Maintaining a vehicle can be costly, but there are ways to reduce those costs. One way is to create and use a mileage log printable form. A mileage log can help you keep track of your car's gas mileage and maintenance expenses. It can also help you prove your mileage for tax purposes. You can find many different mileage logs online, or you can create your own using a word processing program or spreadsheet software. No matter which route you choose, having a Mileage Log Printable Form on hand will save you time and money in the long run.

In the list, there is some information regarding the mileage log printable. Before you fill in the form, it is usually worth checking out more about it.

| Question | Answer |

|---|---|

| Form Name | Mileage Log Printable |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | mileage reimbursement form, mileage log template, mileage tracker, mileage tracker form |

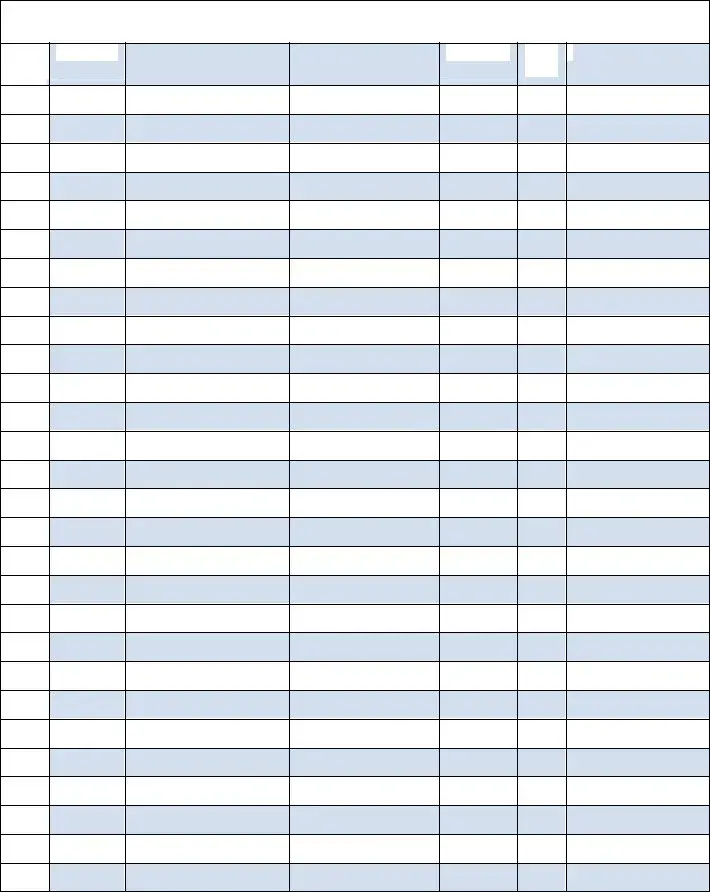

Mileage Log Vehicle____________________________________________________

Date

Odometer |

Start |

From

To

Odometer |

End |

TOTAL  Parking, etc.

Parking, etc.

MILES

Free printable mileage log courtesy of