Our finest web developers worked hard to design the PDF editor we are delighted to present to you. The app will allow you to shortly create Ifta 101Mn Form and saves your time. Simply follow this specific procedure.

Step 1: Select the button "Get form here" to access it.

Step 2: Once you've accessed the editing page Ifta 101Mn Form, you'll be able to see each of the functions readily available for your document inside the top menu.

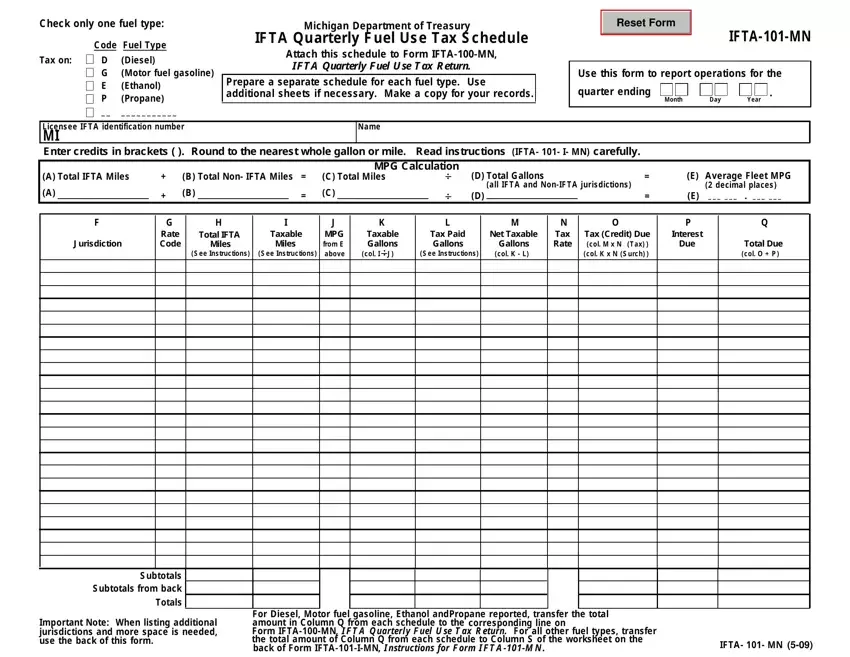

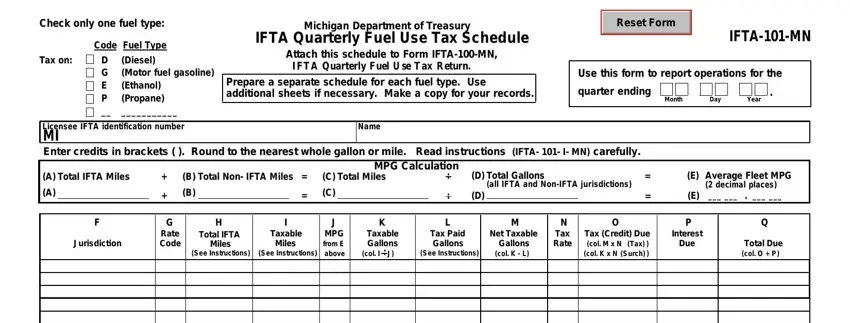

You will need to enter the next details so you can complete the document:

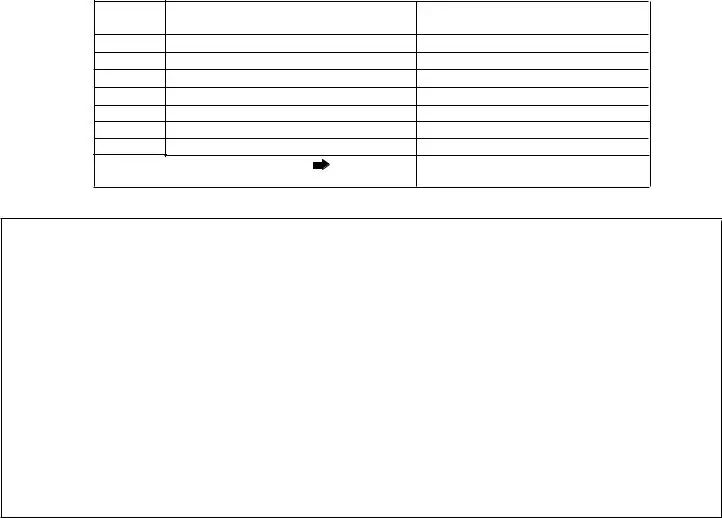

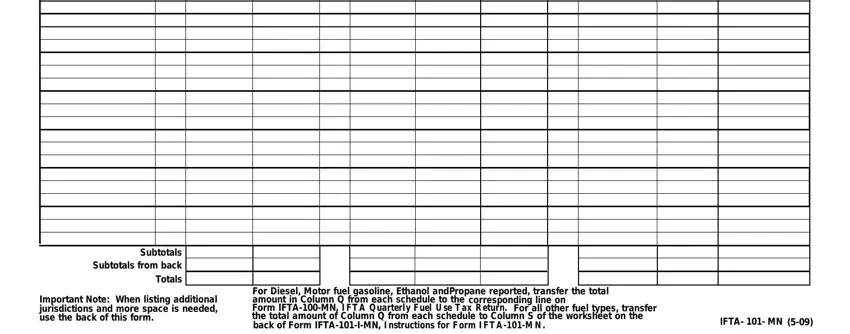

Provide the demanded data in the field Subtotals Subtotals from back, Important Note When listing, For Diesel Motor fuel gasoline, corresponding line on, and IFTAMN.

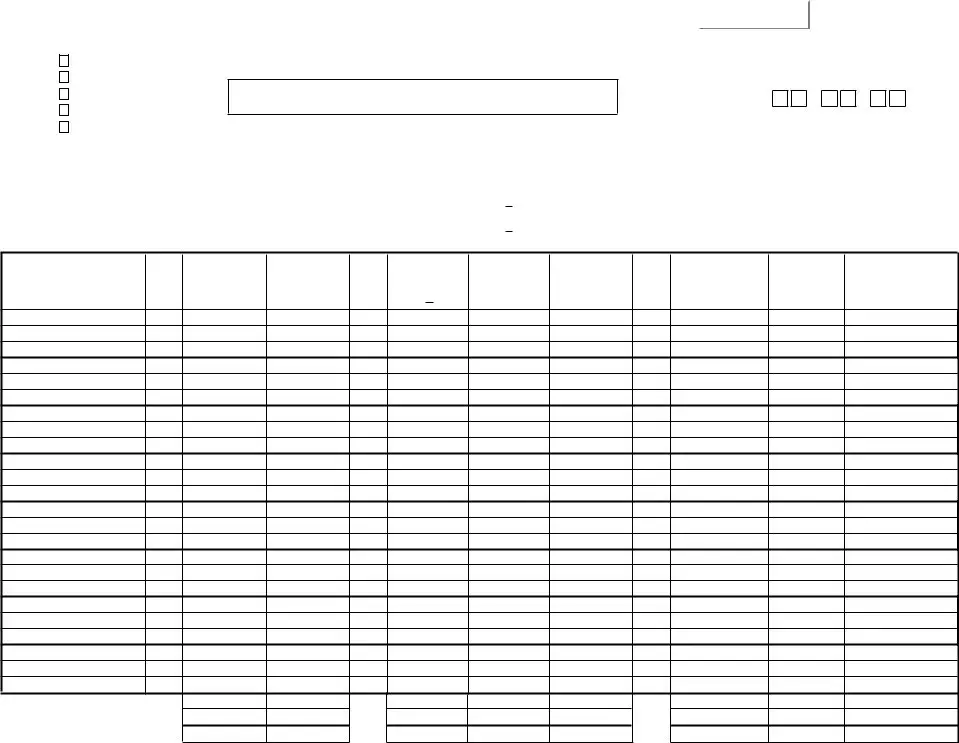

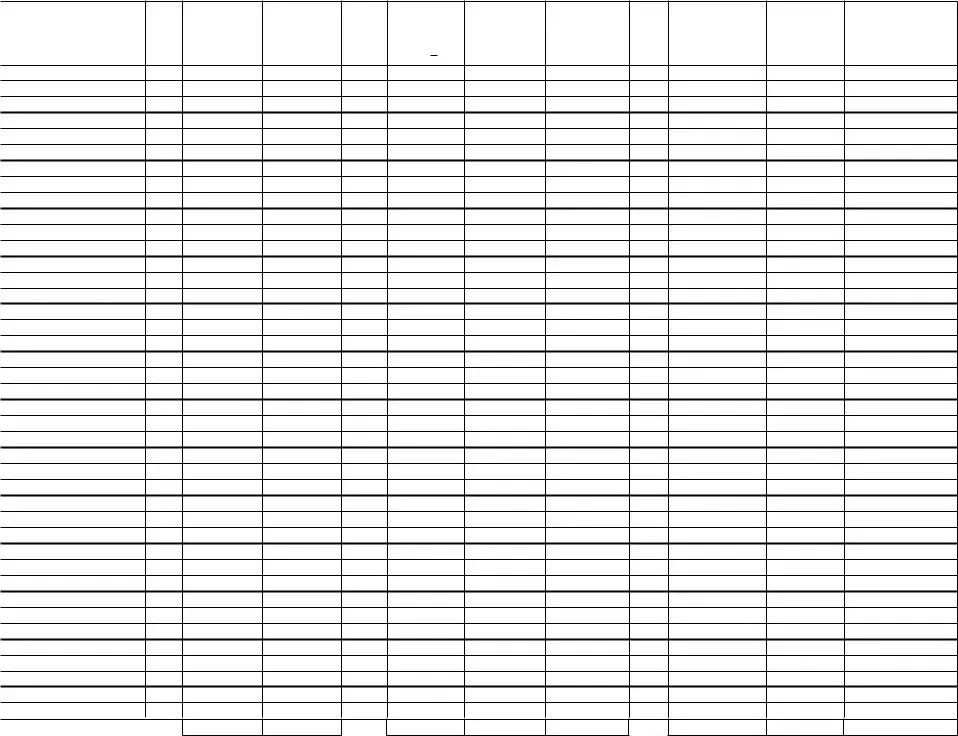

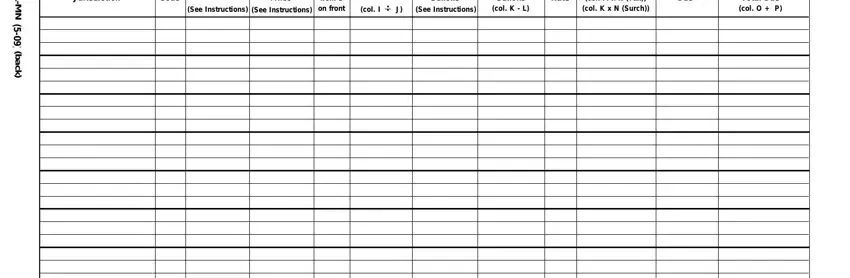

The software will ask you for data to easily fill out the section Jurisdiction, Rate Code, Total IFTA Miles, See Instructions, Taxable Miles See Instructions, MPG from E on front, K Taxable Gallons, col I J, Tax Paid Gallons See Instructions, Net Taxable Gallons col K L, Tax Rate, Tax Credit Due col M x N Tax col K, Interest Due, Total Due col O P, and I F T A M N.

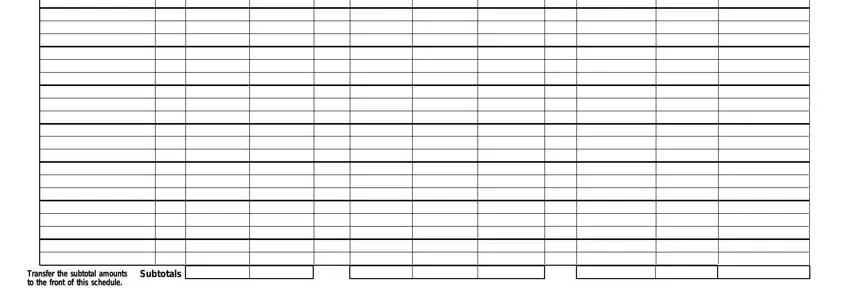

The Transfer the subtotal amounts to, and Subtotals segment has to be used to list the rights or obligations of each party.

Fill in the document by checking these fields: Jurisdictions with surcharge, Indiana Kentucky and Virginia, IFTAIMN, and Make a copy of this return for.

Step 3: When you click on the Done button, the ready document is readily transferable to any type of of your devices. Or, you might send it through email.

Step 4: Prepare minimally several copies of your document to keep clear of different upcoming troubles.