Making use of the online PDF tool by FormsPal, you are able to fill in or modify individual financial statement right here. The tool is continually updated by our staff, getting powerful functions and growing to be better. This is what you will need to do to get going:

Step 1: Click on the "Get Form" button in the top part of this page to get into our editor.

Step 2: With the help of this handy PDF file editor, you can actually do more than just complete blank fields. Try each of the functions and make your documents seem perfect with customized text put in, or optimize the original input to perfection - all accompanied by an ability to add any type of images and sign the document off.

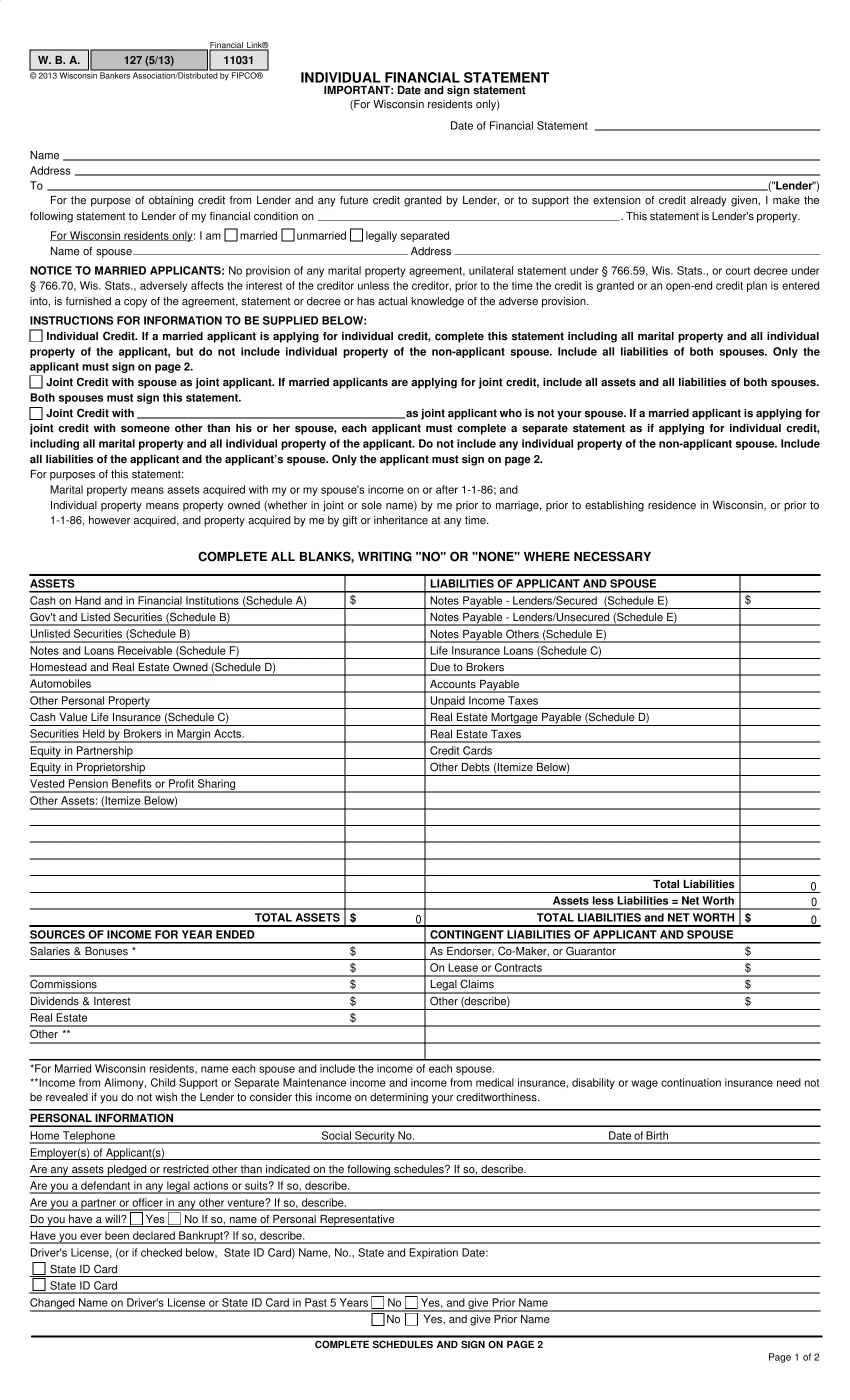

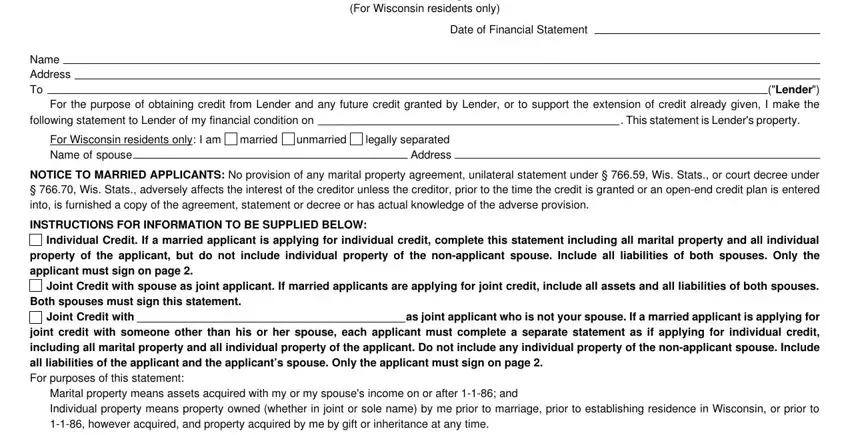

This form will require particular details to be filled in, therefore you need to take whatever time to provide precisely what is asked:

1. Begin filling out your individual financial statement with a number of major blanks. Consider all of the information you need and make sure not a single thing overlooked!

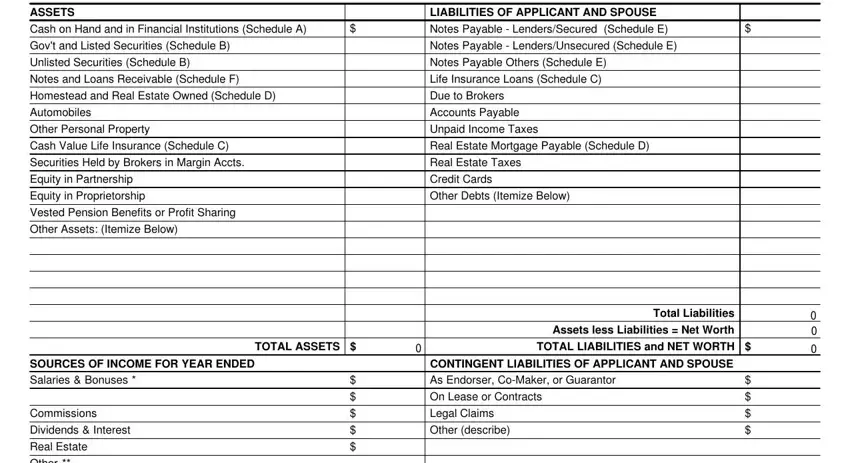

2. Just after filling out the previous section, head on to the next part and fill in the essential details in all these blanks - ASSETS, LIABILITIES OF APPLICANT AND SPOUSE, Cash on Hand and in Financial, Notes Payable LendersSecured, Schedule E, Govt and Listed Securities, Unlisted Securities Schedule B, Notes and Loans Receivable, Homestead and Real Estate Owned, Automobiles, Other Personal Property, Cash Value Life Insurance Schedule, Securities Held by Brokers in, Equity in Partnership, and Equity in Proprietorship.

Lots of people frequently make some mistakes when filling in Notes Payable LendersSecured in this section. Make sure you review what you enter right here.

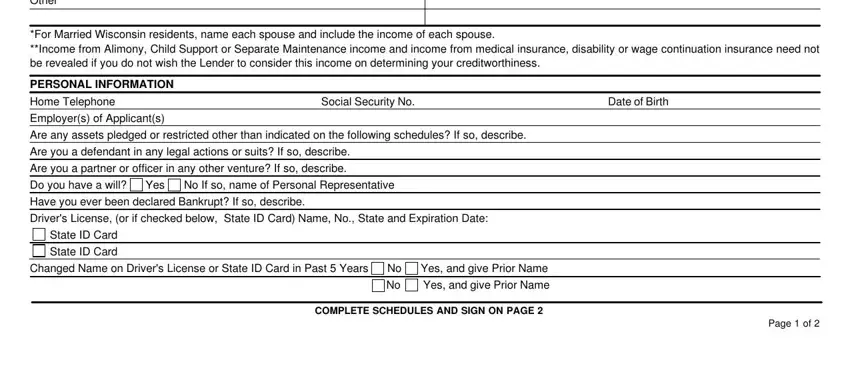

3. The following segment is about Other, For Married Wisconsin residents, PERSONAL INFORMATION, Home Telephone, Employers of Applicants, Social Security No, Date of Birth, Are any assets pledged or, Are you a defendant in any legal, Are you a partner or officer in, Do you have a will, Yes, No If so name of Personal, Have you ever been declared, and Drivers License or if checked below - complete every one of these fields.

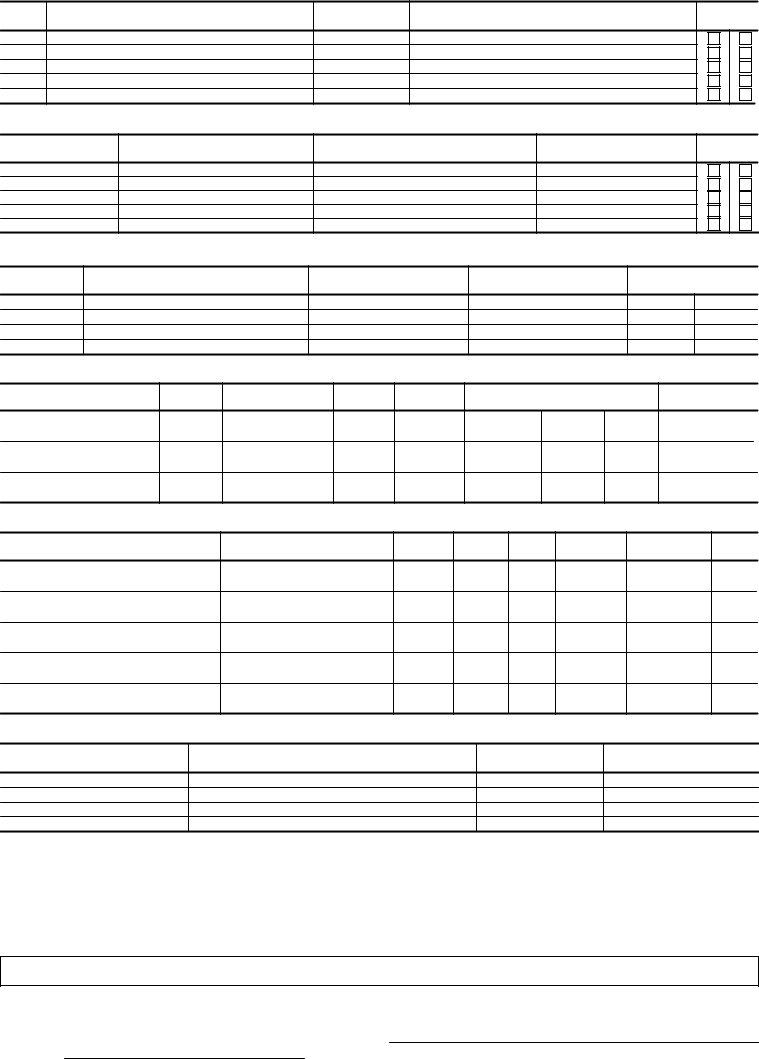

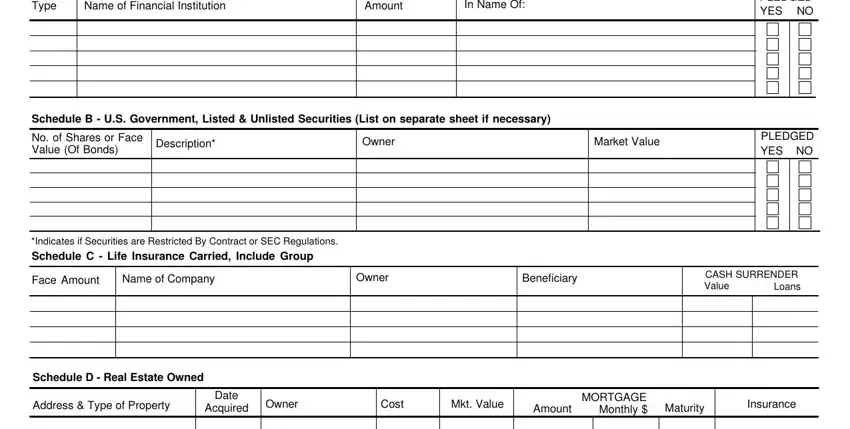

4. This next section requires some additional information. Ensure you complete all the necessary fields - Type, Name of Financial Institution, Amount, In Name Of, Schedule B US Government Listed, necessary, No of Shares or Value Of Bonds, Face, Description, Owner, Market, Value, PLEDGED YES NO, PLEDGED YES NO, and Indicates if Securities are - to proceed further in your process!

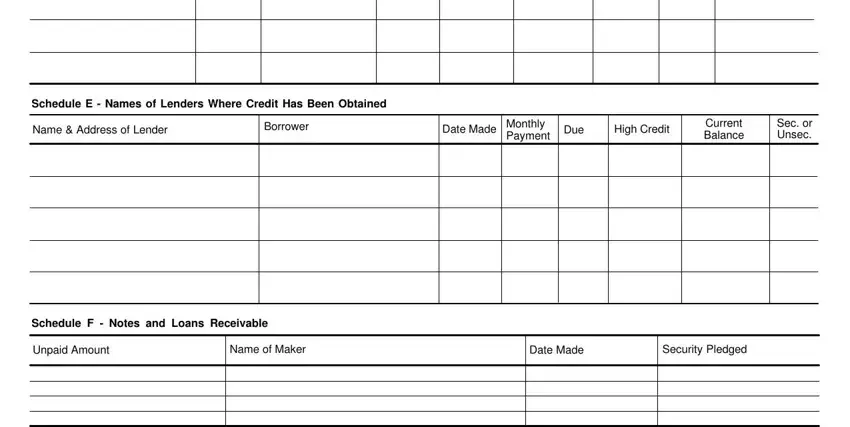

5. This last section to submit this document is crucial. Make sure that you fill in the necessary fields, for instance Schedule E Names of Lenders Where, Name Address of, Lender, Borrower, Date, Made, Monthly Payment, Due, High, Credit, Current Balance, or Sec Unsec, Schedule F Notes and Loans, Receivable, and Unpaid Amount, prior to submitting. Neglecting to do this could generate an unfinished and potentially invalid document!

Step 3: Prior to obtaining the next stage, you should make sure that form fields were filled in right. When you are satisfied with it, press “Done." Try a free trial plan with us and get immediate access to individual financial statement - download or edit from your FormsPal account. FormsPal ensures your data confidentiality via a secure method that in no way records or shares any private information used. Be confident knowing your paperwork are kept protected whenever you work with our tools!