gst34 can be completed easily. Just use FormsPal PDF editor to accomplish the job promptly. FormsPal team is focused on giving you the best possible experience with our tool by regularly introducing new functions and improvements. Our tool is now much more useful with the latest updates! Now, filling out PDF forms is easier and faster than ever before. Should you be looking to begin, here is what it will require:

Step 1: Press the "Get Form" button at the top of this page to open our PDF editor.

Step 2: With the help of our state-of-the-art PDF file editor, it is possible to accomplish more than simply fill out blank fields. Express yourself and make your forms seem faultless with customized textual content added in, or adjust the file's original content to excellence - all comes along with an ability to insert just about any graphics and sign the file off.

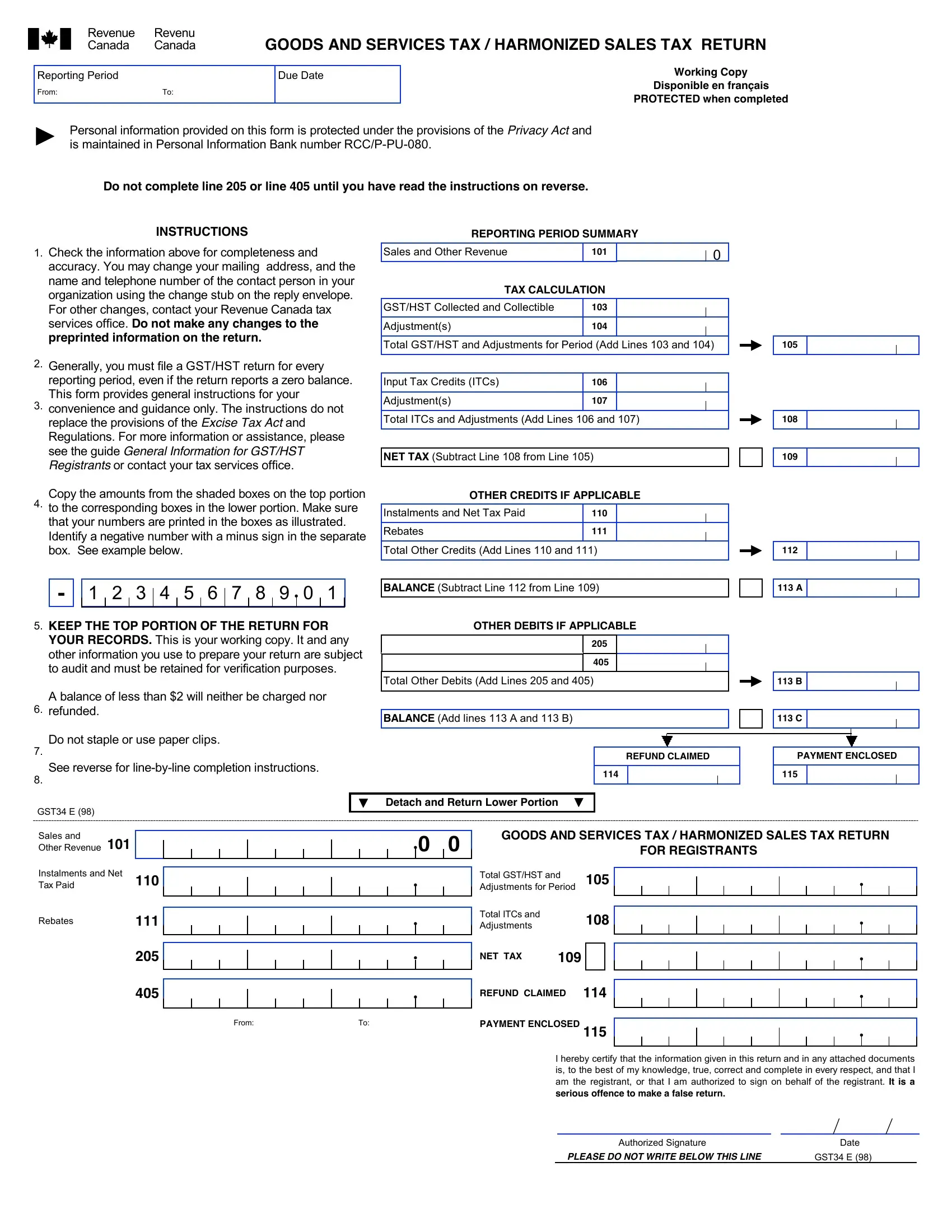

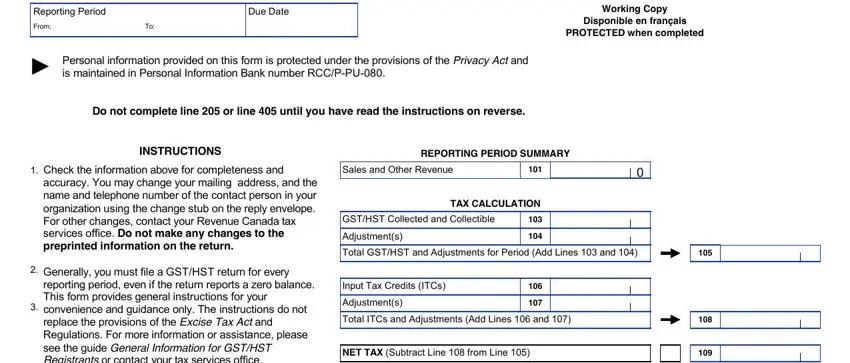

If you want to finalize this PDF document, be sure to enter the necessary details in every blank field:

1. While filling in the gst34, be sure to include all of the needed fields in the associated form section. It will help expedite the work, which allows your information to be processed promptly and correctly.

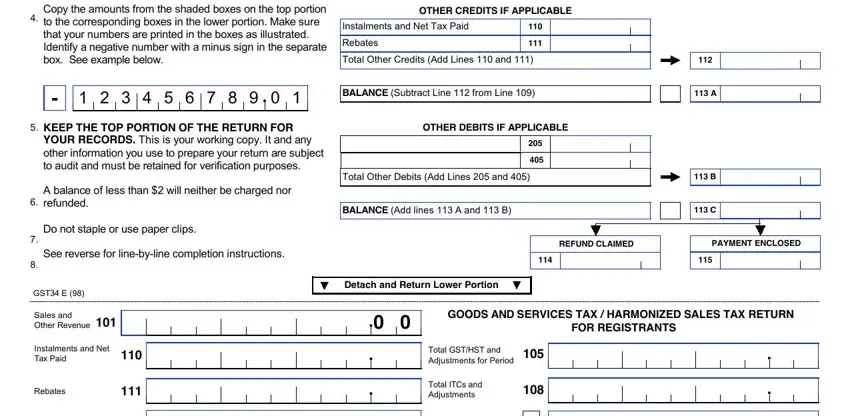

2. Once your current task is complete, take the next step – fill out all of these fields - Copy the amounts from the shaded, OTHER CREDITS IF APPLICABLE, Instalments and Net Tax Paid, Rebates, Total Other Credits Add Lines and, BALANCE Subtract Line from Line, KEEP THE TOP PORTION OF THE RETURN, OTHER DEBITS IF APPLICABLE, Tax Due on Acquisition of Real, Other Tax to be SelfAssessed, Total Other Debits Add Lines and, A balance of less than will, Do not staple or use paper clips, See reverse for linebyline, and BALANCE Add lines A and B with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Always be really attentive when filling in Total Other Credits Add Lines and and See reverse for linebyline, since this is where a lot of people make mistakes.

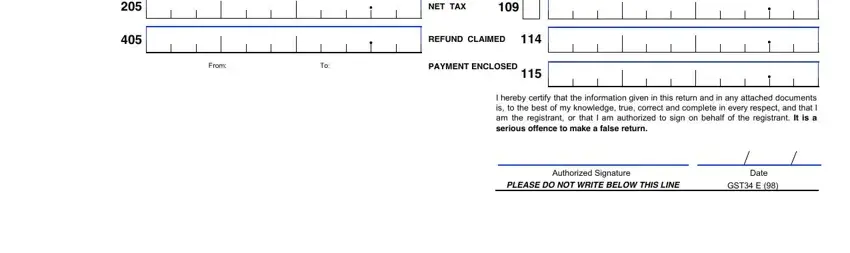

3. Your next part is usually easy - complete all of the blanks in Tax Due on Acquisition of Real, Other Tax to be SelfAssessed, NET TAX, REFUND CLAIMED, From, PAYMENT ENCLOSED, I hereby certify that the, Authorized Signature, PLEASE DO NOT WRITE BELOW THIS LINE, Date, and GST E to conclude this process.

Step 3: Make sure your information is right and just click "Done" to continue further. Join FormsPal today and immediately gain access to gst34, all set for download. Every single edit you make is handily preserved , which enables you to edit the file later when required. At FormsPal, we do our utmost to be certain that your details are stored protected.