Are you an owner of a business in the transportation industry within Texas and looking to understand what Ifta Texas Form is? If so, then this article is for you. This blog post will discuss all about Ifta Texas Form and how it’s used in the state of Texas as well provide other important information such as needed paperwork, fees, rules,and regulations. We want to make sure that our readers are well informed with regards to their travel needs when operating a vehicle or fleet in the Lone Star State. Read on below to learn more!

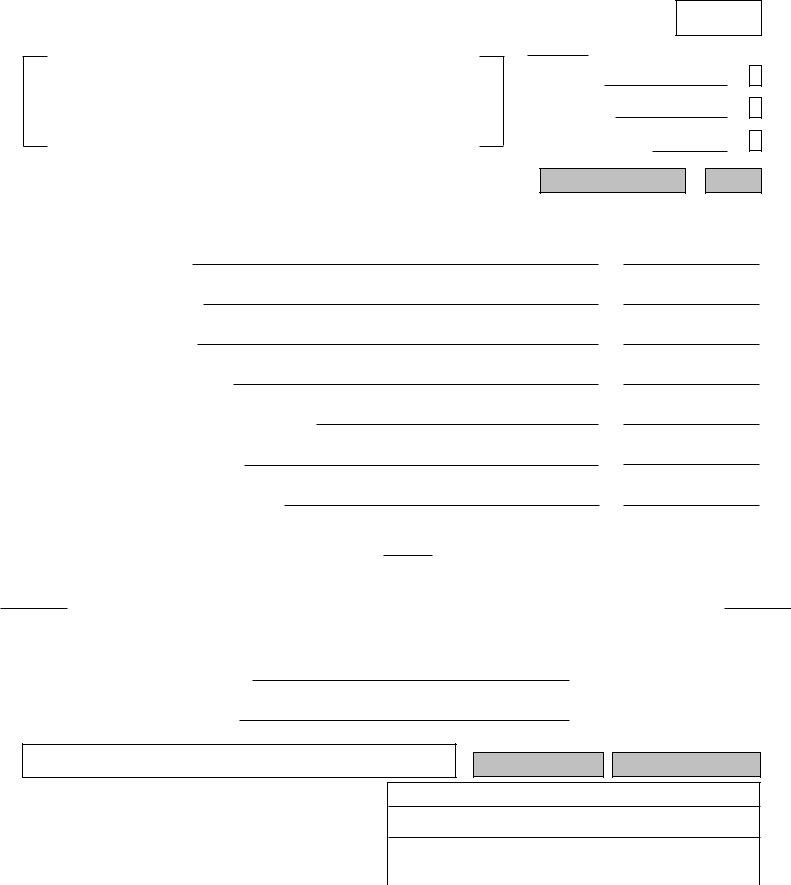

| Question | Answer |

|---|---|

| Form Name | Ifta Texas Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | form 56 101, tx comptroller ifta report, texas comptroller 56 101, texas international tax fuel tax |

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

||

a. T Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c. T xas taxpayer n mber |

|

d. IFTA number |

|

e. iling period |

f. |

||

|

|

|

|

|

|

|

|

. Name and mailing add ess (Make ny neces ary name or address changes below.) |

i. |

|

g. Due date

No Operation - Blacken this box if you did not o erate a qualified motor vehicle(s) d ring the quarter.

Cancel License - Blacken this box if you are fi ing a final report and requesting your license be cancelled.

Address Change - Blacken this box if your mailing address has changed. Show changes next to preprinted information.

j.

k.

$

1. |

Dies l otal due, if applicable |

1. |

|||

2. |

Gasoline |

due, if applicable |

2. |

||

3. |

Ethanol total due, if applicable |

3. |

|||

4. |

Propane (LPG) t tal due, if app icable |

4. |

|||

5. |

Compressed Natural Gas (CNG) total due, if applicable |

5. |

|||

6. |

Other fuel |

ype s) total due, if pplicable |

6. |

||

7. |

Subtotal of amount due |

7. |

|||

7a. |

Amount subject to pe alty, if rep rt is filed late |

|

|

|

|

|

|

|

7a. |

|

|

Form

8. Penalty, if due |

8. |

|

|

$ |

|

9. TOTAL AMOUNT DUE AND PAYABLE |

9. |

|

|

|

|

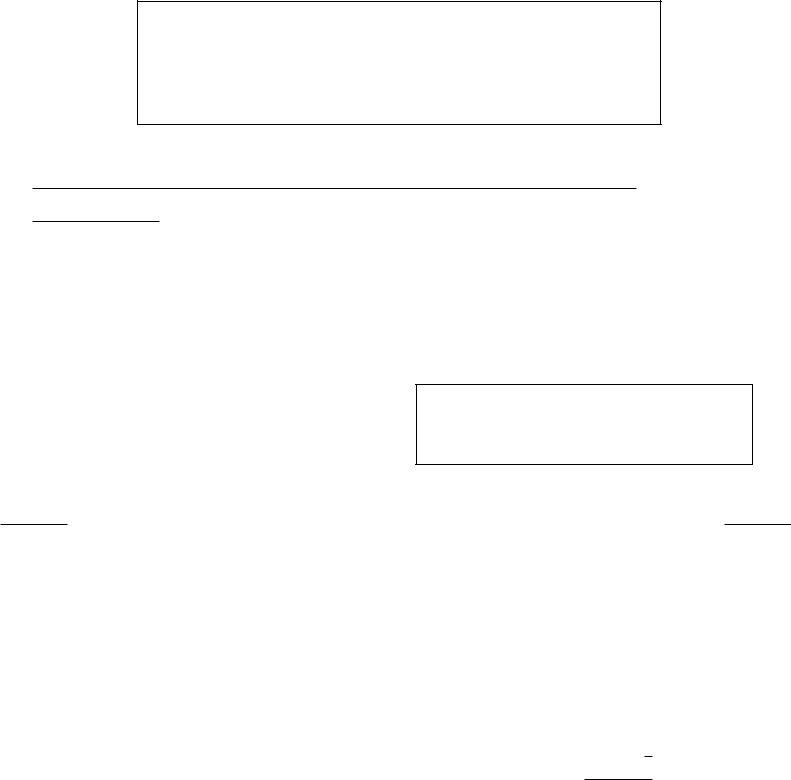

Taxpayer name

l.

m.

T Code |

Taxpayer number |

Period |

|

|

|

|

|

Make the amount in Item 9 |

|

Mail to: Comptroller of Public Accounts |

|

payable to: |

|

P.O. Box 149357 |

|

State Comptroller |

|

Austin, TX |

|

|

|

|

|

For information about International Fuel Tax Agreement, call

I declare the information in this document and all attachments is true and correct to the best of my knowledge and belief.

Authorized agent

Preparer's name (Please print)

Daytime phone |

Date |

(Area code & number) |

|

|

|

Form

under Chapt rs 552 and 559, Government Code,

to review, request and correct information we have on file about you. Contact us at the addr ss or phone numbers listed on this form.

Electronic Tax Filing

You can file yo |

terna ion |

Tax Ag |

t (IFTA) r port using our online webfile syst m. |

your IFTA |

port is fast, easy and |

co veni nt w h we file. Please visit |

|

www.comptroll |

.tex s.gov/t |

||

If you have any webfile questions, pl ase call Elect onic Repor ing at

G neral Information

Who Must File - Each licensee h lding a icense under the International Fuel Tax Agre |

ment (IFTA) is quired to file, on a quarterly basis, an |

||

Int rnational Fuel Tax Agreem |

(IFTA) Fuel Tax Repo t, Form |

||

Failure to file this return and pay the applicab e tax may result in collection action as prescri |

d by Title 2 of the Tax Code. |

||

Form |

nt of the various fuel types computed on each Form |

||

the to al amount due/overpaym |

t, incl |

ding any appropriate penalty. Interest is calculated on Form |

|

Specific Instructions

Item 1 - Enter the total amount from Item 4 of Form

Item 2 - Enter the total amount from Item 4 of Form

Item 3 - Enter the total amount from Item 4 of Form

Item 4 - Enter the total amount from Item 4 of Form

U.S./Metric Conversion Factors

1 liter = 0.2642 gallons |

1 kilometer = 0.62137 miles |

3.785 liters = 1 gallon |

1.6093 kilometers = 1 mile |

Item 5 - Enter the total amount from Item 4 of Form

Item 6 - Other fuel types are:

Methanol.

Item 7a - Amount subject to penalty - Enter the sum of the total Tax Due from Item 2 of all supplements, Form

Item 8 - Penalty - A penalty of $50.00 or 10 percent of delinquent taxes, whichever is greater, is imposed for the failure to file a report, for filing a late report, or for underpayment of taxes due. To determine which is greater, use the worksheet below:

(a) Enter amount from Item 7a of this report. |

. |

(b) Multiply (a) by 10% (.10). |

. |

If Item (b) is greater than $50.00, enter (b) as penalty. If (b) is less than $50.00, enter $50.00 as penalty.