Handling PDF files online is always a breeze with this PDF tool. Anyone can fill out Iradist Form here in a matter of minutes. To make our tool better and easier to utilize, we constantly develop new features, with our users' feedback in mind. To get the process started, consider these basic steps:

Step 1: Simply hit the "Get Form Button" in the top section of this page to access our pdf form editing tool. Here you will find everything that is necessary to work with your document.

Step 2: Using our advanced PDF tool, you may accomplish more than merely fill in forms. Express yourself and make your docs seem professional with custom text put in, or fine-tune the file's original input to perfection - all that backed up by an ability to add any type of images and sign the document off.

This PDF doc will require some specific details; in order to ensure accuracy, take the time to bear in mind the suggestions down below:

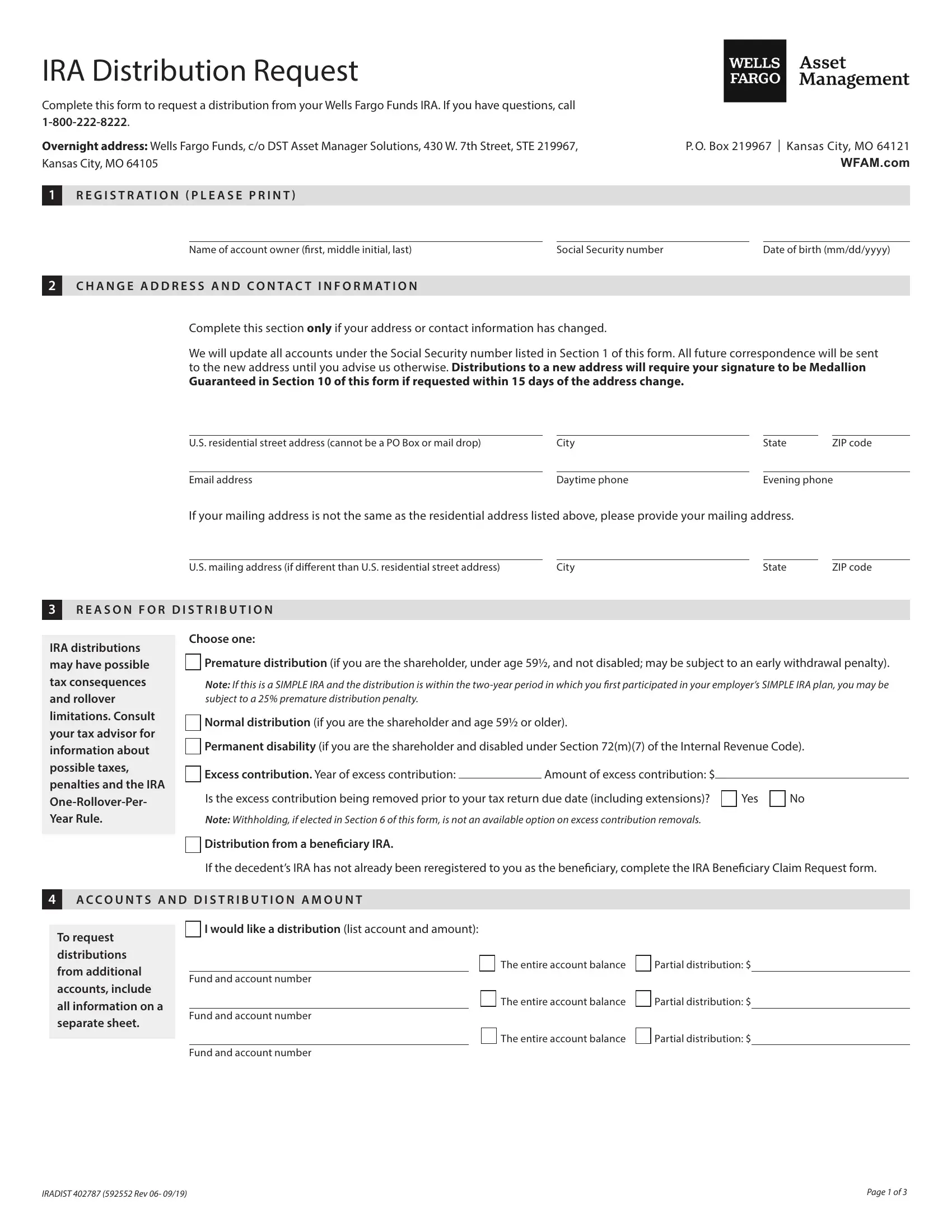

1. It's vital to complete the Iradist Form correctly, so pay close attention when filling in the segments including all these fields:

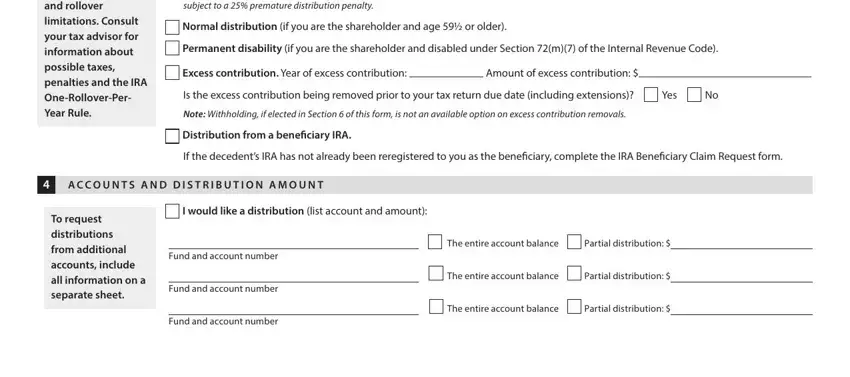

2. Immediately after this section is done, go to enter the applicable information in all these: IRA distributions may have, Note If this is a SIMPLE IRA and, Normal distribution if you are the, Permanent disability if you are, Excess contribution Year of excess, Amount of excess contribution, Is the excess contribution being, Yes, Note Withholding if elected in, Distribution from a benefciary IRA, If the decedents IRA has not, A C C O U N T S A N D D I S T R I, To request distributions from, I would like a distribution list, and Fund and account number.

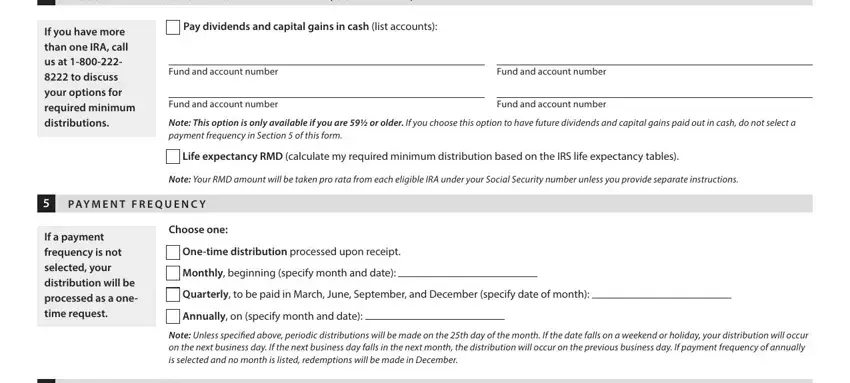

3. The next stage is going to be easy - complete all of the blanks in A C C O U N T S A N D D I S T R I, If you have more than one IRA call, Pay dividends and capital gains in, Fund and account number, Fund and account number, Fund and account number, Fund and account number, Note This option is only available, Life expectancy RMD calculate my, Note Your RMD amount will be taken, P AY M E N T F R E Q U E N C Y, If a payment frequency is not, Choose one, Onetime distribution processed, and Monthly beginning specify month to finish this segment.

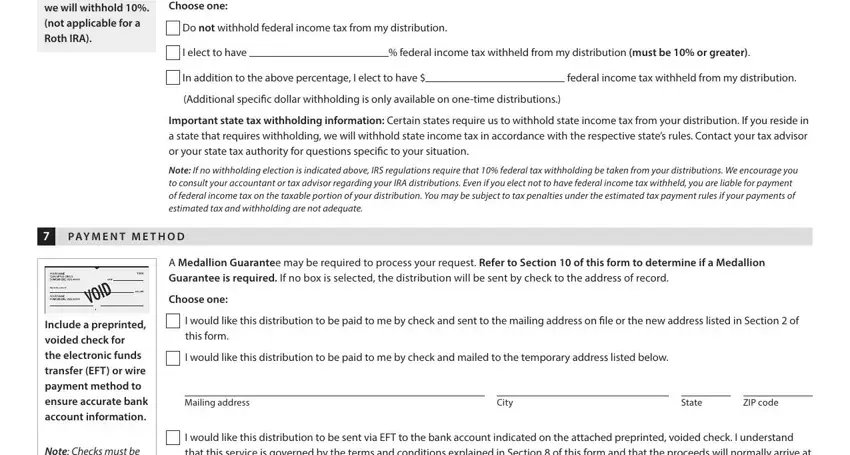

4. To go onward, this fourth form section will require filling in a handful of empty form fields. These comprise of If no box is checked we will, Choose one, Do not withhold federal income tax, I elect to have, federal income tax withheld from, In addition to the above, federal income tax withheld from, Additional specifc dollar, Important state tax withholding, Note If no withholding election is, P AY M E N T M E T H O D, A Medallion Guarantee may be, Choose one, I would like this distribution to, and this form, which are integral to carrying on with this particular document.

5. The final point to complete this document is crucial. Make certain to fill in the required form fields, for example I would like this distribution to, I would like a onetime, Note Checks must be preprinted, IRADIST Rev, and Page of, before using the document. Neglecting to do it can end up in a flawed and probably unacceptable paper!

Lots of people frequently make errors when completing I would like this distribution to in this area. Make sure you review whatever you type in right here.

Step 3: Always make sure that the details are right and click on "Done" to progress further. After creating afree trial account at FormsPal, it will be possible to download Iradist Form or send it via email without delay. The PDF form will also be readily accessible via your personal cabinet with your every single edit. FormsPal ensures your information confidentiality via a protected method that never saves or distributes any type of private information involved. Be assured knowing your documents are kept protected each time you work with our service!