By using the online PDF tool by FormsPal, you're able to complete or change statement of mortgage or contract indebtedness right here. In order to make our tool better and less complicated to work with, we constantly design new features, with our users' feedback in mind. Starting is simple! All you have to do is take the following basic steps down below:

Step 1: Open the form in our tool by pressing the "Get Form Button" at the top of this webpage.

Step 2: This editor allows you to change your PDF file in a range of ways. Improve it with personalized text, correct what is already in the PDF, and add a signature - all when it's needed!

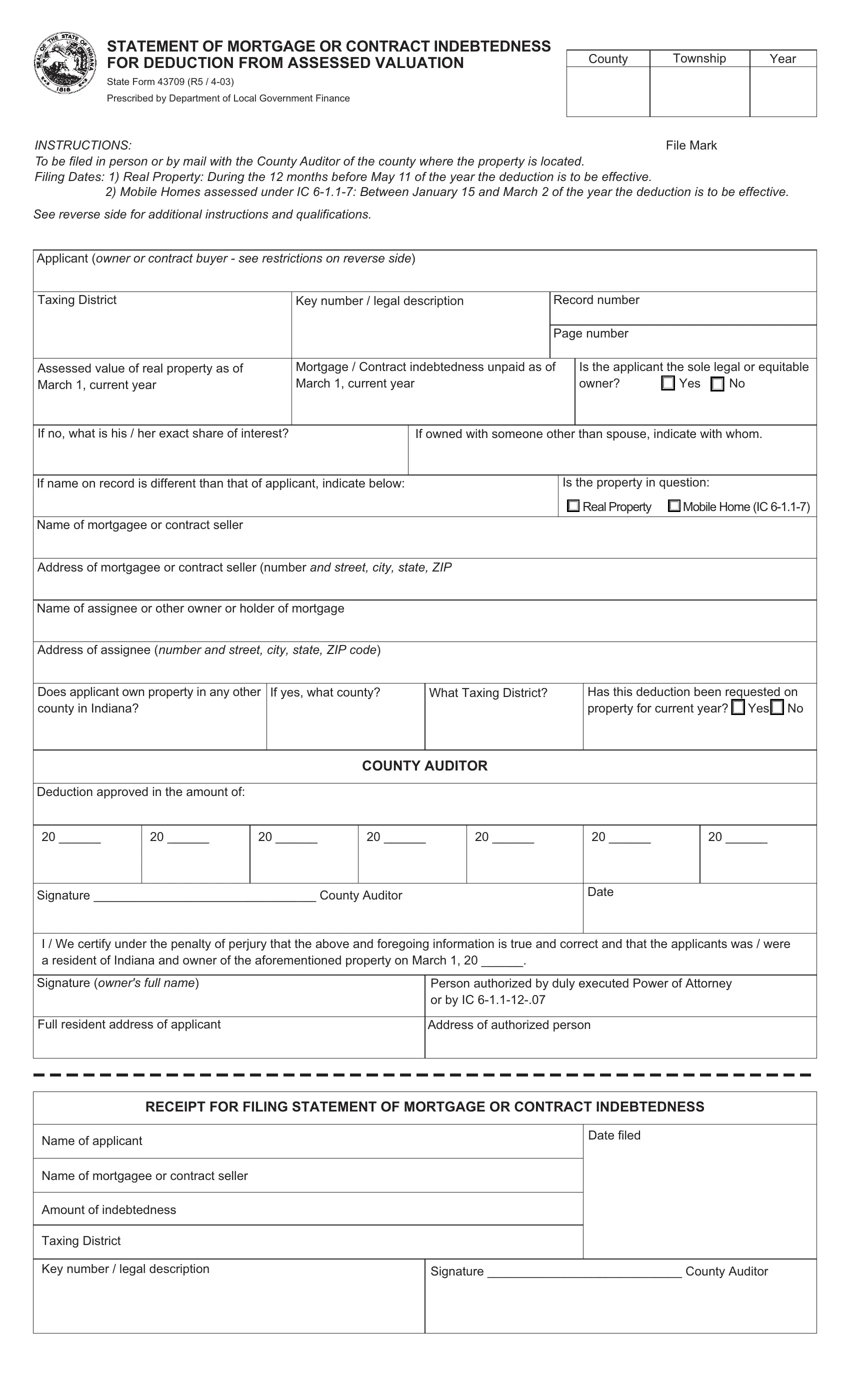

This form requires specific info to be entered, therefore be sure you take whatever time to fill in exactly what is requested:

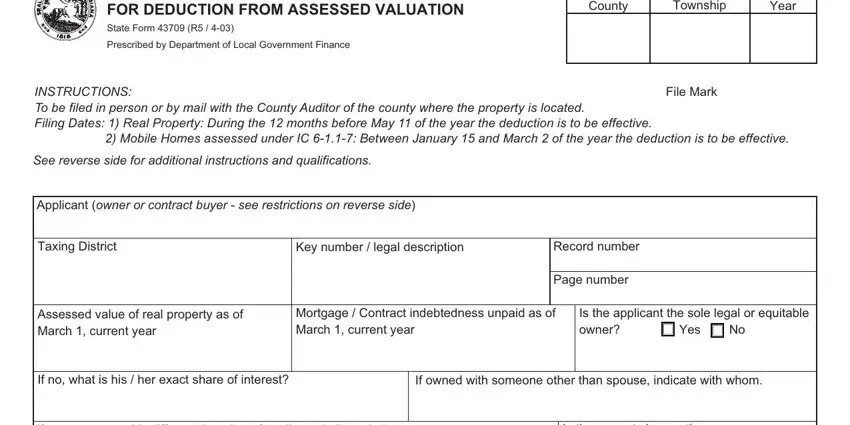

1. Begin completing your statement of mortgage or contract indebtedness with a selection of necessary blanks. Gather all of the required information and make certain not a single thing left out!

2. Just after this section is filled out, proceed to enter the suitable information in all these: If name on record is different, Is the property in question, Real Property, Mobile Home IC, Name of mortgagee or contract, Address of mortgagee or contract, Name of assignee or other owner or, Address of assignee number and, Does applicant own property in any, If yes what county, What Taxing District, Has this deduction been requested, Deduction approved in the amount of, COUNTY AUDITOR, and Signature County Auditor.

You can certainly get it wrong when filling out your Name of assignee or other owner or, hence be sure you reread it before you finalize the form.

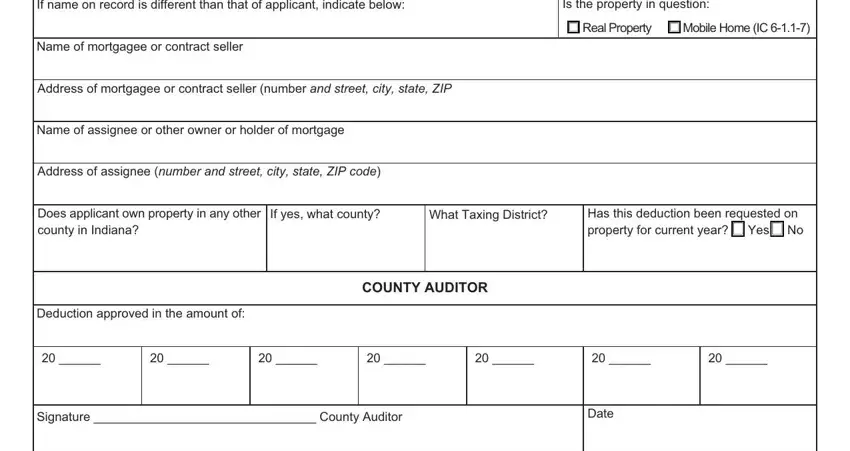

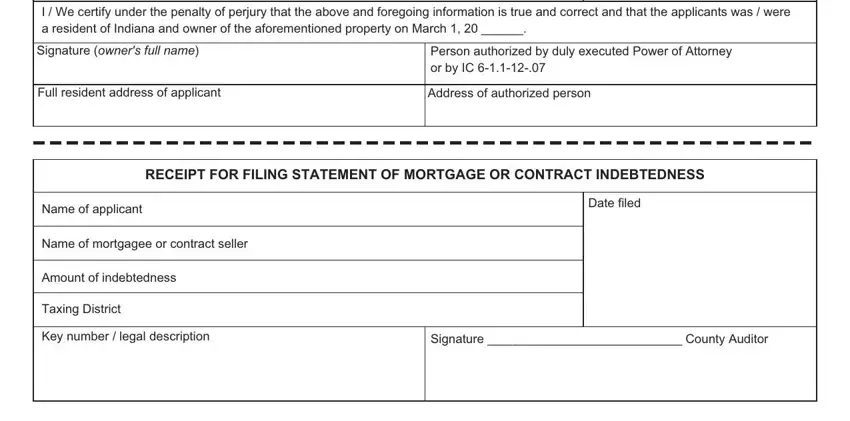

3. In this stage, review I We certify under the penalty of, Signature owners full name, Person authorized by duly executed, Full resident address of applicant, Address of authorized person, RECEIPT FOR FILING STATEMENT OF, Name of applicant, Name of mortgagee or contract, Amount of indebtedness, Taxing District, Key number legal description, Date filed, and Signature County Auditor. These will have to be completed with highest accuracy.

Step 3: Glance through all the details you have entered into the blanks and then click on the "Done" button. Sign up with FormsPal now and easily get statement of mortgage or contract indebtedness, set for download. Every single change you make is conveniently kept , which means you can modify the document at a later stage anytime. FormsPal is invested in the confidentiality of our users; we ensure that all personal data entered into our system continues to be secure.