When you desire to fill out 62-MAHASKA, you don't have to install any applications - simply make use of our online PDF editor. To make our editor better and easier to work with, we continuously work on new features, bearing in mind feedback from our users. With some easy steps, you can start your PDF journey:

Step 1: Access the PDF form in our tool by pressing the "Get Form Button" in the top section of this webpage.

Step 2: The editor provides the capability to customize PDF files in a variety of ways. Transform it with personalized text, correct original content, and include a signature - all within the reach of a few clicks!

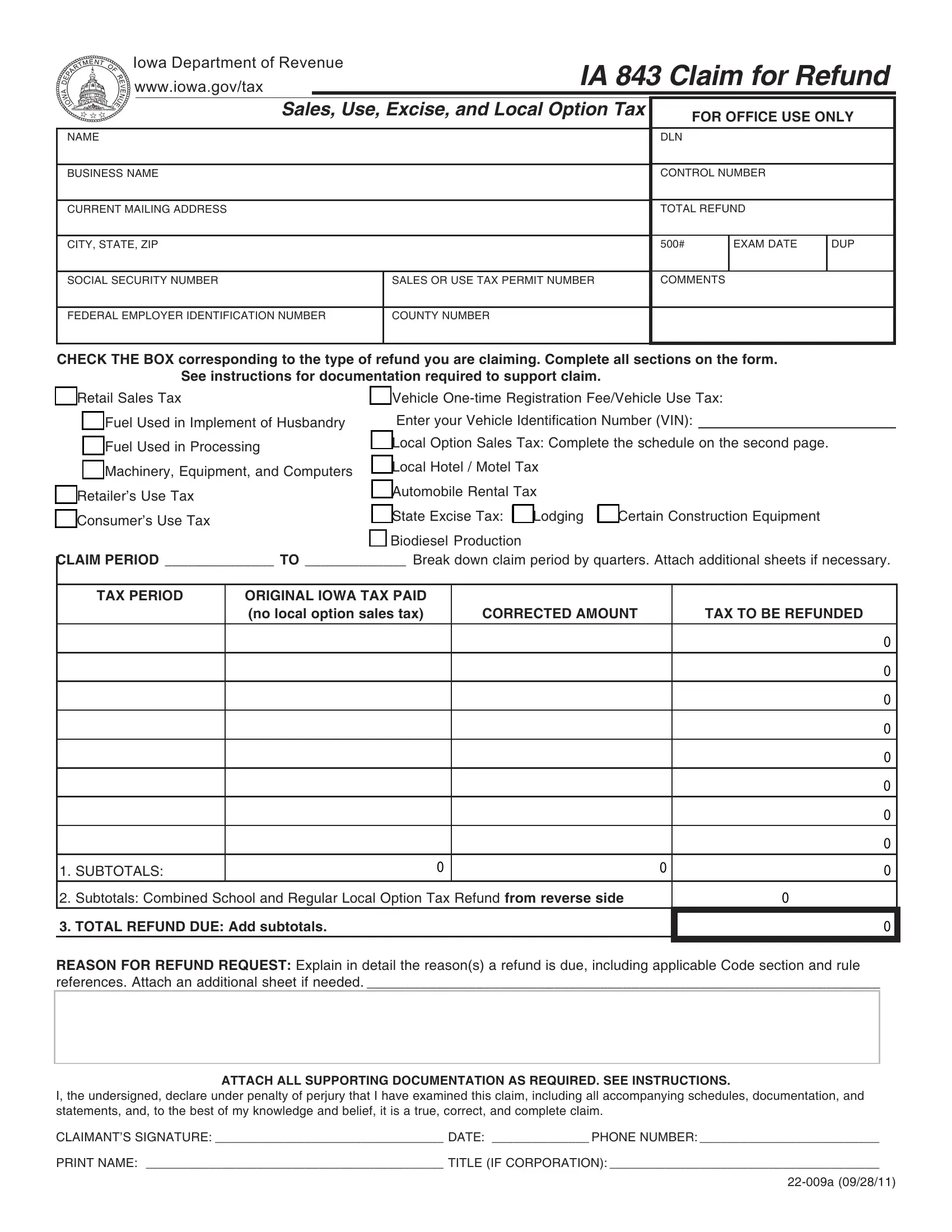

With regards to the blanks of this precise document, here is what you want to do:

1. You need to fill out the 62-MAHASKA accurately, thus be careful when filling in the segments containing all these blank fields:

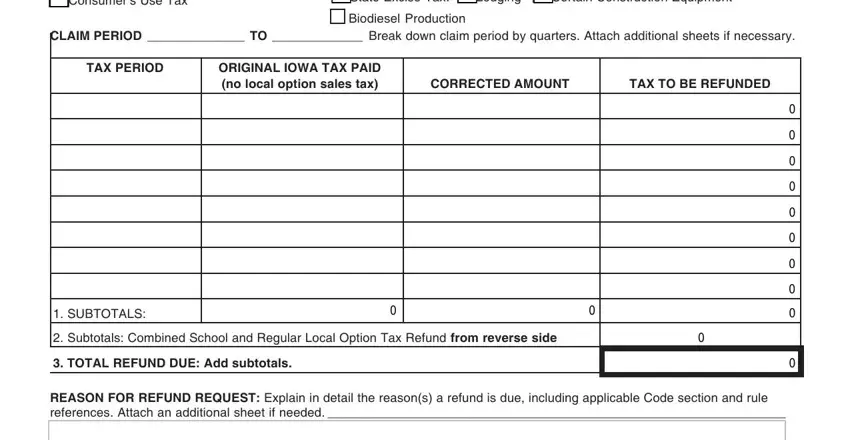

2. Right after finishing this section, head on to the subsequent step and complete the essential details in these blanks - Consumers Use Tax, Automobile Rental Tax State Excise, Lodging, Biodiesel Production, Certain Construction Equipment, CLAIM PERIOD TO Break down claim, TAX PERIOD, ORIGINAL IOWA TAX PAID no local, CORRECTED AMOUNT, TAX TO BE REFUNDED, SUBTOTALS, Subtotals Combined School and, TOTAL REFUND DUE Add subtotals, and REASON FOR REFUND REQUEST Explain.

It's easy to make an error while filling in the Certain Construction Equipment, therefore you'll want to take a second look before you decide to send it in.

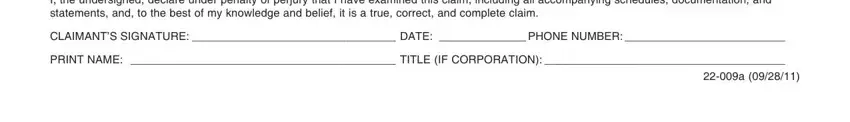

3. This part is generally hassle-free - fill out all the blanks in I the undersigned declare under, CLAIMANTS SIGNATURE DATE PHONE, and PRINT NAME TITLE IF CORPORATION to complete this segment.

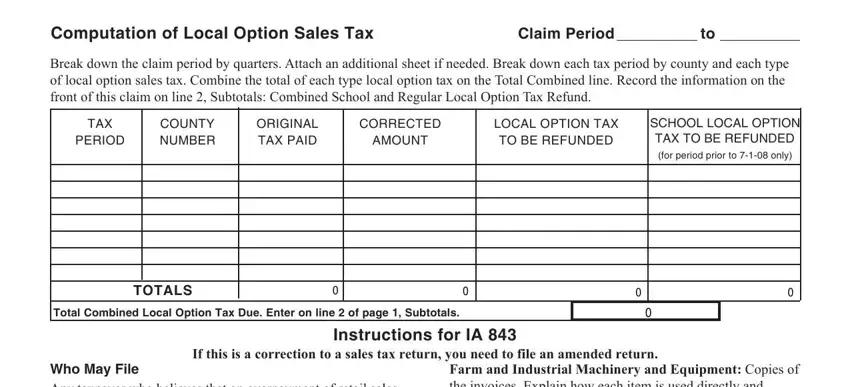

4. To go forward, this fourth step requires typing in a handful of empty form fields. These comprise of Computation of Local Option Sales, Break down the claim period by, TAX, PERIOD, COUNTY NUMBER, ORIGINAL TAX PAID, CORRECTED, AMOUNT, LOCAL OPTION TAX TO BE REFUNDED, SCHOOL LOCAL OPTION TAX TO BE, TOTALS, Total Combined Local Option Tax, Instructions for IA, If this is a correction to a sales, and Farm and Industrial Machinery and, which you'll find crucial to moving forward with this document.

Step 3: Reread all the information you've entered into the blank fields and then click on the "Done" button. Sign up with us today and easily use 62-MAHASKA, all set for downloading. All modifications you make are preserved , allowing you to edit the document later on as needed. FormsPal is devoted to the confidentiality of our users; we make sure that all personal information entered into our editor stays secure.