You may work with 425D without difficulty by using our PDFinity® online PDF tool. FormsPal team is focused on making sure you have the perfect experience with our tool by constantly releasing new features and enhancements. Our editor has become even more user-friendly as the result of the latest updates! Currently, editing PDF documents is a lot easier and faster than ever. Here's what you will want to do to get going:

Step 1: First, open the pdf tool by clicking the "Get Form Button" in the top section of this page.

Step 2: With this handy PDF editing tool, you are able to do more than simply fill in blanks. Express yourself and make your forms look faultless with customized textual content added, or tweak the original content to perfection - all supported by an ability to incorporate any type of photos and sign the file off.

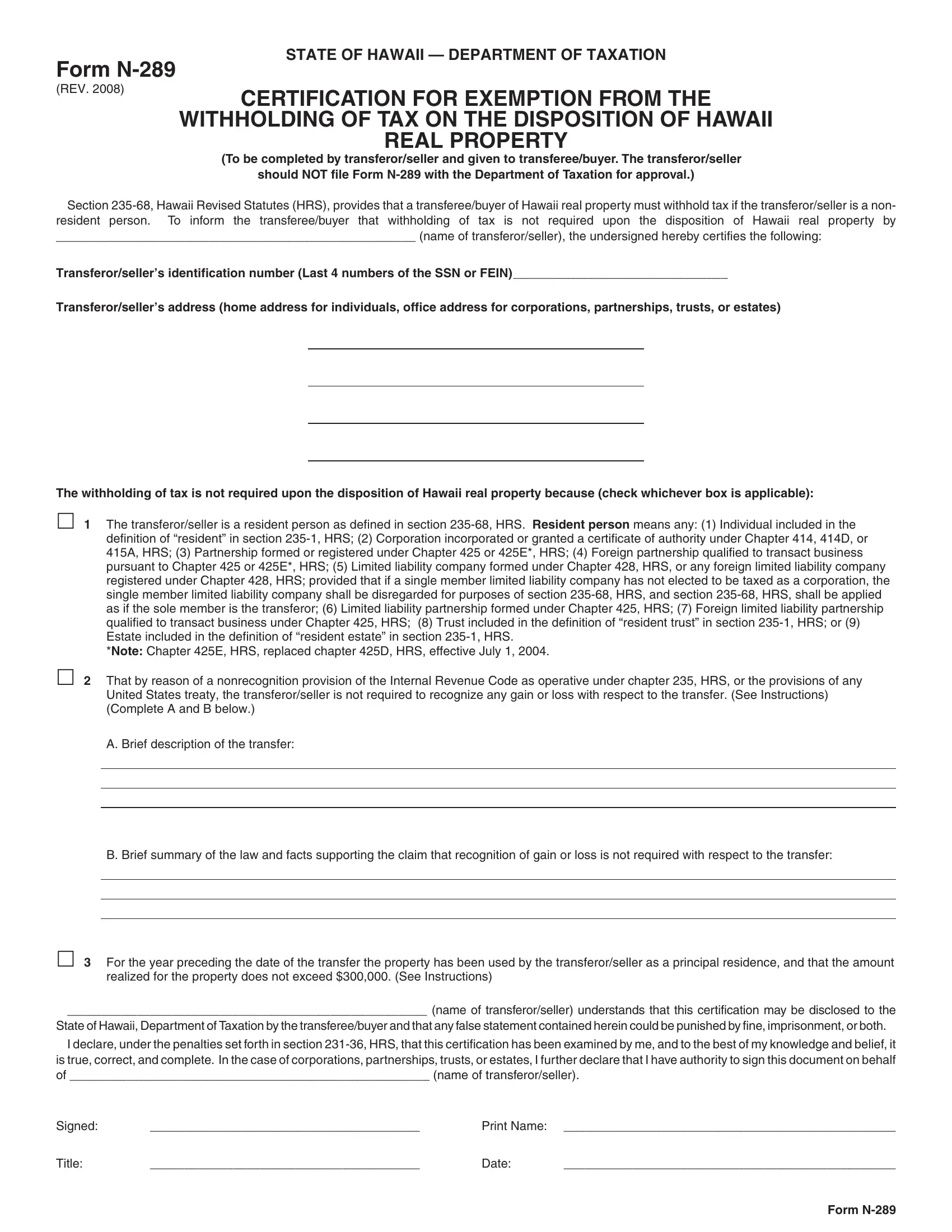

This document requires specific information; in order to guarantee consistency, be sure to take heed of the next guidelines:

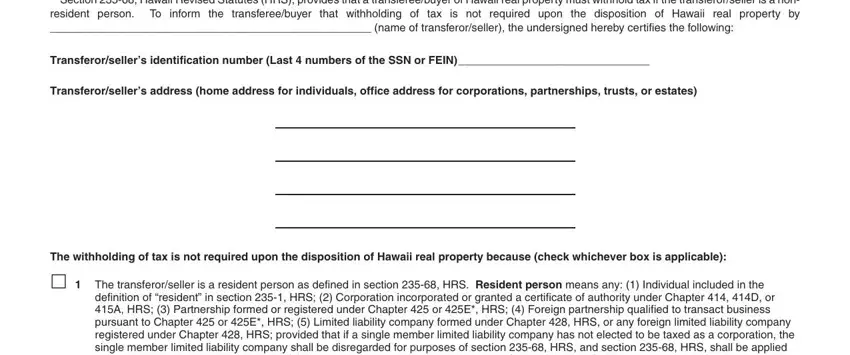

1. The 425D will require specific details to be entered. Ensure the next fields are completed:

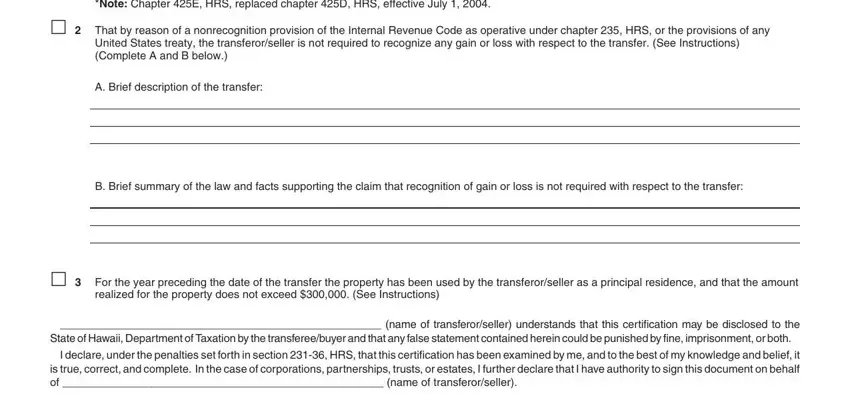

2. Just after finishing the previous step, go on to the subsequent step and enter the necessary details in these blank fields - The transferorseller is a resident, That by reason of a nonrecognition, A Brief description of the transfer, B Brief summary of the law and, For the year preceding the date of, name of transferorseller, State of Hawaii Department of, and I declare under the penalties set.

3. The following portion will be focused on Signed, Print Name, Title, Date, and Form N - fill out these blank fields.

It is easy to make errors when filling in the Signed, so make sure that you go through it again before you submit it.

Step 3: After looking through the form fields you have filled out, click "Done" and you are all set! Make a free trial option with us and get instant access to 425D - download or edit from your FormsPal account. Here at FormsPal, we do our utmost to ensure that all of your information is kept private.