Using the online editor for PDFs by FormsPal, it is possible to fill out or change icici bank rtgs form in excel here. To have our tool on the cutting edge of efficiency, we aim to put into operation user-oriented capabilities and improvements on a regular basis. We are routinely glad to get suggestions - play a vital part in revampimg how we work with PDF forms. With just a few easy steps, you can start your PDF journey:

Step 1: Access the form in our tool by clicking on the "Get Form Button" in the top section of this page.

Step 2: When you open the online editor, there'll be the form made ready to be filled in. Besides filling out different fields, you could also do various other actions with the Document, namely adding custom words, changing the initial text, inserting graphics, affixing your signature to the PDF, and more.

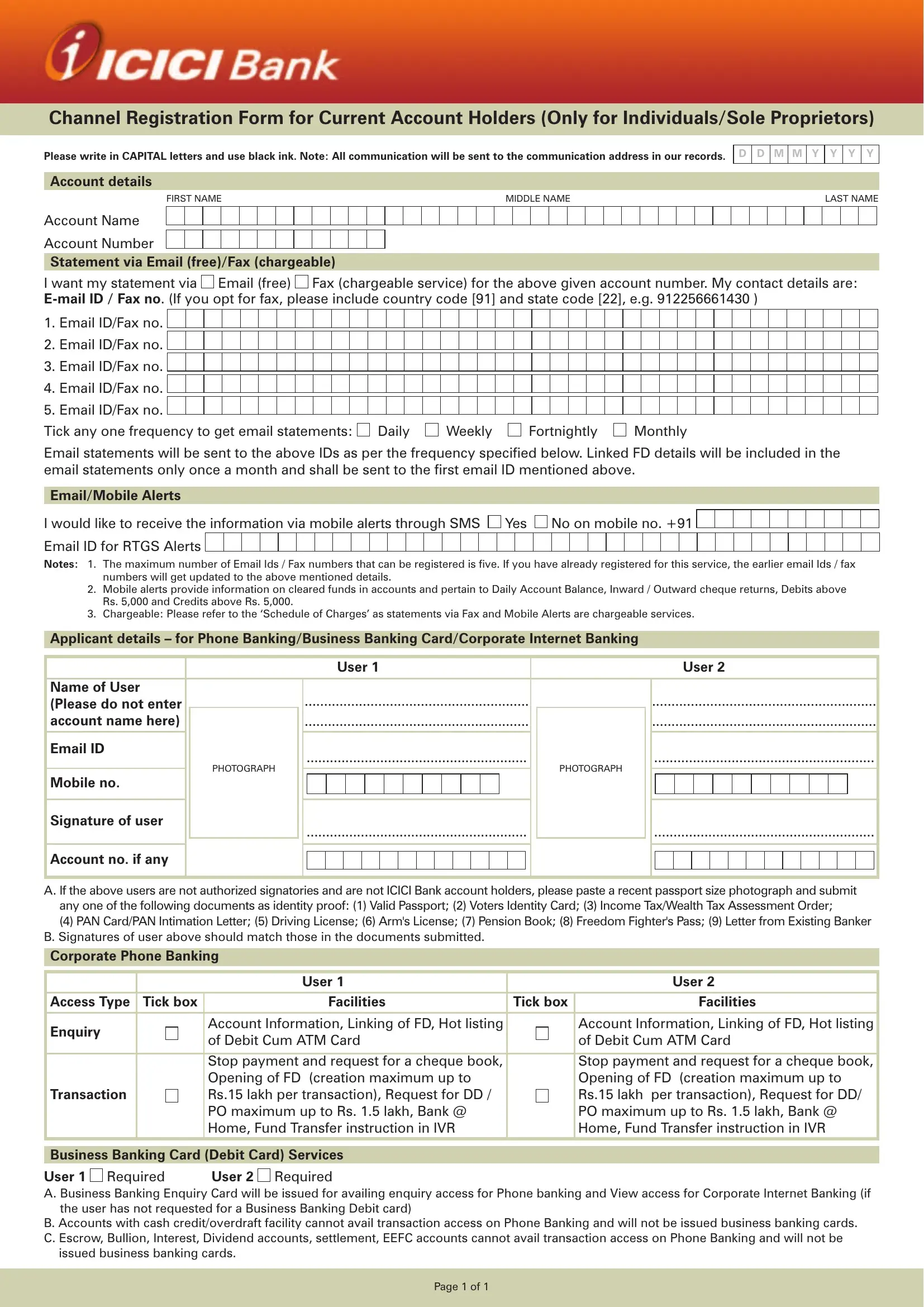

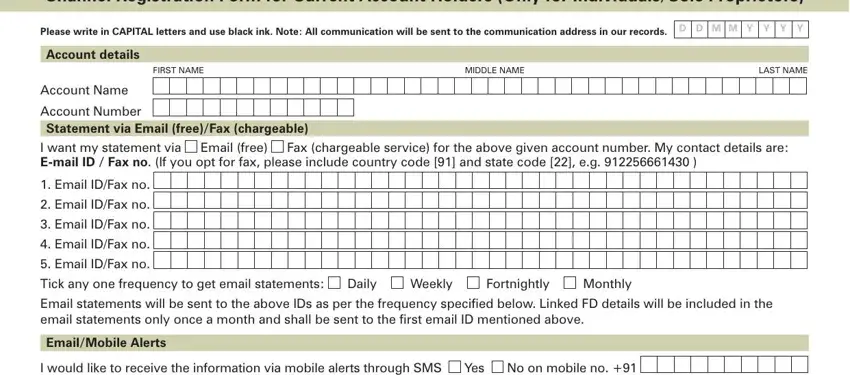

When it comes to fields of this particular form, this is what you should consider:

1. To start off, once filling in the icici bank rtgs form in excel, start with the form section that has the following fields:

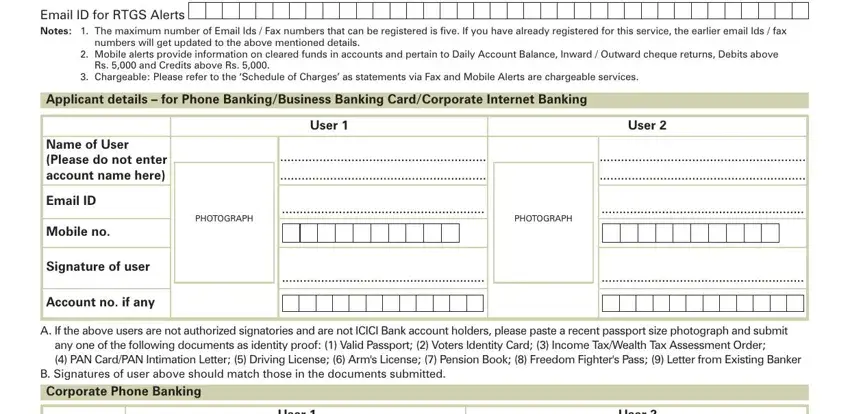

2. Your next step would be to complete the following blanks: I would like to receive the, Email ID for RTGS Alerts Notes, numbers will get updated to the, Mobile alerts provide information, Rs and Credits above Rs, Chargeable Please refer to the, Applicant details for Phone, Name of User Please do not enter, Email ID, Mobile no, Signature of user, Account no if any, User, User, and PHOTOGRAPH.

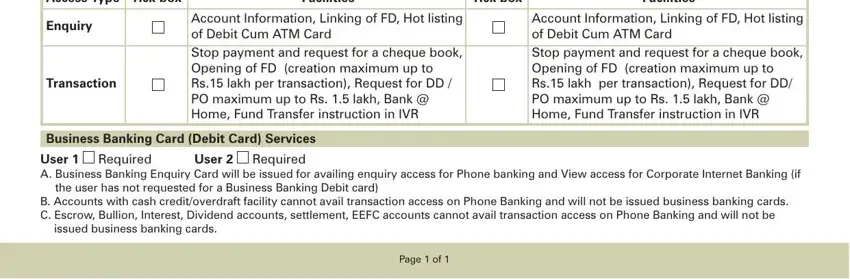

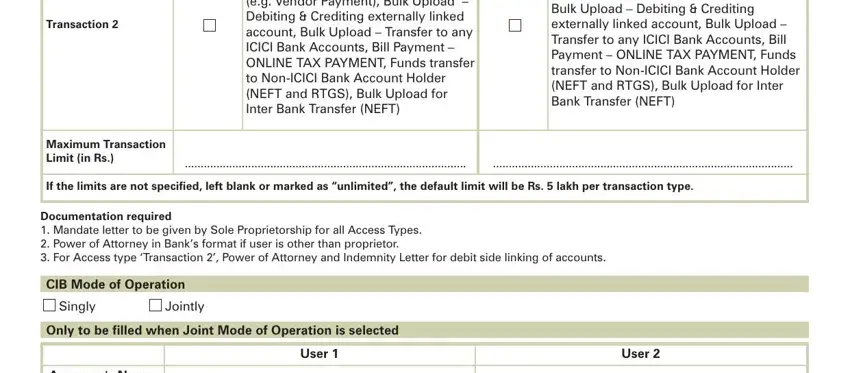

3. Your next part will be hassle-free - fill in all the blanks in Access Type Tick box, Enquiry, Transaction, Facilities, Tick box, Facilities, Account Information Linking of FD, Account Information Linking of FD, Stop payment and request for a, Stop payment and request for a, Business Banking Card Debit Card, User A Business Banking Enquiry, Required, User, and Required in order to finish the current step.

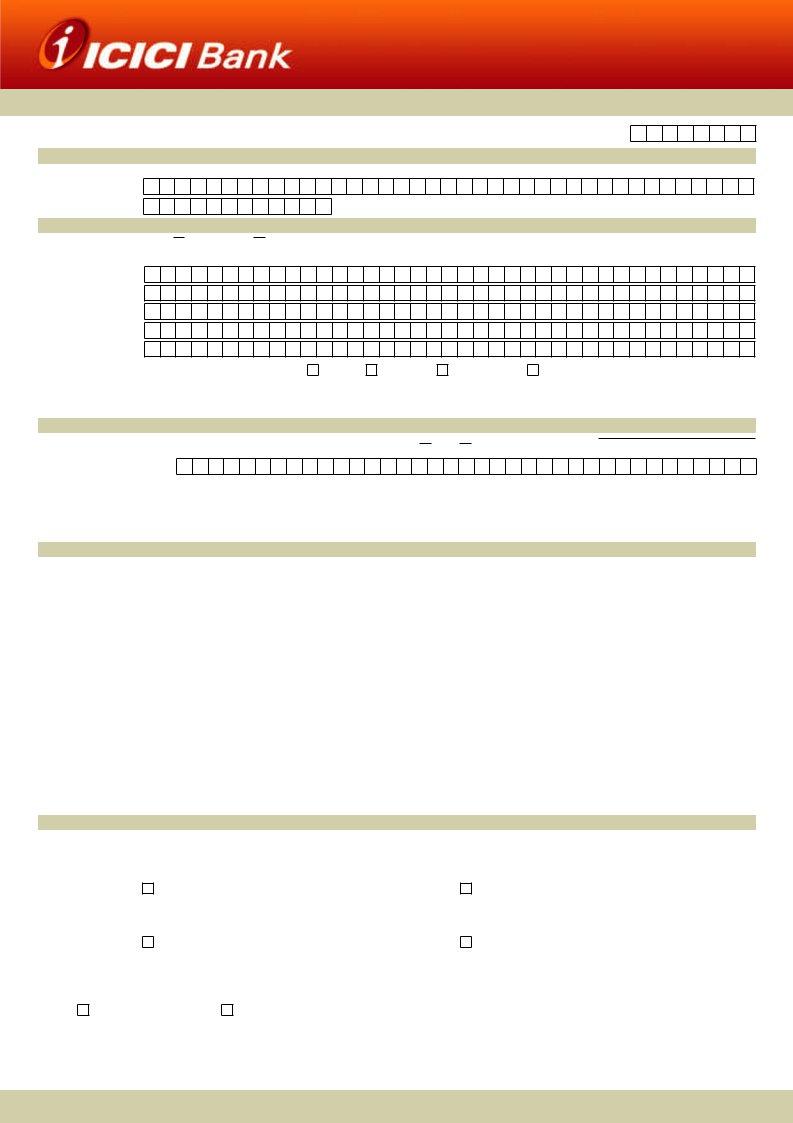

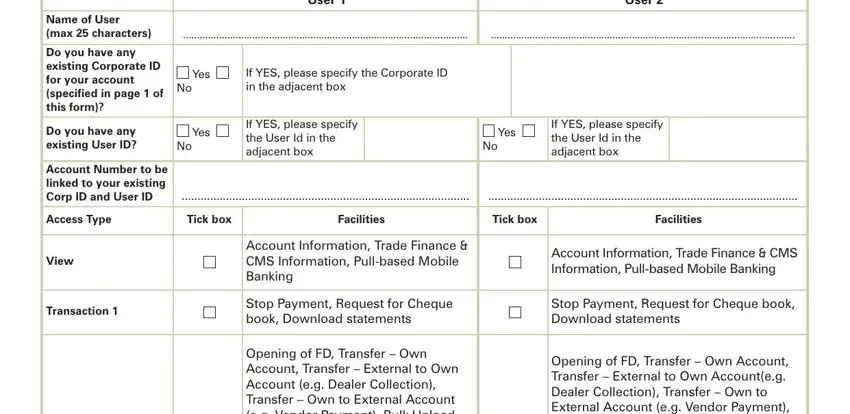

4. You're ready to fill out this fourth section! In this case you'll have these Name of User max characters, Do you have any existing Corporate, User, User, Yes, If YES please specify the, Do you have any existing User ID, Yes, If YES please specify the User Id, Yes, If YES please specify the User Id, Account Number to be linked to, Access Type, Tick box, and Facilities fields to fill out.

It is easy to make a mistake while filling in your Do you have any existing User ID, therefore be sure you take another look before you decide to submit it.

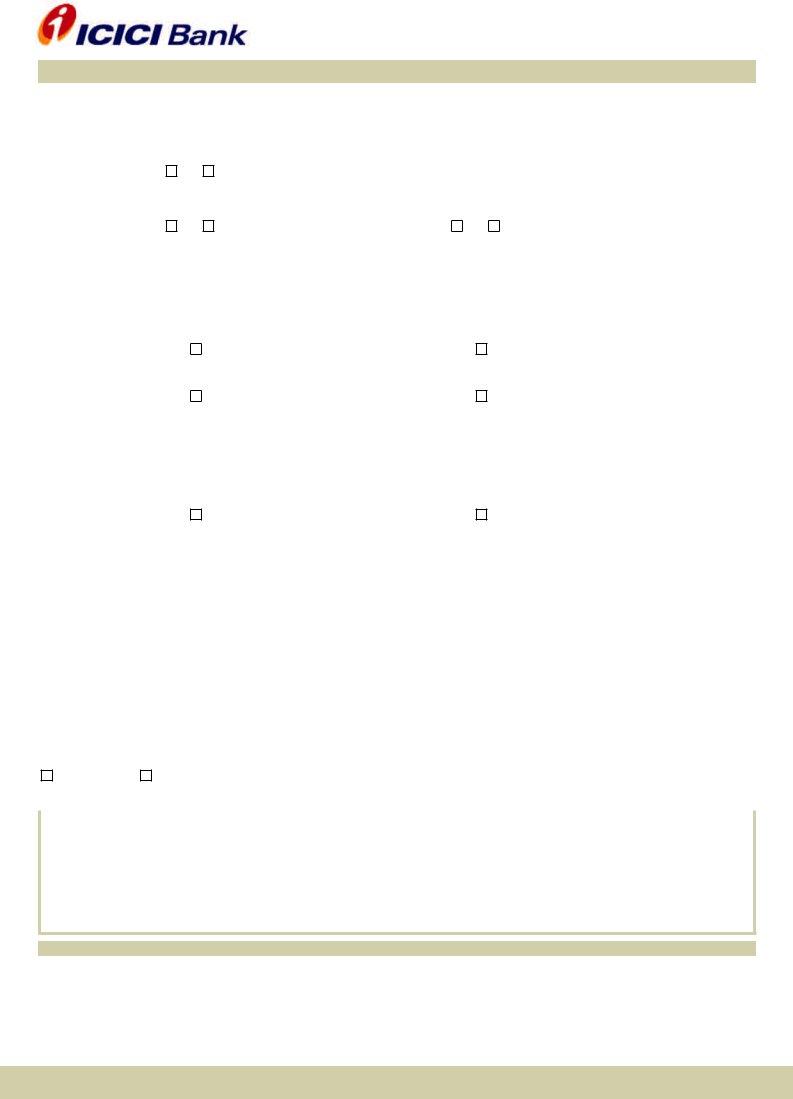

5. Last of all, the following last subsection is precisely what you should finish prior to submitting the form. The blanks in this instance include the next: Transaction, Opening of FD Transfer Own, Opening of FD Transfer Own, Maximum Transaction Limit in Rs, If the limits are not specified, Documentation required Mandate, CIB Mode of Operation, Singly, Jointly, Only to be filled when Joint Mode, User, User, and Approvers Name Checker characters.

Step 3: Glance through the information you've entered into the blank fields and hit the "Done" button. Right after getting a7-day free trial account with us, it will be possible to download icici bank rtgs form in excel or send it through email immediately. The PDF will also be available from your personal account menu with your every change. When you work with FormsPal, you can certainly fill out forms without being concerned about database incidents or data entries being shared. Our secure software helps to ensure that your personal data is kept safely.