Should you would like to fill out pennsylvania sales tax exemption form, you don't have to download and install any sort of programs - simply give a try to our PDF tool. Our editor is constantly evolving to provide the very best user experience attainable, and that's thanks to our commitment to constant improvement and listening closely to customer comments. Getting underway is easy! Everything you should do is stick to the next simple steps directly below:

Step 1: Simply press the "Get Form Button" at the top of this webpage to access our pdf form editing tool. There you will find all that is needed to fill out your document.

Step 2: Once you start the online editor, you will notice the document made ready to be filled in. In addition to filling out various fields, you could also perform other actions with the PDF, particularly adding custom textual content, editing the initial text, inserting images, putting your signature on the form, and much more.

To be able to finalize this PDF form, ensure that you type in the necessary information in every single blank:

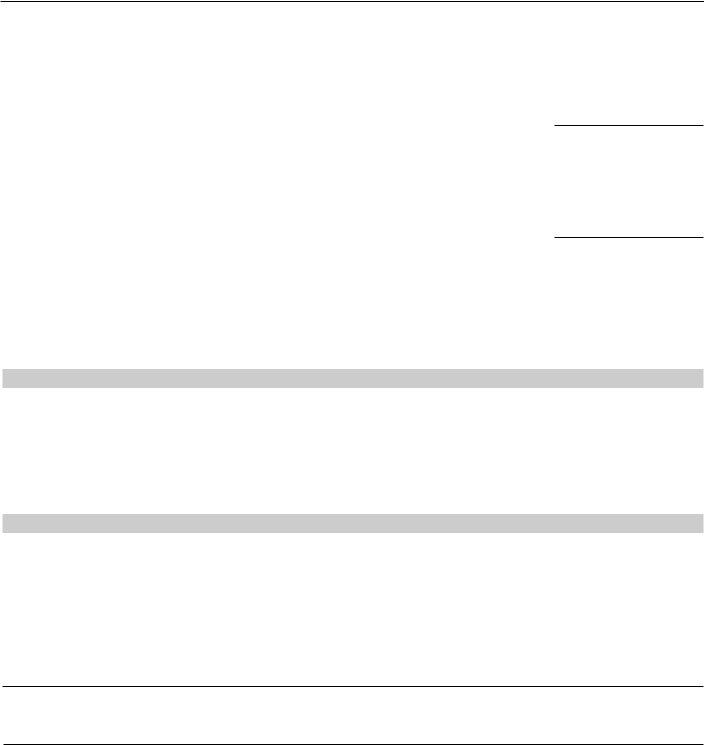

1. The pennsylvania sales tax exemption form will require certain information to be typed in. Make sure the next fields are finalized:

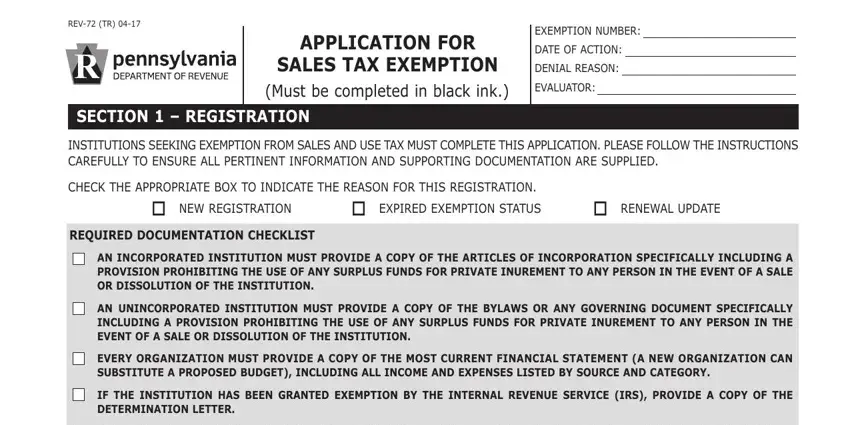

2. When this array of fields is completed, you need to add the needed particulars in SUBSECTION A INSTITUTION, INSTITUTION TRADE NAME IF, INSTITUTION STREET ADDRESS do not, CITY STATE ZIP CODE DATE OF FIRST, LOCATION OF INSTITUTION RECORDS, COUNTY STATE ZIP CODE, INSTITUTION MAILING ADDRESS if, An organization granted c tax, SUBSECTION B TYPE OF ORGANIZATION, CHECK THE APPROPRIATE BOx o, DATE OF INCORPORATION STATE OF, IS THE INSTITUTION ORGANIZED FOR, IF THE INSTITUTION QUALIFIES AS, IF THE INSTITUTION HAS PREVIOUSLY, and HAS THERE BEEN A COURT DECISION IN so you're able to move forward to the next stage.

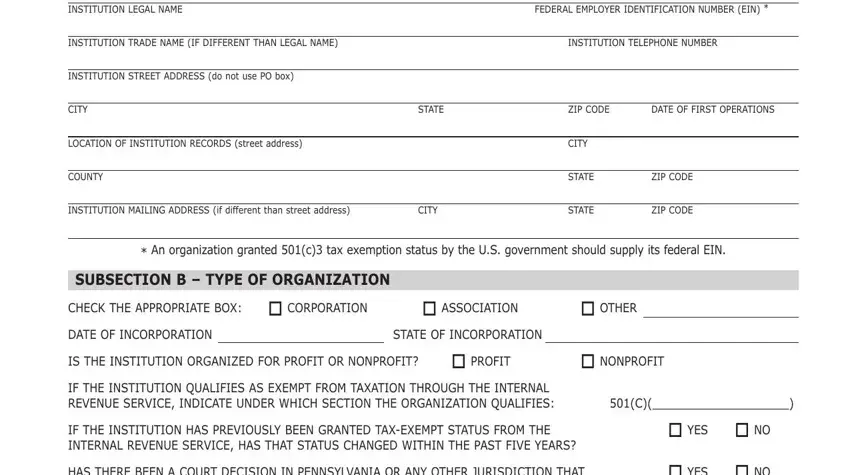

3. Completing HAS THERE BEEN A COURT DECISION IN, and IS THE TAxExEMPT STATUS CURRENTLY is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

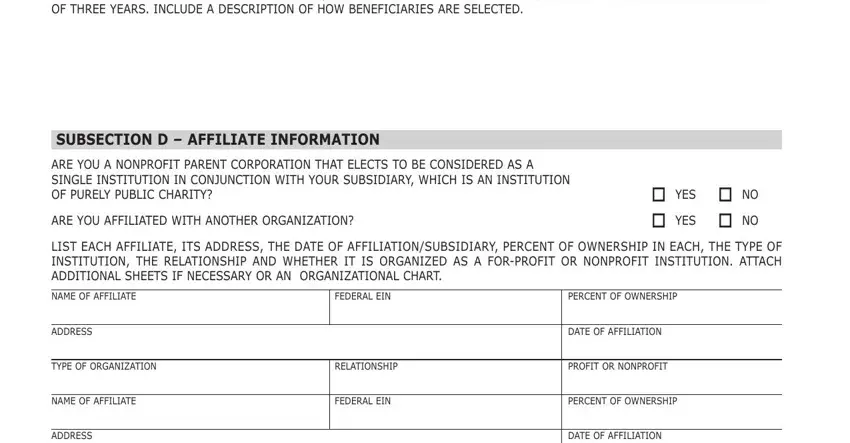

4. This fourth subsection comes with all of the following blanks to fill out: SUBSECTION C ORGANIZATION, SUBSECTION D AFFILIATE, ARE YOU AFFILIATED WITH ANOTHER, LIST EACH AFFILIATE ITS ADDRESS, ADDRESS DATE OF AFFILIATION, TYPE OF ORGANIZATION RELATIONSHIP, NAME OF AFFILIATE FEDERAL EIN, and ADDRESS DATE OF AFFILIATION.

It's simple to make a mistake when filling in your SUBSECTION D AFFILIATE, thus make sure you look again prior to deciding to submit it.

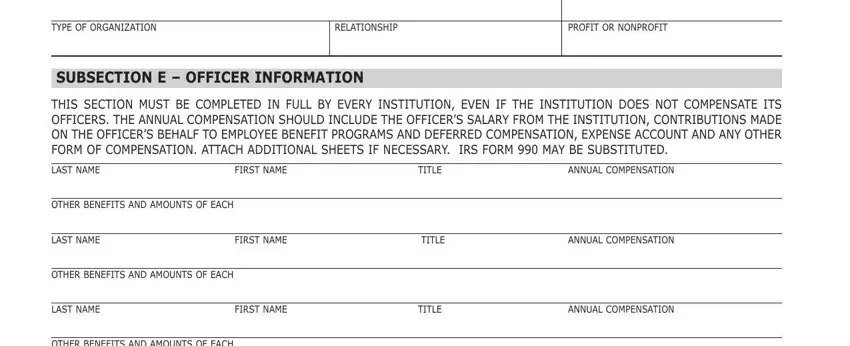

5. Now, this last subsection is precisely what you will have to finish prior to using the document. The blanks at issue include the next: TYPE OF ORGANIZATION RELATIONSHIP, SUBSECTION E OFFICER INFORMATION, OTHER BENEFITS AND AMOUNTS OF EACH, LAST NAME FIRST NAME TITLE ANNUAL, OTHER BENEFITS AND AMOUNTS OF EACH, LAST NAME FIRST NAME TITLE ANNUAL, and OTHER BENEFITS AND AMOUNTS OF EACH.

Step 3: After taking another look at the fields and details, press "Done" and you are all set! Right after starting afree trial account at FormsPal, you will be able to download pennsylvania sales tax exemption form or email it without delay. The document will also be available via your personal account menu with all your edits. FormsPal provides safe document editing devoid of data record-keeping or sharing. Rest assured that your details are secure with us!