We have applied the hard work of the best programmers to make the PDF editor you may want to begin using. The app allows you to fill out the hmrc starter file without trouble and don’t waste precious time. All you have to do is follow these easy-to-follow rules.

Step 1: This page contains an orange button stating "Get Form Now". Please click it.

Step 2: The form editing page is right now open. It's possible to add text or change present details.

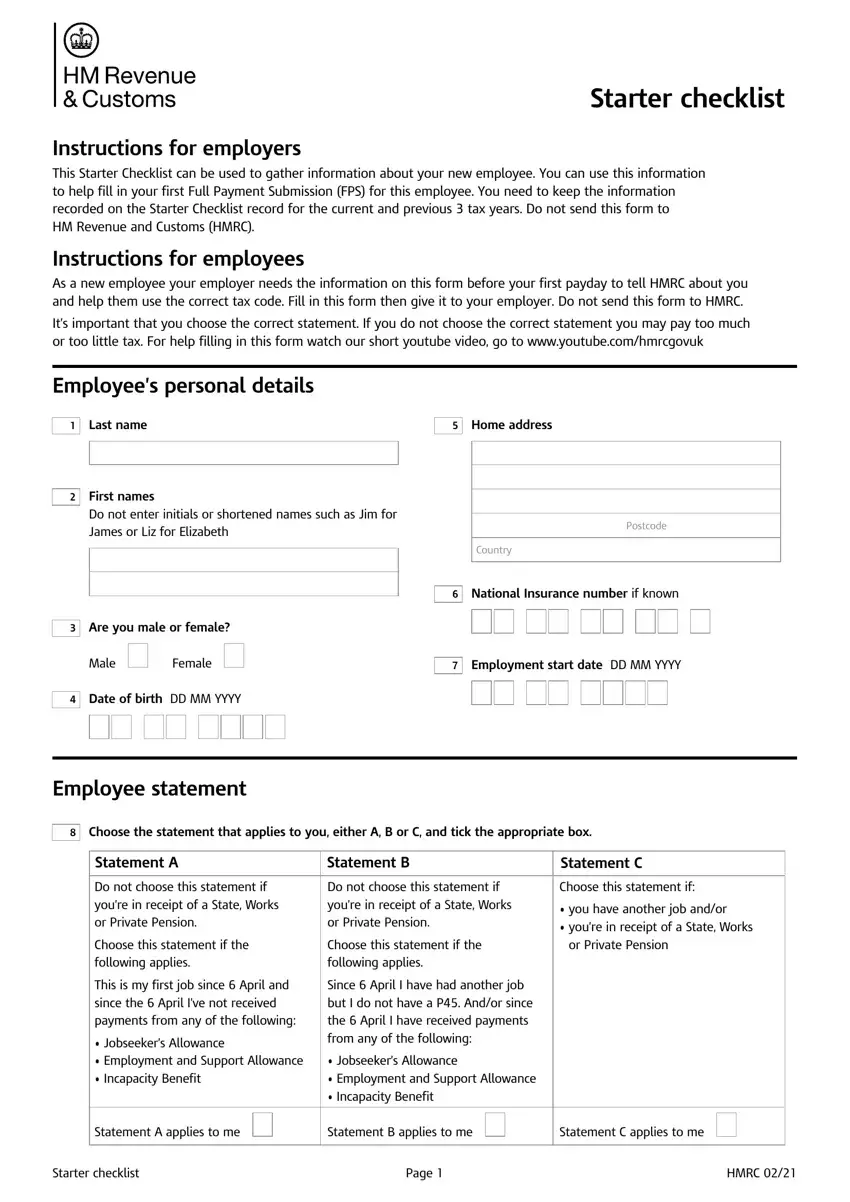

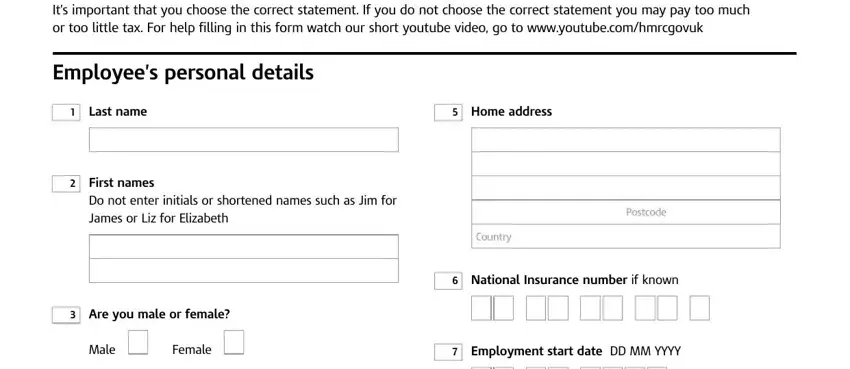

The next sections are what you are going to fill in to receive the prepared PDF form.

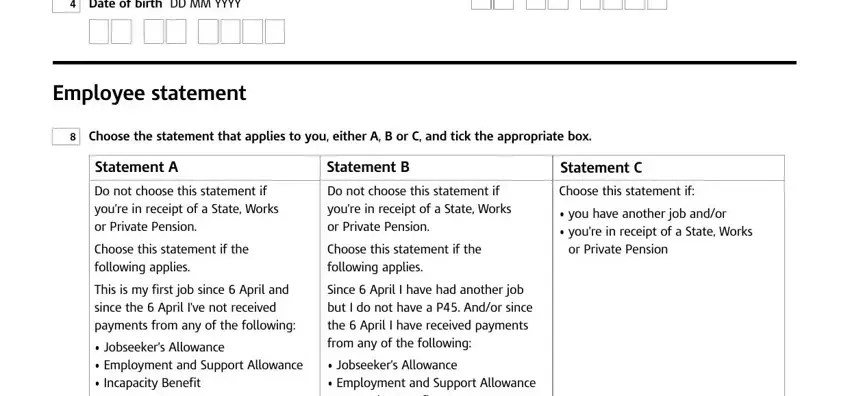

Type in the appropriate particulars in Dateofbirth, DD, MM, YYYY Employee, statement Statement, C, Choose, this, statement, if and or, Private, Pension box.

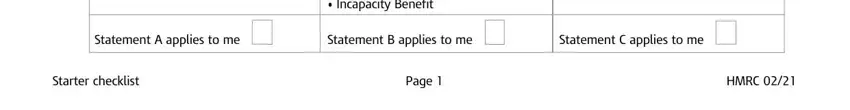

The application will require details to effortlessly complete the part Statement, A, applies, tome Statement, B, applies, tome Statement, C, applies, tome Starter, checklist Page, and H, MRC

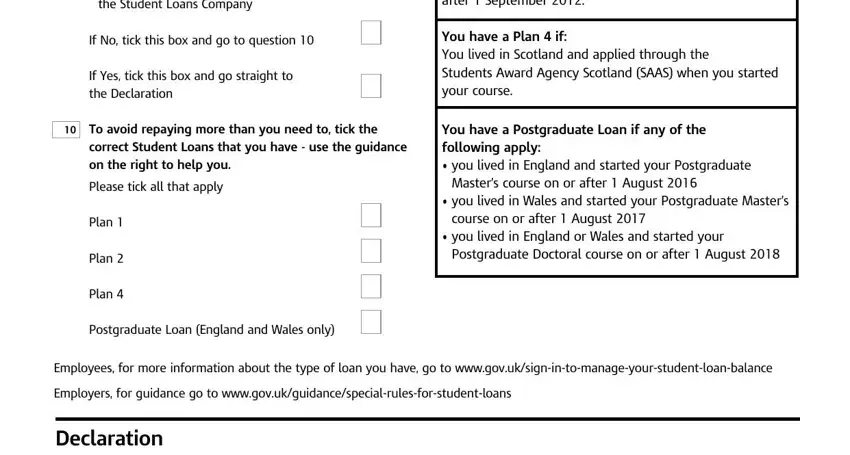

Within the paragraph If, No, tick, this, box, and, goto, question Please, tick, all, that, apply Plan, Plan, Plan, Postgraduate, Loan, England, and, Wales, only Masters, course, on, or, after, August and course, on, or, after, August include the rights and responsibilities of the parties.

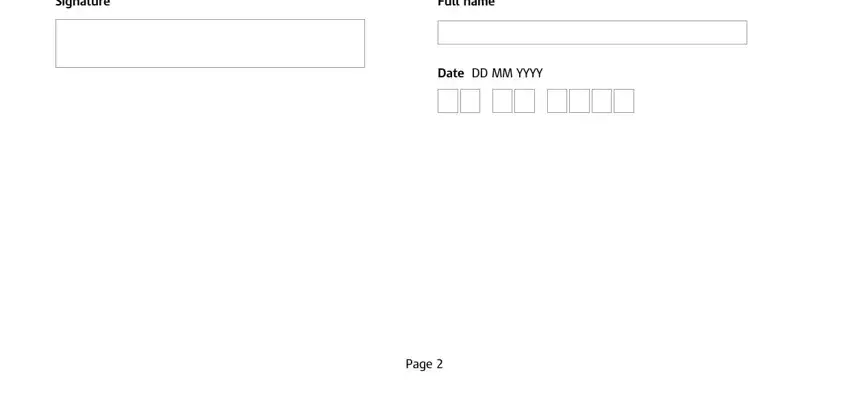

Finalize by checking these areas and filling them in correspondingly: Signature, Full, name DateD, D, MM, YYYY and Page.

Step 3: When you hit the Done button, the completed document is conveniently exportable to each of your gadgets. Or, you may deliver it by means of mail.

Step 4: Generate duplicates of your file. This may prevent possible future challenges. We don't check or distribute your data, as a consequence feel comfortable knowing it's going to be secure.