With the help of the online PDF tool by FormsPal, you may fill in or alter internal revenue commission here. Our team is relentlessly working to enhance the tool and ensure it is much easier for users with its cutting-edge features. Bring your experience to another level with continually developing and fantastic possibilities we provide! In case you are seeking to start, here's what it's going to take:

Step 1: Simply click on the "Get Form Button" in the top section of this site to open our pdf file editing tool. This way, you will find all that is required to fill out your file.

Step 2: With this handy PDF editor, you are able to do more than merely fill in blank fields. Express yourself and make your forms seem sublime with custom textual content added, or fine-tune the file's original content to perfection - all that comes with an ability to incorporate just about any pictures and sign it off.

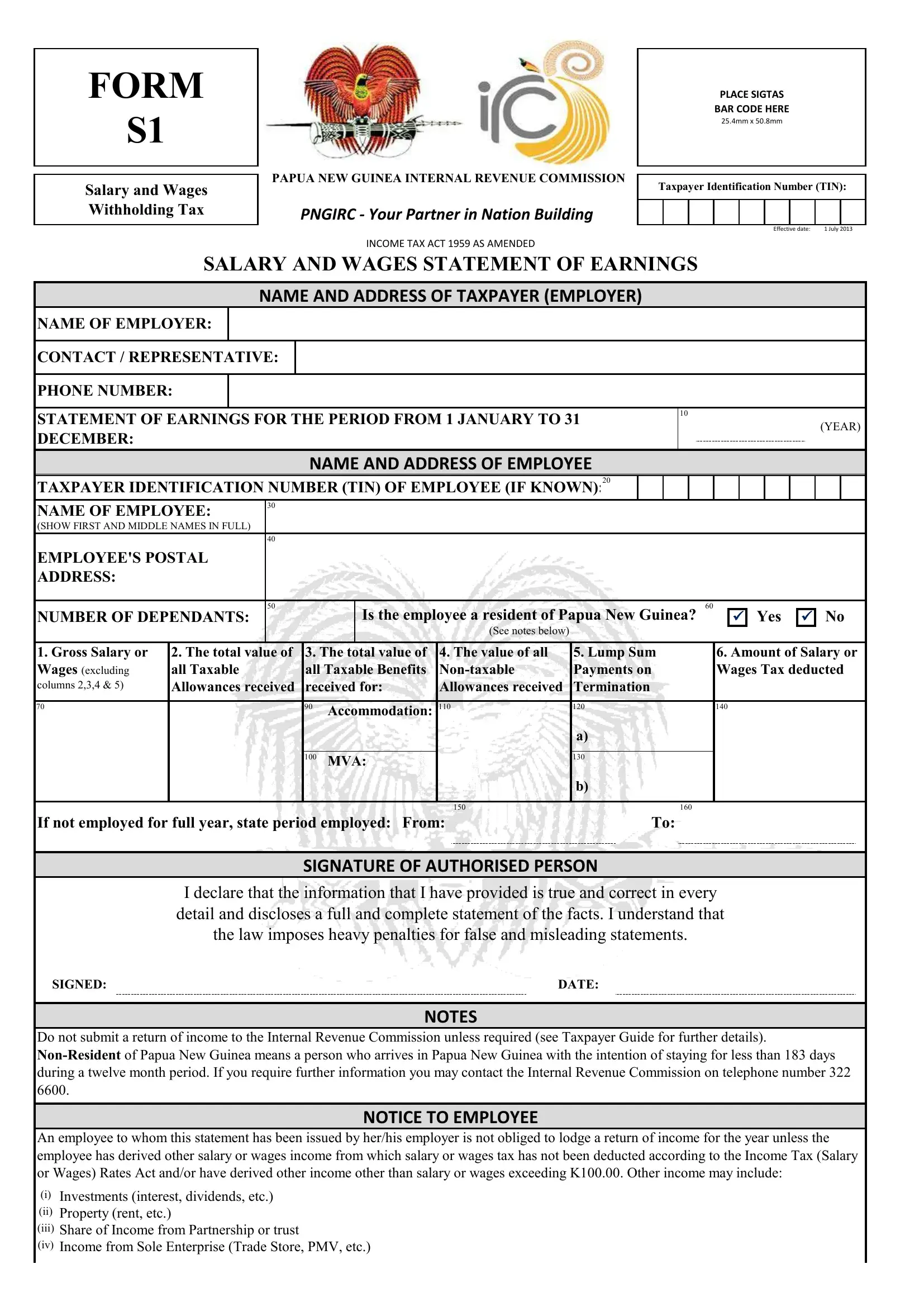

If you want to complete this form, ensure you enter the information you need in every field:

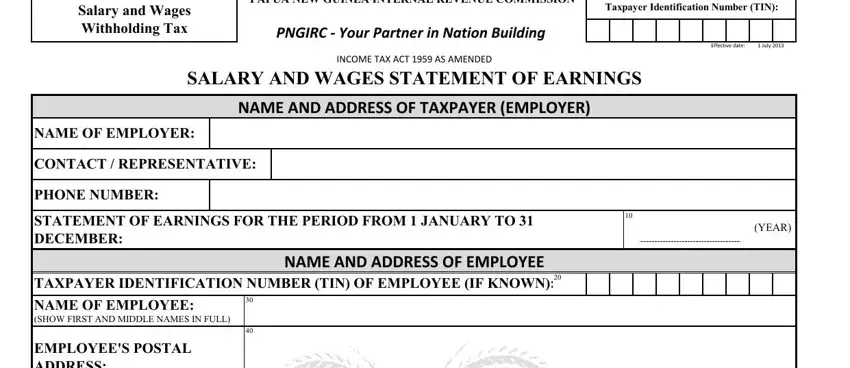

1. Whenever completing the internal revenue commission, ensure to incorporate all needed blank fields within the associated section. This will help expedite the work, making it possible for your information to be handled promptly and correctly.

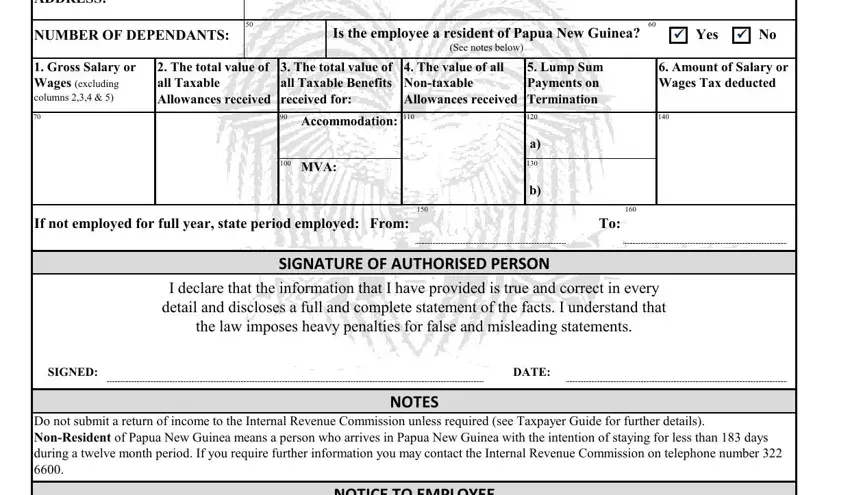

2. Your next step is usually to fill in these particular blanks: EMPLOYEES POSTAL ADDRESS, NUMBER OF DEPENDANTS, Is the employee a resident of, Yes, See notes below, Gross Salary or Wages excluding, The total value of all Taxable, The total value of all Taxable, The value of all Nontaxable, Lump Sum Payments on Termination, Accommodation, MVA, If not employed for full year, Amount of Salary or Wages Tax, and SIGNATURE OF AUTHORISED PERSON.

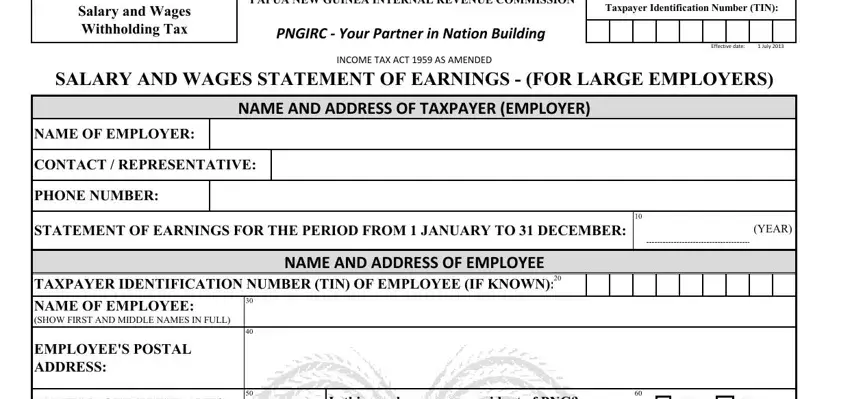

3. This next portion is related to Salary and Wages Withholding Tax, PAPUA NEW GUINEA INTERNAL REVENUE, Taxpayer Identification Number TIN, PNGIRC Your Partner in Nation, INCOME TAX ACT AS AMENDED, Effective date, July, SALARY AND WAGES STATEMENT OF, NAME AND ADDRESS OF TAXPAYER, NAME OF EMPLOYER, CONTACT REPRESENTATIVE, PHONE NUMBER, STATEMENT OF EARNINGS FOR THE, YEAR, and TAXPAYER IDENTIFICATION NUMBER - type in every one of these blank fields.

Be extremely mindful while completing PAPUA NEW GUINEA INTERNAL REVENUE and INCOME TAX ACT AS AMENDED, since this is the part where most users make a few mistakes.

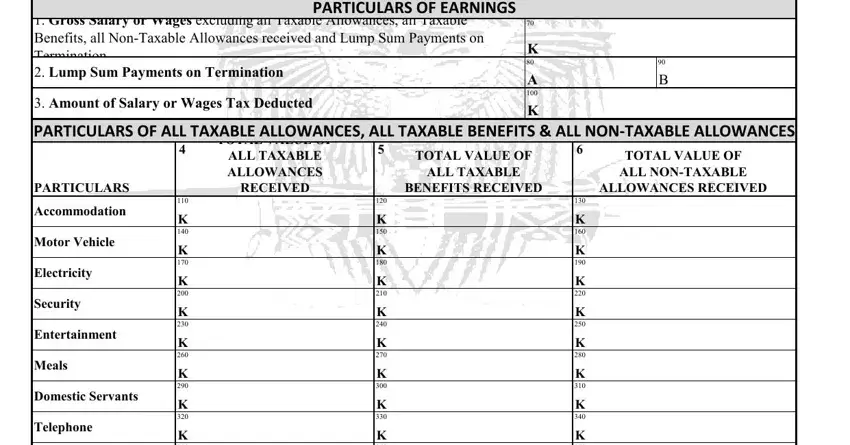

4. This next section requires some additional information. Ensure you complete all the necessary fields - Gross Salary or Wages excluding, PARTICULARS OF EARNINGS, Amount of Salary or Wages Tax, PARTICULARS OF ALL TAXABLE, TOTAL VALUE OF, ALL TAXABLE ALLOWANCES, RECEIVED, PARTICULARS, Accommodation, Motor Vehicle, Electricity, Security, Entertainment, Meals, and Domestic Servants - to proceed further in your process!

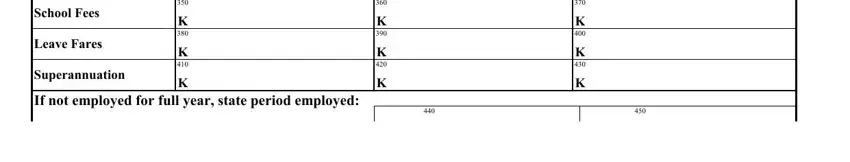

5. The form must be wrapped up by filling out this area. Below there is a detailed listing of form fields that require specific information in order for your form submission to be faultless: School Fees, Leave Fares, Superannuation, and If not employed for full year.

Step 3: Prior to finalizing this document, double-check that blank fields have been filled out the correct way. When you’re satisfied with it, click “Done." Make a free trial option with us and acquire immediate access to internal revenue commission - downloadable, emailable, and editable in your FormsPal cabinet. FormsPal guarantees your data privacy by having a secure system that never saves or distributes any kind of private information involved in the process. Be confident knowing your files are kept safe every time you work with our tools!