The PDF editor makes it simple to create the idaho business registration firm form. You should be able to obtain the form as soon as possible through using these basic steps.

Step 1: Hit the "Get Form Now" button to begin the process.

Step 2: You are now capable of alter idaho business registration firm. You possess a lot of options with our multifunctional toolbar - you can add, eliminate, or change the content material, highlight its particular components, as well as conduct similar commands.

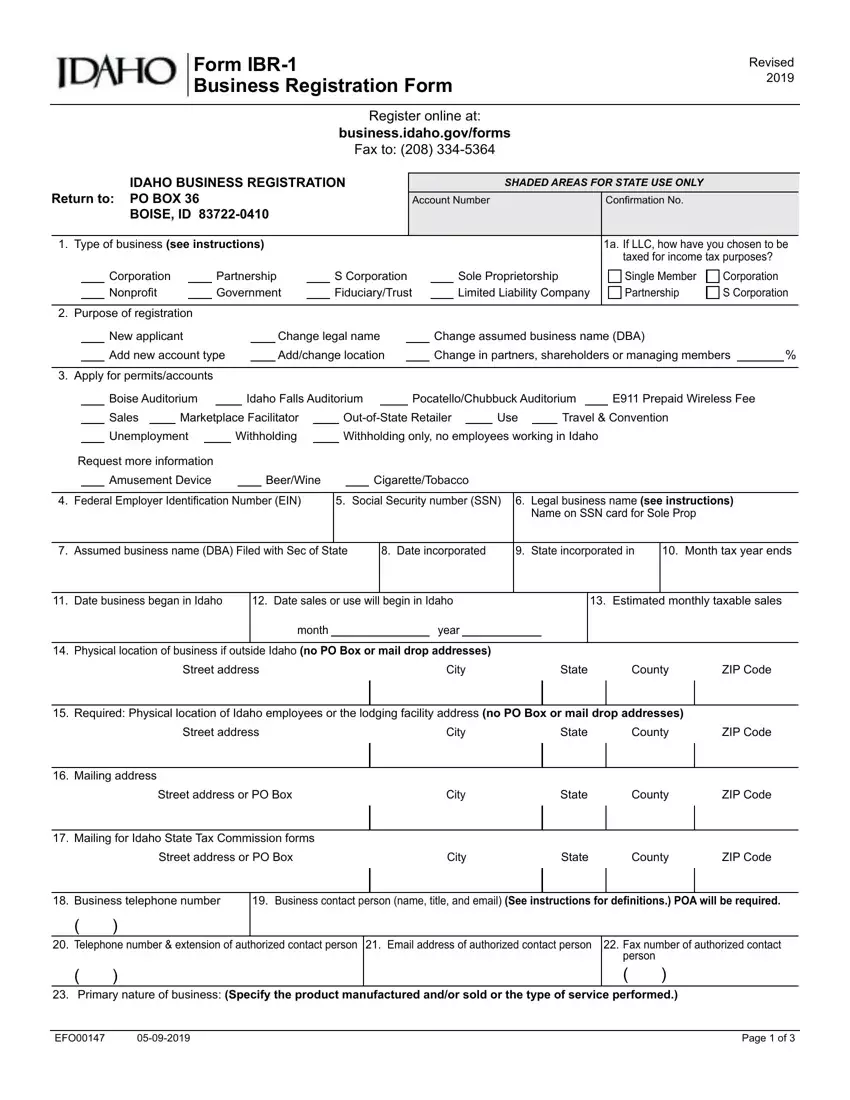

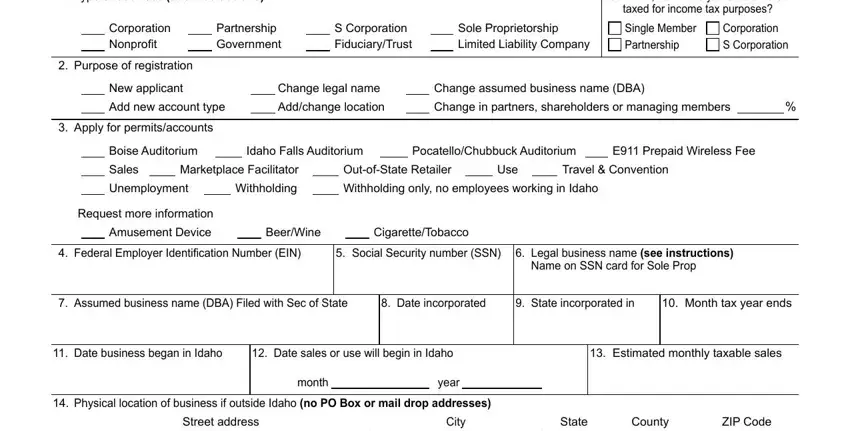

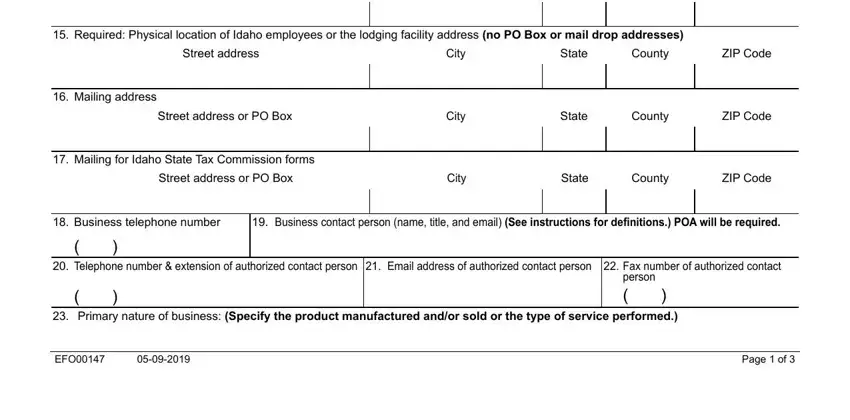

Prepare the idaho business registration firm PDF and type in the details for every single section:

Include the required information in the Required Physical location of, Street address, Mailing address, Street address or PO Box, Mailing for Idaho State Tax, Street address or PO Box, City, City, City, State, County, ZIP Code, State, County, and ZIP Code segment.

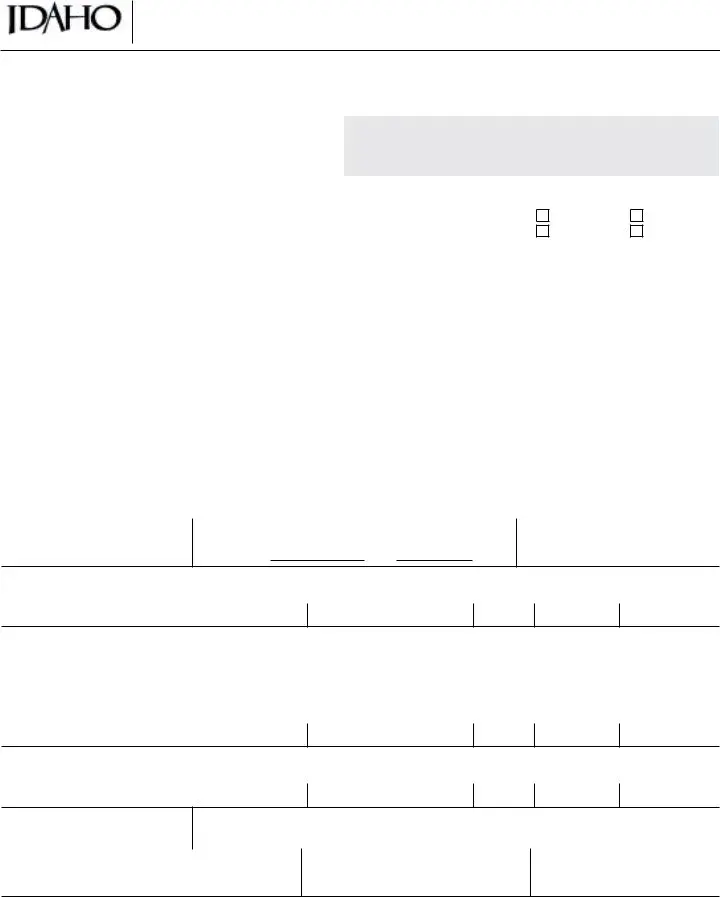

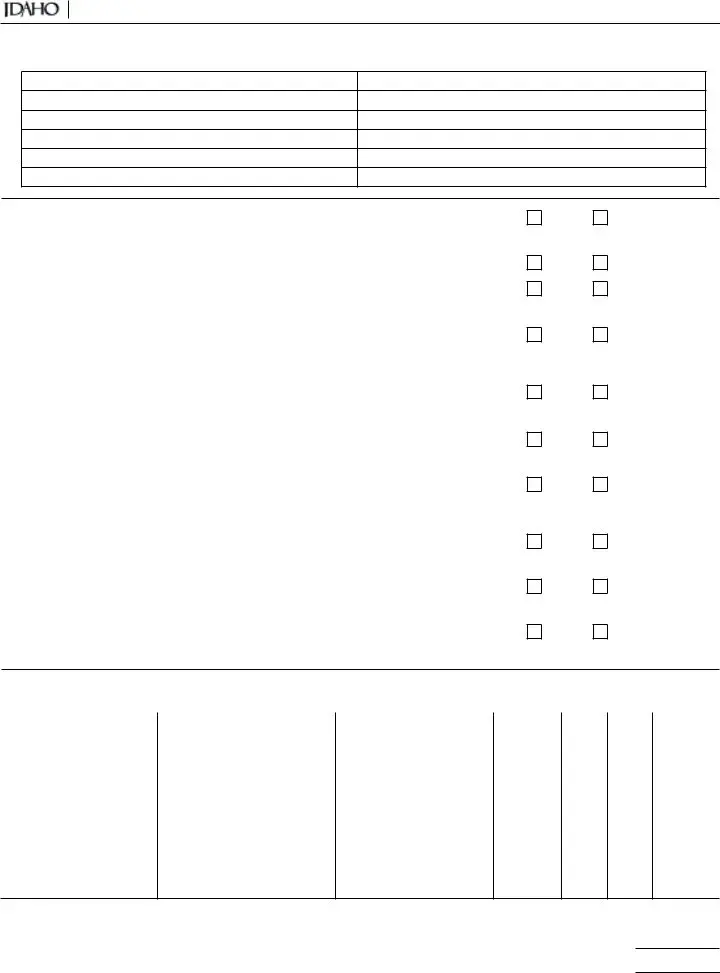

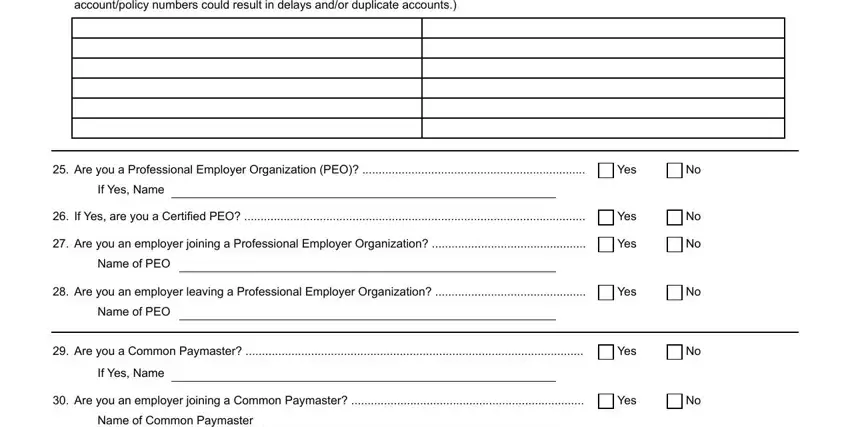

You can be asked to type in the information to let the application prepare the area Have you ever had a withholding, Are you a Professional Employer, Yes, If Yes Name, If Yes are you a Certified PEO, Are you an employer joining a, Yes, Yes, Name of PEO, Are you an employer leaving a, Yes, Name of PEO, Are you a Common Paymaster, Yes, and If Yes Name.

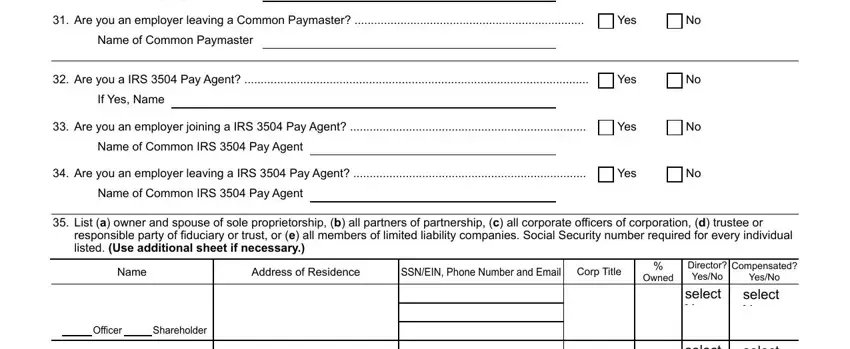

The space Name of Common Paymaster, Are you an employer leaving a, Yes, Name of Common Paymaster, Are you a IRS Pay Agent, Yes, If Yes Name, Are you an employer joining a IRS, Yes, Name of Common IRS Pay Agent, Are you an employer leaving a IRS, Yes, Name of Common IRS Pay Agent, List a owner and spouse of sole, and responsible party of fiduciary or is where one can put all sides' rights and obligations.

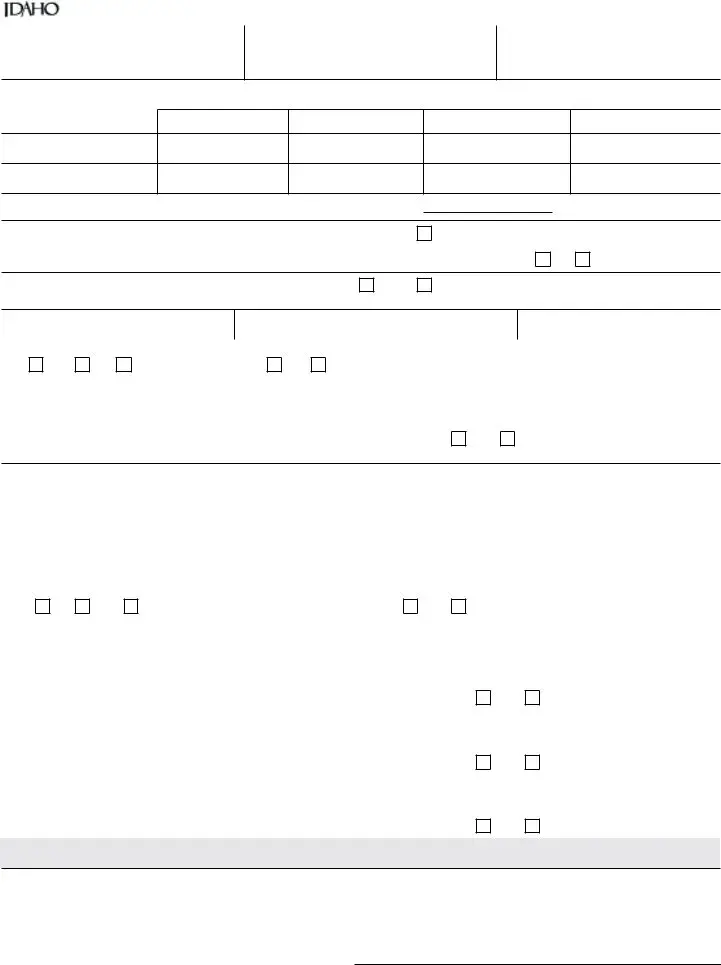

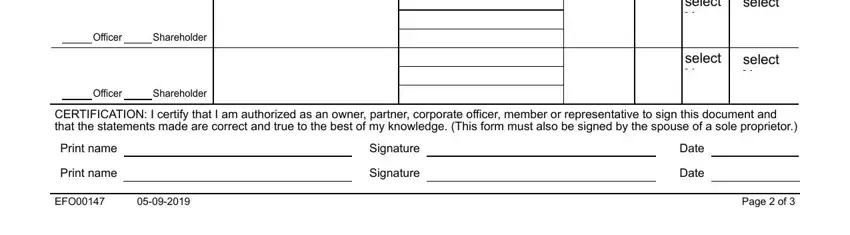

Finish by reviewing the following sections and filling them out accordingly: Officer, Shareholder, Officer, Shareholder, CERTIFICATION I certify that I am, Print name, Print name, EFO, Signature, Signature, Date, Date, and Page of.

Step 3: Select the Done button to make sure that your finished file can be exported to every device you want or mailed to an email you indicate.

Step 4: Be sure to make as many copies of the file as possible to remain away from possible problems.