Any time you would like to fill out Ia 1040Es Form, you don't need to download any sort of software - simply give a try to our PDF editor. To make our editor better and simpler to utilize, we continuously design new features, with our users' suggestions in mind. Getting underway is simple! All that you should do is take the following basic steps directly below:

Step 1: Open the PDF in our tool by clicking the "Get Form Button" in the top area of this page.

Step 2: When you open the PDF editor, you will notice the document made ready to be completed. In addition to filling in various fields, it's also possible to do other sorts of actions with the file, namely putting on custom words, editing the original textual content, adding images, placing your signature to the PDF, and a lot more.

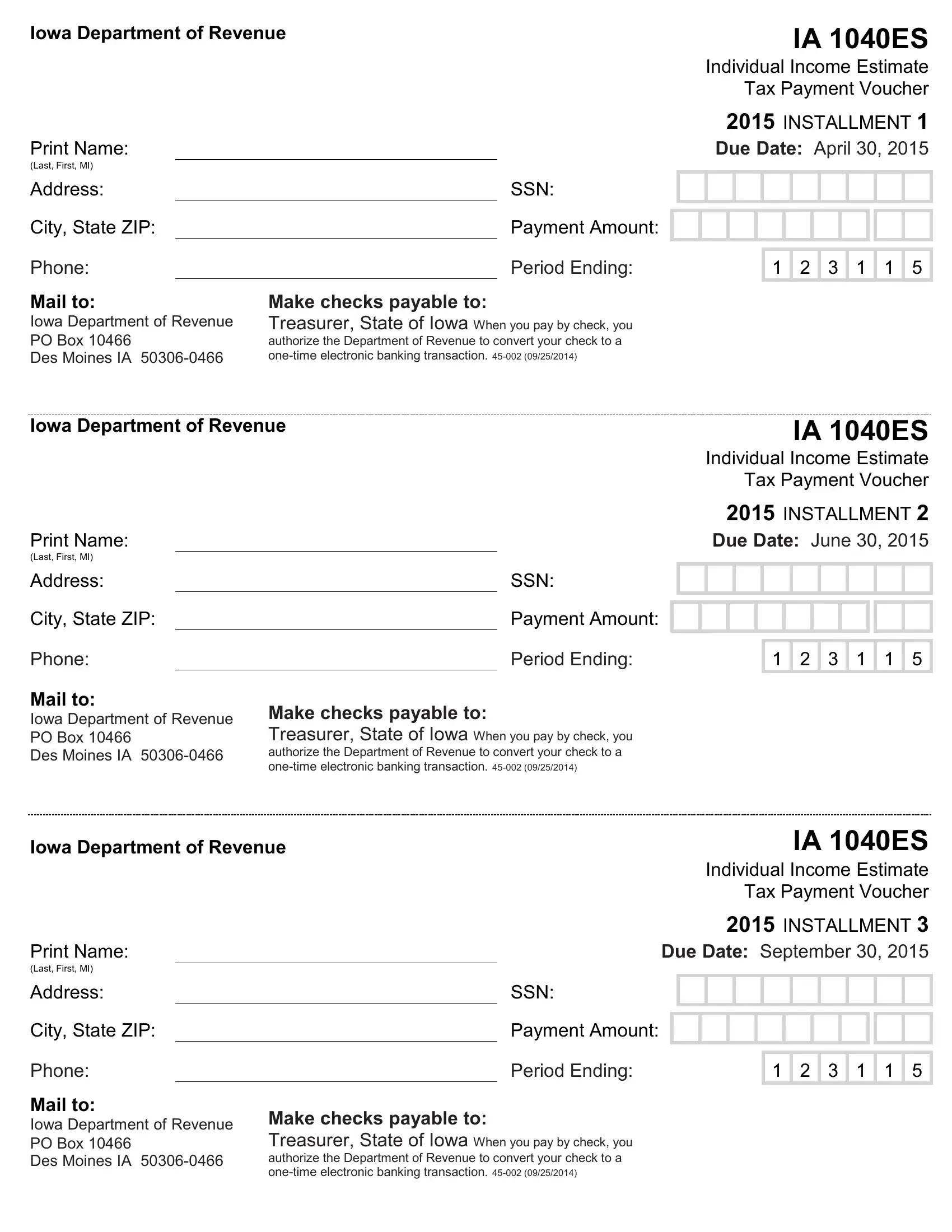

As for the fields of this specific document, here is what you want to do:

1. Whenever filling out the Ia 1040Es Form, make certain to incorporate all of the important fields in the associated section. This will help to expedite the process, allowing for your details to be processed without delay and accurately.

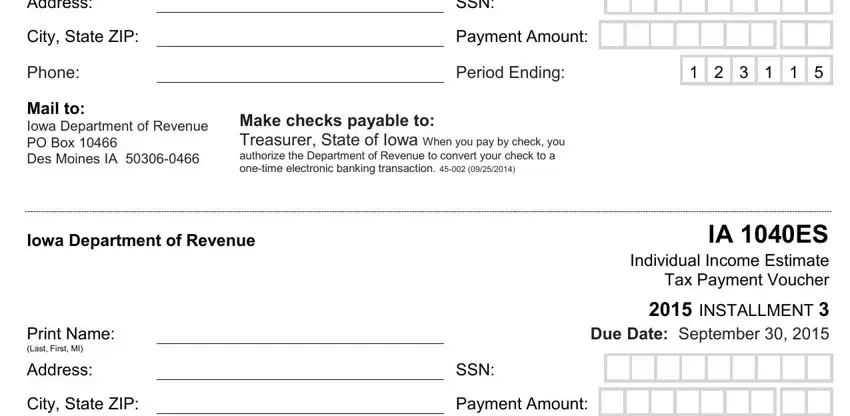

2. After the prior part is done, proceed to enter the applicable details in all these: Payment Amount, Period Ending, SSN, SSN, Address, City State ZIP, Phone, Iowa Department of Revenue, Print Name, Last First MI, Address, City State ZIP, Mail to Iowa Department of Revenue, Make checks payable to Treasurer, and IA ES Individual Income Estimate.

Always be extremely careful while filling out Period Ending and Last First MI, as this is where many people make a few mistakes.

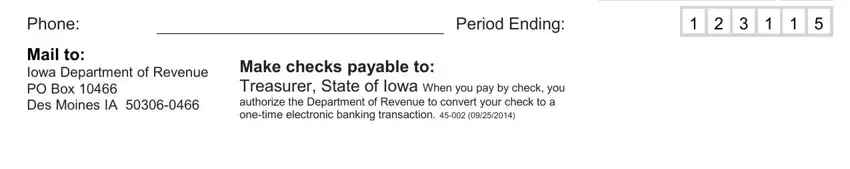

3. This next step is all about Phone, Mail to Iowa Department of Revenue, Period Ending, and Make checks payable to Treasurer - fill in these blank fields.

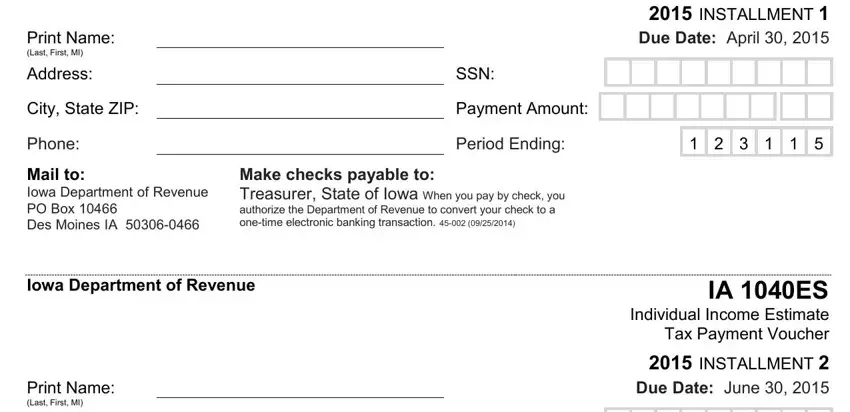

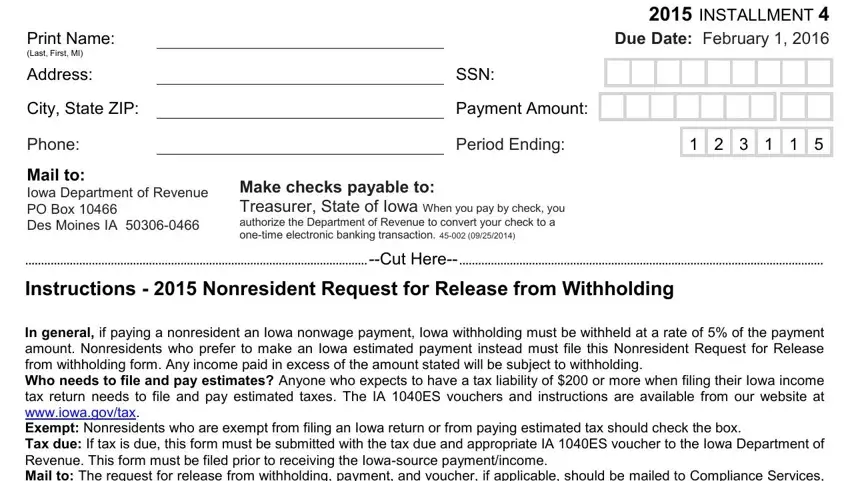

4. Completing Print Name Last First MI, Address, City State ZIP, Phone, INSTALLMENT Due Date February, SSN, Payment Amount, Period Ending, Mail to Iowa Department of Revenue, Make checks payable to Treasurer, Cut Here, Instructions Nonresident Request, and In general if paying a nonresident is key in this form section - always be patient and be attentive with each blank area!

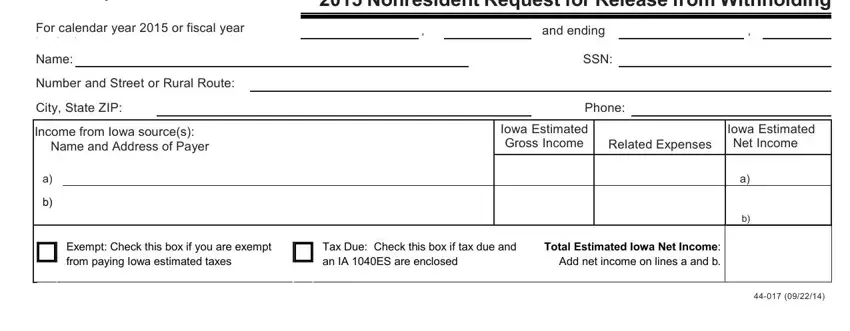

5. And finally, this last subsection is what you'll have to wrap up before submitting the document. The fields at this point include the following: Iowa Department of Revenue, For calendar year or fiscal year, Number and Street or Rural Route, City State ZIP Income from Iowa, Name and Address of Payer, Exempt Check this box if you are, Nonresident Request for Release, and ending, SSN, Phone, Related Expenses, Iowa Estimated Net Income, Iowa Estimated Gross Income, Tax Due Check this box if tax due, and Total Estimated Iowa Net Income.

Step 3: Immediately after rereading the entries, press "Done" and you're all set! Make a 7-day free trial option at FormsPal and gain immediate access to Ia 1040Es Form - download, email, or edit inside your personal account. When using FormsPal, you can easily complete forms without the need to get worried about database incidents or records being distributed. Our protected software ensures that your private information is kept safe.