Any time you desire to fill out declaration financial, there's no need to download any applications - simply try using our online tool. FormsPal team is dedicated to providing you with the ideal experience with our tool by constantly presenting new capabilities and enhancements. Our tool is now a lot more useful as the result of the newest updates! So now, editing documents is easier and faster than before. Getting underway is easy! All you should do is adhere to these basic steps below:

Step 1: First, open the pdf tool by clicking the "Get Form Button" in the top section of this page.

Step 2: This editor will give you the opportunity to work with almost all PDF files in various ways. Modify it by writing personalized text, adjust what is already in the document, and place in a signature - all within a few clicks!

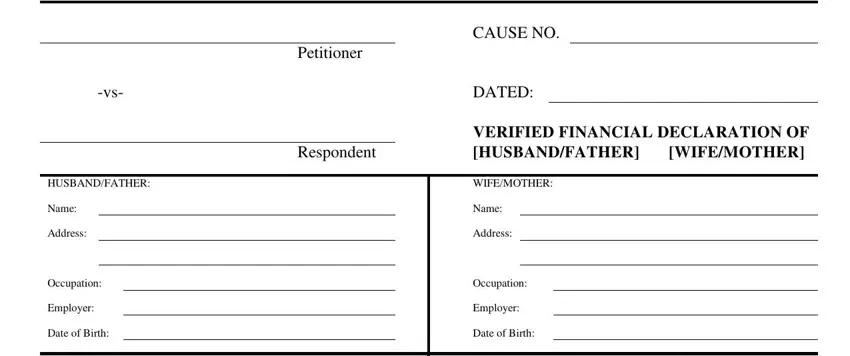

This PDF requires particular info to be filled in, thus you must take your time to enter exactly what is required:

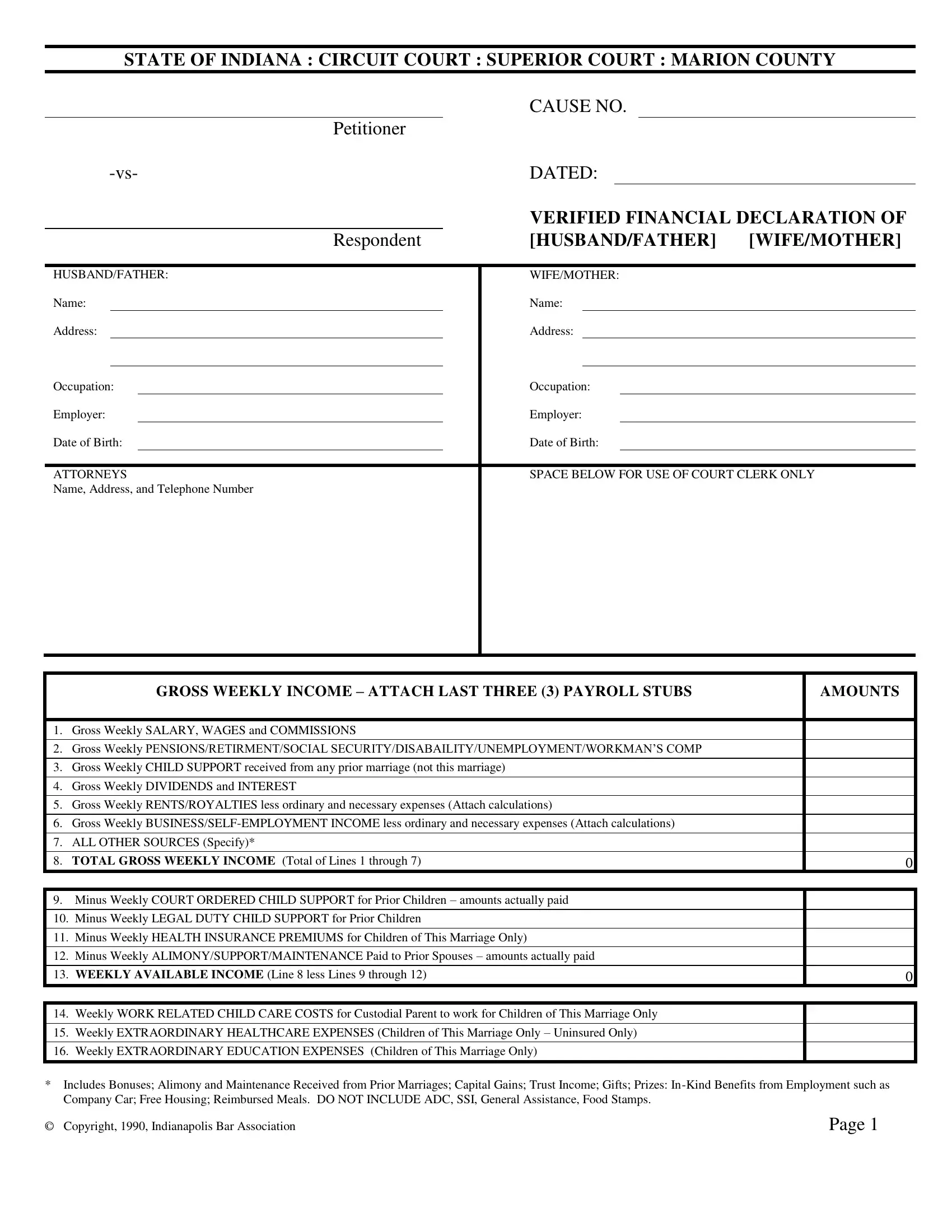

1. While submitting the declaration financial, be certain to incorporate all of the essential blanks within its associated section. This will help speed up the process, making it possible for your details to be handled quickly and appropriately.

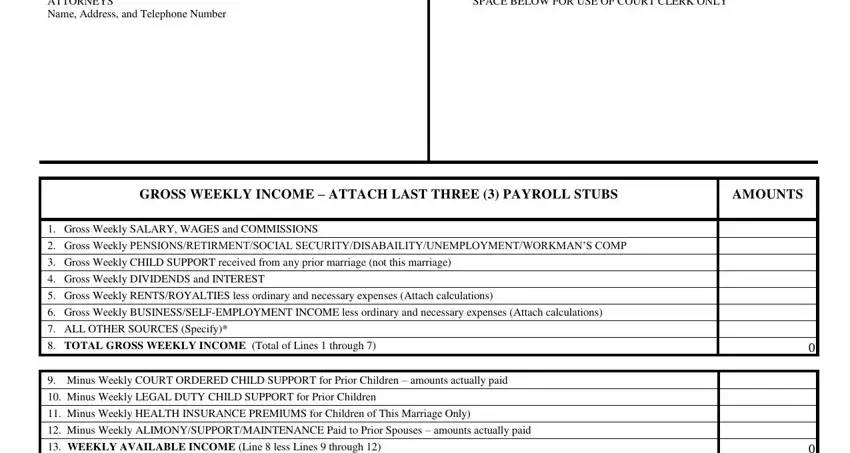

2. After filling out this step, head on to the next stage and complete all required particulars in all these blanks - ATTORNEYS Name Address and, SPACE BELOW FOR USE OF COURT CLERK, GROSS WEEKLY INCOME ATTACH LAST, AMOUNTS, Gross Weekly SALARY WAGES and, Gross Weekly DIVIDENDS and, Gross Weekly RENTSROYALTIES less, Gross Weekly, ALL OTHER SOURCES Specify, TOTAL GROSS WEEKLY INCOME Total, Minus Weekly COURT ORDERED CHILD, and Minus Weekly HEALTH INSURANCE.

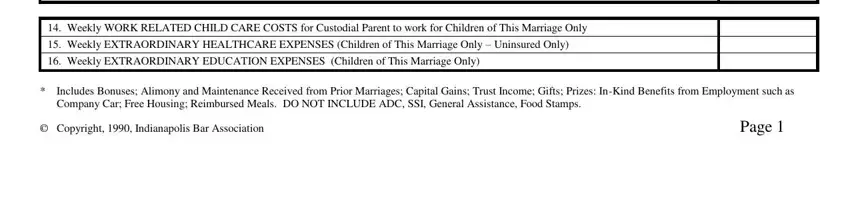

3. The following segment is considered rather easy, Weekly WORK RELATED CHILD CARE, Includes Bonuses Alimony and, Copyright Indianapolis Bar, and Page - all of these empty fields must be filled in here.

Be really careful when completing Includes Bonuses Alimony and and Weekly WORK RELATED CHILD CARE, because this is where many people make mistakes.

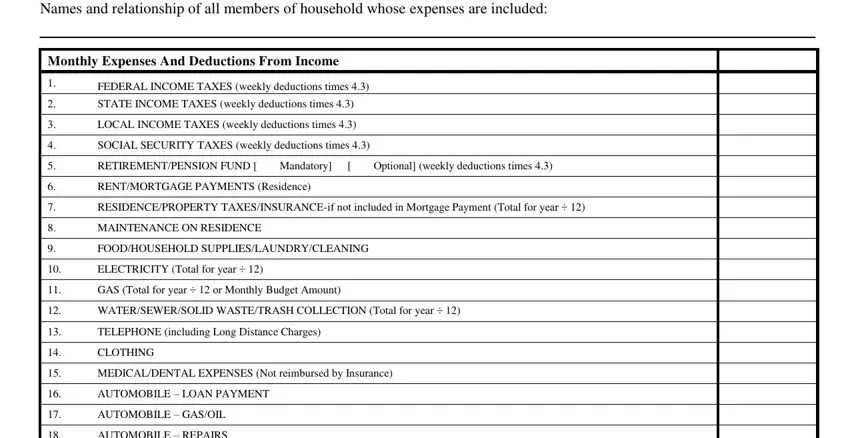

4. Filling out Names and relationship of all, Monthly Expenses And Deductions, FEDERAL INCOME TAXES weekly, STATE INCOME TAXES weekly, LOCAL INCOME TAXES weekly, SOCIAL SECURITY TAXES weekly, RETIREMENTPENSION FUND Mandatory, Optional weekly deductions times, RENTMORTGAGE PAYMENTS Residence, RESIDENCEPROPERTY TAXESINSURANCEif, MAINTENANCE ON RESIDENCE, FOODHOUSEHOLD, ELECTRICITY Total for year, GAS Total for year or Monthly, and WATERSEWERSOLID WASTETRASH is key in the fourth section - don't forget to be patient and take a close look at each and every field!

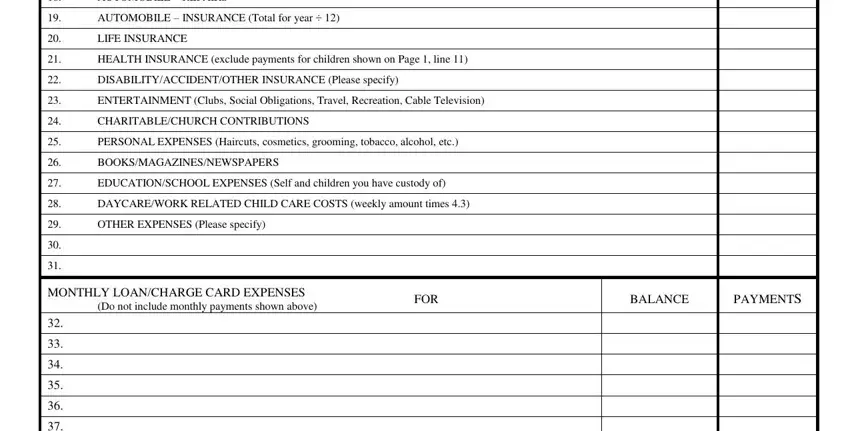

5. To finish your form, the particular part features some extra blank fields. Filling out MEDICALDENTAL EXPENSES Not, LIFE INSURANCE, HEALTH INSURANCE exclude payments, DISABILITYACCIDENTOTHER INSURANCE, ENTERTAINMENT Clubs Social, CHARITABLECHURCH CONTRIBUTIONS, PERSONAL EXPENSES Haircuts, BOOKSMAGAZINESNEWSPAPERS, EDUCATIONSCHOOL EXPENSES Self and, DAYCAREWORK RELATED CHILD CARE, OTHER EXPENSES Please specify, MONTHLY LOANCHARGE CARD EXPENSES, Do not include monthly payments, FOR, and BALANCE will certainly finalize the process and you'll surely be done in a short time!

Step 3: Be certain that the information is accurate and press "Done" to proceed further. Try a 7-day free trial option with us and obtain instant access to declaration financial - download, email, or edit in your FormsPal cabinet. FormsPal guarantees safe form editor without data recording or any type of sharing. Rest assured that your details are safe with us!