landlord letter for snap can be filled out online without any problem. Simply open FormsPal PDF tool to complete the task without delay. Our team is aimed at giving you the absolute best experience with our tool by constantly presenting new features and enhancements. Our tool is now much more user-friendly with the newest updates! So now, working with PDF files is a lot easier and faster than ever. This is what you'll have to do to begin:

Step 1: First, open the pdf tool by pressing the "Get Form Button" in the top section of this site.

Step 2: The tool will give you the opportunity to work with nearly all PDF documents in a range of ways. Change it by writing your own text, adjust original content, and include a signature - all when you need it!

This document will involve specific information; to ensure correctness, be sure to take note of the subsequent suggestions:

1. First, while completing the landlord letter for snap, begin with the section that has the next fields:

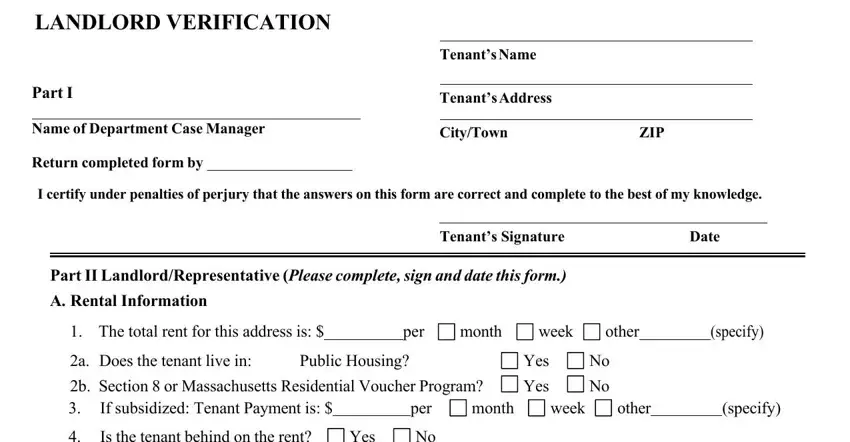

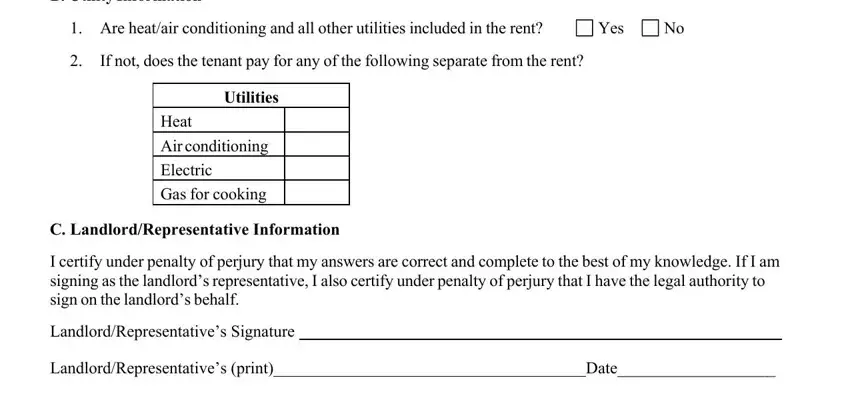

2. Now that this section is done, you have to put in the necessary particulars in B Utility Information, Are heatair conditioning and all, Yes, If not does the tenant pay for any, Utilities, Heat, Air conditioning, Electric, Gas for cooking, C LandlordRepresentative, I certify under penalty of perjury, LandlordRepresentatives Signature, LandlordRepresentatives print, and Date allowing you to proceed to the next stage.

3. The next step is considered quite uncomplicated, LandlordRepresentatives Address, LandlordRepresentatives Daytime, LLVER Rev, See other side for instructions, and Page of - all of these empty fields is required to be filled in here.

It is easy to make a mistake when completing your LLVER Rev, hence make sure that you look again prior to when you send it in.

Step 3: Proofread the information you've typed into the blank fields and click the "Done" button. After setting up a7-day free trial account at FormsPal, you'll be able to download landlord letter for snap or send it through email promptly. The PDF file will also be readily accessible via your personal account page with your each and every edit. Whenever you work with FormsPal, you can certainly fill out forms without the need to get worried about personal information breaches or entries being shared. Our secure platform ensures that your personal data is kept safe.