We were developing the PDF editor with the notion of making it as simple to apply as it can be. That's the reason the process of creating the indian bank account opening will likely to be simple carry out all of these actions:

Step 1: The initial step is to hit the orange "Get Form Now" button.

Step 2: Once you get into our indian bank account opening editing page, there'll be all the functions you can undertake regarding your document in the top menu.

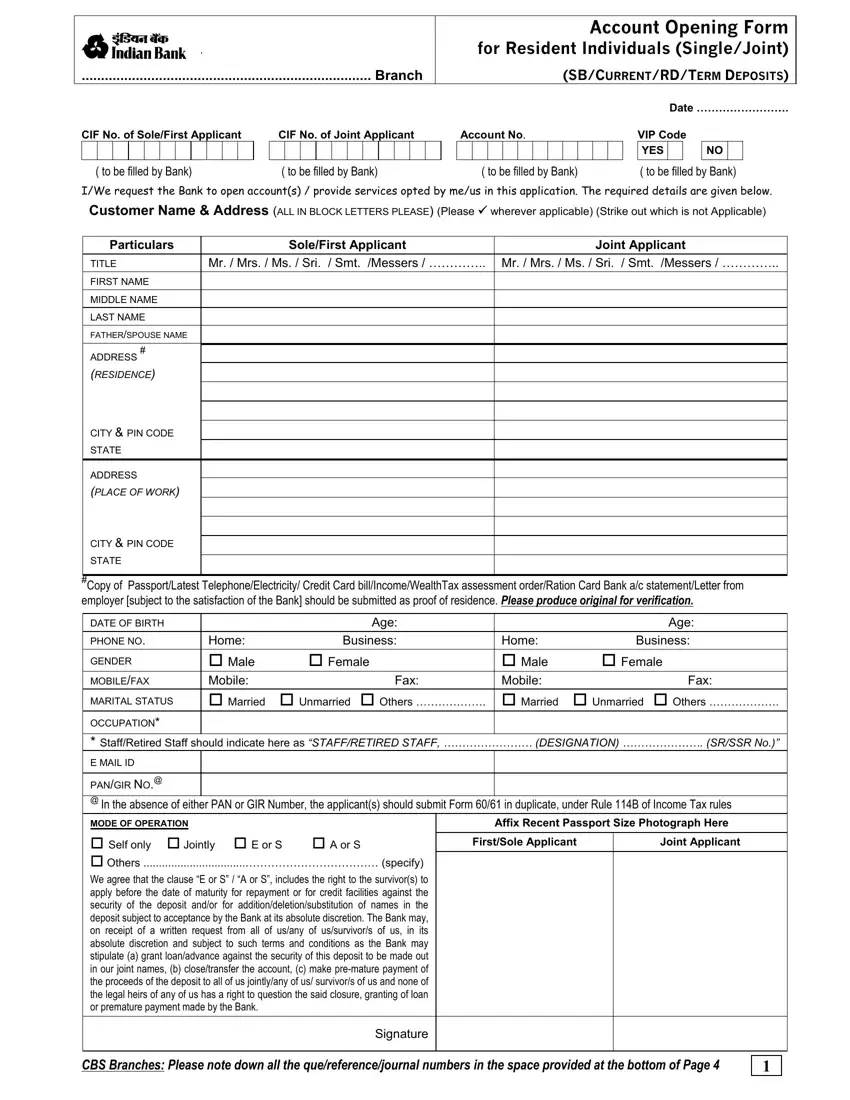

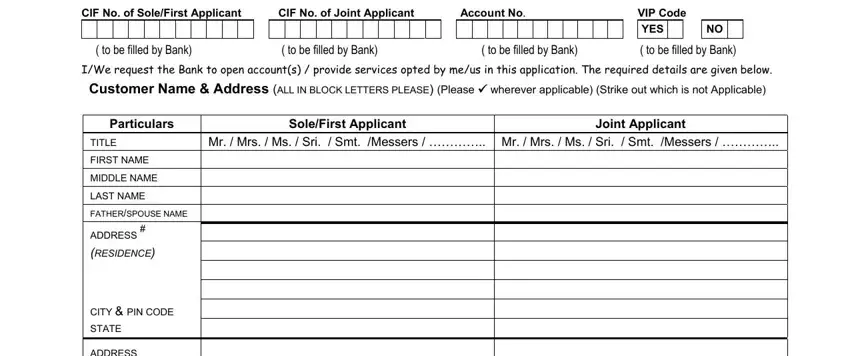

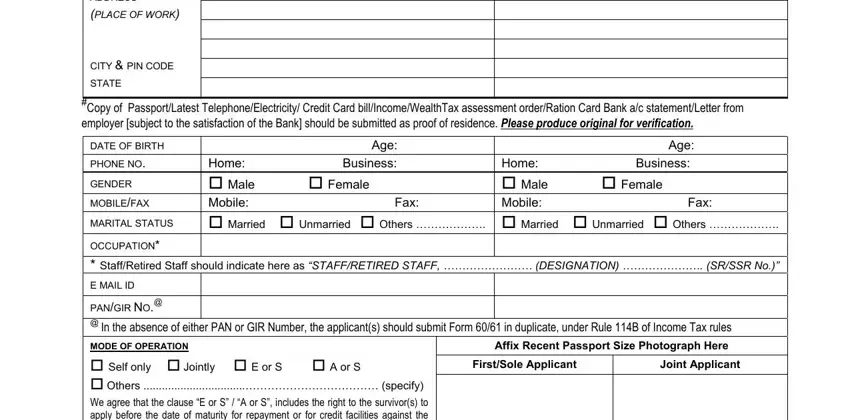

These particular areas are what you are going to create to obtain the ready PDF form.

You need to fill up the ADDRESS PLACE OF WORK, CITY PIN CODE, STATE, Copy of PassportLatest, DATE OF BIRTH PHONE NO, GENDER, MOBILEFAX, MARITAL STATUS, Age Home Business cid Male Mobile, Age Home Business cid Male Mobile, cid Female, cid Female, OCCUPATION StaffRetired Staff, E MAIL ID, and PANGIR NO In the absence of area with the necessary details.

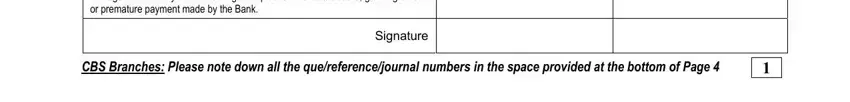

The system will request for additional information in order to quickly complete the box MODE OF OPERATION cid Self only, CBS Branches Please note down all, and Signature.

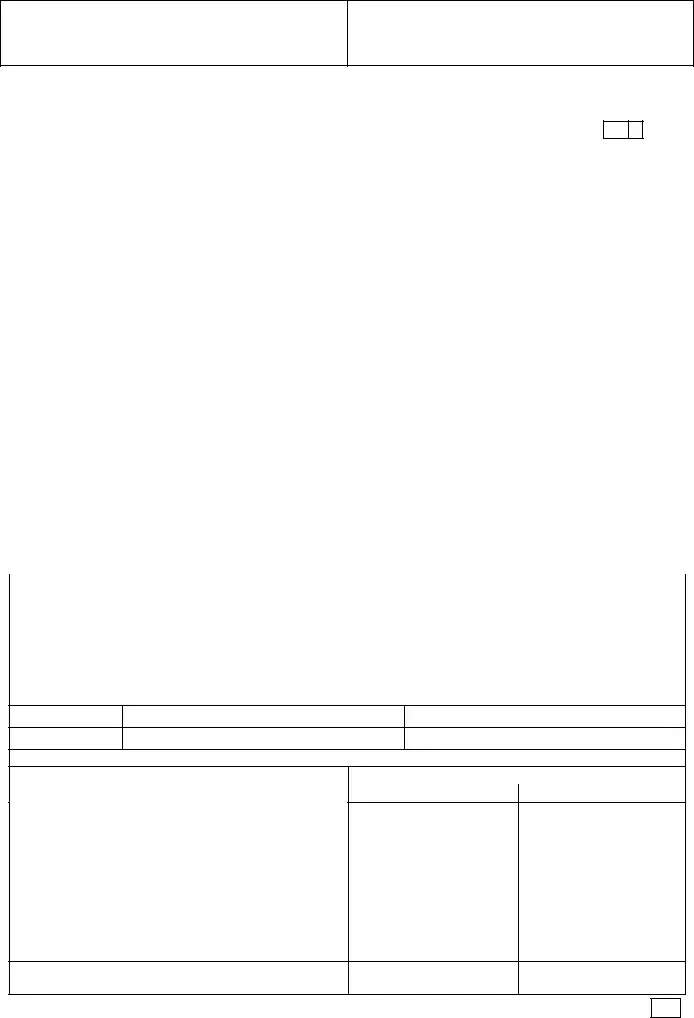

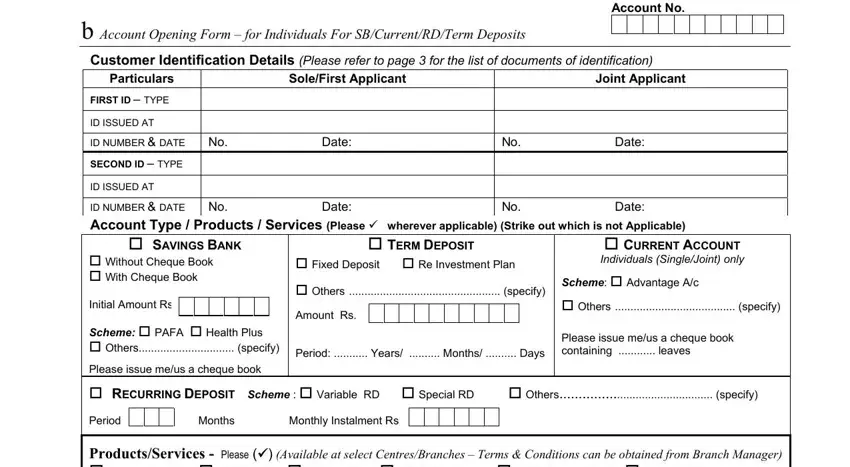

The b Account Opening Form for, Account No, Customer Identification Details, Particulars, FIRST ID TYPE, ID ISSUED AT, SoleFirst Applicant, Joint Applicant, ID NUMBER DATE, No Date, No Date, SECOND ID TYPE, ID ISSUED AT, ID NUMBER DATE Account Type, and No Date section is the place to place the rights and responsibilities of both parties.

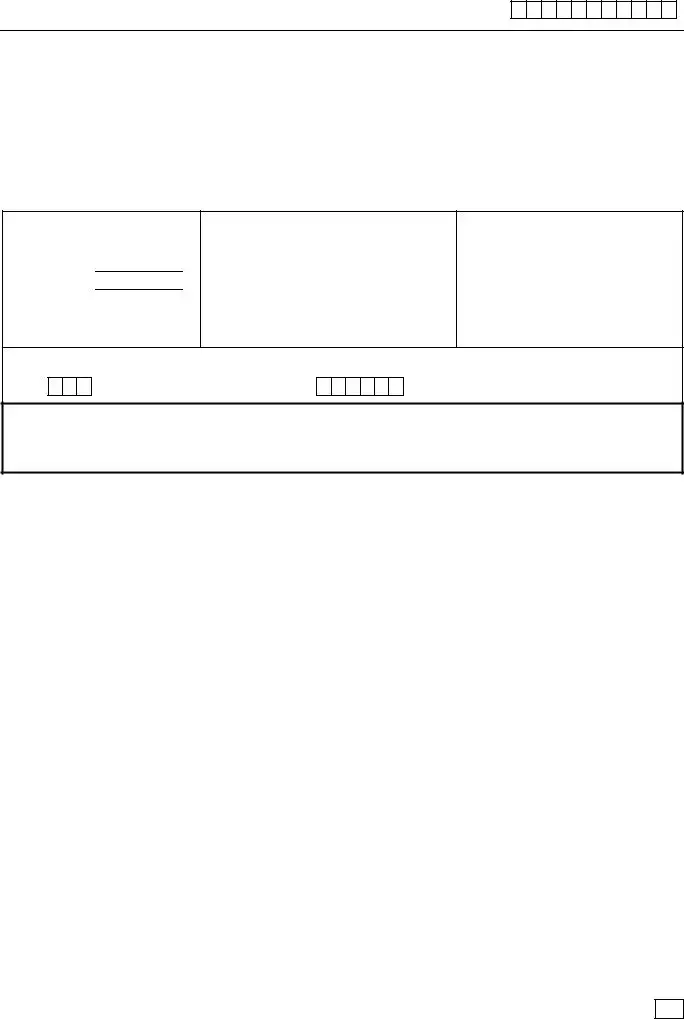

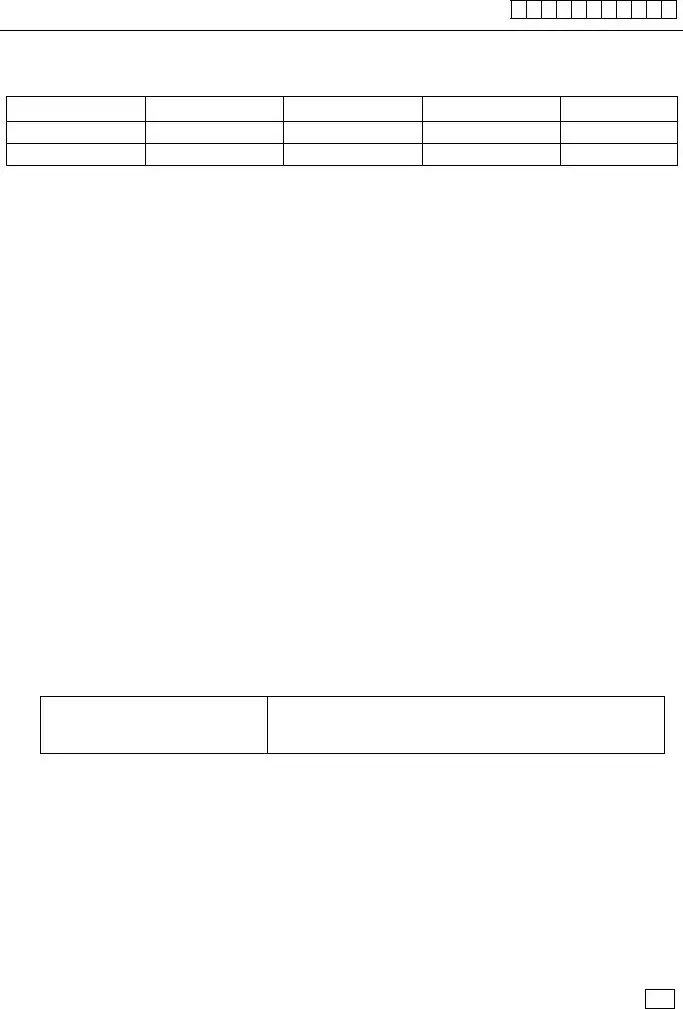

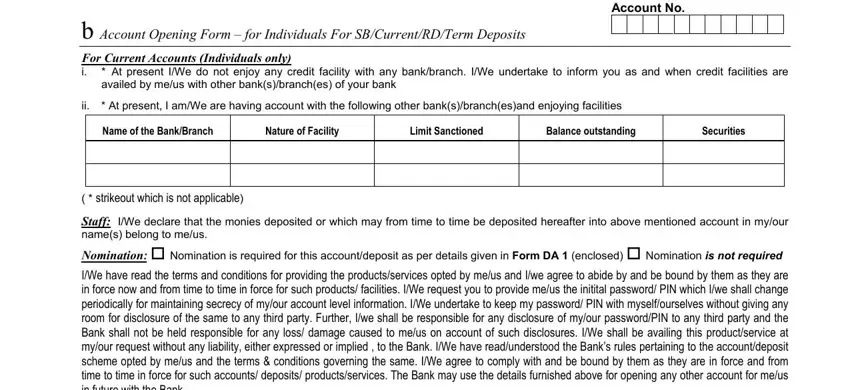

Finish by looking at the following areas and writing the appropriate details: b Account Opening Form for, Account No, For Current Accounts Individuals, At present IWe do not enjoy any, ii At present I amWe are having, Name of the BankBranch, Nature of Facility, Limit Sanctioned, Balance outstanding, Securities, strikeout which is not applicable, and Staff IWe declare that the monies.

Step 3: As soon as you are done, choose the "Done" button to upload the PDF form.

Step 4: Make sure to stay clear of possible future worries by producing a minimum of a couple of copies of the file.