The HMRC 5003 EN form plays a crucial role in international taxation, specifically designed for legal entities seeking a reduction or exemption of withholding tax on royalties from French sources. This application is tethered to the broader framework of Form 5000, serving as an essential attachment. It caters to those who are eligible under Directive 2003/49/EC, aiming to streamline the process for entities that meet specific holding requirements as stipulated. The form comprises detailed sections including the description of the French payer of royalties, the precise nature of goods or rights generating royalty payments, and a financial breakdown involving the gross amount due, the amount of French withholding tax, and the figures pertinent to repayment or deduction as per treaty rates. It mandates the declaration from the recipient affirming their eligibility under the specified directive, thereby facilitating a formal request for either a reduction or complete exemption from the withholding tax attributable to royalties accrued from French entities. The completion and accurate submission of this form are fundamental for legal entities looking to leverage international tax treaties and directives to optimize their fiscal responsibilities.

| Question | Answer |

|---|---|

| Form Name | Hmrc Form 5003 En |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | form 5003 hmrc, form 5003 en, 5003-EN, 2003 |

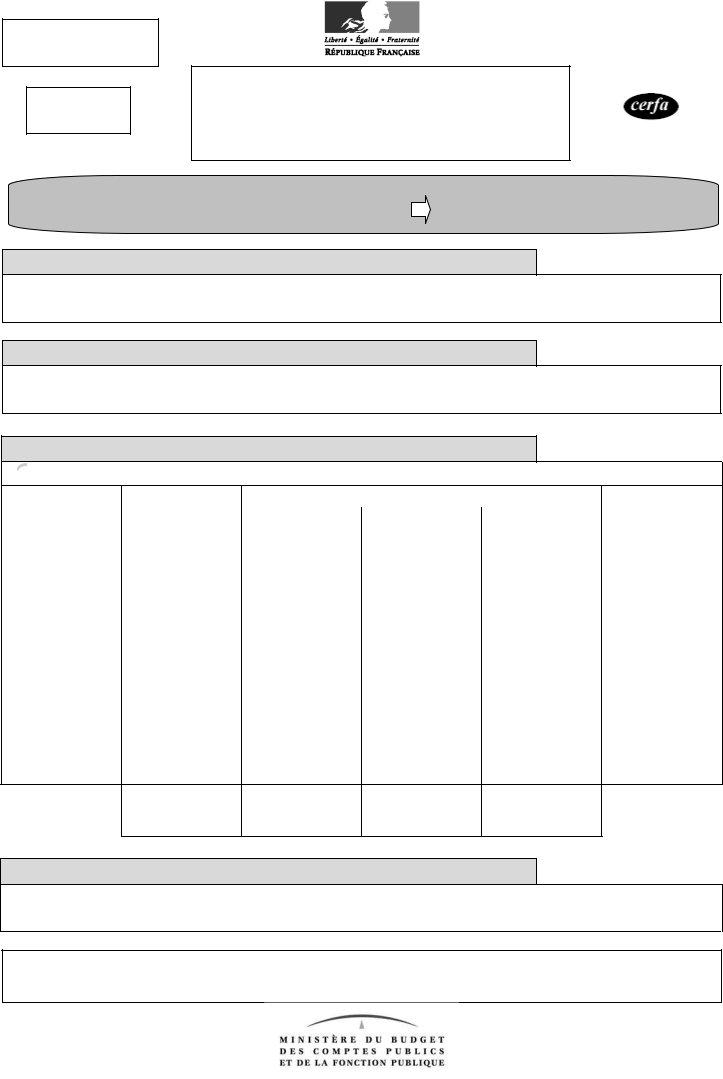

Recipient’s name

For use by the

foreign tax

authority

APPLICATION FOR A REDUCTION OF WITHHOLDING TAX

ON ROYALTIES

Attachment to Form 5000

@ INTERNET - DGFIP

12816*01

YOU ARE A LEGAL ENTITY

If you are eligible for the exemption under Directive 2003/49/EC of |

make sure the Box VI is completed |

of 3 June 2003 |

|

I) Description of French payer of royalties

Name ……………………………………………………………………………………………………..………………………………………………………………..

Registered office or management office ………………………………………………………………………………………………………………………….

II) Precise description of the goods or rights giving rise to royalty payments

....................................................................................................................................................................................................................

....................................................................................................................................................................................................................

III) To be completed by the French payer of royalties

Please make sure that you complete Boxes I, II and III on Form 5000

|

|

Amount of French withholding tax |

|

|||

Gross amount due |

|

|

|

|

Control (do not write |

|

Date paid: |

Amount due |

|

Amount reclaimed |

|||

€ |

Amount paid |

in this space) |

||||

|

€ |

€ |

||||

|

€ |

|||||

|

|

(column 1 x treaty rate) |

column 4 – column 3 |

|

||

|

|

|

|

|||

|

|

|

|

|

|

|

1 |

2 |

3 |

4 |

5 |

6 |

|

TOTALS |

|

|

|

AMOUNT DUE |

AMOUNT TO BE REPAID |

(column 3 – column 4) |

(column 4 – column 3) |

IV) Declaration of recipient applying for an exemption under Directive 2003/49/EC

I hereby certify that I meet the holding requirements stipulated in Directive 2003/49/EC of 3 June 2003 and, consequently, I am applying for an exemption from the withholding tax on royalties collected from French sources.

………………………………………………...

Recipient’s name

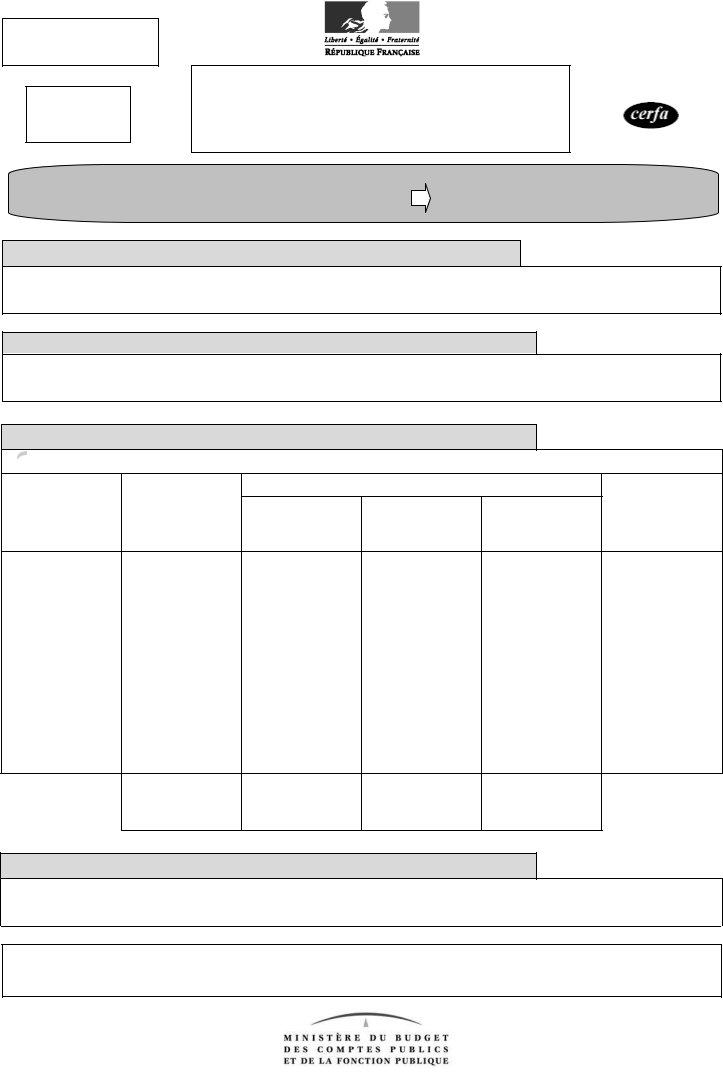

To be kept by the beneficiary

APPLICATION FOR A REDUCTION OF WITHHOLDING TAX

ON ROYALTIES

Attachment to Form 5000

@ INTERNET - DGFIP

12816*01

YOU ARE A LEGAL ENTITY

If you are eligible for the exemption under Directive 2003/49/EC of |

make sure the Box VI is completed |

of 3 June 2003 |

|

I) Description of French payer of royalties

Name ……………………………………………………………………………………………………..………………………………………………………………..

Registered office or management office ………………………………………………………………………………………………………………………….

II) Precise description of the goods or rights giving rise to royalty payments

....................................................................................................................................................................................................................

....................................................................................................................................................................................................................

III) To be completed by the French payer of royalties

Please make sure that you complete Boxes I, II and III on Form 5000

Gross amount due

€

Date paid:

Amount of French withholding tax

Amount due |

Amount paid |

Amount reclaimed |

|

€ |

€ |

||

€ |

|||

(column 1 x treaty rate) |

column 4 – column 3 |

||

|

Control (do not write

in this space)

1

2

3

4

5

6

TOTALS |

|

|

|

AMOUNT DUE |

AMOUNT TO BE REPAID |

(column 3 – column 4) |

(column 4 – column 3) |

IV) Declaration of recipient applying for an exemption under Directive 2003/49/EC

I hereby certify that I meet the holding requirements stipulated in Directive 2003/49/EC of 3 June 2003 and, consequently, I am applying for an exemption from the withholding tax on royalties collected from French sources.

………………………………………………...

Date and place |

Signature of beneficiary or his/her legal representative |

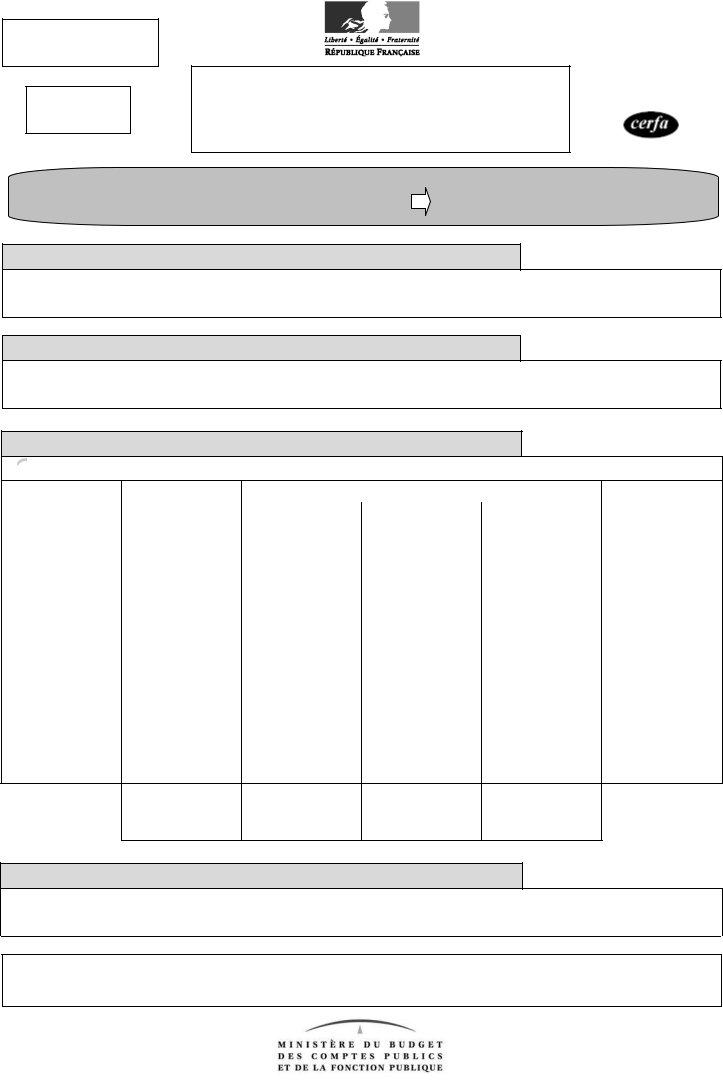

Report du nom du créancier

For use by the

French tax

authority

DEMANDE DE REDUCTION DE LA RETENUE À LA SOURCE

SUR REDEVANCES

Annexe au formulaire n°5000

@ INTERNET - DGFIP

12816*01

VOUS ETES UNE PERSONNE MORALE

Si vous pouvez bénéficier de l’exonération prévue par la directive |

N’oubliez pas de remplir le cadre IV |

n° 2009/49/CE du 3 juin 2003 |

|

I) Désignation du débiteur français des redevances

Dénomination ou raison sociale ................................................................................................................................................................

Siège social ou de direction .......................................................................................................................................................................

II) Désignation précise des biens ou droits générateurs des redevances

....................................................................................................................................................................................................................

....................................................................................................................................................................................................................

III) A remplir par le débiteur français des revenus

N’oubliez pas de faire compléter par le créancier les cadres I, II et III du formulaire n°5000

|

|

|

Montant de l’impôt français à la source |

|

||

Montant brut des |

|

|

|

|

|

Contrôle (cadre |

Date de |

|

|

|

Dont le dégrèvement |

||

sommes à encaisser |

Exigible |

|

|

est demandé |

réservé à |

|

l’encaissement |

|

Payé |

||||

en € |

en € |

|

en € |

l’administration) |

||

|

|

en € |

||||

|

|

Col 1 x taux convention |

|

|||

|

|

|

|

|

||

|

|

|

|

|

col 4 – col 3 |

|

|

|

|

|

|

|

|

1 |

2 |

3 |

|

4 |

5 |

6 |

TOTAUX |

|

|

|

A PAYER |

A REMBOURSER |

Col 3 – col 4 |

Col 4 – col 3 |

IV) Déclaration du créancier demandant le bénéfice de la directive n° 2003/49/CE

Je déclare satisfaire aux conditions de participation prévues par la directive n° 2003/49/CE du 3 juin 2003 et demande en conséquence l’exonération de retenue à la source au titre des redevances de source française perçues.

………………………………………………...

Date et lieu |

Signature du créancier ou de son représentant légal |