example of total operating expense on a income statement can be filled in online very easily. Simply use FormsPal PDF editing tool to complete the task without delay. To maintain our tool on the leading edge of efficiency, we aim to put into action user-driven features and improvements on a regular basis. We are always looking for suggestions - help us with remolding PDF editing. Here is what you will need to do to begin:

Step 1: Open the form inside our tool by clicking the "Get Form Button" in the top part of this page.

Step 2: After you access the file editor, you will find the form ready to be filled out. Apart from filling in various blanks, it's also possible to do several other things with the file, particularly writing your own text, editing the initial text, adding images, signing the PDF, and a lot more.

This PDF doc will require some specific information; in order to ensure consistency, take the time to adhere to the subsequent guidelines:

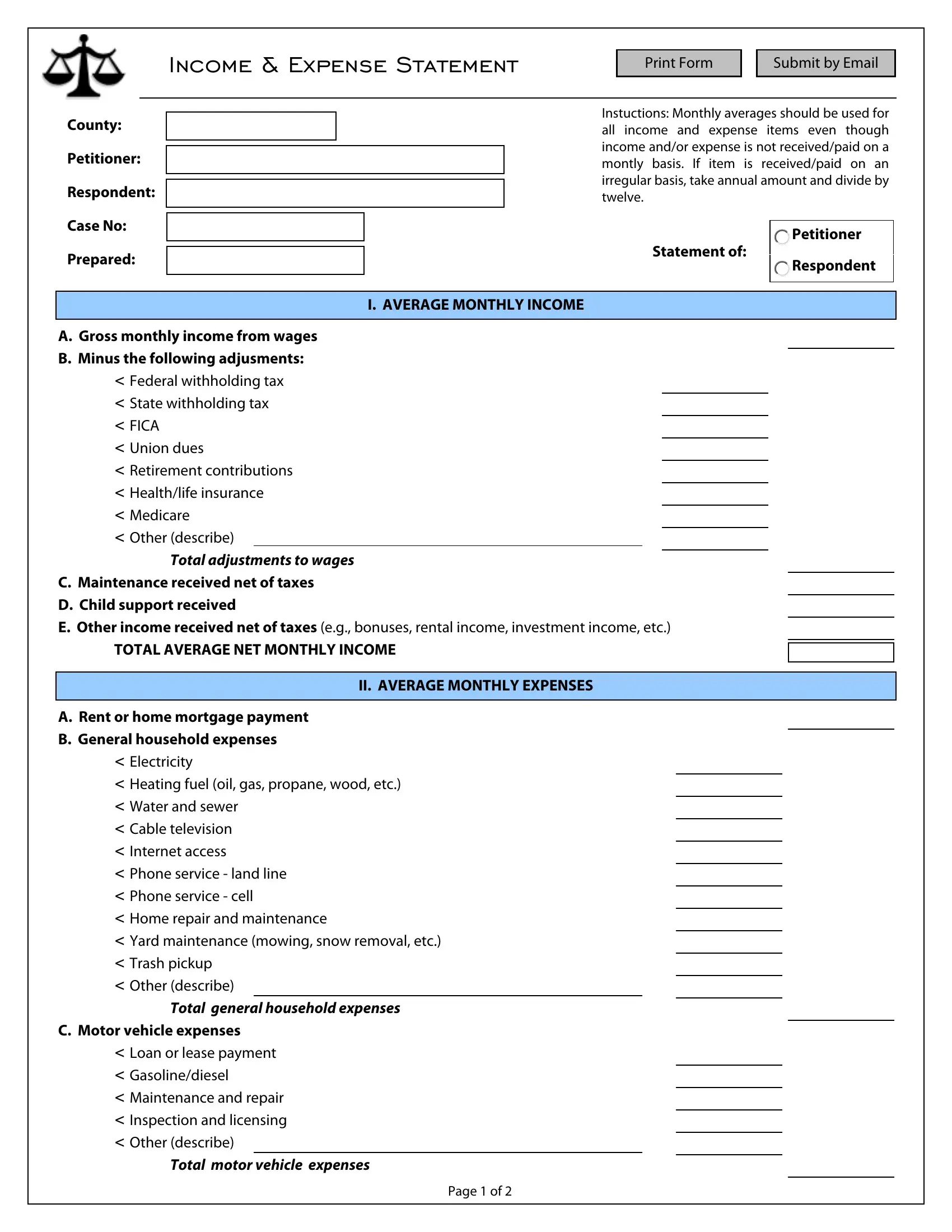

1. Begin filling out your example of total operating expense on a income statement with a number of essential blanks. Consider all of the important information and make certain there's nothing forgotten!

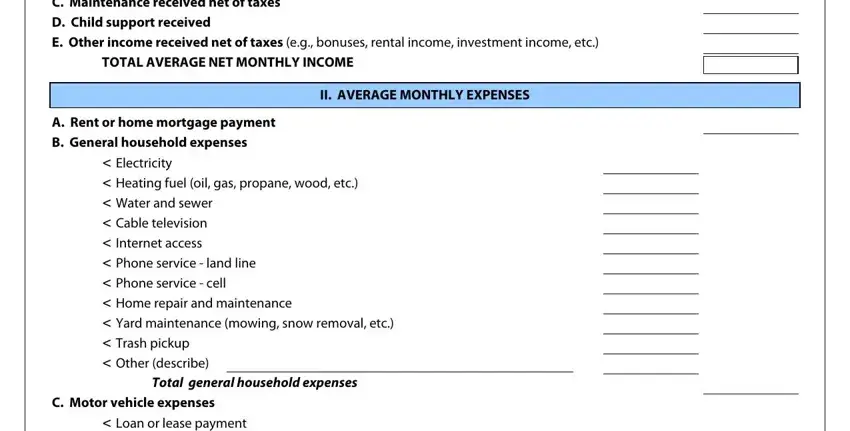

2. The next step would be to complete these blank fields: C Maintenance received net of taxes, D Child support received, E Other income received net of, TOTAL AVERAGE NET MONTHLY INCOME, II AVERAGE MONTHLY EXPENSES, A Rent or home mortgage payment, B General household expenses, Electricity Heating fuel oil gas, Total general household expenses, C Motor vehicle expenses, and Loan or lease payment.

Concerning A Rent or home mortgage payment and Loan or lease payment, make sure you get them right in this section. The two of these are viewed as the key ones in the form.

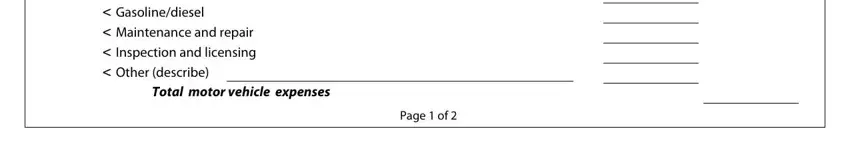

3. The next part is going to be simple - complete every one of the fields in Loan or lease payment, Total motor vehicle expenses, and Page of in order to complete this segment.

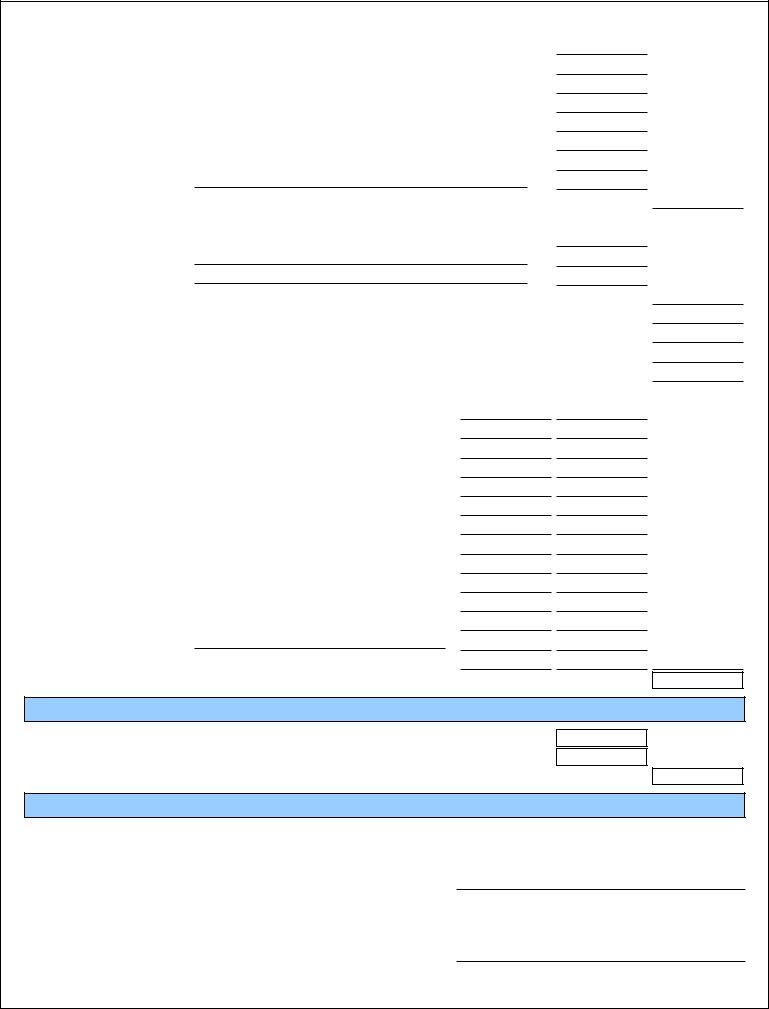

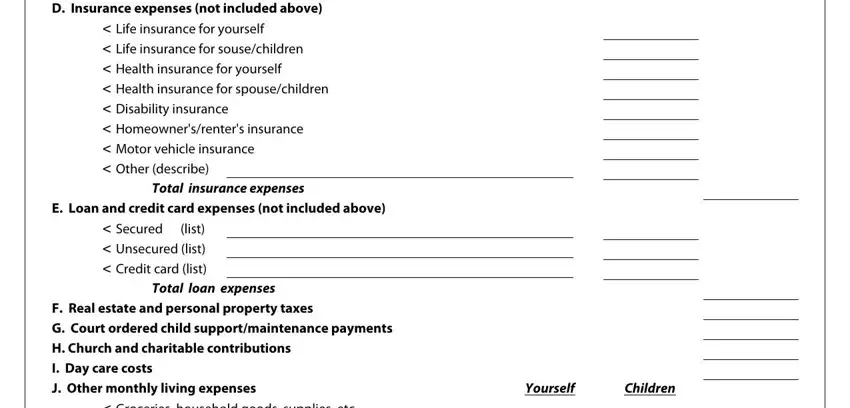

4. This part arrives with all of the following form blanks to complete: D Insurance expenses not included, Life insurance for yourself Life, Total insurance expenses, E Loan and credit card expenses, Secured list Unsecured list, Total loan expenses, F Real estate and personal, G Court ordered child, H Church and charitable, I Day care costs, J Other monthly living expenses, Groceries household goods, Yourself, and Children.

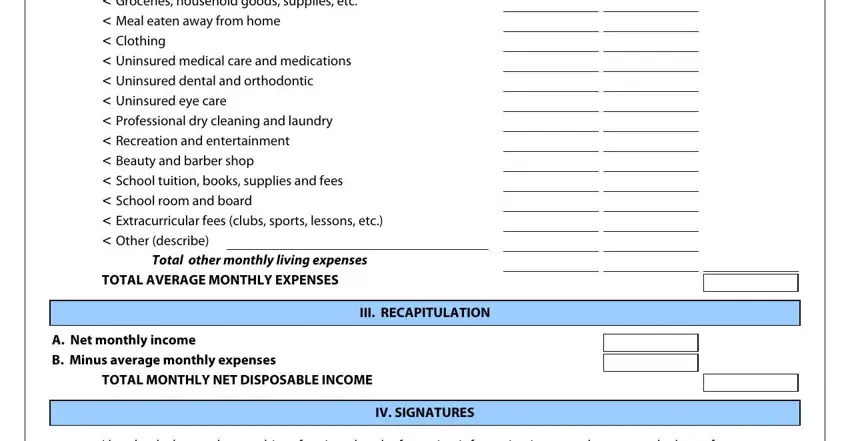

5. The pdf has to be wrapped up by going through this section. Here one can find a comprehensive list of blank fields that need accurate information in order for your document usage to be accomplished: Groceries household goods, Total other monthly living expenses, TOTAL AVERAGE MONTHLY EXPENSES, A Net monthly income, B Minus average monthly expenses, TOTAL MONTHLY NET DISPOSABLE INCOME, III RECAPITULATION, IV SIGNATURES, and I hereby declare under penalties.

Step 3: As soon as you've reread the information in the file's blank fields, click on "Done" to complete your form at FormsPal. Go for a 7-day free trial subscription at FormsPal and acquire instant access to example of total operating expense on a income statement - downloadable, emailable, and editable from your personal account. FormsPal guarantees your data confidentiality by having a protected system that never records or distributes any kind of private information involved in the process. You can relax knowing your files are kept confidential every time you work with our editor!