You can fill in il 505b effectively with the help of our online PDF editor. FormsPal is dedicated to giving you the best possible experience with our editor by regularly releasing new features and upgrades. With these updates, using our editor becomes better than ever before! To start your journey, take these easy steps:

Step 1: First of all, open the pdf tool by clicking the "Get Form Button" above on this site.

Step 2: This editor enables you to customize your PDF in a variety of ways. Change it by adding any text, adjust what is already in the document, and include a signature - all when you need it!

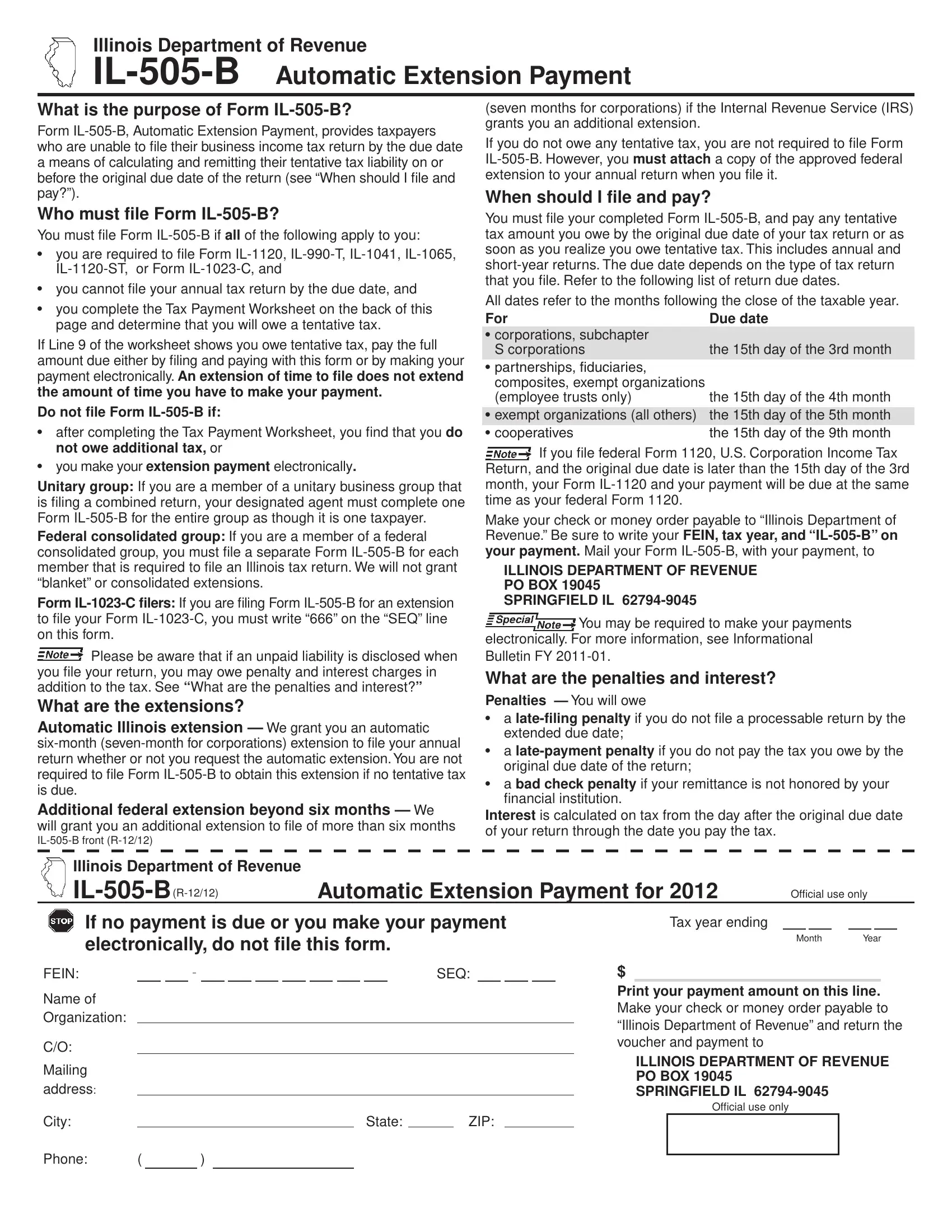

This document will need specific data to be entered, hence be sure you take the time to provide precisely what is expected:

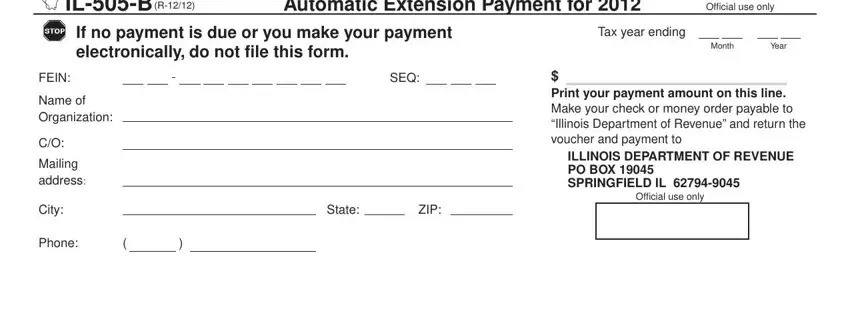

1. The il 505b will require particular details to be typed in. Be sure the next blank fields are finalized:

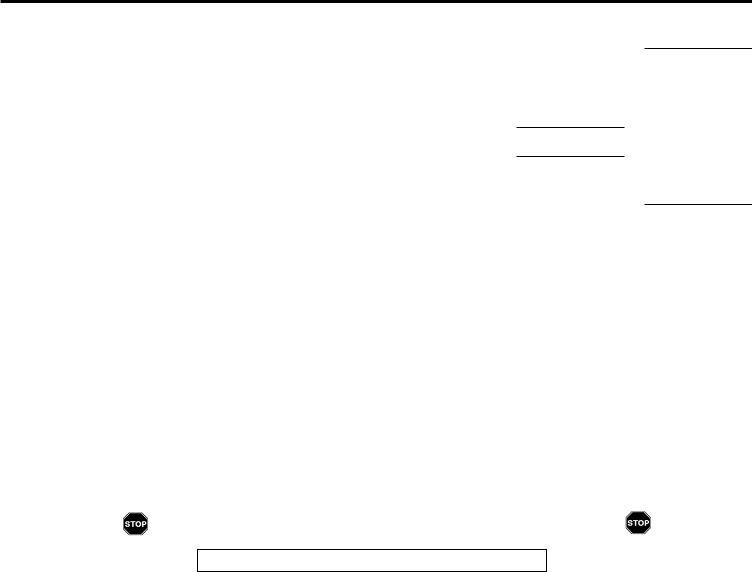

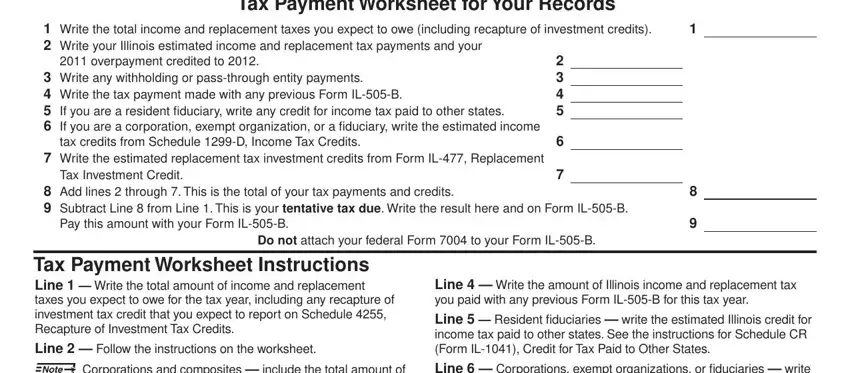

2. The third stage is to fill in the next few fields: Tax Payment Worksheet for Your, overpayment credited to, Write the total income and, tax credits from Schedule D Income, Pay this amount with your Form ILB, Tax Investment Credit, Do not attach your federal Form, Tax Payment Worksheet Instructions, Corporations and composites, and Line Write the amount of.

Be extremely attentive while filling out Pay this amount with your Form ILB and Do not attach your federal Form, since this is where most users make a few mistakes.

Step 3: Prior to finalizing the document, double-check that all blanks were filled in the right way. When you are satisfied with it, click “Done." Create a free trial subscription with us and gain instant access to il 505b - accessible in your FormsPal account page. Here at FormsPal.com, we strive to be sure that all your details are stored protected.