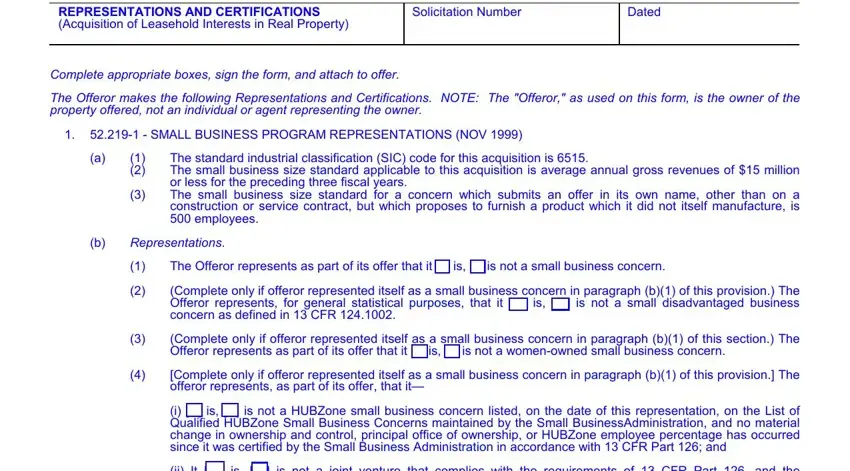

REPRESENTATIONS AND CERTIFICATIONS

(Acquisition of Leasehold Interests in Real Property)

Complete appropriate boxes, sign the form, and attach to offer.

The Offeror makes the following Representations and Certifications. NOTE: The "Offeror," as used on this form, is the owner of the property offered, not an individual or agent representing the owner.

1.52.219-1 - SMALL BUSINESS PROGRAM REPRESENTATIONS (NOV 1999)

(a)(1) The standard industrial classification (SIC) code for this acquisition is 6515.

(2)The small business size standard applicable to this acquisition is average annual gross revenues of $15 million or less for the preceding three fiscal years.

(3)The small business size standard for a concern which submits an offer in its own name, other than on a construction or service contract, but which proposes to furnish a product which it did not itself manufacture, is 500 employees.

(b)Representations.

(1)The Offeror represents as part of its offer that it [ ] is, [ ] is not a small business concern.

(2)(Complete only if offeror represented itself as a small business concern in paragraph (b)(1) of this provision.) The Offeror represents, for general statistical purposes, that it [ ] is, [ ] is not a small disadvantaged business concern as defined in 13 CFR 124.1002.

(3)(Complete only if offeror represented itself as a small business concern in paragraph (b)(1) of this section.) The Offeror represents as part of its offer that it [ ] is, [ ] is not a women-owned small business concern.

(4)[Complete only if offeror represented itself as a small business concern in paragraph (b)(1) of this provision.] The offeror represents, as part of its offer, that it—

(i)[ ] is, [ ] is not a HUBZone small business concern listed, on the date of this representation, on the List of Qualified HUBZone Small Business Concerns maintained by the Small BusinessAdministration, and no material change in ownership and control, principal office of ownership, or HUBZone employee percentage has occurred since it was certified by the Small Business Administration in accordance with 13 CFR Part 126; and

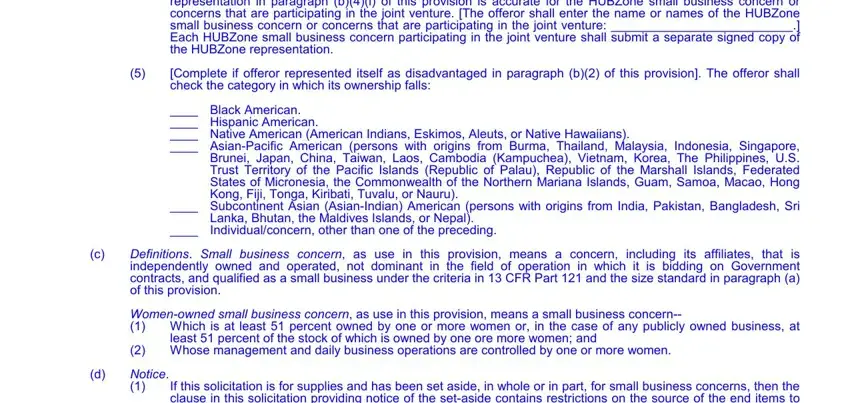

(ii)It [ ] is, [ ] is not a joint venture that complies with the requirements of 13 CFR Part 126, and the representation in paragraph (b)(4)(i) of this provision is accurate for the HUBZone small business concern or concerns that are participating in the joint venture. [The offeror shall enter the name or names of the HUBZone small business concern or concerns that are participating in the joint venture: __________________________.] Each HUBZone small business concern participating in the joint venture shall submit a separate signed copy of the HUBZone representation.

(5)[Complete if offeror represented itself as disadvantaged in paragraph (b)(2) of this provision]. The offeror shall check the category in which its ownership falls:

____ Black American.

____ |

Hispanic American. |

____ |

Native American (American Indians, Eskimos, Aleuts, or Native Hawaiians). |

____ |

Asian-Pacific American (persons with origins from Burma, Thailand, Malaysia, Indonesia, Singapore, |

|

Brunei, Japan, China, Taiwan, Laos, Cambodia (Kampuchea), Vietnam, Korea, The Philippines, U.S. |

|

Trust Territory of the Pacific Islands (Republic of Palau), Republic of the Marshall Islands, Federated |

|

States of Micronesia, the Commonwealth of the Northern Mariana Islands, Guam, Samoa, Macao, Hong |

|

Kong, Fiji, Tonga, Kiribati, Tuvalu, or Nauru). |

____ |

Subcontinent Asian (Asian-Indian) American (persons with origins from India, Pakistan, Bangladesh, Sri |

|

Lanka, Bhutan, the Maldives Islands, or Nepal). |

____ |

Individual/concern, other than one of the preceding. |

(c)Definitions. Small business concern, as use in this provision, means a concern, including its affiliates, that is independently owned and operated, not dominant in the field of operation in which it is bidding on Government contracts, and qualified as a small business under the criteria in 13 CFR Part 121 and the size standard in paragraph (a) of this provision.

Women-owned small business concern, as use in this provision, means a small business concern--

(1)Which is at least 51 percent owned by one or more women or, in the case of any publicly owned business, at least 51 percent of the stock of which is owned by one ore more women; and

(2)Whose management and daily business operations are controlled by one or more women.

(d)Notice.

(1)If this solicitation is for supplies and has been set aside, in whole or in part, for small business concerns, then the clause in this solicitation providing notice of the set-aside contains restrictions on the source of the end items to be furnished.

INITIALS: |

|

& |

|

|

LESSOR |

GOVERNMENT |

GSA FORM 3518 PAGE 1 (REV 12/99) |

(2)Under 15 U.S.C. 645(d), any person who misrepresents a firm’s status as a small, small disadvantaged, or women-owned small business concern in order to obtain a contract to be awarded under the preference programs established pursuant to sections 8(a), 8(d), 9, or 15 of the Small Business Act or any other provision of Federal law that specifically references section 8(d) for a definition of program eligibility, shall--

(i)Be punished by imposition of fine, imprisonment, or both;

(ii)Be subject to administrative remedies, including suspension and debarment; and

(iii)Be ineligible for participation in programs conducted under the authority of the Act.

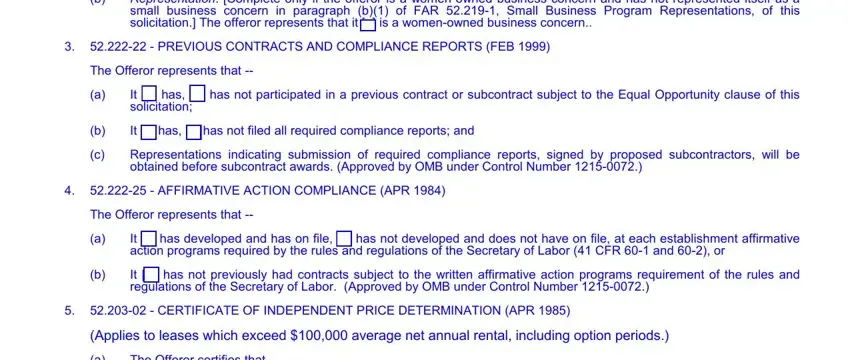

2.52.204-5 - WOMEN-OWNED BUSINESS (OTHER THAN SMALL BUSINESS) (MAY 1999)

(a)Definition. "Women-owned business concern," as used in this provision, means a concern which is at least 51 percent owned by one or more women; or in the case of any publicly owned business, at least 51 percent of its stock is owned by one or more women; and whose management and daily business operations are controlled by one or more women.

(b)Representation. [Complete only if the offeror is a women-owned business concern and has not represented itself as a small business concern in paragraph (b)(1) of FAR 52.219-1, Small Business Program Representations, of this solicitation.] The offeror represents that it [ ] is a women-owned business concern..

3.52.222-22 - PREVIOUS CONTRACTS AND COMPLIANCE REPORTS (FEB 1999) The Offeror represents that --

(a)It [ ] has, [ ] has not participated in a previous contract or subcontract subject to the Equal Opportunity clause of this solicitation;

(b)It [ ] has, [ ] has not filed all required compliance reports; and

(c)Representations indicating submission of required compliance reports, signed by proposed subcontractors, will be obtained before subcontract awards. (Approved by OMB under Control Number 1215-0072.)

4.52.222-25 - AFFIRMATIVE ACTION COMPLIANCE (APR 1984) The Offeror represents that --

(a)It [ ] has developed and has on file, [ ] has not developed and does not have on file, at each establishment affirmative action programs required by the rules and regulations of the Secretary of Labor (41 CFR 60-1 and 60-2), or

(b)It [ ] has not previously had contracts subject to the written affirmative action programs requirement of the rules and regulations of the Secretary of Labor. (Approved by OMB under Control Number 1215-0072.)

5.52.203-02 - CERTIFICATE OF INDEPENDENT PRICE DETERMINATION (APR 1985)

(Applies to leases which exceed $100,000 average net annual rental, including option periods.)

(a)The Offeror certifies that--

(1)The prices in this offer have been arrived at independently, without, for the purpose of restricting competition, any consultation, communication, or agreement with any other Offeror or competitor relating to (i) those prices, (ii) the intention to submit an offer, or (iii) the methods or factors used to calculate the prices offered;

(2)The prices in this offer have not been and will not be knowingly disclosed by the Offeror, directly or indirectly, to any other Offeror or competitor before bid opening (in the case of a sealed bid solicitation) or contract award (in the case of a negotiated solicitation) unless otherwise required by law; and

(3)No attempt has been made or will be made by the Offeror to induce any other concern to submit or not to submit an offer for the purpose of restricting competition.

(b)Each signature on the offer is considered to be a certification by the signatory that the signatory--

(1)Is the person in the Offeror's organization responsible for determining the prices being offered in this bid or proposal, and that the signatory has not participated and will not participate in any action contrary to subparagraphs (a)(1) through (a)(3) above; or

(2)(i) Has been authorized, in writing, to act as agent for the following principals in certifying that those principals have not participated, and will not participate in any action contrary to subparagraphs (a)(1) through (a)(3) above _______________________________________________ [insert full name of person(s) in the Offeror's organization responsible for determining the prices offered in this bid or proposal, and the title of his or her position in the Offeror's organization];

(ii)As an authorized agent, does certify that the principals named in subdivision (b)(2)(i) above have not participated, and will not participate, in any action contrary to subparagraphs (a)(1) through (a)(3) above; and

(iii)As an agent, has not personally participated, and will not participate, in action contrary to subparagraphs (a)(1) through (a)(3) above.

(c)If the Offeror deletes or modifies subparagraph (a)(2) above, the Offeror must furnish with its offer a signed statement setting forth in detail the circumstances of the disclosure.

INITIALS: |

|

& |

|

|

LESSOR |

GOVERNMENT |

GSA FORM 3518 PAGE 2 (REV 12/99) |

6.52.203-11 - CERTIFICATION AND DISCLOSURE REGARDING PAYMENTS TO INFLUENCE CERTAIN FEDERAL TRANSACTIONS (APR 1991) (DEVIATION)

(Applies to leases which exceed $100,000.)

(a)The definitions and prohibitions contained in the clause, at FAR 52.203-12, Limitation on Payments to Influence Certain Federal Transactions, are hereby incorporated by reference in paragraph (b) of this certification.

(b)The offeror, by signing its offer, hereby certifies to the best of his or her knowledge and belief that on or after December 23, 1989,--

(1)No Federal appropriated funds have been paid or will be paid to any person for influencing or attempting to influence an officer or employee of any agency, a Member of Congress, an officer or employee of Congress, or an employee of a Member of Congress on his or her behalf in connection with the awarding of a contract resulting from this solicitation.

(2)If any funds other than Federal appropriated funds (including profit or fee received under a covered Federal transaction) have been paid, or will be paid, to any person for influencing or attempting to influence an officer or employee of any agency, a Member of Congress, an officer or employee of Congress, or an employee of a Member of Congress on his or her behalf in connection with this solicitation, the offeror shall complete and submit, with its offer, OMB standard form LLL, Disclosure of Lobbying Activities, to the Contracting Officer; and

(3)He or she will include the language of this certification in all subcontract awards at any tier and require that all recipients of subcontract awards in excess of $100,000 shall certify and disclose accordingly.

(c)Submission of this certification and disclosure is a prerequisite for making or entering into this contract imposed by section 1352, title 31, United States Code. Any person who makes an expenditure prohibited under this provision or who fails to file or amend the disclosure form to be filed or amended by this provision, shall be subject to a civil penalty of not less than $10,000, and not more than $100,000, for each such failure.

7.52.209-5 - CERTIFICATION REGARDING DEBARMENT, SUSPENSION, PROPOSED DEBARMENT, AND OTHER RESPONSIBILITY MATTERS (MAR 1996)

(Applies to leases which exceed $100,000 average net annual rental, including option periods.)

(a)(1) The Offeror certifies, to the best of its knowledge and belief, that--

(i)The Offeror and/or any of its Principals--

(A)Are [ ] are not [ ] presently debarred, suspended, proposed for debarment, or declared ineligible for the award of contracts by any Federal agency;

(B)Have [ ] have not [ ], within a three-year period preceding this offer, been convicted of or had a civil judgment rendered against them for: commission of fraud or a criminal offense in connection with obtaining, attempting to obtain, or performing a public (Federal, State, or local) contract or subcontract; violation of Federal or State antitrust statutes relating to the submission of offers; or commission of embezzlement, theft, forgery, bribery, falsification or destruction of records, making false statements, tax evasion, or receiving stolen property; and

(C)Are [ ] are not [ ] presently indicted for, or otherwise criminally or civilly charged by a governmental entity with, commission of any of the offenses enumerated in subdivision (a)(1)(i)(B) of this provision.

(ii)The Offeror has [ ] has not [ ], within a three-year period preceding this offer, had one or more contracts terminated for default by any Federal agency.

(2)"Principals," for the purposes of this certification, means officers; directors; owners; partners; and, persons having primary management or supervisory responsibilities within a business entity (e.g., general manager; plant manager; head of a subsidiary, division, or business segment, and similar positions).

THIS CERTIFICATION CONCERNS A MATTER WITHIN THE JURISDICTION OF AN AGENCY OF THE UNITED STATES AND THE MAKING OF A FALSE, FICTITIOUS, OR FRAUDULENT CERTIFICATION MAY RENDER THE MAKER SUBJECT TO PROSECUTION UNDER SECTION 1001, TITLE 18, UNITED STATES CODE.

(b)The Offeror shall provide immediate written notice to the Contracting Officer if, at any time prior to contract award, the Offeror learns that its certification was erroneous when submitted or has become erroneous by reason of changed circumstances.

(c)A certification that any of the items in paragraph (a) of this provision exists will not necessarily result in withholding of an award under this solicitation. However, the certification will be considered in connection with a determination of the Offeror's responsibility. Failure of the Offeror to furnish a certification or provide such additional information as requested by the Contracting Officer may render the Offeror nonresponsible.

(d)Nothing contained in the foregoing shall be construed to require establishment of a system of records in order to render, in good faith, the certification required by paragraph (a) of this provision. The knowledge and information of an Offeror is not required to exceed that which is normally possessed by a prudent person in the ordinary course of business dealings.

(e)The certification in paragraph (a) of this provision is a material representation of fact upon which reliance was placed when making award. If it is later determined that the Offeror knowingly rendered an erroneous certification, in addition to other remedies available to the Government, the Contracting Officer may terminate the contract resulting from this solicitation for default.

INITIALS: |

|

& |

|

|

LESSOR |

GOVERNMENT |

GSA FORM 3518 PAGE 3 (REV 12/99) |

8.52.204-3 - TAXPAYER IDENTIFICATION (JUN 1997)

(a)Definitions.

“Common parent,” as used in this solicitation provision, means that corporate entity that owns or controls an affiliated group of corporations that files its Federal income tax returns on a consolidated basis, and of which the offeror is a member.

“Taxpayer Identification Number (TIN),” as used in this solicitation provision, means the number required by the IRS to be used by the offeror in reporting income tax and other returns. The TIN may be either a Social Security Number or an Employer Identification Number.

(b)All offerors must submit the information required in paragraphs (d) through (f) of this provision to comply with debt collection requirements of 31 U.S.C. 7701(c) and 3325(d), reporting requirements of 26 U.S.C. 6041, 6041A, and 6050M, and implementing regulations issued by the IRS. If the resulting contract is subject to the payment reporting requirements described in Federal Acquisition Regulation (FAR) 4.904, the failure or refusal by the offeror to furnish the information may result in a 31 percent reduction of payments otherwise due under the contract.

(c)The TIN may be used by the Government to collect and report on any delinquent amounts arising out of the offeror’s relationship with the Government (31 U.S.C. 7701(c)(3)). If the resulting contract is subject to the payment reporting requirements described in FAR 4.904, the TIN provided hereunder may be matched with IRS records to verify the accuracy of the offeror’s TIN.

(d)Taxpayer Identification Number (TIN).

*TIN:_____________________.

*TIN has been applied for.

*TIN is not required because:

*Offeror is a nonresident alien, foreign corporation, or foreign partnership that does not have income effectively connected with the conduct of a trade or business in the United States and does not have an office or place of business or a fiscal paying agent in the United States;

*Offeror is an agency or instrumentality of a foreign government;

*Offeror is an agency or instrumentality of the Federal government;

(e)Type of organization.

*Sole proprietorship;

*Partnership; Not a corporate entity:

*Corporate entity (not tax-exempt);

*Corporate entity (tax-exempt);

*Government entity (Federal, State, or local);

*Foreign government;

*International organization per 26 CFR 1.6049-4;

*Other ______________________.

(f)Common Parent.

*Offeror is not owned or controlled by a common parent as defined in paragraph (a) of this provision.

*Name and TIN of common parent:

Name_______________________________

TIN________________________________

9.OFFEROR'S DUNS NUMBER (APR 1996) Enter number, if known:

OFFEROR OR

AUTHORIZED REPRESENTATIVE

Name and Address (Including ZIP Code)

INITIALS: |

|

& |

|

|

LESSOR |

GOVERNMENT |

GSA FORM 3518 PAGE 4 (REV 12/99) |