 ) |

|

|

3. |

|

4. |

Subtractions from Federal Income (from Schedule 5) |

|

|

4. |

|

5. |

Balance (Line 3 less Line 4) |

|

|

5. |

|

6. |

Georgia Net Operating loss deduction (from Schedule 11) |

|

6. |

||

7. |

Georgia Taxable Income (Line 5 less Line 6 or Schedule 7, Line 9) |

|

7. |

||

8. |

Income Tax - (6% x Line 7) |

|

|

8. |

|

|

COMPUTATION OF NET WORTH TAX |

(ROUND TO NEAREST DOLLAR) |

SCHEDULE 2 |

||

1. |

Total Capital stock issued |

|

|

1. |

|

2. |

Paid in or Capital surplus |

|

|

2. |

|

3. |

Total Retained earnings |

|

|

3. |

|

4. |

Net Worth (Total of Lines 1, 2, and 3) |

|

|

4. |

|

5. |

Ratio (GA. and Dom. For. |

5. |

|

||

6. |

Net Worth Taxable by Georgia (Line 4 x Line 5 ) |

|

|

6. |

|

7. |

Net Worth Tax (from table in instructions) |

|

|

7. |

|

|

COMPUTATION OF TAX DUE OR OVERPAYMENT |

(ROUND TO NEAREST DOLLAR) |

SCHEDULE 3 |

||

|

|

A. Income Tax |

B. Net Worth Tax |

C. Total |

|

1. |

Total Tax (Schedule 1, Line 8, and Schedule 2, Line 7) |

|

|

|

1. |

2. |

Less Credits and payments of estimated tax |

|

|

|

2. |

3. |

Less Credits from Schedule 9, Line 6* |

|

|

|

3. |

4. |

Withholding Credits |

|

|

|

4. |

5. |

Balance of tax due (Line 1, less Lines 2, 3, and 4) .. |

|

|

|

5. |

6. |

Amount of overpayment (Lines 2, 3, and 4 less Line1) |

|

|

|

6. |

7. |

Interest due (See Instructions) |

|

|

|

7. |

8. |

Penalty due (See Instructions) |

|

|

|

8. |

9. Balance of Tax, Interest and Penalty due with return |

|

|

|

9. |

|

10. |

Amount of Line 6 to be credited to 2011 estimated tax |

|

|

Refunded |

|

*NOTE: Any tax credits from Schedule 9 may be applied against income tax liability only, not net worth tax liability.

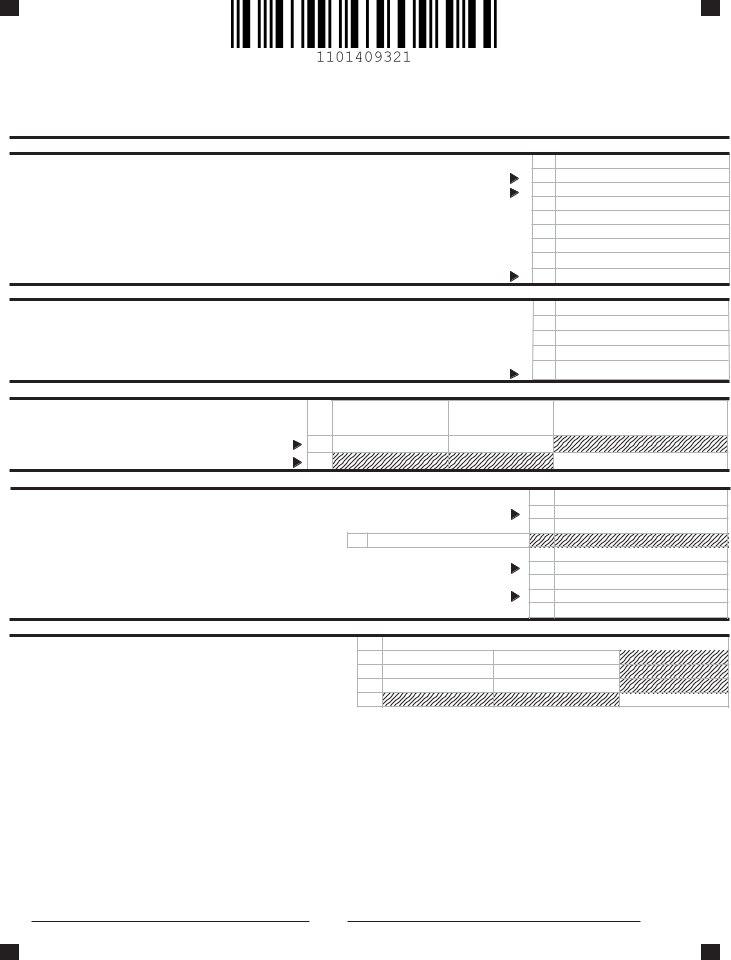

Georgia Form 600/2010 (Corporation) Name_______________________________________FEIN____________________

|

ADDITIONS TO FEDERAL TAXABLE INCOME |

(ROUND TO NEAREST DOLLAR) |

|

SCHEDULE 4 |

|

1. |

State and municipal bond interest (other than Georgia or political subdivision thereof) |

..................... |

1. |

|

|

2. |

Net income or net profits taxes imposed by taxing jurisdictions other than Georgia |

2. |

|

||

3. |

Expense attributable to tax exempt income |

|

3. |

|

|

4. |

Net operating loss deducted on Federal return |

|

4. |

|

|

5. |

Federal deduction for income attributable to domestic production activities (IRC Section 199) |

5. |

|

||

6. |

Intangible expenses and related interest cost |

|

6. |

|

|

7. |

Captive REIT expenses and costs |

|

7. |

|

|

8. |

Other Additions (Attach Schedule) |

|

8. |

|

|

9. |

TOTAL - Enter also on LINE 2, SCHEDULE 1 |

|

9. |

|

|

|

SUBTRACTIONS FROM FEDERAL TAXABLE INCOME |

(ROUND TO NEAREST DOLLAR) |

|

SCHEDULE 5 |

|

1. |

Interest on obligations of United States (must be reduced by direct and indirect interest expense) . |

1. |

|

||

2. |

|

||||

2. |

Exception to intangible expenses and related interest cost (Attach |

|

|

||

|

|

||||

3. |

Exception to captive REIT expenses and costs (Attach |

|

3. |

|

|

|

|

||||

4. |

Other Subtractions (Must Attach Schedule) |

|

4. |

|

|

|

|

|

|||

5. |

TOTAL - Enter also on LINE 4, SCHEDULE 1 |

|

5. |

|

|

|

|

|

|||

|

APPORTIONMENT OF INCOME |

|

|

|

SCHEDULE 6 |

|

|

A. WITHIN GEORGIA |

B. EVERYWHERE |

|

C. DO NOT ROUND |

|

|

|

|

|

COL (A)/ COL (B) |

|

|

|

|

|

COMPUTE TO SIX DECIMALS |

1. Gross receipts from business |

1. |

|

|

|

|

|

|

|

|

||

2. |

Georgia Ratio (Divide Column A by Column B) |

2. |

|

|

|

|

COMPUTATION OF GEORGIA NET INCOME |

(ROUND TO NEAREST DOLLAR) |

|

SCHEDULE 7 |

|

1. |

Net business income (Schedule 1, Line 5) |

|

1. |

|

|

2. |

Income allocated everywhere (Must Attach Schedule) |

|

2. |

|

|

3. |

Business income subject to apportionment (Line 1 less Line 2) |

3. |

|

||

4. |

Georgia Ratio (Schedule 6, Column C) |

4. |

|

|

|

5. |

Net business income apportioned to Georgia (Line 3 x Line 4) |

5. |

|

||

6. |

Net income allocated to Georgia (Attach Schedule) |

|

6. |

|

|

7. |

Total of Lines 5 and 6 |

|

7. |

|

|

8. |

Less: net operating loss apportioned to GA. (from Schedule 11) |

8. |

|

||

9. |

Georgia taxable income (Enter also on Schedule 1, Line 7 ) |

............................................................... |

9. |

|

|

|

COMPUTATION OF GEORGIA NET WORTH RATIO |

(TO BE USED BY FOREIGN CORPS ONLY) |

SCHEDULE 8 |

||

1.Total value of property owned (Total assets from Federal balance sheet)

2.Gross receipts from business ............................................................

3.Totals (Line 1 plus Line 2) .................................................................

4.Georgia Ratio (Divide Line 3A by 3B) .................................................

A. Within Georgia |

B.TotalEverywhere |

C. GA. ratio (A/B) |

1. |

|

|

2. |

|

|

3. |

|

|

4. |

|

|

A copy of the Federal Return and supporting Schedules must be attached, otherwise this return shall be deemed incomplete. No extension of time for filing will be allowed unless a copy of the request for a Federal extension or Form

Make check payable to: Georgia Department of Revenue

Mail to: Georgia Department of Revenue, Processing Center, P.O. Box 740397, Atlanta, Georgia

Georgia Public Revenue Code Section

my/our knowledge and belief it is true, correct, and complete. If prepared by a person other than taxpayer, their declaration is based on all information of which they |

||||||||

have any knowledge. |

|

|

|

|

|

|

Checktheboxto |

|

Email Address: |

|

|

|

|

|

|

|

authorize the |

|

|

|

|

|

|

|

|

Georgia |

|

|

|

|

|

|

|

|

Department of |

|

|

|

|

|

|

|

|

Revenue to discuss |

|

|

|

|

|

|

|||

SIGNATURE OF OFFICER |

DATE |

|

SIGNATURE OF INDIVIDUAL OR FIRM PREPARING THE RETURN the contents of this |

|||||

tax return with the named preparer.

TITLE |

IDENTIFICATION OR SOCIAL SECURITY NUMBER |

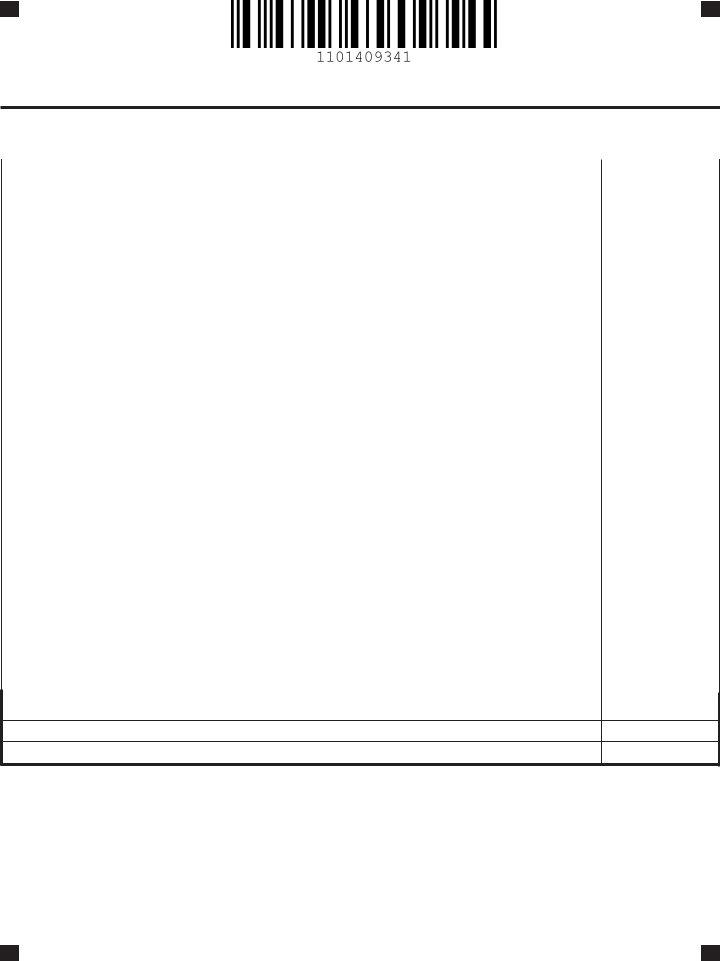

Georgia Form 600/2010 (Corporation) Name_______________________________________FEIN____________________

CLAIMED TAX CREDITS |

(ROUND TO NEAREST DOLLAR) |

SCHEDULE 9 |

See pages 14 through 19 for a list of available credits and their applicable codes. You must list the appropriate credit type code in the space provided. If you claim more than four credits, attach a schedule. Enter the total of the additional schedule on Line 5. If the tax credit is flowing or being assigned into this corporation from another corporation, please enter the name and FEIN of the corporation where the tax credit originated. If the credit originated with the corporation filing this return, enter “Same” in the spaces for corporation and FEIN.

|

Credit Type Code |

|

Corporation Name |

|

FEIN |

|

Amount of Credit |

|

|

|

|

|

|

|

|

1. |

|

|

|

|

|

1. |

|

2. |

|

|

|

|

|

2. |

|

3. |

|

|

|

|

|

3. |

|

4. |

|

|

|

|

|

4. |

|

5. |

Enter the total from attached schedule(s) |

|

5. |

|

|||

6. |

...............................Enter the total of Lines 1 through 5 here and on Schedule 3, Line 3, Page 1 |

6. |

|

||||

|

|

|

|

|

|

||

|

ASSIGNED TAX CREDITS |

|

(ROUND TO NEAREST DOLLAR) |

|

SCHEDULE 10 |

||

Georgia Code Section

1)A corporation that is a member of the taxpayer’s affiliated group within the meaning of Section 1504(a) of the Internal Revenue Code; or

2)An entity affiliated with a corporation, business, partnership, or limited liability company taxpayer, which entity:

(a)Owns or leases the land on which a project is constructed;

(b)Provides capital for construction of the project; and

(c)Is the grantor or owner under a management agreement with a managing company for the project.

No carryover attributable to the unused portion of any previously claimed or assigned credit may be assigned or reassigned, except if the assignor and the recipient of an assigned tax credit cease to be affiliated entities, then any carryover attributable to the unused portion of the credit is transferred back to the assignor of the credit. The assignor is permitted to use any such carryover and also shall be permitted to assign the carryover to one or more affiliated entities, as if such carryover were an income tax credit for which the assignor became eligible in the taxable year in which the carryover was transferred back to the assignor. In the case of any credit that must be claimed in installments in more than one taxable year, the election under this subsection may be made on an annual basis with respect to each such installment. For additional information, please refer to Georgia Code Section

If the corporation filing this return is assigning tax credits to other affiliates, please provide detail below specifying where the tax credits are being assigned.

All assignments of credits must be made before the statutory due date (including extensions) per O.C.G.A. §

|

Credit Type Code |

Corporation Name |

FEIN |

|

Amount of Credit |

1. |

|

|

|

1. |

|

2. |

|

|

|

2. |

|

3. |

|

|

|

3. |

|

4. |

|

|

|

4. |

|

If this corporation and its affiliates to whom credits are being assigned are filing as part of a Georgia consolidated return, you must provide the name and FEIN of the corporation under which the consolidated Georgia return is being filed to ensure that the tax credits are properly applied.

Corporation: ____________________________________________ FEIN __________________

Georgia Form 600/2010 (Corporation) Name_______________________________________FEIN____________________

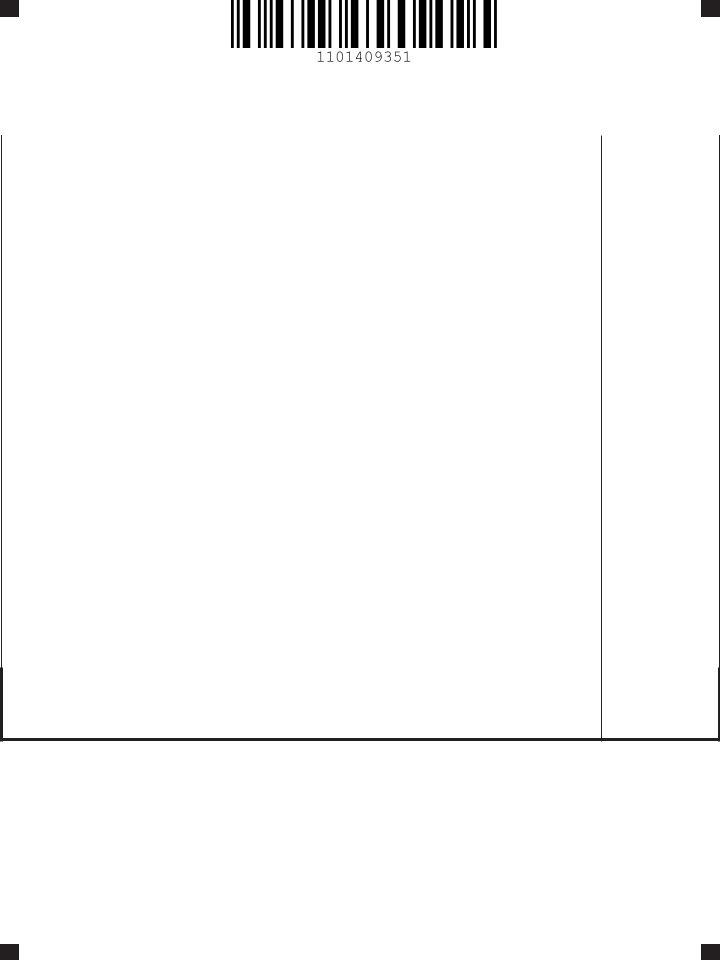

GA NOL Carry Forward Worksheet |

(ROUND TO NEAREST DOLLAR) |

SCHEDULE 11 |

|||

|

|

|

|

|

|

For calendar year or fiscal year beginning |

|

and ending |

|

|

|

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

A |

B |

C |

D |

E |

F |

Loss Year |

Loss Amount |

Income Year |

NOL Utilized |

Balance |

Remaining NOL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.NOL Carry Forward Available to Current Year (Enter on Schedule 1, Line 6 or Schedule 7, Line 8)

2.Current Year Income / (Loss)

3.NOL Carry Forward Available to Next Year (Subtract Line 2 from Line 1)

INSTRUCTIONS

Column A:List the loss year(s).

Column B:List the loss amount for the tax year listed in Column A.

Columns C& D:List the years in which the losses were utilized and the amount utilized each year.

Column E:List the balance of the NOL after each year has been applied.

Column F: List the remaining NOL applicable to each loss year.

Total the remaining NOL (Col. F) and enter in the space at the bottom of the worksheet for “NOL Carry Forward Available to Current Year”. Then insert “Current Year Income / (Loss)” in the space provided and compute the “NOL Carry Forward Available to Next Year” in the last space. DO NOT check the box for IT 552 on the return if Schedule 11 is used.

Create photocopies as needed. See example worksheet on page 9.

GEORGIA NOL CARRY FORWARD WORKSHEET EXAMPLE

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

A |

|

B |

C |

|

D |

|

E |

|

F |

Loss Year |

Loss Amount |

Income Year |

|

NOL Utilized |

|

Balance |

Remaining NOL |

||

1994 |

$ |

225,351 |

1996 |

$ |

49,052 |

$ |

176,299 |

|

|

1994 |

|

|

1997 |

$ |

39,252 |

$ |

137,047 |

|

|

1994 |

|

|

1998 |

$ |

26,880 |

$ |

110,167 |

|

|

1994 |

|

|

2000 |

$ |

59,504 |

$ |

50,663 |

$ |

50,663 |

1999 |

$ |

86,280 |

|

|

|

|

|

$ |

86,280 |

2001 |

$ |

116,287 |

|

|

|

|

|

$ |

116,287 |

2002 |

$ |

18,765 |

|

|

|

|

|

$ |

18,765 |

2003 |

$ |

52,711 |

|

|

|

|

|

$ |

52,711 |

2004 |

$ |

35,972 |

|

|

|

|

|

$ |

35,972 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. NOL Carry forward Available to Current Year (Enter on Schedule 1, Line 6 or Schedule 7, Line 8) |

360,678 |

2. Current Year Income / (Loss) |

100,000 |

3. NOL Carry forward Available to Next Year (Subtract line 2 from line 1) |

260,678 |

INSTRUCTIONS

Column A: List the loss year(s).

Column B List the loss amount for the tax year listed in Column A.

Columns C& D:List the years in which the losses were utilized and the amount utilized each year.

Column E: List the balance of the NOL after each year has been applied.

Column F: List the remaining NOL applicable to each loss year.

Total the remaining NOL (Col. F) and enter in the space at the bottom of the worksheet for “NOL Carry forward Available to Current Year”. Then insert “Current Year Income / (Loss)” in the space provided and compute the “NOL Carry forward Available to Next Year” in the last space. Do not check the box for IT 552 on the return if schedule 11 is used. Create photocopies as needed.

Page 9