Our qualified developers have worked collectively to build the PDF editor that one could begin using. The following software allows you to submit action for children forms income verification documentation quickly and with ease. This is certainly all you need to conduct.

Step 1: The initial step would be to choose the orange "Get Form Now" button.

Step 2: The document editing page is presently open. You can include information or enhance existing details.

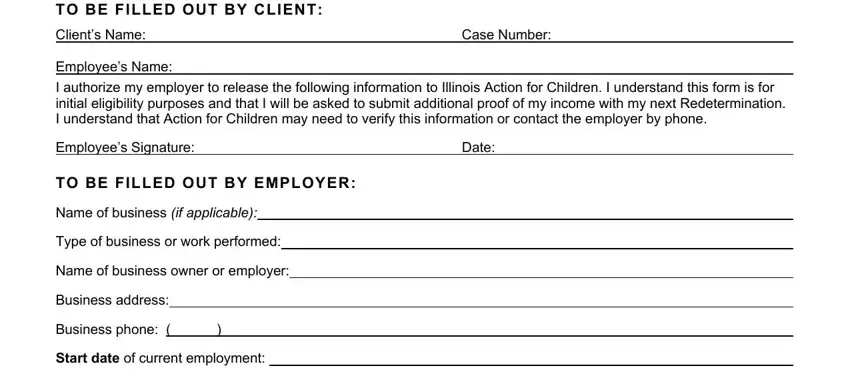

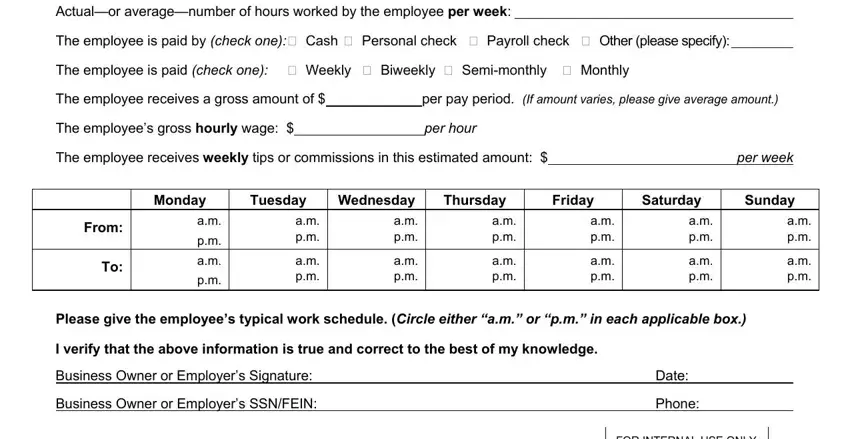

For each segment, fill out the details asked by the program.

Write the information in Actualor averagenumber of hours, The employee is paid by check one, The employee is paid check one cid, The employee receives a gross, per pay period If amount varies, The employees gross hourly wage, per hour, The employee receives weekly tips, per week, Monday, Tuesday, Wednesday, Thursday, Friday, and Saturday.

Step 3: After you've selected the Done button, your file is going to be accessible for export to any device or email you indicate.

Step 4: Create copies of the form - it may help you stay clear of potential concerns. And don't get worried - we are not meant to publish or view your information.