Making use of the online PDF editor by FormsPal, it is possible to fill in or alter rd handbook hb 2 3560 right here and now. FormsPal expert team is always working to improve the tool and enable it to be even faster for users with its extensive functions. Take your experience to the next level with constantly improving and exciting opportunities available today! To start your journey, go through these simple steps:

Step 1: First of all, open the editor by pressing the "Get Form Button" in the top section of this page.

Step 2: With this online PDF tool, you can accomplish more than just fill out blank form fields. Edit away and make your documents seem perfect with customized textual content added, or tweak the original content to excellence - all backed up by an ability to add stunning pictures and sign it off.

Be attentive while completing this document. Make sure that all required blank fields are completed accurately.

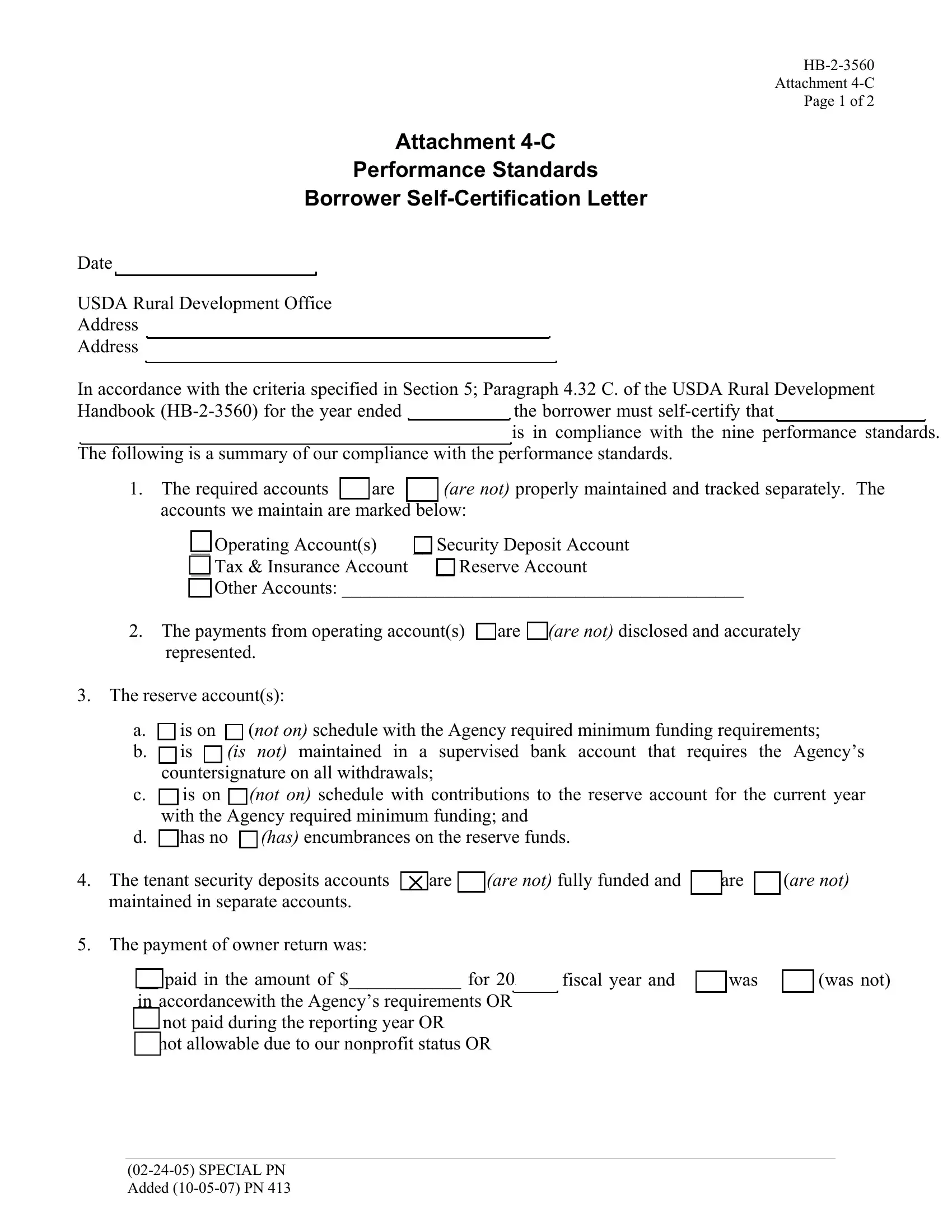

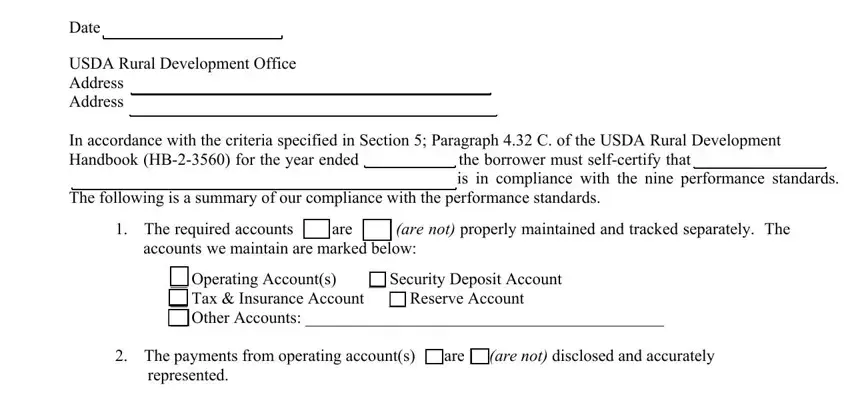

1. The rd handbook hb 2 3560 needs particular details to be typed in. Make certain the next fields are filled out:

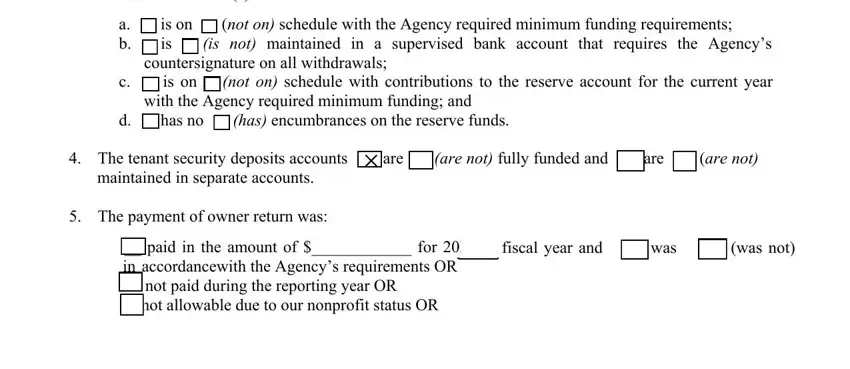

2. After finishing this section, head on to the subsequent stage and fill in the necessary details in all these fields - The reserve accounts, a is on not on schedule with the, countersignature on all withdrawals, c is on not on schedule with, with the Agency required minimum, d has no has encumbrances on the, The tenant security deposits, maintained in separate accounts, The payment of owner return was, and paid in the amount of for XX.

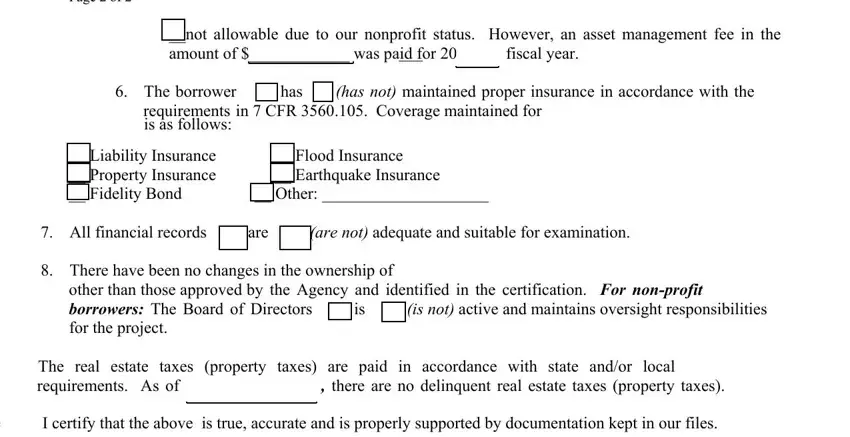

3. Completing HB Attachment C Page of, not allowable due to our nonprofit, The borrower has has not, requirements in CFR Coverage, is as follows, Liability Insurance Property, Flood Insurance Earthquake, Other, All financial records are are not, There have been no changes in the, other than those approved by the, for the project, The real estate taxes property, and I certify that the above I certify is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

4. The fourth section comes next with all of the following form blanks to consider: Signature of GP or Printed, and ROW.

As to ROW and Signature of GP or Printed, make sure you take another look here. Those two are certainly the most significant fields in this document.

Step 3: Ensure the details are correct and then click on "Done" to complete the project. Make a free trial plan at FormsPal and acquire instant access to rd handbook hb 2 3560 - accessible from your FormsPal account page. We do not sell or share any details that you provide when working with documents at our site.