a.Type or print all entries in BLOCK or CAPITAL LETTERS.

b.Accomplish this form in softcopy when making remittances to Pag-IBIG Fund or to any accredited collecting partner based on the following payment schedule:

Schedule of Payments |

First Letter of |

Due Date |

Employer/Business Name |

|

A to D |

10th to the 14th day of the month |

E to L |

15th to the 19th day of the month |

M to Q |

20th to the 24th day of the month |

R to Z, Numeral |

25th at the end of the month |

c. For employer with branch offices, please prepare separate Membership Savings Remittance Form (MSRF) for each branch indicating therein their respective addresses.

d. A separate MSRF should be accomplished per type of payment (whether cash or check payment) and in case Credit Memo shall be applied as payment to the Fund.

e. RATE OF MEMBERSHIP SAVINGS (MS) |

|

|

MONTHLY COMPENSATION |

CONTRIBUTION RATE |

|

(BASIC + COLA) |

EMPLOYEE |

EMPLOYER |

TOTAL |

P1,500.00 and below |

1% |

2% |

3% |

Over P1,500.00 |

2% |

2% |

4% |

The maximum Monthly Compensation to be used in computing the employee and employer contribution shall not be more than 5,000.00.

A member may contribute more than what is required, however the employer shall only be mandated to contribute two percent (2%) of the monthly compensation of the member as counterpart contribution. In case the member increases his/her monthly membership savings, the employer shall have the option to match said increase or to contribute only what is required.

f.Membership contribution payments to be remitted should be equal to the total amount reflected in the MSRF. Check payments should be made payable to Pag-IBIG Fund and shall be posted upon clearing (clearing policy shall not be applicable to National Government Agency (NGA), instead payment shall be

posted within 72 hours upon receipt of collection).

g. Employers with over remittance from previous payments shall be issued with a Notice of Overpayment and Credit Memo. For remittances previously made

for employees for whom remittances should not have been made, the employer shall request a refund subject to the Fund’s verification and

approval. The request shall be made not later than six (6) months from the time said remittance was made.

h. Employers who shall remit on or before the due date as evidenced by the validated Membership Savings Remittance Form (MSRF) or Pag-IBIG Fund Receipt shall be entitled to an incentive fee equivalent to 0.2% of the amount remitted provided he satisfy all the conditions required.

|

|

|

|

|

1 |

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

4 |

5 |

6 |

7 |

8 |

9 |

11 |

12 |

13 |

|

|

|

|

|

10 |

|

14

15

16

i.Failure or refusal of the Employer to pay or to remit the contributions herein prescribed shall not prejudice the right of the covered employee to the benefits under the Fund. Such Employer shall be charged a penalty equivalent to 1/10 of 1% per day of delay of the amount due starting on the first day immediately following the due date until the date of full settlement.

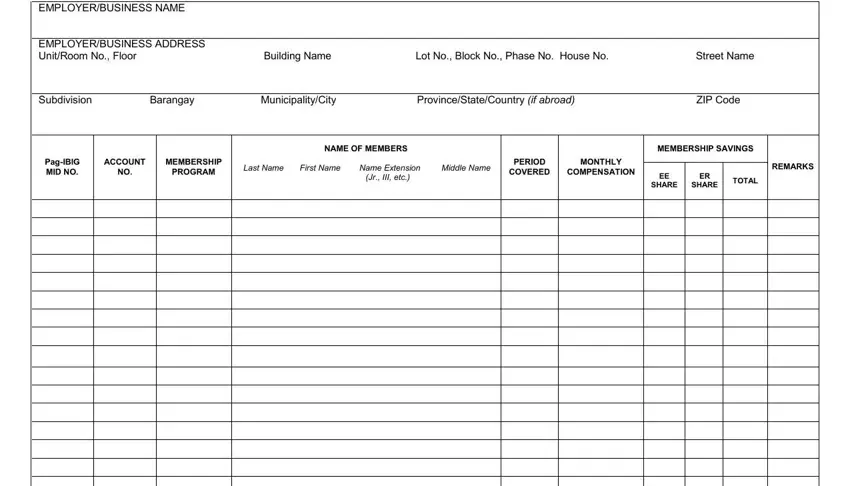

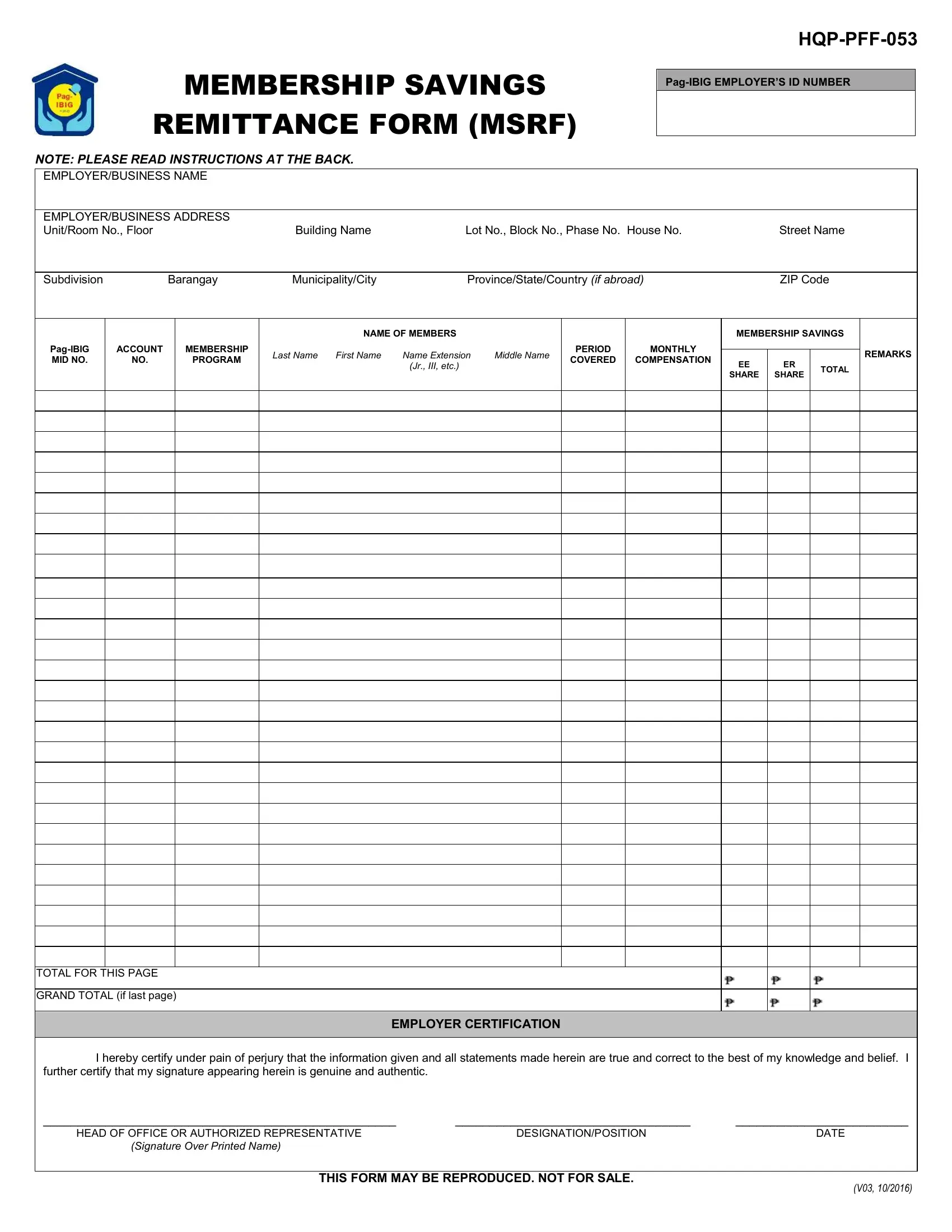

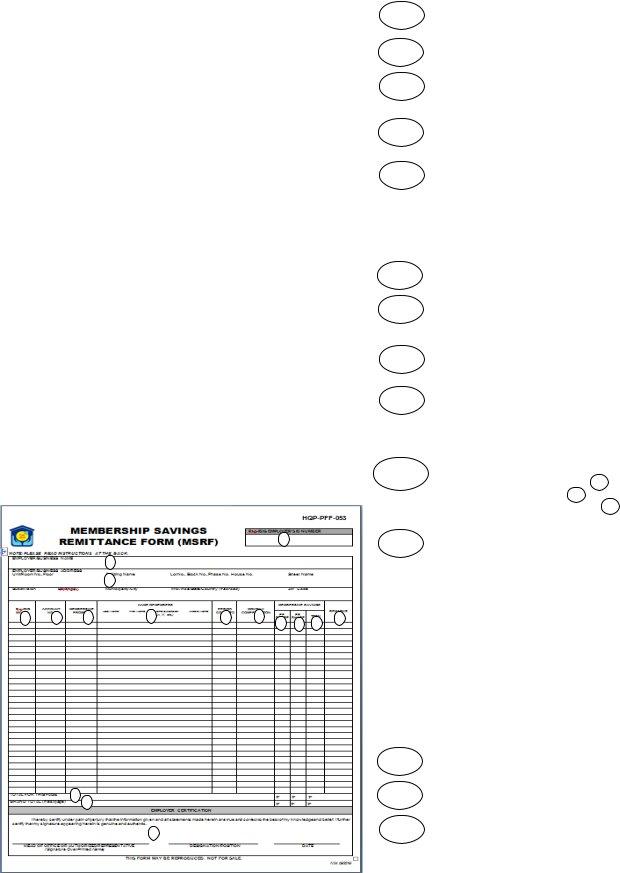

1 Pag-IBIG Employer’s ID No. – assigned Pag-IBIG Employer’s ID Number.

2Employer/Business Name – per DTI/SEC Registration.

Employer/Business Address - indicate Unit/Room No., Floor,

3Building Name or Lot No., Block No., Phase No. or House No. and Street Name, Subdivision, Barangay, Municipality/City, Province, and ZIP Code.

4Pag-IBIG MID No. – indicate the member’s assigned Pag-IBIG Membership Identification (MID) Number.

Account No. – indicate the member’s assigned Account Number

5per Membership Program.

NOTE: In accomplishing the Account Number column, for Pag-IBIG I contributions, indicate MID Number or RTN; for Pag-IBIG II, indicate the assigned Account Number ; for MP2, indicate the system-generated Account Number provided after successful enrollment.

Membership Program – indicate if MS remittance is for Pag-IBIG

6I, Pag-IBIG II or Modified Pag-IBIG II program.

|

|

Name of Members - indicate member’s complete name in the |

|

7 |

following format: Last Name, First Name, Name Extension (Jr., III, |

|

etc.), Middle Name |

|

|

|

8 |

Period Covered – indicate the applicable month and year of MS |

|

remittance in the following format (YYYYMM). |

|

|

Monthly Compensation – refer to the basic salary and other

9allowances, where basic salary includes, but is not limited to, fees,

salaries, wages, and similar items received in a month. Accomplish this portion only when remitting the member’s initial membership savings or if here are changes in monthly compensation of the member.

10-12 Membership Savings – indicate the amount of employee contributions under column 10 the amount of employer contributions under column 11 , and the total amount of employee and employer contributions under 12 . Do not round off nor drop centavos.

Remarks – accomplish this portion only to report changes in the

13employee’s/member’s employment status and to update any information regarding the employee/member. Indicate the appropriate code and effectivity date in the following format (mm/dd/yy) on the space provided for. Please refer to the following codes and examples:

N |

- Newly Hired |

Examples |

L |

- Leave Without Pay/AWOL |

1. |

N: |

1/4/2010 |

RS |

- Resigned/Separated |

2. |

L: |

1/21/2010 |

RT |

- Retired |

3. |

RS: 1/3/2010 |

D |

- Deceased |

4. |

D: |

1/14/2010 |

O- Others, please specify reason

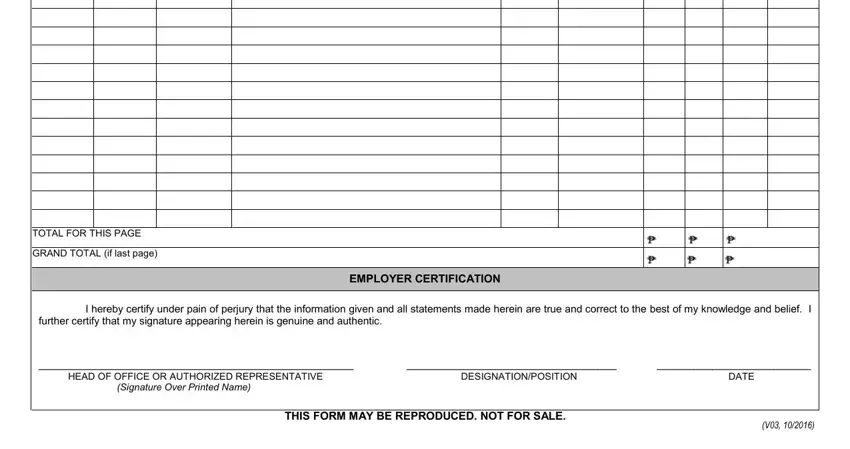

14Indicate the total amount due and employer contributions per page. Indicate the total amount due and employer contributions if this is

15the last page.

16Employer Certification - to be accomplished and duly signed by the Head of Office/Authorized Representative.