Our skilled computer programmers have worked collectively to develop the PDF editor which you will work with. The application makes it simple to obtain Georgia Form Att 21 files quickly and without problems. This is all you should carry out.

Step 1: You should click the orange "Get Form Now" button at the top of the webpage.

Step 2: The file editing page is currently available. You can add text or edit existing details.

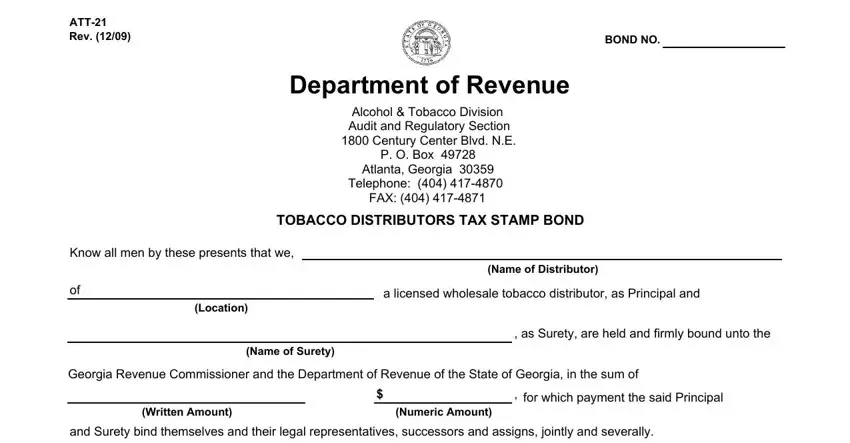

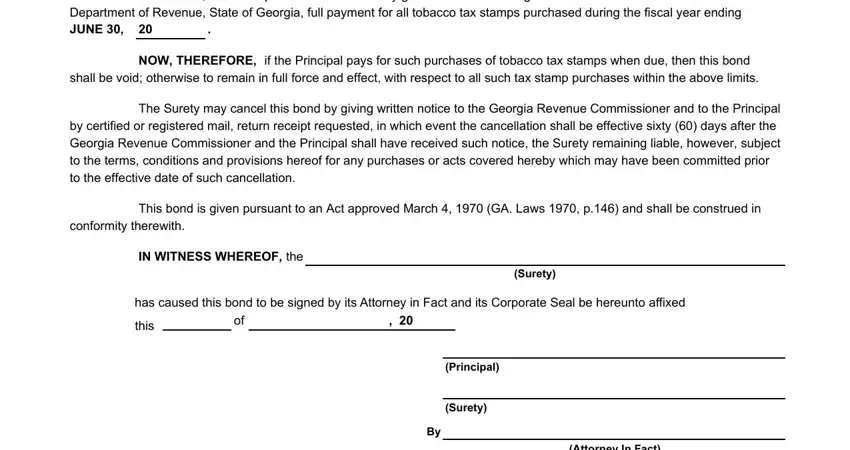

All of the following segments are what you are going to create to receive the ready PDF document.

Provide the appropriate data in the segment WHEREAS the Principal does, Department of Revenue State of, if the Principal pays for such, NOW THEREFORE, The Surety may cancel this bond by, This bond is given pursuant to an, conformity therewith, IN WITNESS WHEREOF the, has caused this bond to be signed, this, Surety, Principal, Surety, and Attorney In Fact.

Step 3: After you have hit the Done button, your form is going to be obtainable for transfer to any kind of device or email address you identify.

Step 4: Create a duplicate of each separate document. It will certainly save you time and assist you to refrain from issues as time goes on. Also, your information is not used or monitored by us.