I (“Custom er”) confirm and agree that the follow ing term s and conditions shall govern m y/ our electronic banking transactions w ith the Bank.

"Service" m eans the Electronic Banking Services of United Bank for Africa Plc (”the Bank”), including ATM Transactions, Internet Banking,Telephone. Banking, Secure m essage facilit y and bills paym ent services "User nam e and Passw ord" m eans the enabling code w ith w hich you access the system and w hich is know n to you only.

“Account" m eans a current or savings account or other account m aintained w ith the Bank at any of the Bank's branches in Nigeria and other Country(s)

“PIN" m eans your personal identification num ber.

"Mailing Address" m eans the custom er's m ailing address in the Bank's records as updated from tim e to tim e. "Instruction" m eans the custom er's request to the Bank for the services.

"ATM" m eans Autom ated Teller Machine that dispenses cash to or receives cash/ cheque from account holders w ith the use of a debit card or credit card.

"ATM Card" m eans the card used by a custom er for processing transactions through Autom ated Teller Machine.

"Secure Message Facilit y" m eans the facilit y w ithin the e-Banking Service that enables the Client to send electronic m essages (e-m ail, SMS) to the Bank, including w ithout lim itation free-form at m essages, fixed form at m essages, or instructions to m ake paym ents, requests for cheque books, Banker's drafts or the purchase or sale of securities and interest in m utual fund.

1. The service allow s the custom ers to give the Bank instructions by use of:

(a)ATM, PIN, Passw ord, User nam e and secure m essage (em ail, SMS) for the follow ing:

(i)obtain inform ation regarding custom er's balance as at the last date of business w ith the bank.

(ii)Obtain inform ation w ith regards to any instrum ent in clearing or any credit standing in the custom ers account as at the last date of transaction on the custom er's account .

(iii)Authorize the Bank to debit the custom er's account to pay a specified utilit y bill such as NITEL, NEPA, WATERRATEand/ or any other bills as specified by the

custom er subject how ever to availability of such bill paym ent under this service.

(iv)Authorizing the Bank to effect a transfer of funds from the custom er's account to any other account w ith the Bank.

(v)Authorizing the bank to effect any stop paym ent order.

(vi)Authorizing the bank to debit custom ers account and load sam e into any form of prepaid card.

2.On receipt of Instructions, the Bank w ill endeavor to carry out the Instructions prom ptly, except in situations of unforeseen circum stances such as Act of God, Force Majeure, system failure and other causes beyond the Bank's control.

3.For the service to be available to any custom er, he/ she m ust have a com bination of the follow ing:

(i)An account w ith the Bank (ii) a usernam e and passw ord

(iii)a Personal Identification Num ber "PIN"

(iv)an E-m ail address;

4.Under no circum stances shall the custom er allow any body access to his/ her account through the service.

5.The Passw ord/ e-m ail

(a)The Custom er understands that his/ her Passw ord/ e-m ail is to be used to give instructions to the Bank and accordingly undertakes:

(i)That under no circum stance shall the Passw ord be disclosed to or assessed by any body.

(ii)Not to w rite the Passw ord to avoid third part y com ing across sam e.

(b)The custom er instructs and authorizes the Bank to com ply w ith any instructions given to the ban through the use of the service.

(c,) Once the bank is instructed by m eans of the custom er's PIN the bank is entitled to assum e that those are the instructions given by the custom er and to rely on sam e.

(d)The custom er's Passw ord, Access codes m ust be changed im m ediately it becom es know n to som eone else.

(e)The Bank is exem pted from any form of liabilit y w hatsoever for com plying w ith any or all instruction(s) given by m eans of the custom er's Passw ord/ PIN if by any m eans the Passw ord/ PIN, becom es know n to a third part y or otherw ise becom es com prom ised.

(f ) Where a custom er notifies the Bank through e-m ail of his/ her intention to change his Passw ord/ PIN arising from loss of m em ory of sam e, or that it has com e to the notice of a third part y, the Bank shall, w ith the consent of the custom er, delete sam e and thereafter allow the custom er to enter a new Passw ord/ PIN provided that the bank shall not be responsible for any loss that occurs bet w een the period of such loss of m em ory of the Passw ord/ PIN or know ledge of a third part y and the tim e the report is lodged w ith the Bank. (g) Once a custom er's Passw ord/ PIN is given, it shall be sufficient confirm ation of the authenticit y of the instruction given. (h) The custom er shall be responsible for any instruction given by m eans of the custom er's Passw ord/ PIN. Accordingly, the bank shall not be responsible for any fraudulent, duplicate or erroneous instructions given by m eans of the custom er's Passw ord/ PIN.

6. Where an ATM card is issued to a custom er, the card shall rem ain the propert y of the Bank at all tim es. The Bank m ay, at its sole discretion, cancel the ATM card and request its return at any tim e, in w hich case the cardholder shall im m ediately com ply w ith such request .

DISCLAIM ER

1. User acknow ledges that the alert and other inform ation sent to him or accessed by him contain confidential inform ation and should such inform ation be sent to a third part y through no fault of UBA Plc, UBA shall not be held liable.

2. UBA w ill not be liable for non delivery or delayed delivery of alerts, em ails, errors or losses or distortion in transm ission of alerts and em ails to the USER. UBA shall not be liable for lack of receipt of alerts due to technical defects on custom er's phone or com puter or any dam age or loss incurred by the USERas a result of causes not directly attributable to UBA.

3.UBA shall not be liable to the user, or to any third part y for any draw ing, transfer, rem ittance, disclosure, or any activit y, or incidence on the user's account, w hether authorized by the user or not, PROVIDED that such draw ing, transfer, rem ittance, disclosure, or any activit y, or incidence w as user

7.The ATM card is issued entirely at the risk of the custom er w ho shall indem nify the Bank for all loss or dam age how soever caused resulting from the use of the card. The cardholder shall take every possible care to prevent the card from being lost, m islaid or stolen and the cardholder undertakes not to pass the card to any other person.

8.The ATM card holder shall notify the Bank im m ediately if the ATM card is lost, m islaid or stolen or if it com es

into the hands of a third part y or if the PIN is unw ittingly or otherw ise is disclosed or m ade available to a third part y, in all circum stances. The Bank w ill not be liable for any dam ages or loss resulting from loss of the card. Where oral notice of loss or theft is given, it m ust be confirm ed in w riting to the cardholder's branch of the Bank w ithin 48 hours of the receipt of notice.

9.The Bank shall debit the ATM card holder's account w ith the am ount of any w ithdraw al/ transfer paym ent of telephone, w ater, electricit y bills/ paym ent for goods and services at point of sales (POS) term inals and all such paym ents as effected by the use of the ATM card along w ith the related bank charges.

10.The Bank reserves the right to lim it the total cash sum w ithdraw n by the ATM cardholder and total am ount spent on POS term inals during any 24 hour period . The Bank shall not be responsible for any loss or dam age arising directly or indirectly from any m alfunction or failure of the ATM card or the ATM or the tem porary insufficiency of funds in such m achine.

11.Custom er's Responsibilit y

(I) The custom er undertakes to be absolutely responsible for safeguarding his usernam e, passw ord, PIN, and under no circum stance shall the custom er disclose any or all of these to any person.

(ii) The custom er undertakes to ensure the secrecy of his passw ord/ PIN and passw ord by not reproducing sam e in any m anner w hatsoever either in w riting or otherw ise capable of m aking it know n to persons other than the custom er.

(iii)The Bank is expressly exem pted from any liabilit y arising from unauthorized access to the custom er's account and/ or data as contained in the Bank's records via the service, w hich arises as a result of inabilit y and/ or otherw ise of the custom er to safeguard his PIN, Passw ord and/ or failure to log out of the system com pletely by allow ing on screen display of his account inform ation.

(iv) The Bank is further relieved of any liabilit y as regards breach of dut y of secrecy arising out of custom er's inabilit y to scrupulously observe and im plem ent the provisions of clauses.

(v) The custom ers access code and passw ord m ust be changed im m ediately it becom es know n to anyone else and therefore the custom er is under a duty to notify the Bank by contacting the Custom er Interaction Centre by telephone and in w riting w henever his/ her access code and/ or passw ord is suspected to be or has becom e know n to another person.

(vi) The custom er shall be responsible for any fraud, loss and/ or liabilit y to the Bank or third part y arising from usage of the custom er's access code, passw ord, PIN and/ or passw ord by both a third part y and other unauthorized access. Accordingly the Bank shall not be responsible for any fraud that arises from usage of the custom er's access code, passw ord, PIN and/ or passw ord.

(vii)The Custom er undertakes to ensure that his/ her PIN is not one that can be easily guessed by anyone including but not lim ited to addresses, telephone num bers, anniversaries, birthdays, sim ple sequence num bers etc.

12.Upon enrolling a custom er for the Service, the custom er m ay be charged the applicable m onthly fee and/ or usage fee w hether or not the custom er m akes use of the service during the period in question.

13.Under no circum stances w ill the Bank be liable for any dam ages, including w ithout lim itation direct or indirect, special, incidental or consequential dam ages, losses or expenses arising in connection w ith this service or use thereof or inabilit y to use by any part y, or in connection w ith any failure of perform ance, error, om ission, interruption, defect, delay in operation, transm ission, com puter virus or line or system failure, even if the Bank or its representatives thereof are advised of the possibilit y of such dam ages, losses or hyperlink to other internet resources are at the custom er's risk.

14.Copyright in the pages and in the screens displaying the pages, and in the inform ation and m aterial therein and arrangem ent is ow ned by the Bank.

authorized or m ade possible by the fact of the know ledge and/ or use, or m anipulation of the user's passw ord, or otherw ise by the user's negligence. User acknow ledges that his passw ord shall be know n only to him and kept secret at all tim es.

4.In the event of loss or theft of the phone or com prom ise of the securit y of the provided em ail account, the user shall call CIC hotlines: 07022255822, 01-2898822 or em ail CIC@ubagroup.com and

im m ediately notify the Bank in w riting w ithin 24 hours of the loss/ theft of phone or com puter and em ail/ passw ord com prom ise.

5.UBA in its absolute discretion and w ithout prior notice can tem porary suspend this, any or all of the service or term inate them com pletely.

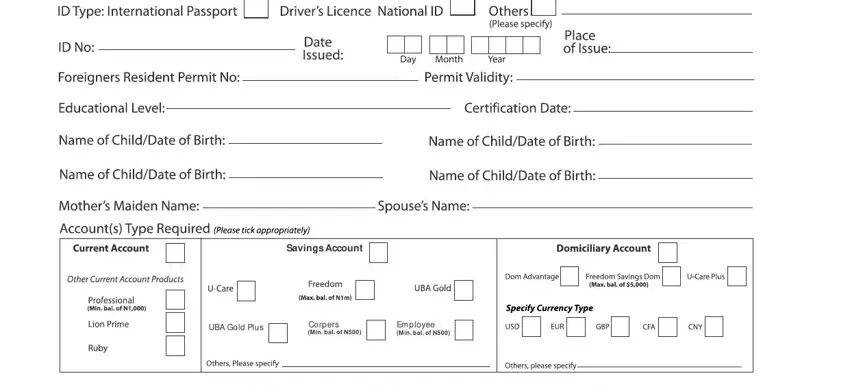

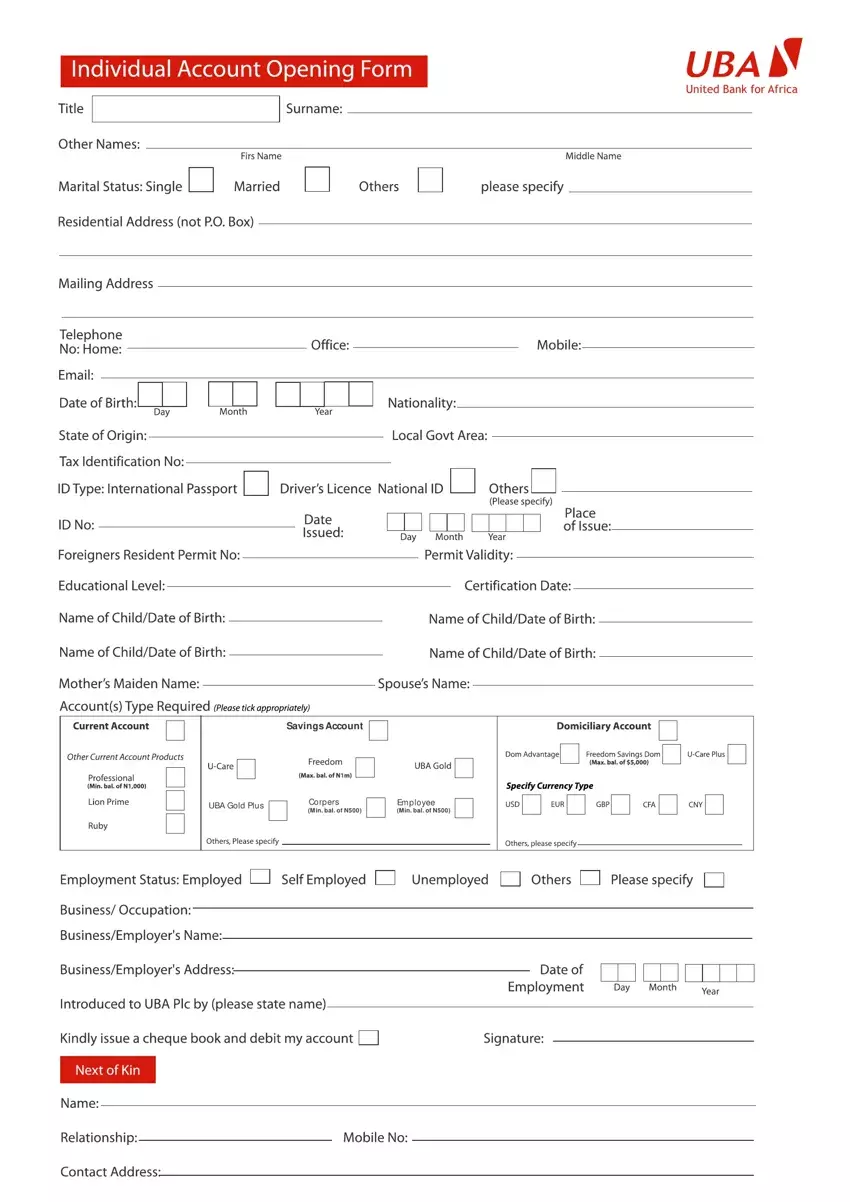

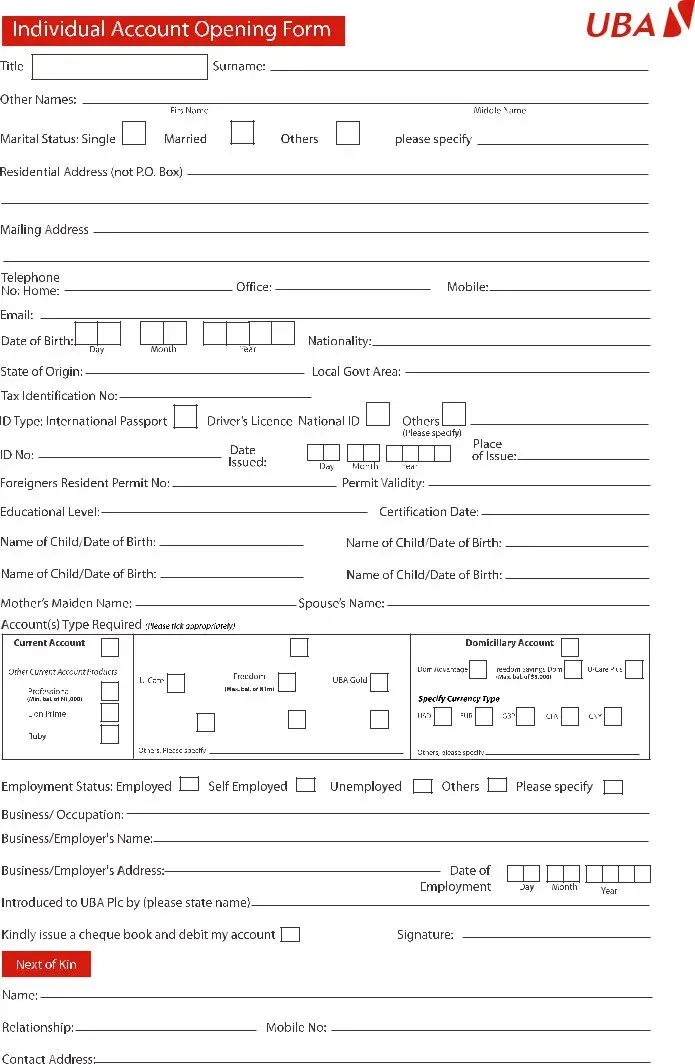

, Voter’s ID, Please bring along the original for

, Voter’s ID, Please bring along the original for

D M

D M  M Y

M Y  Y Y

Y Y  Y

Y