If you wish to fill out calibration st 105 online, you won't have to download any sort of software - just make use of our PDF editor. The tool is constantly maintained by our staff, acquiring powerful functions and becoming better. By taking a few easy steps, you can begin your PDF journey:

Step 1: Access the PDF doc inside our tool by pressing the "Get Form Button" at the top of this page.

Step 2: As you start the PDF editor, you will notice the document prepared to be filled out. Other than filling in different blanks, you might also do other sorts of actions with the form, namely adding any text, editing the initial text, adding graphics, affixing your signature to the PDF, and much more.

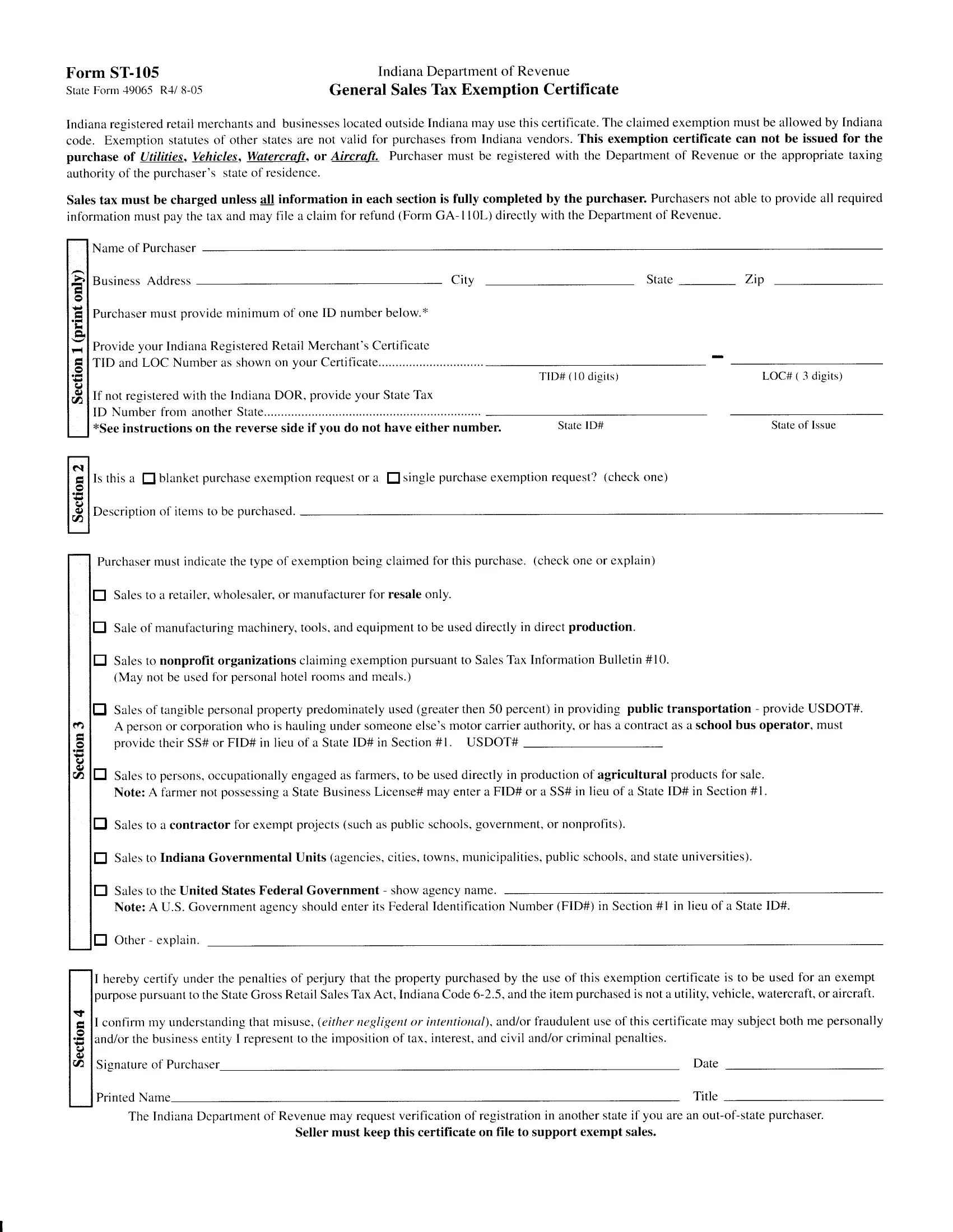

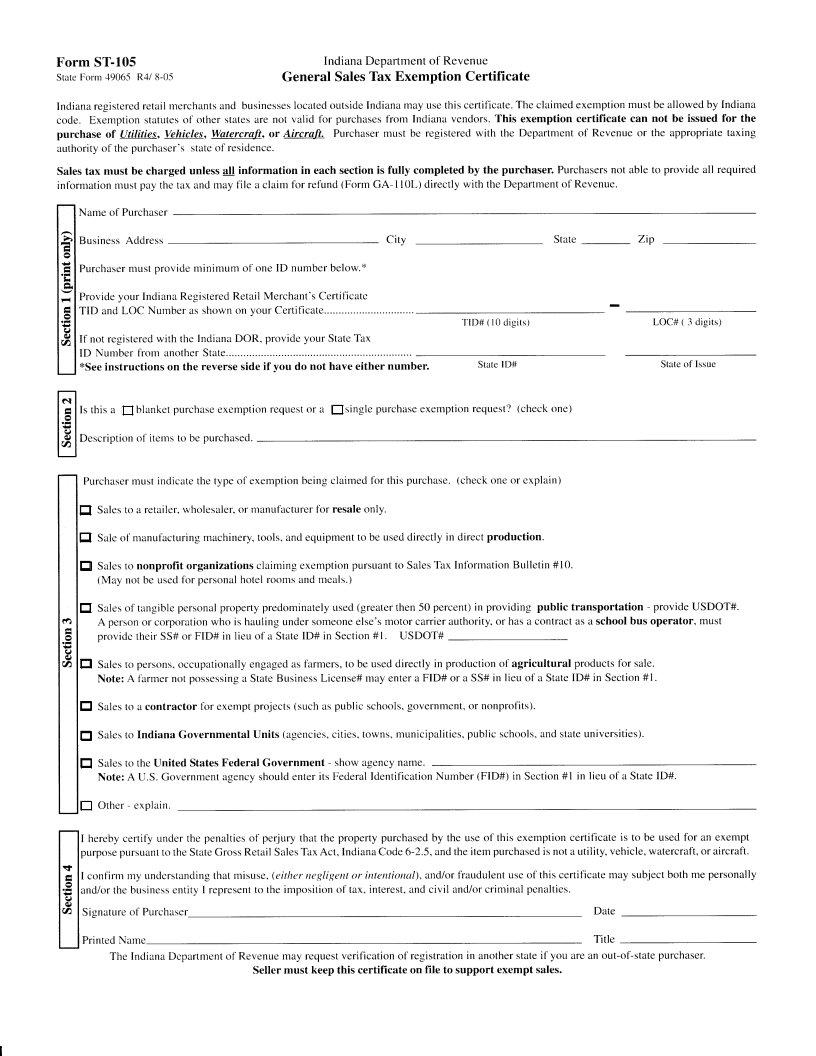

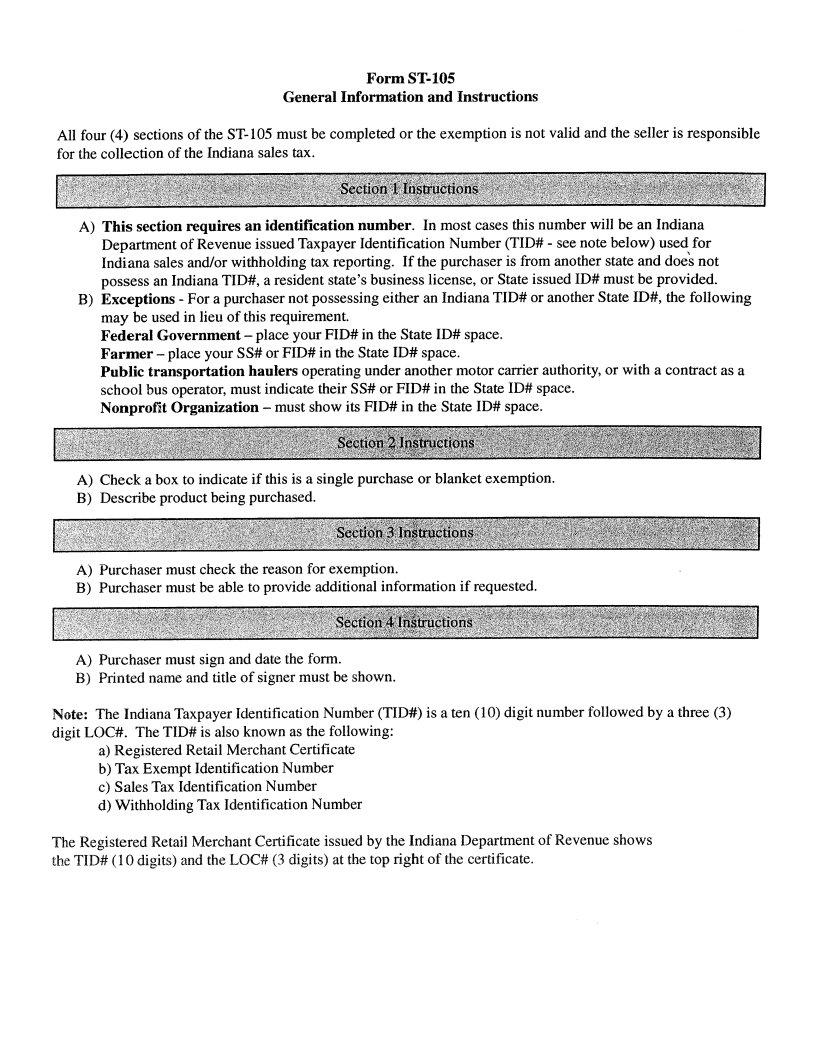

This document requires some specific details; to ensure consistency, remember to pay attention to the recommendations listed below:

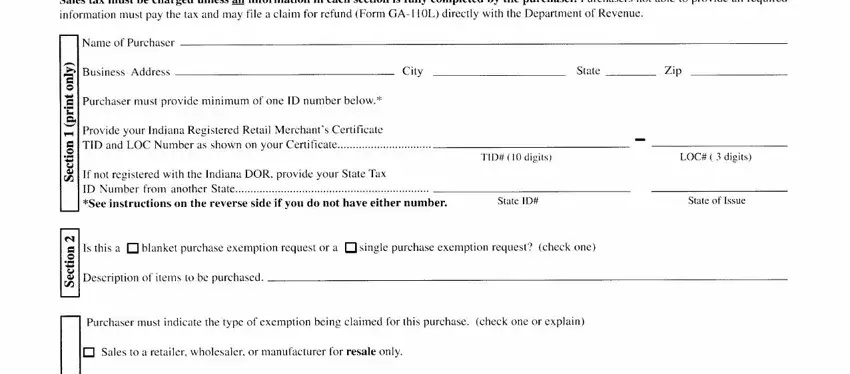

1. The calibration st 105 online needs specific details to be typed in. Ensure that the next blank fields are finalized:

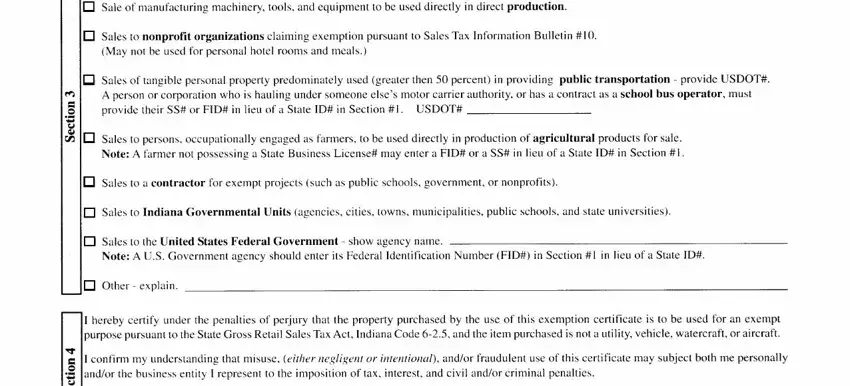

2. Your next part is usually to complete the following blank fields: E Sale of manufactu ng machinery, E Sales to nonprofft organizations, May not be used for personal hotel, E Sales ofrangible personal, A person or corporalion who is, E Sales to persons occupationally, E Sales to a contractor for exempt, E Sales to Indiana Governmental, El Sales to the United States, Note A US Government asencv should, E O t h e r e x p l a i n, I hereby cerlify under the, and I confirm my undeBtanding that.

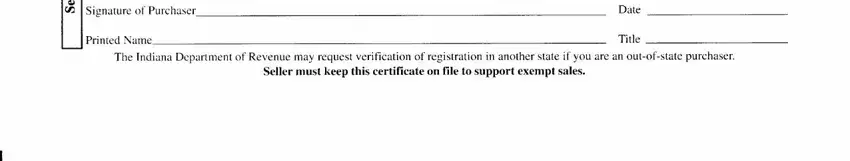

3. In this specific step, review Signature of Purchaser, Printed Name, Date, Title, The Indiana Dcpartntent of Revenue, and Seller must keep this certificate. Every one of these will need to be filled in with greatest precision.

Many people generally make mistakes while filling out Title in this area. You need to go over what you type in right here.

Step 3: Be certain that the details are right and just click "Done" to complete the project. Create a free trial subscription with us and acquire direct access to calibration st 105 online - downloadable, emailable, and editable from your personal account page. We do not sell or share the details that you enter when filling out forms at our website.