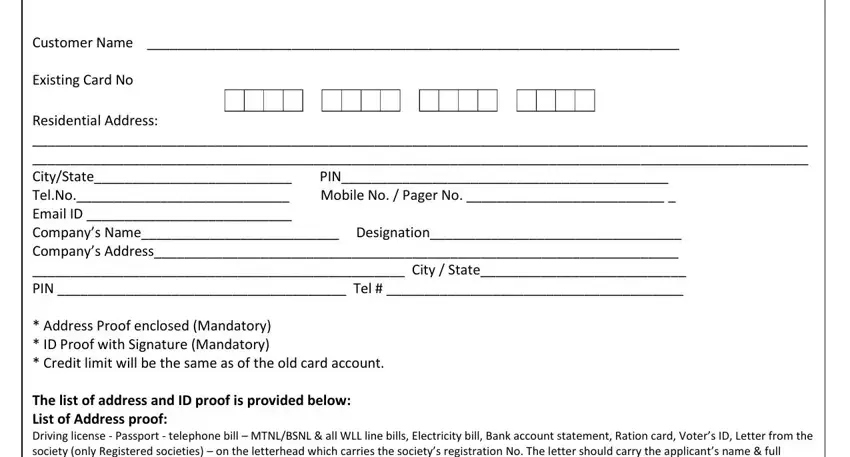

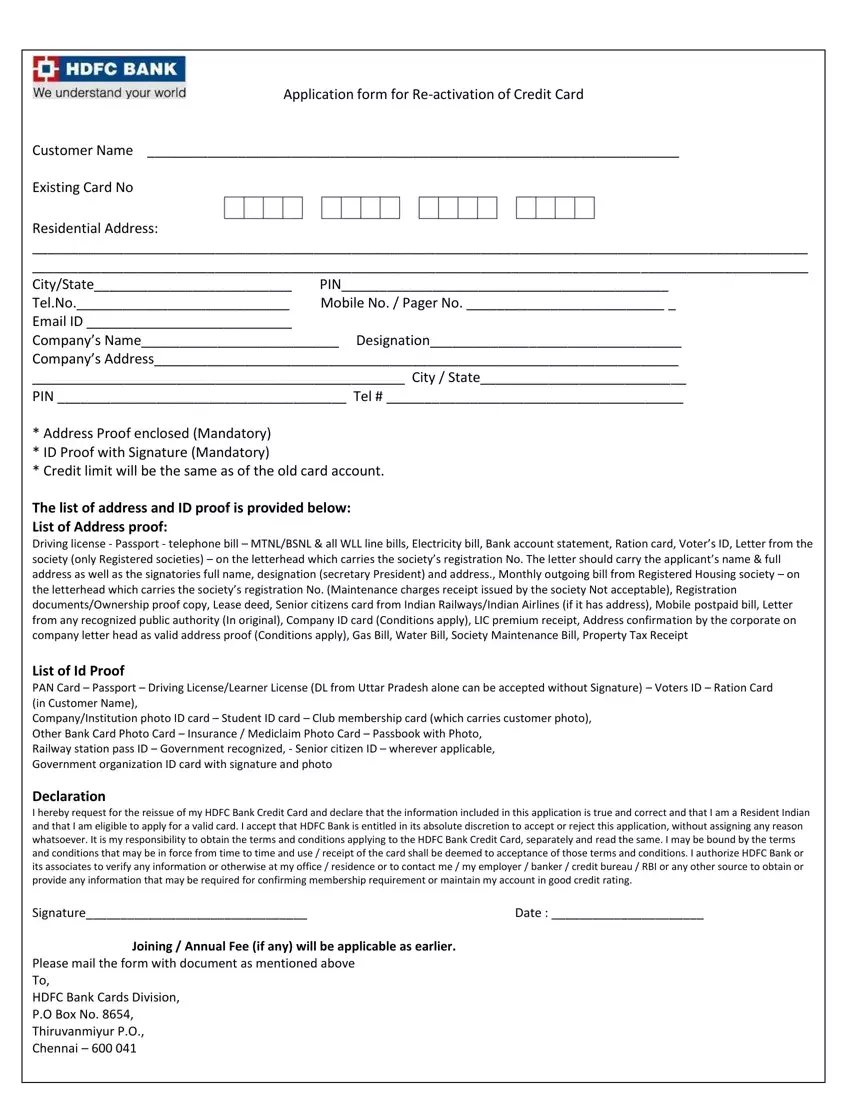

Application form for Re-activation of Credit Card

Customer Name ______________________________________________________________________

Existing Card No

Residential Address:

______________________________________________________________________________________________________

______________________________________________________________________________________________________

|

|

|

|

City/State__________________________ |

PIN___________________________________________ |

Tel.No.____________________________ |

Mobile No. / Pager No. __________________________ _ |

Email ID ___________________________ |

|

Co |

pa |

y’s Na e__________________________ Desig atio _________________________________ |

Co |

pa |

y’s Address_____________________________________________________________________ |

_________________________________________________ City / State___________________________

PIN ______________________________________ Tel # _______________________________________

* Address Proof enclosed (Mandatory) * ID Proof with Signature (Mandatory)

* Credit limit will be the same as of the old card account.

The list of address and ID proof is provided below:

List of Address proof:

Driving license - Passport - telephone bill – MTNL/BSNL & all WLL li e ills, Ele tri ity ill, Ba |

k a ou t state e t, Ratio ard, Voter’s ID, Letter fro the |

society (only Registered societies) – o the letterhead whi h arries the so iety’s registratio |

No. The letter should arry the appli a t’s a e & full |

address as well as the signatories full name, designation (secretary President) and address., Monthly outgoing bill from Registered Housing society – on the letterhead whi h arries the so iety’s registratio No. (Maintenance charges receipt issued by the society Not acceptable), Registration

documents/Ownership proof copy, Lease deed, Senior citizens card from Indian Railways/Indian Airlines (if it has address), Mobile postpaid bill, Letter from any recognized public authority (In original), Company ID card (Conditions apply), LIC premium receipt, Address confirmation by the corporate on company letter head as valid address proof (Conditions apply), Gas Bill, Water Bill, Society Maintenance Bill, Property Tax Receipt

List of Id Proof

PAN Card – Passport – Driving License/Learner License (DL from Uttar Pradesh alone can be accepted without Signature) – Voters ID – Ration Card (in Customer Name),

Company/Institution photo ID card – Student ID card – Club membership card (which carries customer photo), Other Bank Card Photo Card – Insurance / Mediclaim Photo Card – Passbook with Photo,

Railway station pass ID – Government recognized, - Senior citizen ID – wherever applicable, Government organization ID card with signature and photo

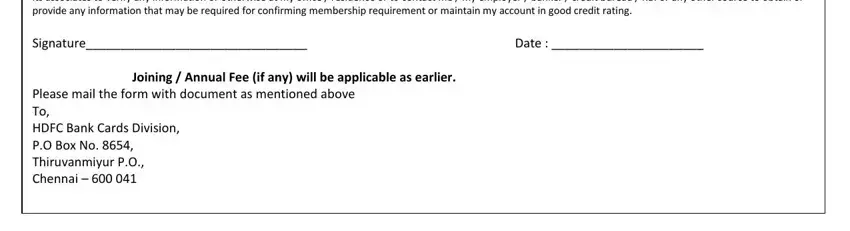

Declaration

I hereby request for the reissue of my HDFC Bank Credit Card and declare that the information included in this application is true and correct and that I am a Resident Indian and that I am eligible to apply for a valid card. I accept that HDFC Bank is entitled in its absolute discretion to accept or reject this application, without assigning any reason whatsoever. It is my responsibility to obtain the terms and conditions applying to the HDFC Bank Credit Card, separately and read the same. I may be bound by the terms and conditions that may be in force from time to time and use / receipt of the card shall be deemed to acceptance of those terms and conditions. I authorize HDFC Bank or its associates to verify any information or otherwise at my office / residence or to contact me / my employer / banker / credit bureau / RBI or any other source to obtain or provide any information that may be required for confirming membership requirement or maintain my account in good credit rating.

Signature________________________________ |

Date : ______________________ |

Joining / Annual Fee (if any) will be applicable as earlier.

Please mail the form with document as mentioned above

To,

HDFC Bank Cards Division,

P.O Box No. 8654,

Thiruvanmiyur P.O.,

Chennai – 600 041