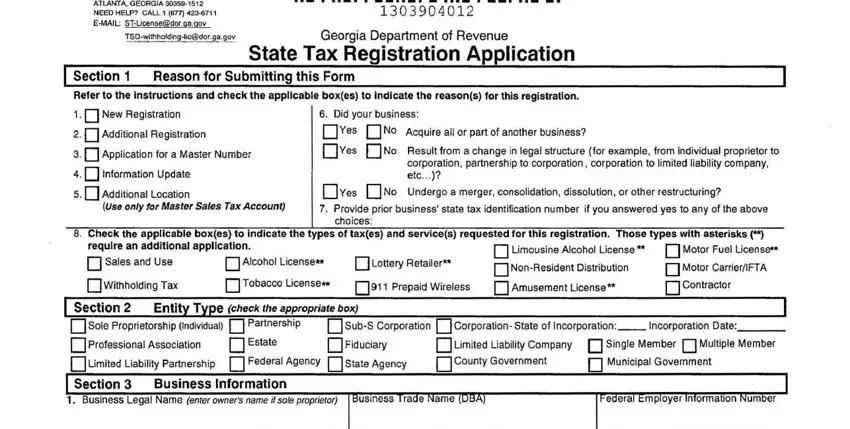

It shouldn’t be challenging to create how to georgia state tax instruction making use of our PDF editor. Here's how you can rapidly prepare your file.

Step 1: Initially, click the orange button "Get Form Now".

Step 2: At this point, you are on the document editing page. You may add information, edit existing information, highlight particular words or phrases, place crosses or checks, add images, sign the form, erase unrequired fields, etc.

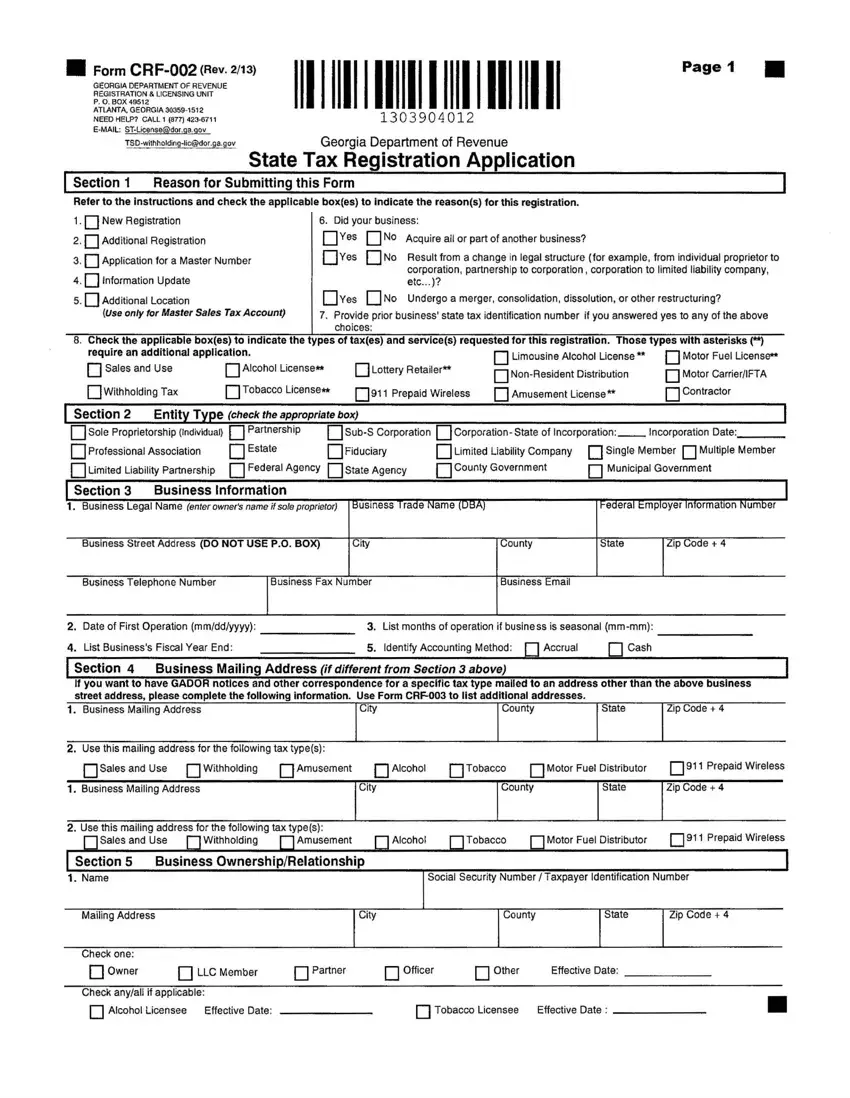

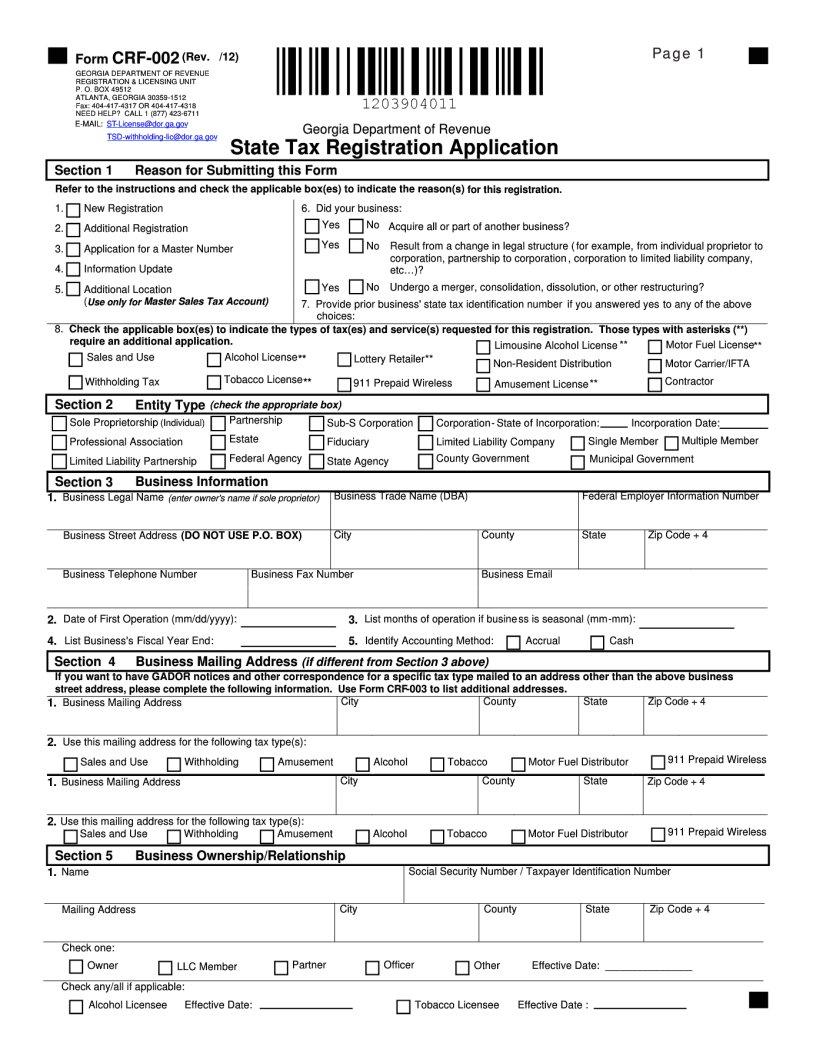

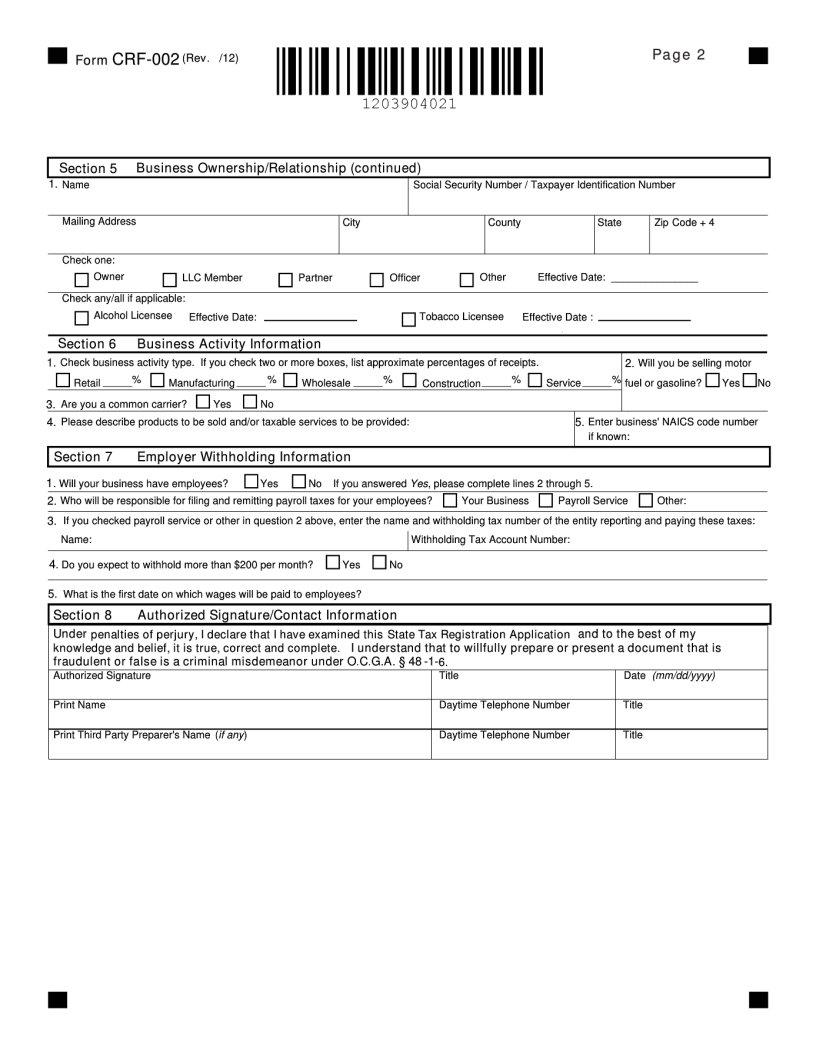

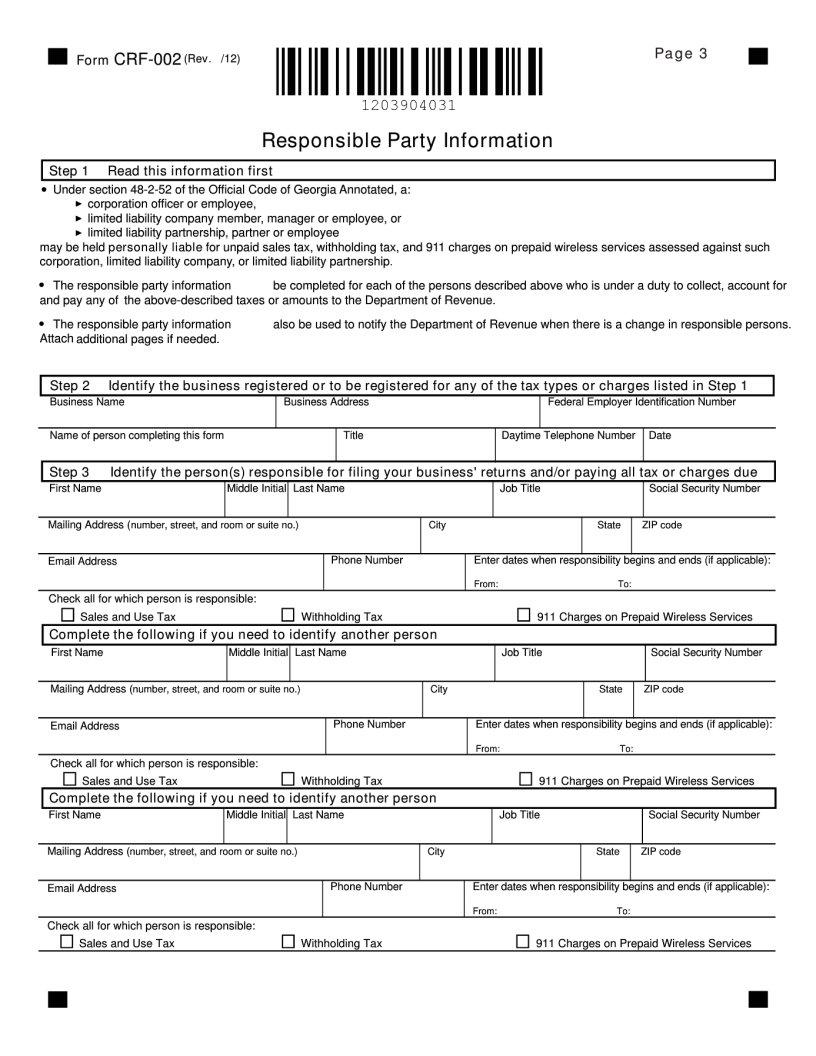

Enter the necessary content in each one part to create the PDF how to georgia state tax instruction

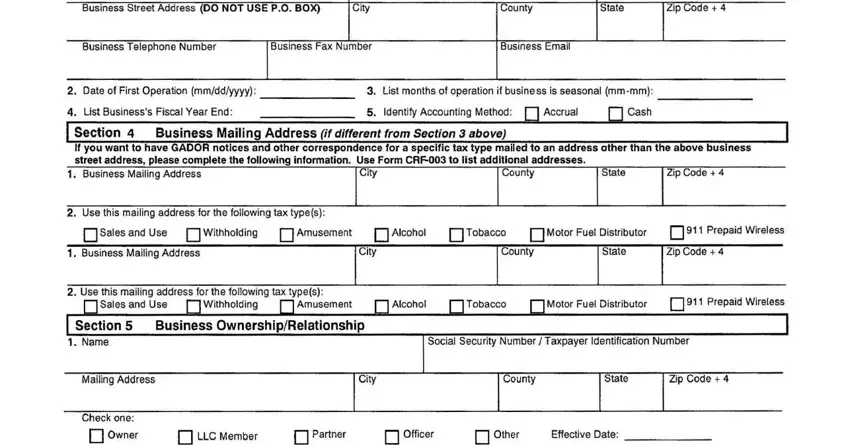

In the part Business, Street, Address, DO, NOT, USE, PO, BOX City, County, State, Zip, Code Business, Telephone, Number Business, Fax, Number Business, Email Zip, Code County, State, City, Motor, Fuel, Distributor, Prepaid, Wireless Business, Mailing, Address and City note the information that the system asks you to do.

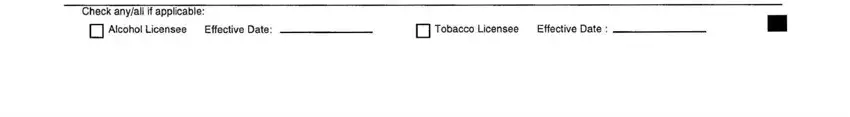

Remember to emphasize the necessary data in the Check, any, all, if, applicable Alcohol, Licensee, Effective, Date and Tobacco, Licensee, Effective, Date area.

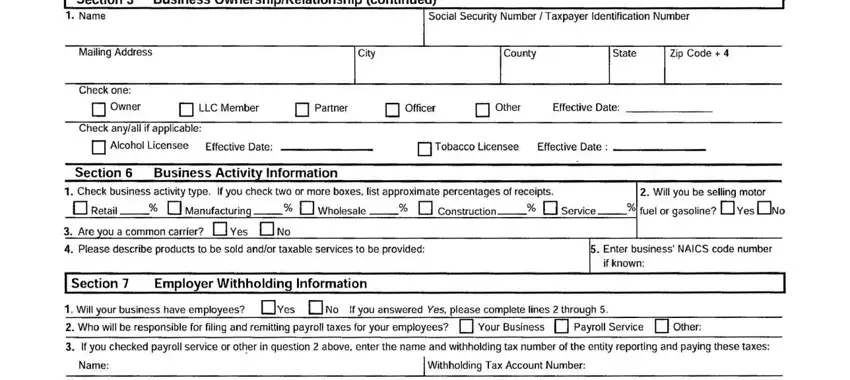

The Mailing, Address Check, one City, County, State, Zip, Code Owner, II, LLC, Member, Partner, Officer Other, Effective, Date Check, any, all, if, applicable II, Alcohol, Licensee, Effective, Date Tobacco, Licensee, Effective, Date Section, Business, Activity, Information Retail, and Manufacturing box could be used to specify the rights and responsibilities of each party.

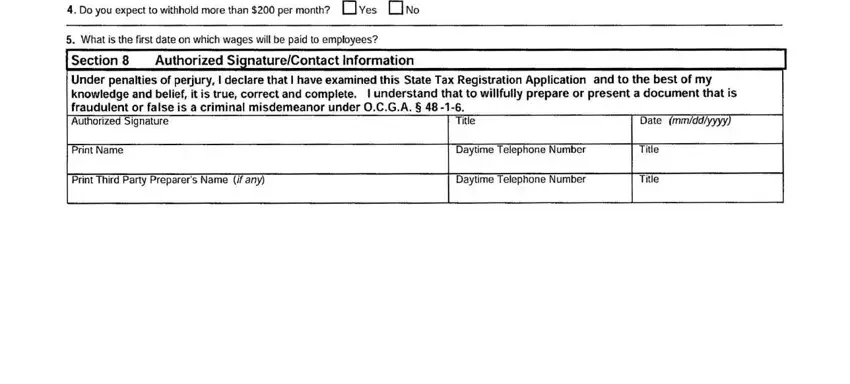

Finalize by looking at these areas and typing in the suitable data: Date, mm, dd, yyyy Title, Print, Name Print, Third, Party, Preparer, s, Name, if, any Daytime, Telephone, Number Daytime, Telephone, Number Title, and Title.

Step 3: Hit the Done button to save the file. Now it is obtainable for upload to your electronic device.

Step 4: Produce at least several copies of your file to stay clear of any specific potential troubles.