We were designing this PDF editor with the idea of allowing it to be as quick to apply as possible. For this reason the entire process of filling in the Washington will undoubtedly be smooth perform all of these steps:

Step 1: The first step should be to choose the orange "Get Form Now" button.

Step 2: So, you can begin editing the Washington. The multifunctional toolbar is at your disposal - insert, eliminate, transform, highlight, and perform other commands with the content material in the file.

These sections will help make up your PDF file:

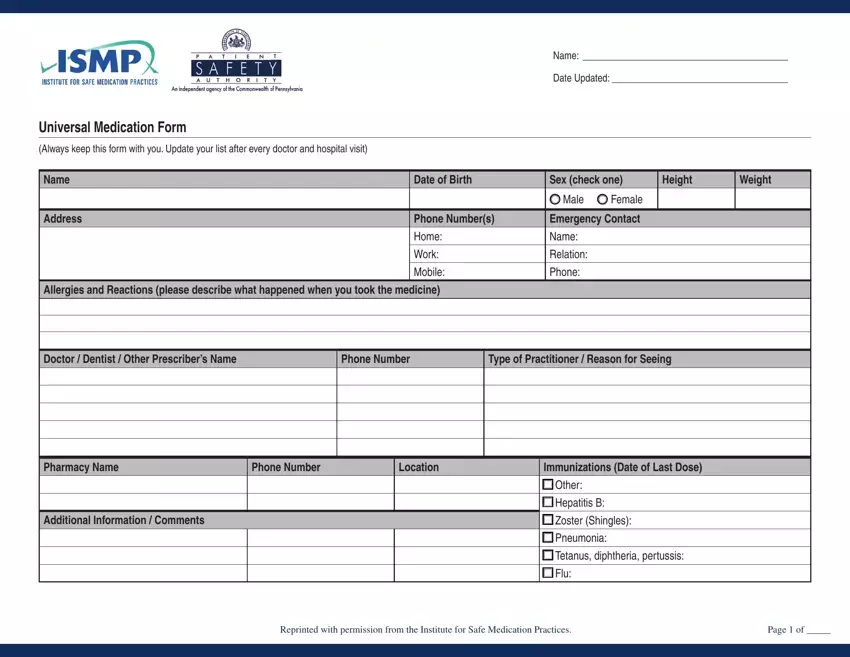

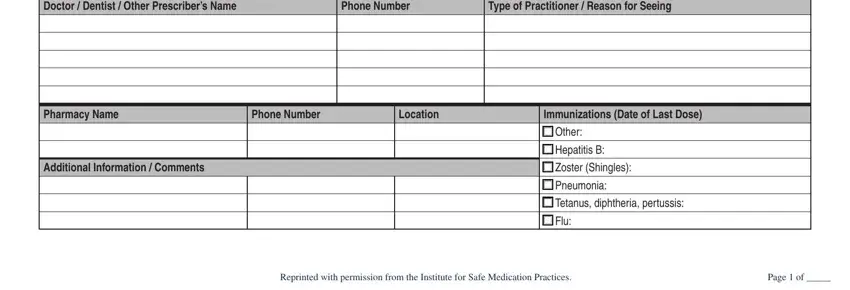

You have to fill in the Doctor Dentist Other Prescribers, Phone Number, Type of Practitioner Reason for, Pharmacy Name, Phone Number, Location, Immunizations Date of Last Dose, Additional Information Comments, Other, Hepatitis B, Zoster Shingles, Pneumonia, Tetanus diphtheria pertussis, Flu, and Reprinted with permission from the space with the required details.

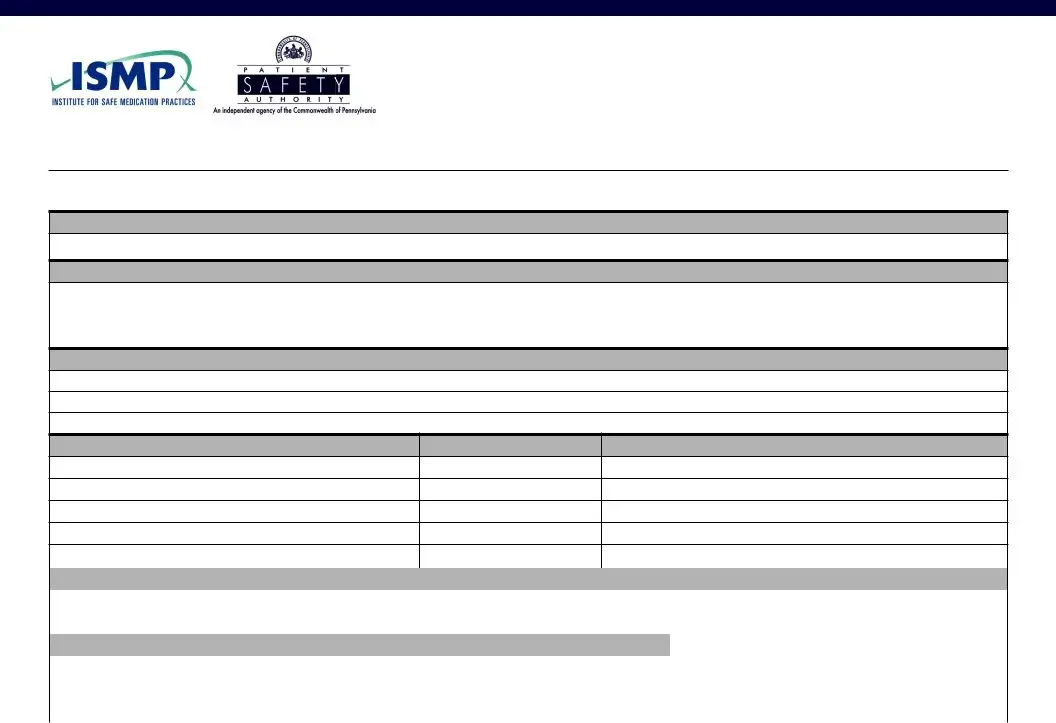

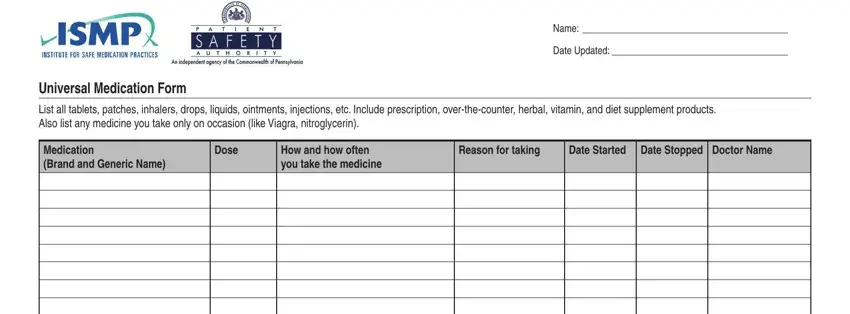

Put down the vital information since you are within the Name, Date Updated, Universal Medication Form, List all tablets patches inhalers, Medication Brand and Generic Name, Dose, How and how often you take the, Reason for taking, Date Started, and Date Stopped Doctor Name section.

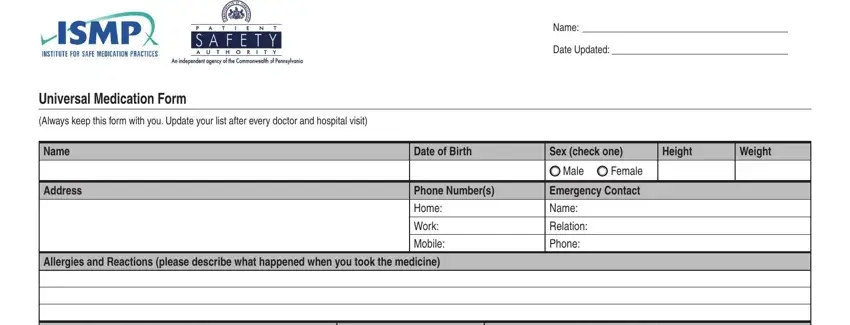

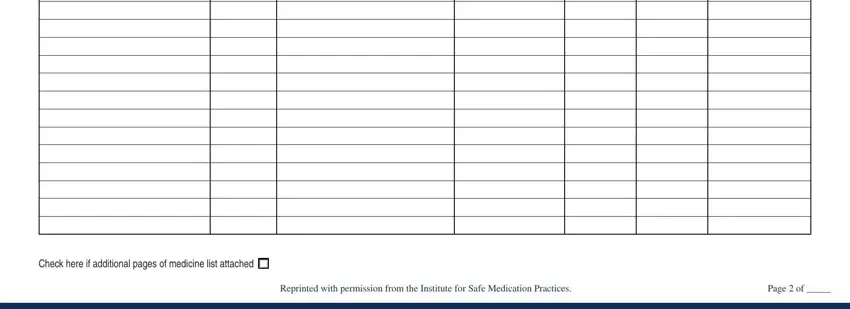

The Check here if additional pages of, Reprinted with permission from the, and Page of section is the place where all sides can insert their rights and responsibilities.

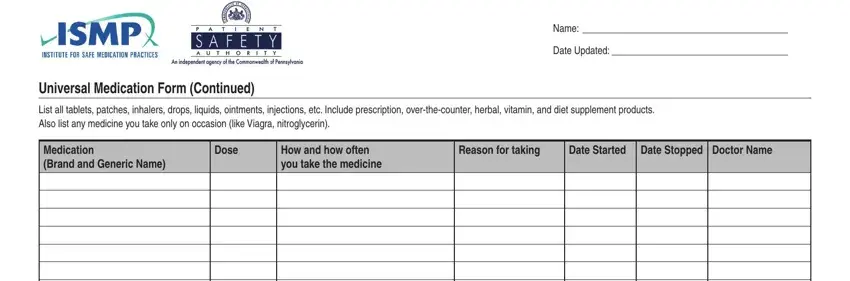

Look at the areas Name, Date Updated, Universal Medication Form Continued, List all tablets patches inhalers, Medication Brand and Generic Name, Dose, How and how often you take the, Reason for taking, Date Started, and Date Stopped Doctor Name and thereafter complete them.

Step 3: Click the "Done" button. So now, it is possible to export the PDF document - download it to your electronic device or forward it by using electronic mail.

Step 4: Create copies of the form - it will help you keep away from potential troubles. And don't be concerned - we do not distribute or read your information.