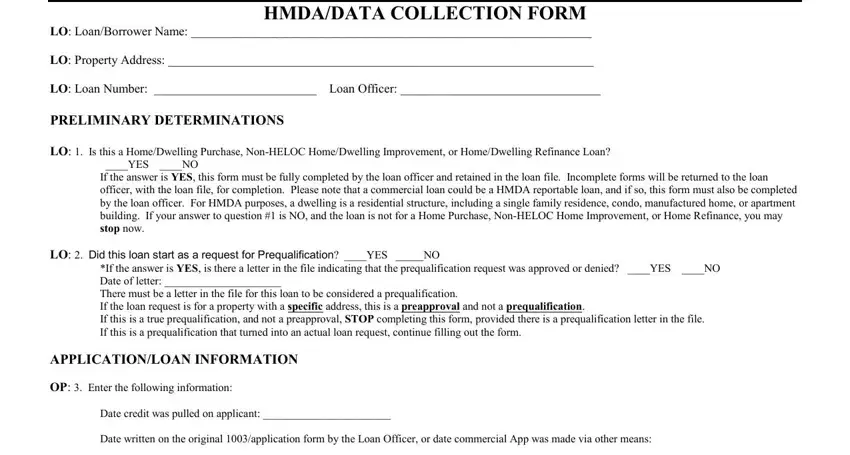

HMDA/DATA COLLECTION FORM

LO: Loan/Borrower Name: ________________________________________________________________

LO: Property Address: ____________________________________________________________________

LO: Loan Number: __________________________ Loan Officer: ________________________________

PRELIMINARY DETERMINATIONS

LO: 1. Is this a Home/Dwelling Purchase, Non-HELOC Home/Dwelling Improvement, or Home/Dwelling Refinance Loan?

____YES ____NO

If the answer is YES, this form must be fully completed by the loan officer and retained in the loan file. Incomplete forms will be returned to the loan officer, with the loan file, for completion. Please note that a commercial loan could be a HMDA reportable loan, and if so, this form must also be completed by the loan officer. For HMDA purposes, a dwelling is a residential structure, including a single family residence, condo, manufactured home, or apartment building. If your answer to question #1 is NO, and the loan is not for a Home Purchase, Non-HELOC Home Improvement, or Home Refinance, you may stop now.

LO: 2. Did this loan start as a request for Prequalification? ____YES _____NO

*If the answer is YES, is there a letter in the file indicating that the prequalification request was approved or denied? ____YES ____NO

Date of letter: _____________________

There must be a letter in the file for this loan to be considered a prequalification.

If the loan request is for a property with a specific address, this is a preapproval and not a prequalification.

If this is a true prequalification, and not a preapproval, STOP completing this form, provided there is a prequalification letter in the file. If this is a prequalification that turned into an actual loan request, continue filling out the form.

APPLICATION/LOAN INFORMATION

OP: 3. Enter the following information:

Date credit was pulled on applicant: _______________________

Date written on the original 1003/application form by the Loan Officer, or date commercial App was made via other means:

__________________________

Date 1003/application form was received at the Bank, if via mail or internet: ________________________

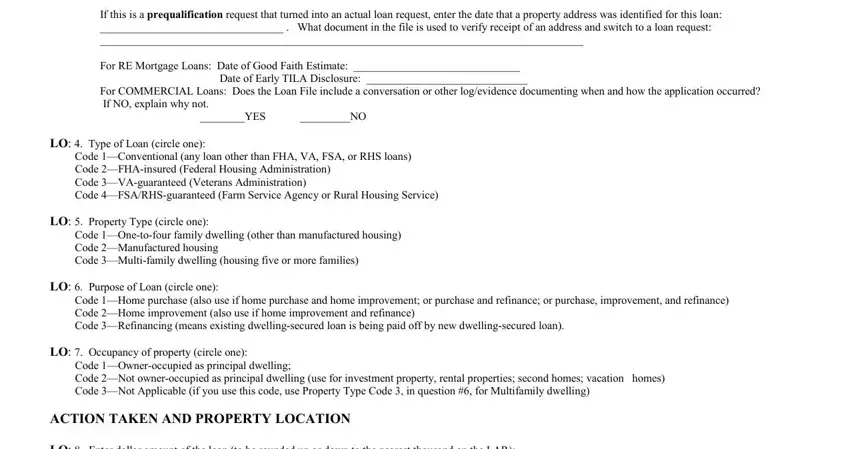

If this is a prequalification request that turned into an actual loan request, enter the date that a property address was identified for this loan:

_________________________________ . What document in the file is used to verify receipt of an address and switch to a loan request:

_______________________________________________________________________________________

For RE Mortgage Loans: Date of Good Faith Estimate: ______________________________

Date of Early TILA Disclosure: _____________________________

For COMMERCIAL Loans: Does the Loan File include a conversation or other log/evidence documenting when and how the application occurred? If NO, explain why not.

________YES _________NO

LO: 4. Type of Loan (circle one):

Code 1—Conventional (any loan other than FHA, VA, FSA, or RHS loans)

Code 2—FHA-insured (Federal Housing Administration)

Code 3—VA-guaranteed (Veterans Administration)

Code 4—FSA/RHS-guaranteed (Farm Service Agency or Rural Housing Service)

LO: 5. Property Type (circle one):

Code 1—One-to-four family dwelling (other than manufactured housing)

Code 2—Manufactured housing

Code 3—Multi-family dwelling (housing five or more families)

LO: 6. Purpose of Loan (circle one):

Code 1—Home purchase (also use if home purchase and home improvement; or purchase and refinance; or purchase, improvement, and refinance) Code 2—Home improvement (also use if home improvement and refinance)

Code 3—Refinancing (means existing dwelling-secured loan is being paid off by new dwelling-secured loan).

LO: 7. Occupancy of property (circle one):

Code 1—Owner-occupied as principal dwelling;

Code 2—Not owner-occupied as principal dwelling (use for investment property, rental properties; second homes; vacation homes) Code 3—Not Applicable (if you use this code, use Property Type Code 3, in question #6, for Multifamily dwelling)

ACTION TAKEN AND PROPERTY LOCATION

LO: 8. Enter dollar amount of the loan (to be rounded up or down to the nearest thousand on the LAR): __________________________

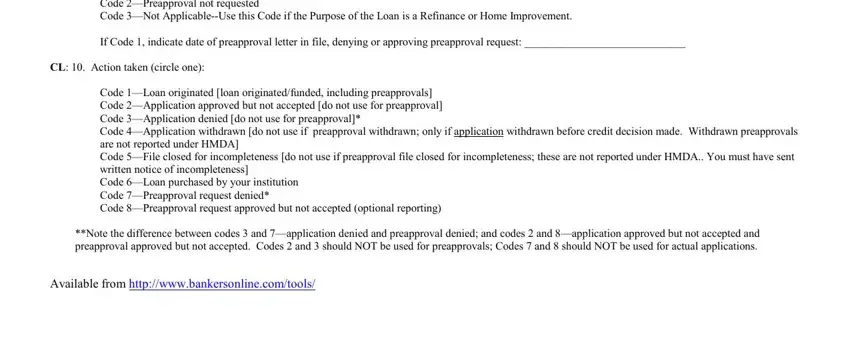

LO: 9. Was this a request for a preapproval for a home purchase (circle one):

Code 1—Preapproval requested

Code 2—Preapproval not requested

Code 3—Not Applicable--Use this Code if the Purpose of the Loan is a Refinance or Home Improvement.

If Code 1, indicate date of preapproval letter in file, denying or approving preapproval request: _____________________________

CL: 10. Action taken (circle one):

Code 1—Loan originated [loan originated/funded, including preapprovals] Code 2—Application approved but not accepted [do not use for preapproval] Code 3—Application denied [do not use for preapproval]*

Code 4—Application withdrawn [do not use if preapproval withdrawn; only if application withdrawn before credit decision made. Withdrawn preapprovals are not reported under HMDA]

Code 5—File closed for incompleteness [do not use if preapproval file closed for incompleteness; these are not reported under HMDA.. You must have sent written notice of incompleteness]

Code 6—Loan purchased by your institution Code 7—Preapproval request denied*

Code 8—Preapproval request approved but not accepted (optional reporting)

**Note the difference between codes 3 and 7—application denied and preapproval denied; and codes 2 and 8—application approved but not accepted and preapproval approved but not accepted. Codes 2 and 3 should NOT be used for preapprovals; Codes 7 and 8 should NOT be used for actual applications.

Available from http://www.bankersonline.com/tools/

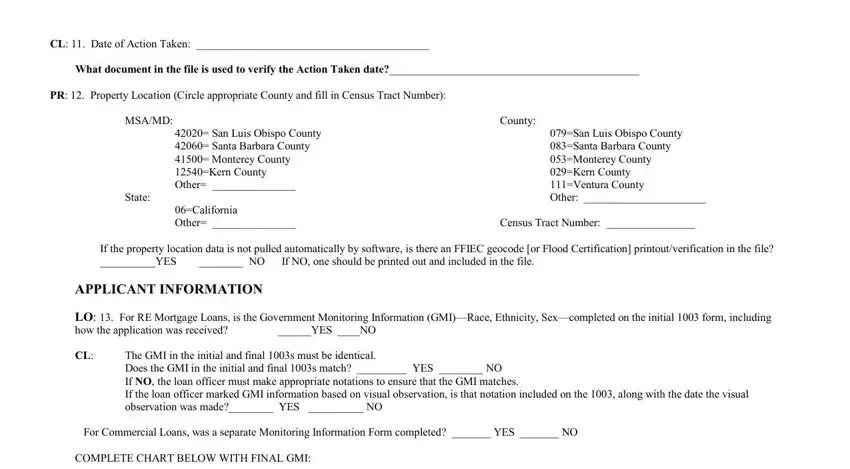

CL: 11. Date of Action Taken: __________________________________________

What document in the file is used to verify the Action Taken date?_____________________________________________

PR: 12. Property Location (Circle appropriate County and fill in Census Tract Number): |

|

MSA/MD: |

|

County: |

42020= San Luis Obispo County |

079=San Luis Obispo County |

42060= Santa Barbara County |

083=Santa Barbara County |

41500= Monterey County |

053=Monterey County |

12540=Kern County |

029=Kern County |

Other= _______________ |

111=Ventura County |

State: |

|

Other: ______________________ |

06=California |

|

Other= _______________ |

Census Tract Number: ________________ |

If the property location data is not pulled automatically by software, is there an FFIEC geocode [or Flood Certification] printout/verification in the file? |

__________YES |

________ NO If NO, one should be printed out and included in the file. |

APPLICANT INFORMATION

LO: 13. For RE Mortgage Loans, is the Government Monitoring Information (GMI)—Race, Ethnicity, Sex—completed on the initial 1003 form, including

how the application was received? |

______YES ____NO |

|

|

|

|

|

|

CL: |

The GMI in the initial and final 1003s must be identical. |

|

|

|

|

|

|

|

Does the GMI in the initial and final 1003s match? _________ YES ________ NO |

|

|

|

|

|

|

If NO, the loan officer must make appropriate notations to ensure that the GMI matches. |

|

|

|

|

|

|

If the loan officer marked GMI information based on visual observation, is that notation included on the 1003, along with the date the visual |

|

observation was made?________ YES |

__________ NO |

|

|

|

|

|

|

For Commercial Loans, was a separate Monitoring Information Form completed? _______ YES _______ NO |

|

|

|

|

COMPLETE CHART BELOW WITH FINAL GMI: |

|

|

|

|

|

|

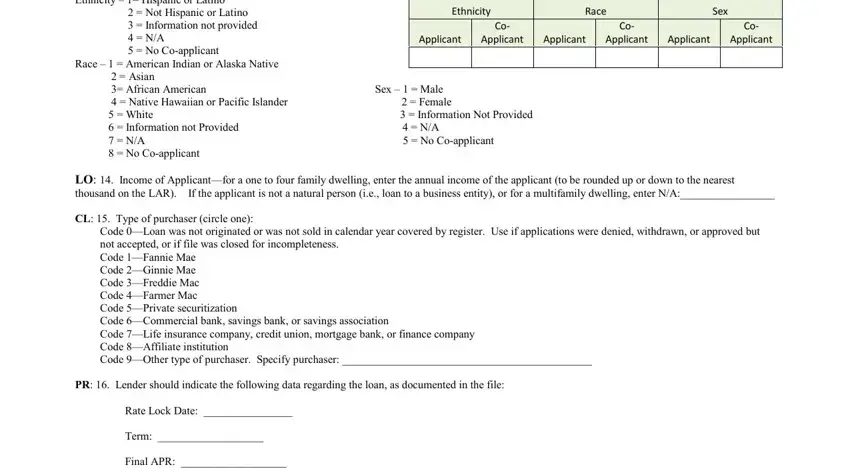

Ethnicity – 1= Hispanic or Latino |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 = Not Hispanic or Latino |

|

|

Ethnicity |

Race |

|

Sex |

|

3 = Information not provided |

|

|

|

Co- |

|

Co- |

|

|

Co- |

|

4 = N/A |

|

|

Applicant |

Applicant |

Applicant |

Applicant |

Applicant |

|

Applicant |

|

5 = No Co-applicant |

|

|

|

|

|

|

|

|

|

Race – 1 |

= American Indian or Alaska Native |

|

|

|

|

|

|

|

|

2 = Asian |

|

|

|

|

|

|

|

|

|

3= African American |

|

Sex – 1 = Male |

|

|

|

|

|

|

4 = Native Hawaiian or Pacific Islander |

2 = Female |

|

|

|

|

|

|

5 |

= White |

|

3 = Information Not Provided |

|

|

|

|

|

6 |

= Information not Provided |

|

4 = N/A |

|

|

|

|

|

|

7 |

= N/A |

|

5 = No Co-applicant |

|

|

|

|

|

8 |

= No Co-applicant |

|

|

|

|

|

|

|

|

|

LO: 14. Income of Applicant—for a one to four family dwelling, enter the annual income of the applicant (to be rounded up or down to the nearest

thousand on the LAR). If the applicant is not a natural person (i.e., loan to a business entity), or for a multifamily dwelling, enter N/A:_________________

CL: 15. Type of purchaser (circle one):

Code 0—Loan was not originated or was not sold in calendar year covered by register. Use if applications were denied, withdrawn, or approved but not accepted, or if file was closed for incompleteness.

Code 1—Fannie Mae Code 2—Ginnie Mae Code 3—Freddie Mac Code 4—Farmer Mac

Code 5—Private securitization

Code 6—Commercial bank, savings bank, or savings association

Code 7—Life insurance company, credit union, mortgage bank, or finance company Code 8—Affiliate institution

Code 9—Other type of purchaser. Specify purchaser: _____________________________________________

PR: 16. Lender should indicate the following data regarding the loan, as documented in the file:

Rate Lock Date: ________________

Term: ___________________

Final APR: ___________________

If loan did not originate, circle N/A here: N/A

CL: 17. Rate Spread:

Using the rate lock date, term, and final APR set forth above, obtain the rate spread through the ffiec.gov website’s rate spread calculator. Indicate Rate Spread from website, or N/A if applicable: _________________________

LO: 18: Lien Status (circle one)—also, for loans that do not originate, circle the code that would have been appropriate:

Code 1—Secured by first lien

Code 2—Secured by subordinate lien

Code 3—Not secured by lien

Code 4—Not applicable (purchased loan)

***********************************************************************************************************

___________________________________________________________________________

LOAN OFFICER’S SIGNATUREDate

___________________________________________________________________________

LOAN PROCESSOR’S SIGNATURE |

Date |

(Including verification of loan officer’s reported data) |

|

___________________________________________________________________________

SIGNATURE OF INDIVIDUAL VERIFING CORRECTNESS OF THIS FORM TO FILE Date

____________________________________________________________________________

SIGNATURE OF INDIVIDUAL INPUTTING HMDA LAR DATA |

Date |