Handling PDF documents online is actually very simple using our PDF tool. You can fill in hsbc remittance form here effortlessly. To have our tool on the forefront of convenience, we aim to put into practice user-driven capabilities and enhancements regularly. We are routinely pleased to receive feedback - join us in revolutionizing PDF editing. Here's what you would have to do to get going:

Step 1: Simply click the "Get Form Button" above on this page to launch our pdf file editor. This way, you will find all that is required to fill out your document.

Step 2: With the help of this state-of-the-art PDF editing tool, you're able to accomplish more than just complete forms. Express yourself and make your docs appear professional with custom text added in, or optimize the original content to perfection - all comes with an ability to add almost any graphics and sign the PDF off.

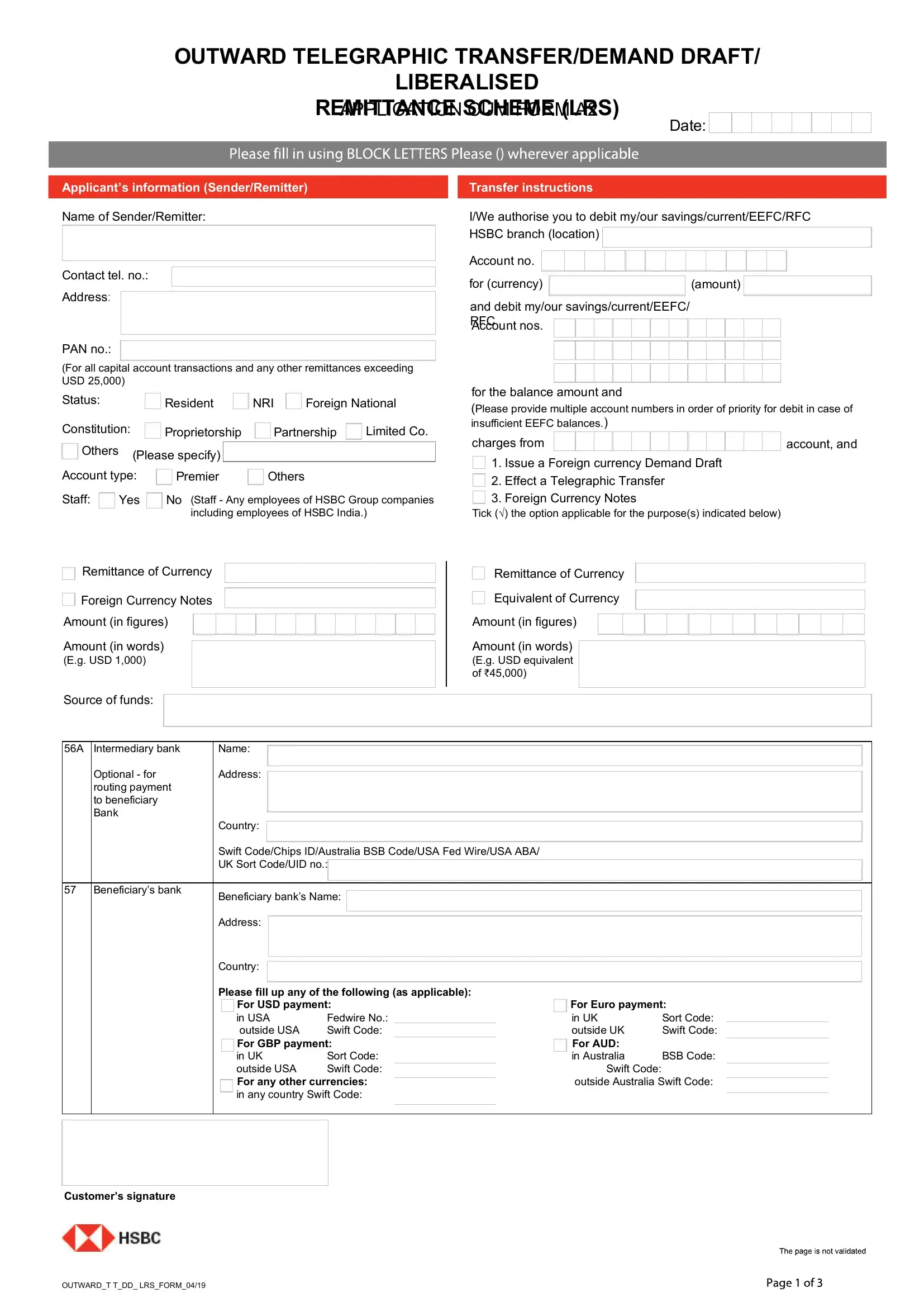

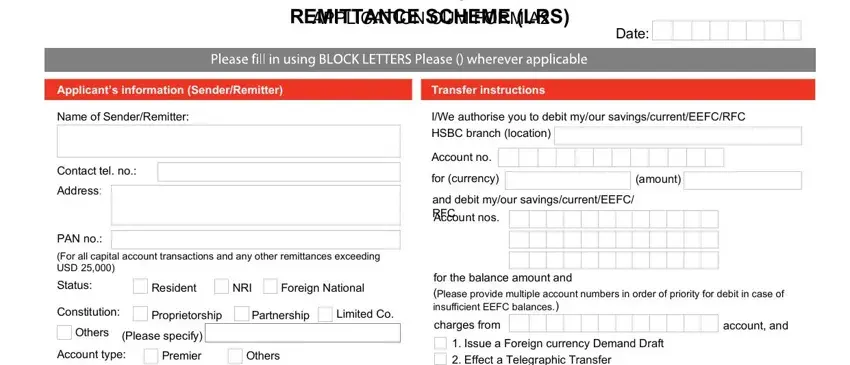

As for the fields of this specific form, here is what you need to know:

1. Firstly, when filling in the hsbc remittance form, start out with the page that includes the next blanks:

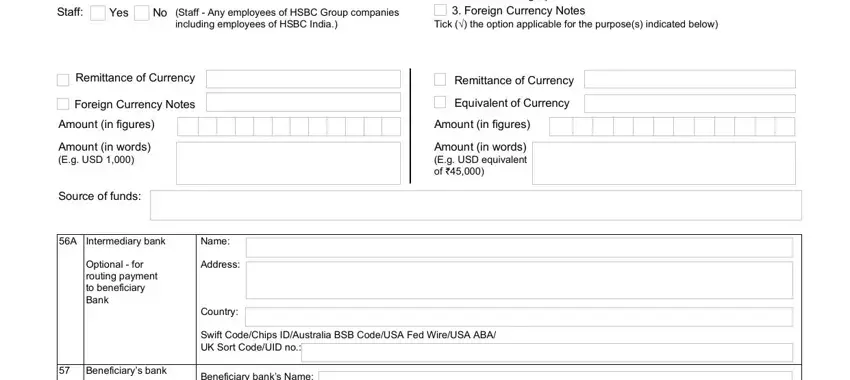

2. The next stage is to submit all of the following blanks: Issue a Foreign currency Demand, Tick the option applicable for, Remittance of Currency Equivalent, Amount in figures Amount in words, Account type Staff Yes, Staff Any employees of HSBC Group, Details of foreign exchange, Remittance of Currency, Foreign Currency Notes, Amount in figures Amount in words, Source of funds, A Intermediary bank, Name, Optional for routing payment to, and Address.

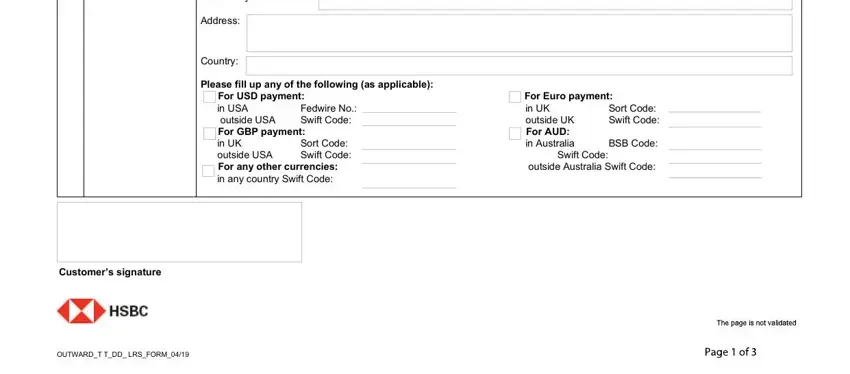

3. Completing Beneficiary banks Name, Address, Country, Please fill up any of the, Fedwire No Swift Code, For USD payment in USA outside USA, Sort Code Swift Code, Customers signature, OUTWARDT TDD LRSFORM, For Euro payment in UK outside UK, Swift Code, Sort Code Swift Code, BSB Code, and outside Australia Swift Code is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Regarding For USD payment in USA outside USA and outside Australia Swift Code, make sure that you double-check them here. Both these are certainly the most important fields in this PDF.

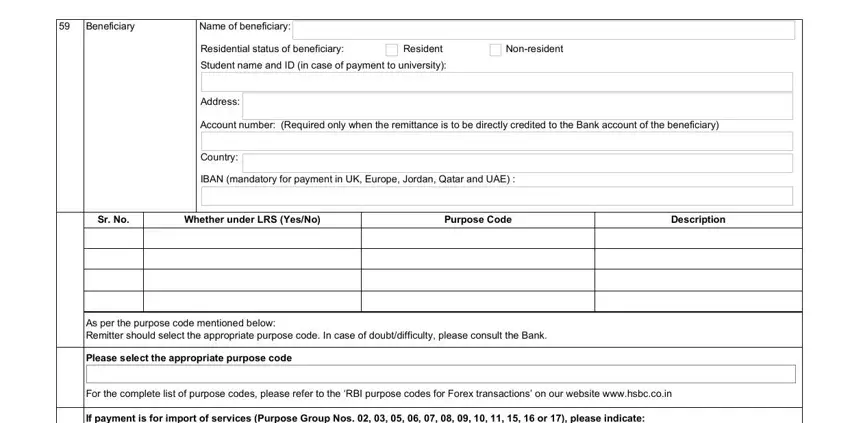

4. Filling out Beneficiary, Name of beneficiary, Residential status of beneficiary, Nonresident, Address, Account number Required only when, Country, IBAN mandatory for payment in UK, Sr No, Whether under LRS YesNo, Purpose Code, Description, As per the purpose code mentioned, Please select the appropriate, and For the complete list of purpose is vital in the next part - be sure to take the time and fill out every empty field!

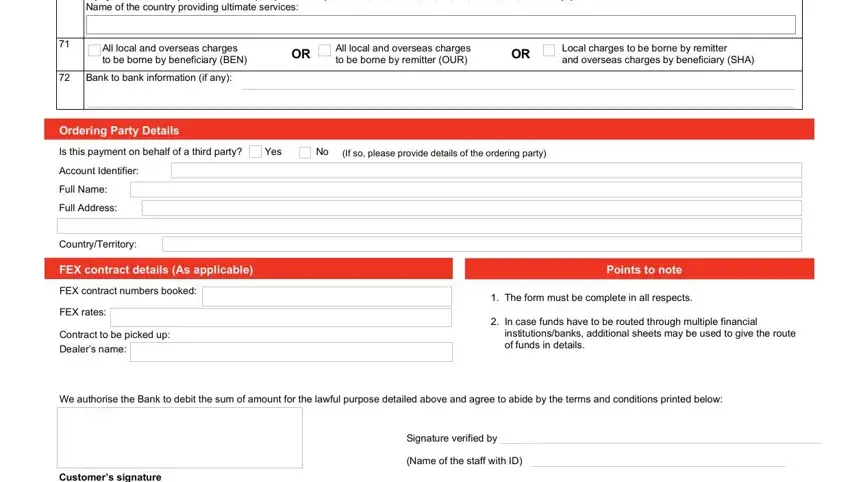

5. The very last stage to submit this PDF form is pivotal. Ensure to fill in the necessary blank fields, for example If payment is for import of, All local and overseas charges to, All local and overseas charges to, Local charges to be borne by, Bank to bank information if any, Ordering Party Details Is this, CountryTerritory, FEX contract details As applicable, FEX rates, Contract to be picked up Dealers, Yes, If so please provide details of, Points to note, The form must be complete in all, and In case funds have to be routed, before submitting. In any other case, it may result in an unfinished and potentially nonvalid document!

Step 3: Make sure that the information is right and then click on "Done" to conclude the task. Create a 7-day free trial subscription with us and acquire direct access to hsbc remittance form - download, email, or edit in your FormsPal cabinet. FormsPal is focused on the privacy of all our users; we always make sure that all information entered into our tool continues to be protected.