Dealing with PDF forms online is definitely simple with our PDF tool. Anyone can fill in ia198p here with no trouble. In order to make our tool better and simpler to utilize, we constantly work on new features, taking into account feedback coming from our users. It just takes a couple of simple steps:

Step 1: First of all, access the pdf editor by clicking the "Get Form Button" in the top section of this page.

Step 2: This tool offers you the capability to customize PDF files in a range of ways. Improve it by writing your own text, correct what is originally in the document, and put in a signature - all at your disposal!

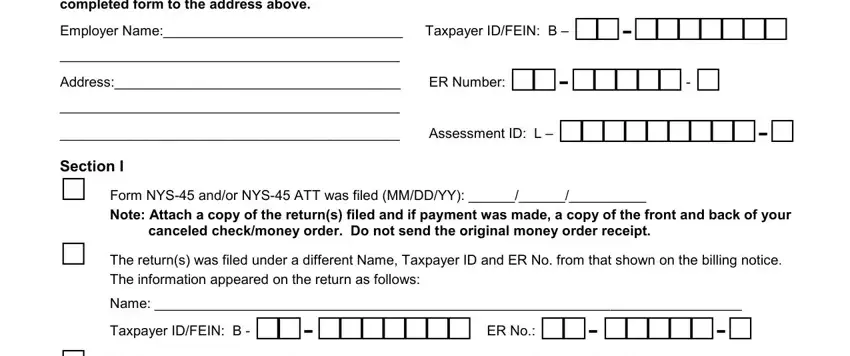

This PDF doc will require you to provide some specific information; to guarantee correctness, remember to take heed of the subsequent steps:

1. To get started, once completing the ia198p, start with the area that features the following blank fields:

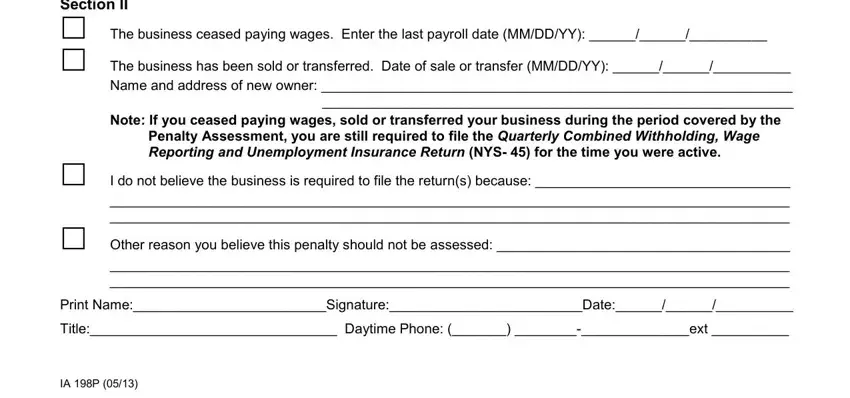

2. Immediately after the prior part is filled out, go to enter the suitable details in all these: Section II, The business ceased paying wages, Name and address of new owner, Note If you ceased paying wages, I do not believe the business is, Other reason you believe this, Print NameSignatureDate, Title Daytime Phone ext, and IA P.

Be really mindful when filling in I do not believe the business is and Print NameSignatureDate, as this is the section in which many people make some mistakes.

Step 3: Right after you have looked over the information provided, click "Done" to finalize your form at FormsPal. Sign up with FormsPal today and easily get access to ia198p, ready for download. Every edit you make is handily preserved , helping you to change the file at a later time when necessary. At FormsPal, we aim to make sure that all your details are stored secure.