You could work with Hawaii N15 Tax Form instantly with the help of our PDF editor online. To have our editor on the forefront of practicality, we aim to put into operation user-driven capabilities and improvements on a regular basis. We are routinely glad to receive feedback - play a pivotal role in remolding how you work with PDF documents. If you're looking to start, this is what you will need to do:

Step 1: First, open the tool by clicking the "Get Form Button" in the top section of this page.

Step 2: This editor allows you to change PDF forms in many different ways. Modify it with customized text, correct existing content, and include a signature - all doable within a few minutes!

It is easy to complete the form using out helpful tutorial! Here's what you should do:

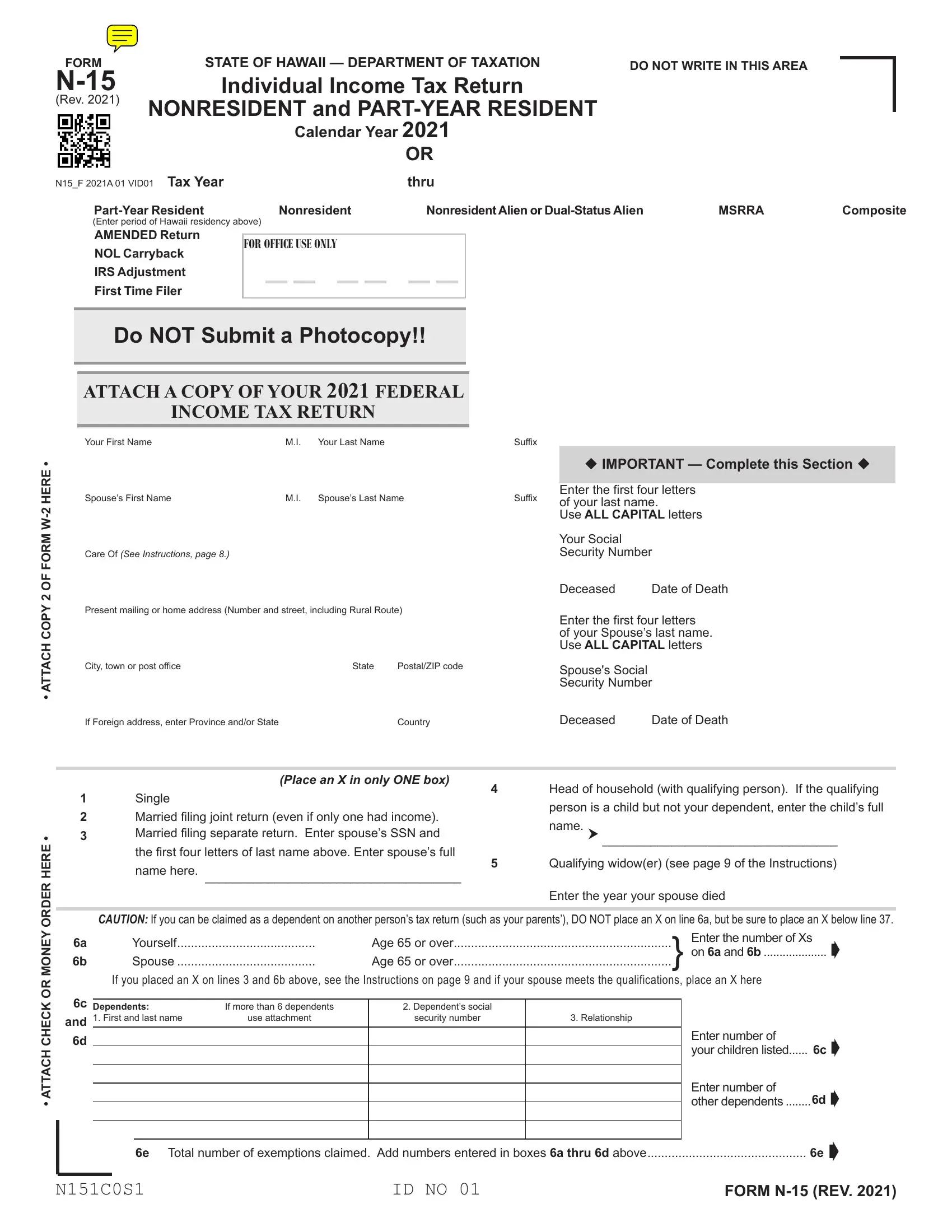

1. It's essential to complete the Hawaii N15 Tax Form properly, thus be mindful while working with the sections that contain these particular fields:

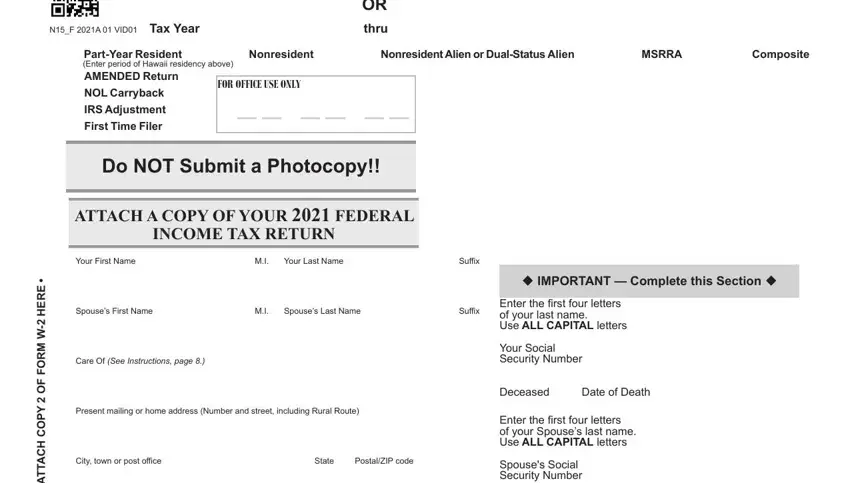

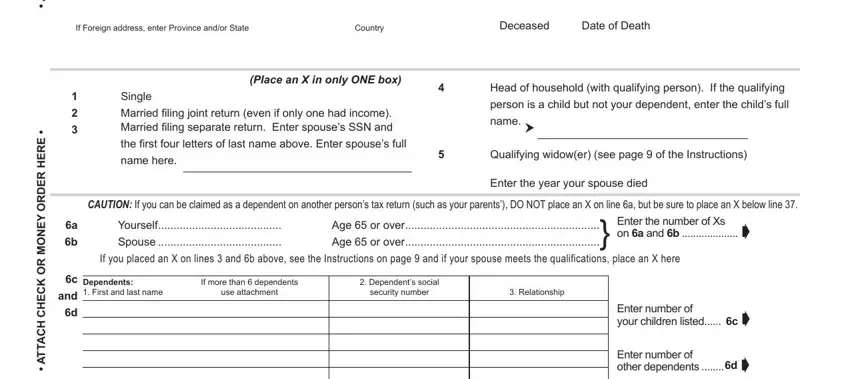

2. Once your current task is complete, take the next step – fill out all of these fields - If Foreign address enter Province, Country, Place an X in only ONE box, Single, Married filing joint return even, the first four letters of last, E R E H W M R O F F O Y P O C, E R E H R E D R O Y E N O M R O K, and, Deceased Enter the first four, Deceased, Date of Death, Head of household with qualifying, Qualifying widower see page of, and Enter the year your spouse died with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

It is possible to make errors when filling out the Deceased, so you'll want to look again prior to deciding to send it in.

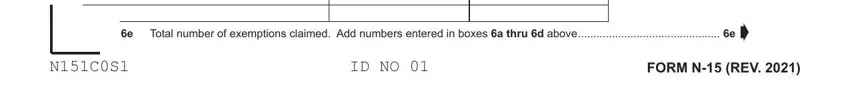

3. Within this stage, review e Total number of exemptions, e Â, NCS, ID NO, and FORM N REV. All these need to be completed with utmost attention to detail.

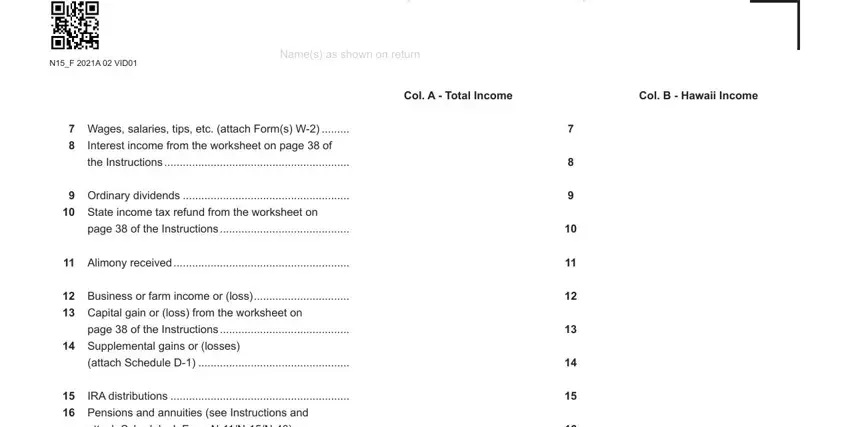

4. Filling in Your Social Security Number, Your Spouses SSN, NF A VID, Names as shown on return, Col A Total Income, Col B Hawaii Income, Wages salaries tips etc attach, Interest income from the worksheet, the Instructions, Ordinary dividends, State income tax refund from the, page of the Instructions, Alimony received, Business or farm income or loss, and Capital gain or loss from the is paramount in this fourth section - ensure to invest some time and fill in each and every blank area!

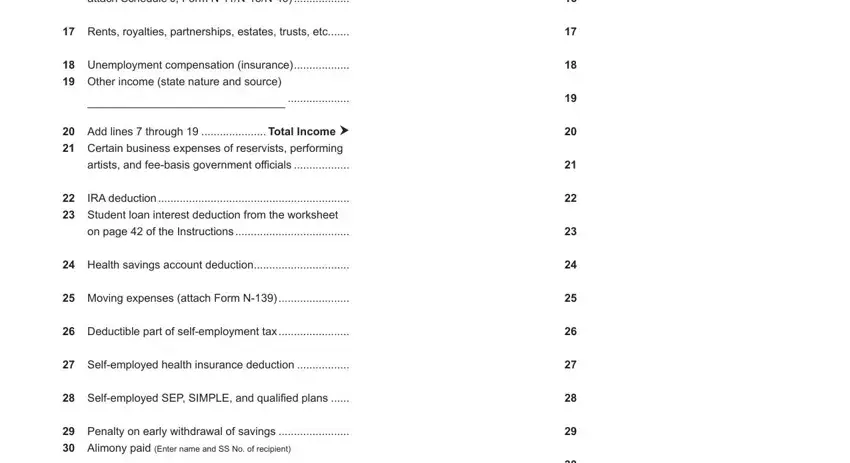

5. Since you near the completion of this file, there are actually just a few more points to complete. Particularly, attach Schedule J Form NNN, Rents royalties partnerships, Unemployment compensation, Other income state nature and, Add lines through Total Income, IRA deduction, Student loan interest deduction, on page of the Instructions, Health savings account deduction, Moving expenses attach Form N, Deductible part of selfemployment, Selfemployed health insurance, Selfemployed SEP SIMPLE and, Penalty on early withdrawal of, and Alimony paid Enter name and SS No should be filled in.

Step 3: Ensure that your details are accurate and simply click "Done" to finish the task. Grab the Hawaii N15 Tax Form when you sign up at FormsPal for a free trial. Instantly access the pdf file inside your FormsPal account page, with any edits and changes being all saved! FormsPal offers protected form editor devoid of data record-keeping or sharing. Rest assured that your details are in good hands with us!