Any time you would like to fill out VP-2, there's no need to download any applications - just try using our online tool. The tool is continually updated by our staff, acquiring awesome features and becoming greater. Here is what you would want to do to get going:

Step 1: Just click the "Get Form Button" above on this site to get into our pdf form editing tool. There you'll find all that is necessary to fill out your document.

Step 2: With this handy PDF editing tool, it's possible to accomplish more than just fill in blanks. Try each of the functions and make your forms look professional with custom text put in, or optimize the original content to perfection - all that supported by the capability to incorporate almost any pictures and sign the document off.

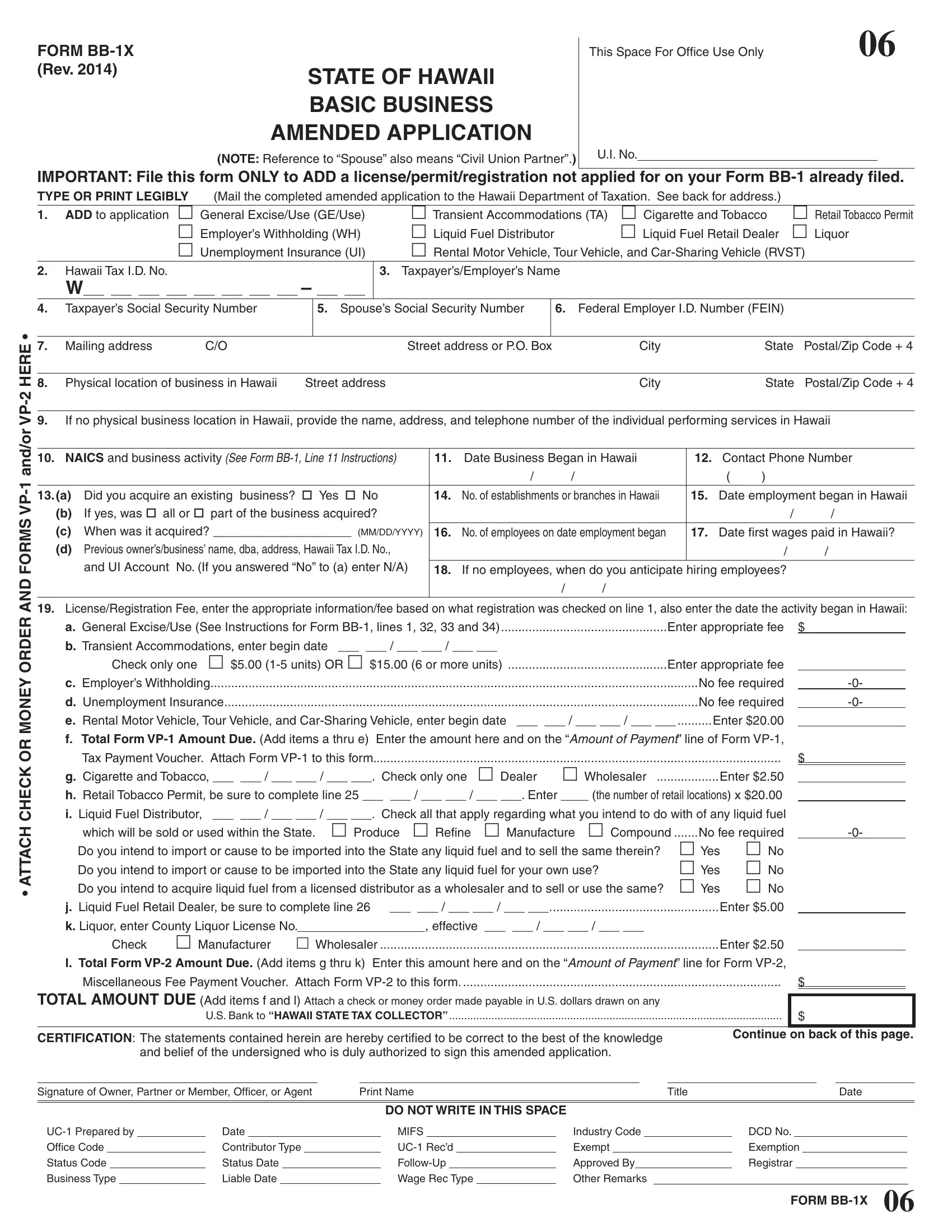

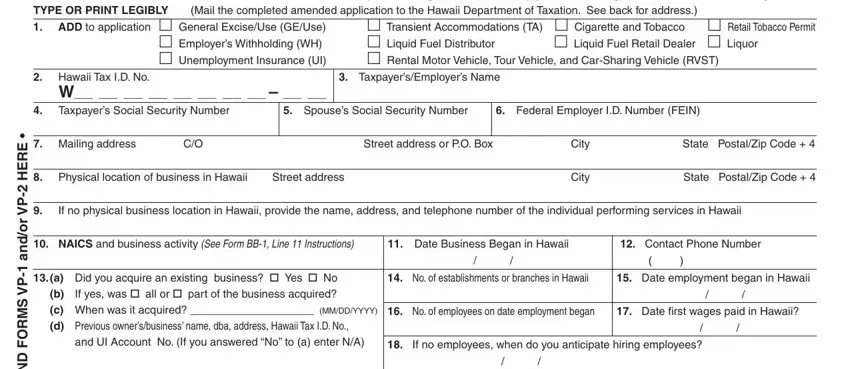

As a way to finalize this PDF form, be certain to provide the right details in every area:

1. The VP-2 necessitates particular details to be entered. Ensure that the next fields are filled out:

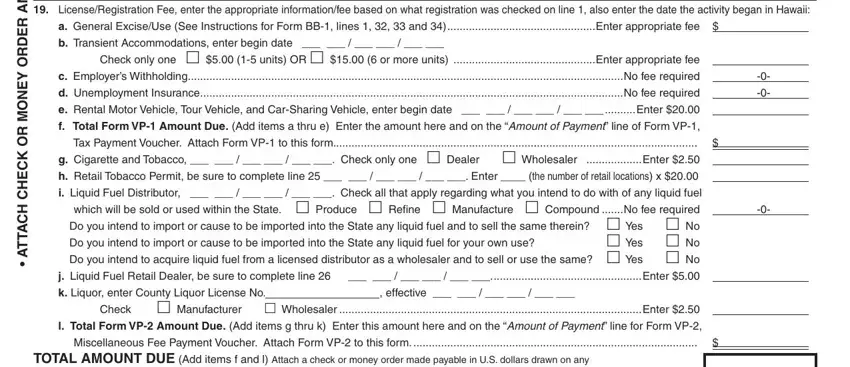

2. After this part is finished, you have to add the required specifics in P V S M R O F D N A R E D R O Y, cid, LicenseRegistration Fee enter the, a General ExciseUse See, b Transient Accommodations enter, Check only one units OR or, d Unemployment Insurance No fee, e Rental Motor Vehicle Tour, f Total Form VP Amount Due Add, Tax Payment Voucher Attach Form VP, i Liquid Fuel Distributor, which will be sold or used within, k Liquor enter County Liquor, effective, and Wholesaler Enter l Total Form VP allowing you to proceed further.

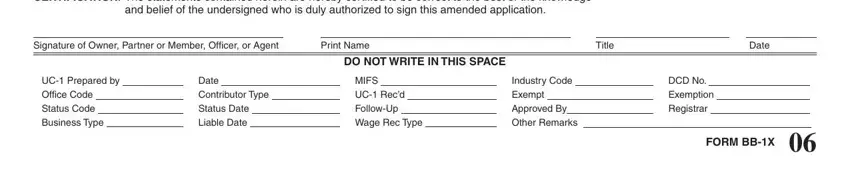

3. In this step, examine CERTIFICATION The statements, and belief of the undersigned who, Continue on back of this page, Signature of Owner Partner or, Print Name, Title, Date, DO NOT WRITE IN THIS SPACE, UC Prepared by Office Code Status, Date Contributor Type Status Date, MIFS UC Recd FollowUp Wage Rec Type, Industry Code Exempt Approved By, DCD No Exemption Registrar, and FORM BBX. All these are required to be taken care of with highest precision.

Be extremely attentive while filling in DCD No Exemption Registrar and Signature of Owner Partner or, since this is where a lot of people make errors.

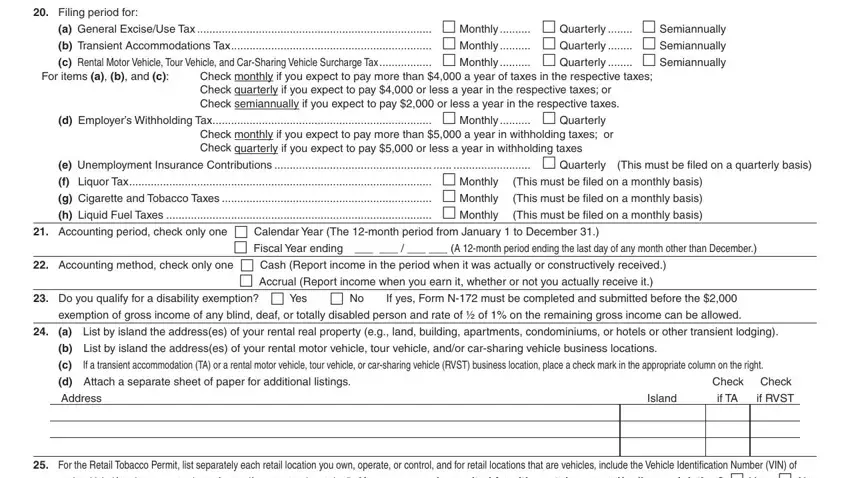

4. Filling in Filing period for, a General ExciseUse Tax Monthly, For items a b and c, Check monthly if you expect to pay, d Employers Withholding Tax, Check monthly if you expect to pay, e Unemployment Insurance, This must be filed on a monthly, This must be filed on a monthly, This must be filed on a monthly, This must be filed on a quarterly, Accounting period check only one, Accrual Report income when you, Fiscal Year ending A month, and exemption of gross income of any is key in the fourth stage - don't forget to take your time and take a close look at each and every blank area!

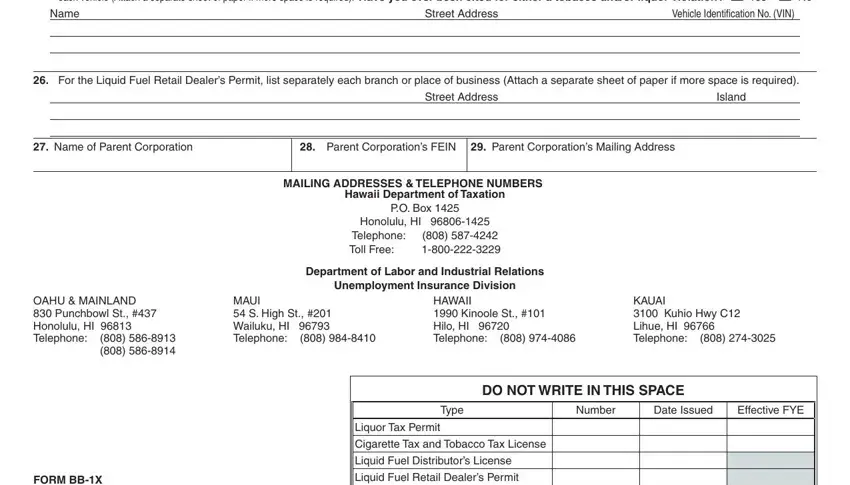

5. To finish your form, the final segment incorporates a few additional fields. Completing each vehicle Attach a separate, Vehicle Identification No VIN, Street Address, For the Liquid Fuel Retail, Street Address, Island, Name of Parent Corporation, Parent Corporations FEIN Parent, MAILING ADDRESSES TELEPHONE, Hawaii Department of Taxation, OAHU MAINLAND Punchbowl St, PO Box, Honolulu HI, Telephone Toll Free, and Department of Labor and Industrial is going to wrap up everything and you'll certainly be done in a short time!

Step 3: Confirm that your details are right and simply click "Done" to complete the task. Create a 7-day free trial account at FormsPal and acquire immediate access to VP-2 - available in your FormsPal account page. FormsPal guarantees secure form editor without personal information recording or distributing. Rest assured that your details are in good hands with us!