|

IRP Form T-138 (Rev. 4/2013) |

Georgia IRP Vehicle Schedule A (Form T-138) |

Page 1 of 4 |

|

|

|

|

|

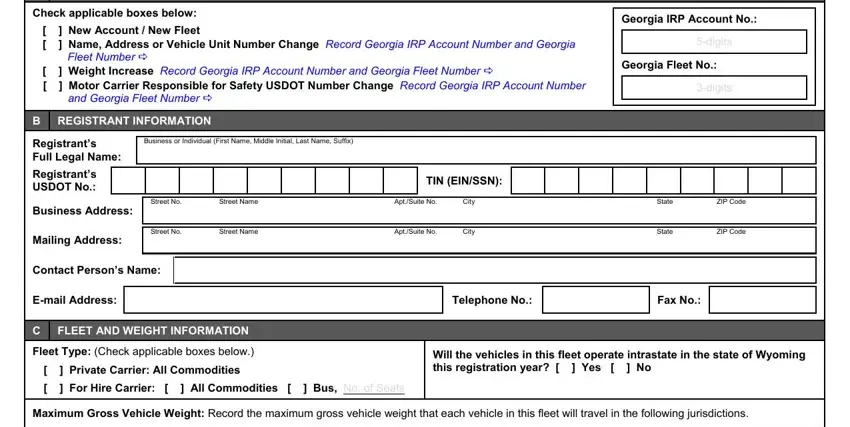

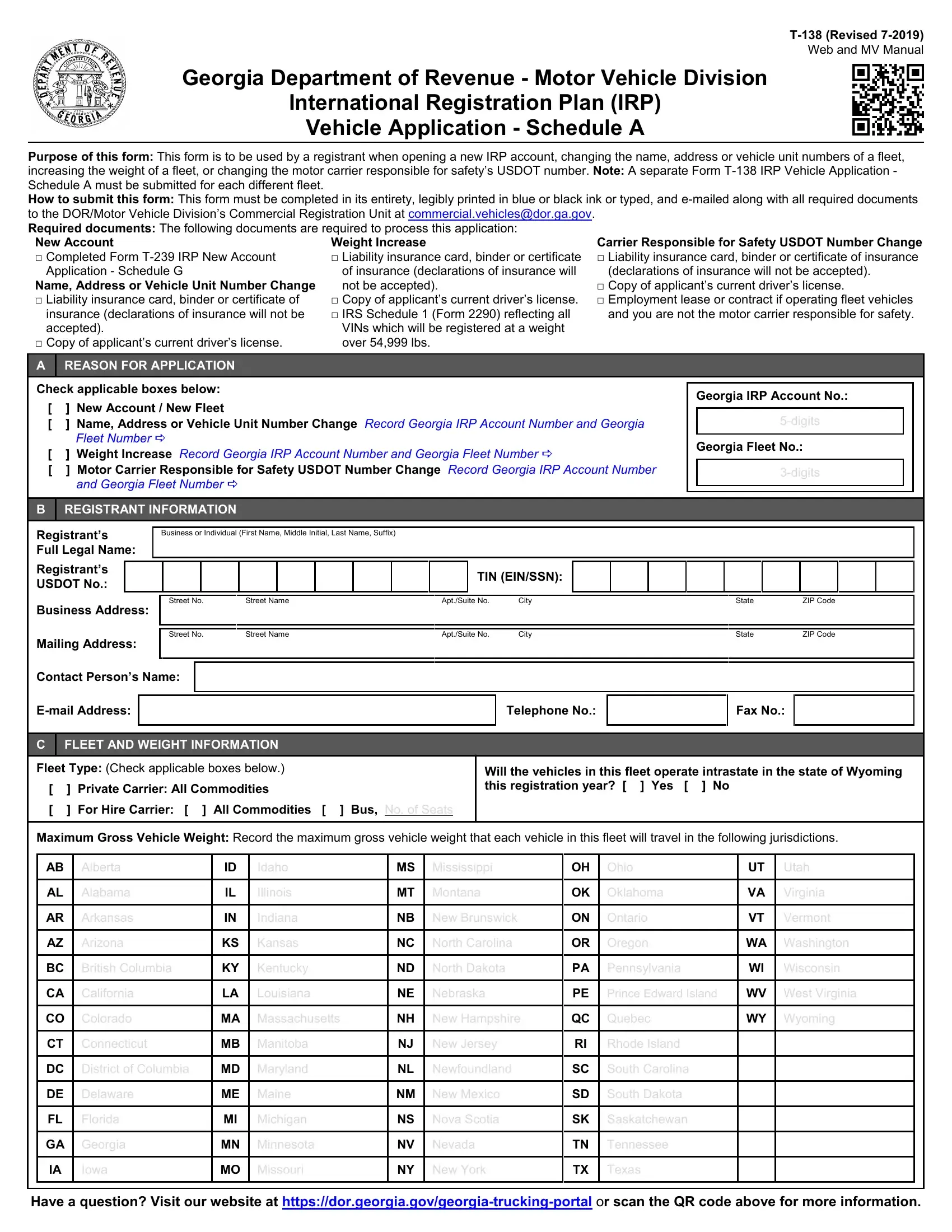

Section 1 Please read all instructions on this form before completing. Click here to view additional information. This form must be typed, electronically completed & printed or legibly hand printed & signed.

(1) New Account? (2) 5-Digit GA IRP Account# (3) 3-Digit GA Fleet# (4) 3-Digit GA Supplement# (5) Registrant’s US DOT# (6) Registrant’s TIN or SSN: No

Yes - If yes, attach

Schedule G, Form T-239

(7)Registrant’s/Carrier’s Full Legal Name & Business Address in Georgia (include city, state & zip code). If the Registrant/Carrier is an individual, record first name, middle name, last name & suffix. A post office box number is not acceptable.

(7a) Georgia County Name:

(8) Registrant’s/Carrier’s Mailing Address (include city, state & zip) if different from the address shown in #7 above. A post office box is acceptable

(9)Registrant’s/Carrier’s Business Phone # + Area Code:

(10)Contact Person’s Name:

(9a) Registrant’s/Carrier’s Cell Phone # + Area Code:

(10a) Contact Person’s Phone # + Area Code:

(9b) Registrant’s/Carrier’s Fax # + Area Code:

(10b) Contact Person’s FAX # + Area Code:

(9c) Registrant’s/Carrier’s E-Mail Address:

(10c) Contact Person’s Internet E-Mail Address:

(11) Wyoming Intrastate? |

|

Yes |

(12) Type of Operation – Check the box that applies to your operation:

Private Carrier: |

|

|

For Hire Carrier: |

|

All Commodities |

|

|

All Commodities |

|

Truck-Tractor – Fertilizer/Milk/Crops |

Household Goods |

|

Farm Vehicle – Farm Products/Farm Equip. |

Bus – Record Number of Seats: _________ |

|

Straight Truck – Agriculture/Fertilizer |

|

|

Forest Products – Check one box below: |

|

|

|

Twin Beam Trailer |

|

Single Pole Trailer |

|

|

|

|

|

|

|

|

|

|

|

SECTION 2

(13) Reason For Application:

Renewal

New Fleet

Add State(s)

Increase Weight

(1) |

Weight Group Number: __________________ If you are a first-time Georgia IRP registrant, leave this field blank and a number will be assigned. |

|

|

|

|

|

(2) |

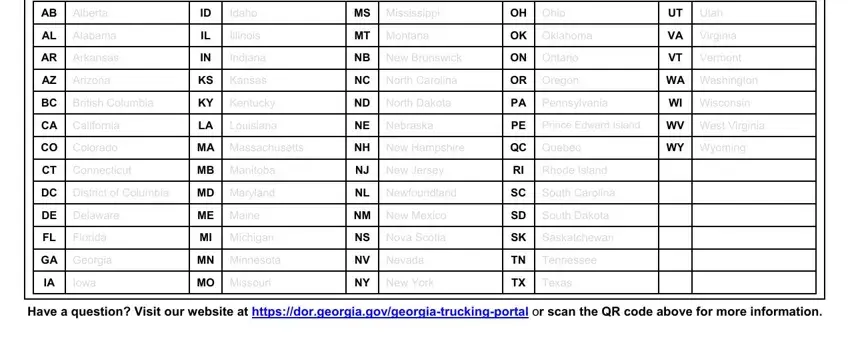

Record the maximum gross vehicle weight that each vehicle in this fleet will travel in the following jurisdictions: |

|

|

|

|

|

Jurisdictions |

|

Jurisdictions |

|

Jurisdictions |

|

Jurisdictions |

|

Jurisdictions |

|

|

|

|

|

|

|

|

|

(AB) Alberta |

|

(IA) Iowa |

|

(MO) Missouri |

|

(NV) Nevada |

|

(TN) Tennessee |

|

|

|

|

|

|

|

|

|

(AK) Alaska |

|

(ID) Idaho |

|

(MS) Mississippi |

|

(NY) New York |

|

(TX) Texas |

|

|

|

|

|

|

|

|

|

(AL) Alabama |

|

(IL) Illinois |

|

(MT) Montana |

|

(OH) Ohio |

|

(UT) Utah |

|

|

|

|

|

|

|

|

|

(AR) Arkansas |

|

(IN) Indiana |

|

(MX) Mexico |

|

(OK) Oklahoma |

|

(VA) Virginia |

|

|

|

|

|

|

|

|

|

(AZ) Arizona |

|

(KS) Kansas |

|

(NB) New Brunswick |

|

(ON) Ontario |

|

(VT) Vermont |

|

|

|

|

|

|

|

|

|

(BC) British Columbia |

|

(KY) Kentucky |

|

(NC) North Carolina |

|

(OR) Oregon |

|

(WA) Washington |

|

|

|

|

|

|

|

|

|

(CA) California |

|

(LA) Louisiana |

|

(ND) North Dakota |

|

(PA) Pennsylvania |

|

(WV) West Virginia |

|

|

|

|

|

|

|

|

|

(CO) Colorado |

|

(MA) Massachusetts |

|

(NE) Nebraska |

|

(PE) Prince Edward Island |

|

(WI) Wisconsin |

|

|

|

|

|

|

|

|

|

(CT) Connecticut |

|

(MB) Manitoba |

|

(NF) Newfoundland |

|

(QC) Quebec |

|

(WY) Wyoming |

|

|

|

|

|

|

|

|

|

(DE) Delaware |

|

(MD) Maryland |

|

(NH) New Hampshire |

|

(RI) Rhode Island |

|

(YT) Yukon Territory |

|

|

|

|

|

|

|

|

|

(DC) District of Columbia |

|

(ME) Maine |

|

(NJ) New Jersey |

|

(SC) South Carolina |

|

|

|

|

|

|

|

|

|

|

|

(FL) Florida |

|

(MI) Michigan |

|

(NM) New Mexico |

|

(SD) South Dakota |

|

|

|

|

|

|

|

|

|

|

|

(GA) Georgia |

|

(MN) Minnesota |

|

(NT) Northwest Territory |

|

(SK) Saskatchewan |

|

|

IRP Vehicle Schedule A Form T-138 Instructions (Rev. 4-2013) |

Page 3 of 4 |

Instructions for Completing Georgia IRP Vehicle Schedule A (Form T-138)

Complete an IRP Mileage Schedule B, Form T-139, for new or renewal applications, adding a new jurisdiction, changing the type of operation, correcting mileage or requesting a fleet-to-fleet transfer. You must complete a IRP Mileage Schedule B, Form T-239, for each fleet listed on an IRP Vehicle Schedule A (Form T-138) and on an IRP Vehicle Schedule A Continuation (Form T- 138A) . IRP registration cannot be completed until all required information is received. The small numbers shown in parentheses ( ) on pages 1 and 2 of this form correspond to the numbers shown below.

SECTION 1

1.New Account? Check the ‘Yes’ box if you are applying for Georgia IRP registration for the first time. If you check the ‘Yes’ box, attach a completed Schedule G (Form T-139).

2.5-Digit GA IRP Account #: Record the Registrant’s/Carrier’s 5-digit Georgia IRP account number. First time Registrants should leave this field blank.

3.3-Digit GA Fleet #: Record a three-digit fleet number. A fleet is one or more vehicles that all travel in the same jurisdictions. A separate IRP Vehicle Schedule A, Form T-138, and IRP Mileage Schedule B, Form T-139, are required for each fleet. Number each fleet in numerical order. In example, 001, 002, 003, etc.

4.3-Digit GA Supplement#: Leave this field blank and a supplement number will be assigned.

5.Registrant’s US DOT Number: Enter the Registrant’s/Carrier’s U.S. Department of Transportation assigned number. Click here for instructions to apply for a U.S. D.O.T. Number online from the Federal Motor Carrier Safety Administration’s website.

6.Federal ID # (FEIN) or Social Security #: Insert the Registrant’s Federal Employer Identification Number (FEIN). If the Registrant does not have a FEIN, record the Registrant’s social security number and apply for a FEIN immediately with the Internal Revenue Service (IRS). Click here to connect to the IRS website.

7.Registrant’s/Carrier’s Full, Legal Name & Business Address in Georgia: Record the Registrant’s/Carrier’s complete name and business address in Georgia including the city, state, and zip code. Please do not abbreviate the city. The address is the same address where the operational records and mileage records for the fleet are maintained. Plates will be mailed to the business address. If the Registrant is an individual, record first name, middle name, last name & suffix. A post office box is not acceptable.

a.Georgia County Name: Record the name of the county in Georgia where the business is located.

8.Registrant’s/Carrier’s Mailing Address: Record the Registrant’s/Carrier’s complete mailing address including the city, state and zip code when the mailing address is different from the business address shown in #7 above.

9.Registrant’s/Carrier’s Business Phone # + Area Code: Enter the Registrant’s/Carrier’s business telephone number including the area number.

a.Registrant’s/Carrier’s Cell Phone # + Area Code: When applicable, record the Registrant’s/Carrier’s cell phone number including the area code.

b.Registrant’s/Carrier’s Fax # + Area Code: When applicable, record the Registrant’s/Carrier’s fax number including the area code.

c.Registrant’s/Carrier’s E-Mail Address: When applicable, record the Registrant’s/Carrier’s Internet e-mail address.

10.Contact Person’s Name: Record the complete legal name of the person to contact regarding this application. This person must be knowledgeable of the requirements of IRP registration and the information shown on this application and the attached document(s).

a.Contact Person’s Phone # + Area Code: Enter the Contact Person’s telephone number including the area code.

b.Contact Person’s FAX # + Area Code: When applicable, record the Contact Person’s fax number including the area code.

c.Contact Person’s Internet E-Mail Address: When applicable, record the Contact Person’s Internet e-mail address.

11.Wyoming Intrastate? Check the ‘Yes’ box if the vehicles in this fleet will operate intrastate in the State of Wyoming this registration year. If the vehicles in this fleet will not operate Intrastate this registration year in the state of Wyoming, please check the ‘No’ box.

12.Type of Operation – Check the applicable box in these fields that describes your type of operation: Private Carrier: Transporting all commodities; Truck Tractor hauling fertilizer, milk &/or crops; Farm Vehicle hauling farm products or farm equipment; Straight Truck hauling agriculture &/or fertilizer; Hauling Forest Products (check the box indicating the type of trailer (twin beam trailer or single pole trailer). For Hire Carrier – Hauling all commodities; hauling household goods; or bus. When registering a bus, record the number of seats in the bus. A ‘For Hire’ bus is a motor vehicle designed to haul seventeen (17) or more passengers for compensation. See the following definitions of the types of operation.

Private Carrier – A person, firm or corporation that utilizes its own trucks to transport its own goods, products or equipment.

Haul for Hire – Any motor carrier providing vehicles and drivers that are available to the general public to engage in the transportation of passengers or property for compensation. Check the box in Section (12) that applies to your operation.

13.Reason for Application- Check the applicable box in these fields that describes your reason for the application.

SECTION 2

1.Weight Group Number: Record a three (3) digit weight group. A weight group is vehicles within the same fleet, which register at different weights from the other units within the same fleet. Weight group numbers should be assigned in numerical order, i.e. 001, 002, etc. Use a separate Schedule A (Form T-138) for each different weight group.

2.Maximum gross vehicle weight: Record the maximum gross vehicle weight for each vehicle in this fleet in the jurisdiction boxes where these vehicles will travel this registration year.

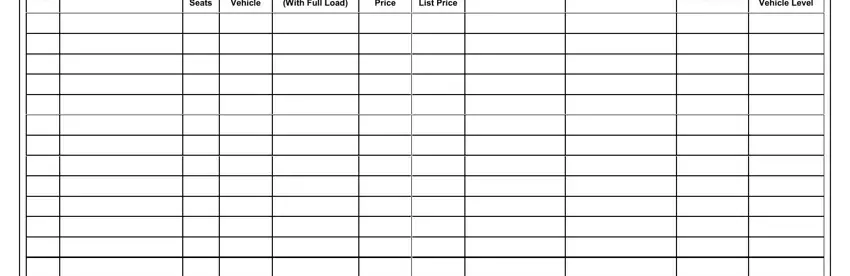

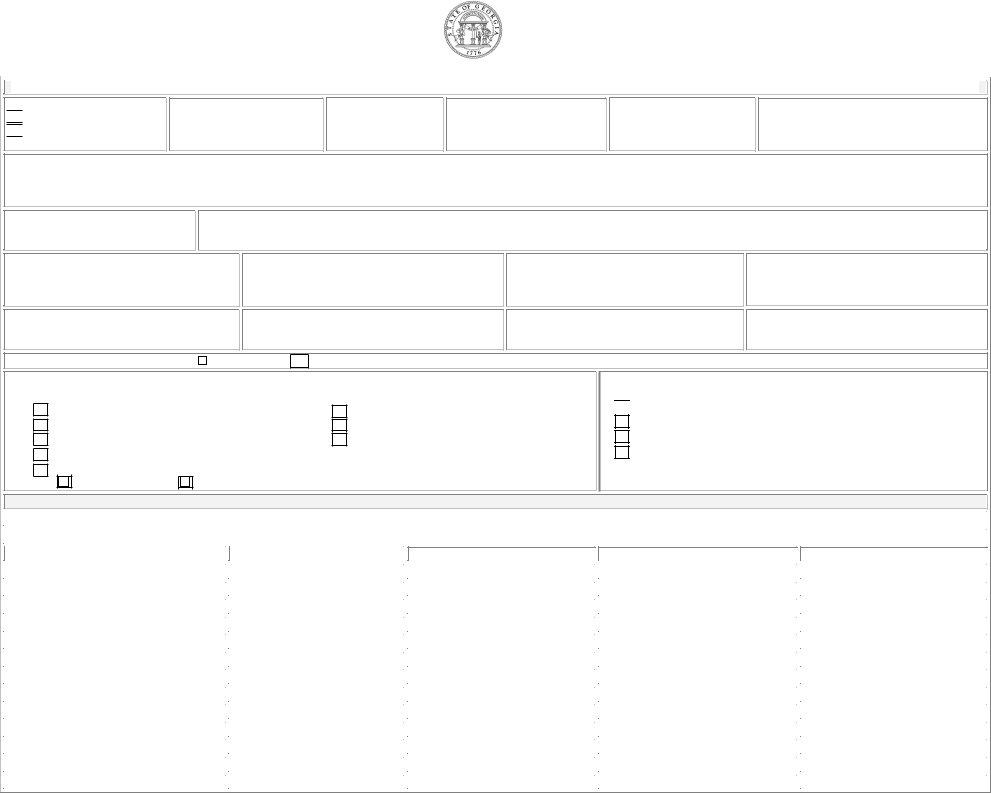

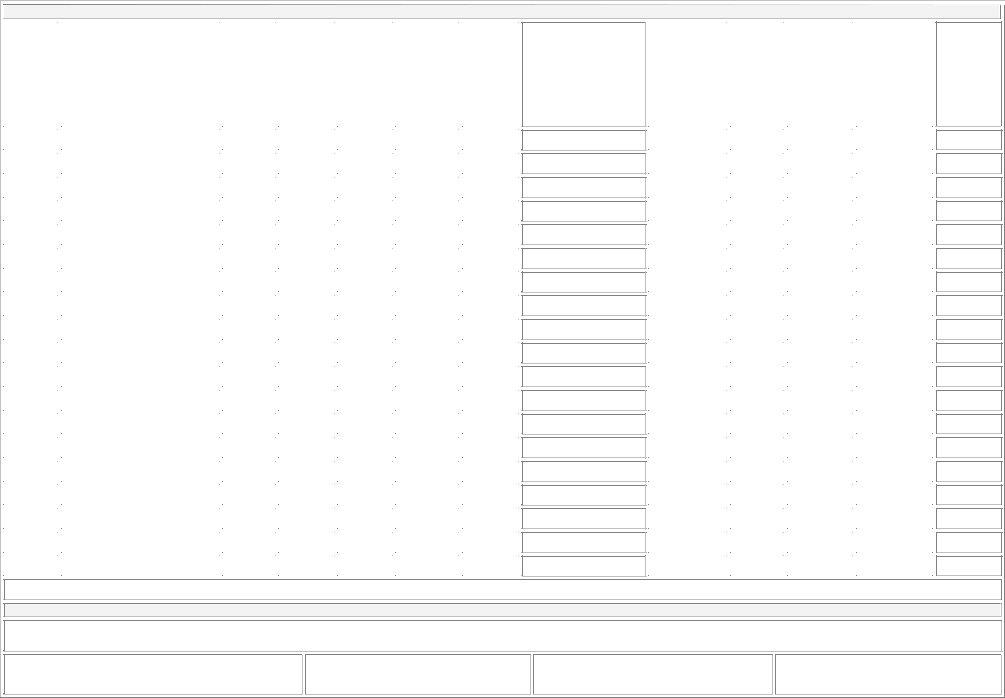

SECTION 3 Spaces are provided to record vehicle information for twenty (20) vehicles. If you need additional space, please complete a Vehicle Schedule A Continuation Form T-138A.

1.Owner’s Equipment or Unit Number: Record the equipment or unit number for each vehicle. The Registrant/Carrier assigns this number. Each vehicle requires a different unit or equipment number. Numbers cannot be reused in a license year.

2.Vehicle Identification #: Record the vehicle’s complete vehicle identification number (VIN) as it appears on the vehicle and on the vehicle’s title. Compare the VIN on the vehicle with the number on the vehicle’s title and ad valorem tax receipt. The VIN on each must match.

3.# of Axles or Seats: Record the number of axles, including the steering axle, for trucks. Please do not include trailer axles with truck axles. Record the number of seats for buses only.

4.Empty Weight of Vehicle: Record the empty weight of the tractor or truck by itself.

IRP Vehicle Schedule A Form T-138 Instructions (Continued) - ( Rev. 4/2013) |

Page 4 of 4 |

5.Combined Gross Weight: For vehicles in combination, record the combined weight of the tractor, trailer, and the heaviest cargo that the vehicle can carry. This weight should be the same as you declared for the Federal Highway Vehicle Use Tax and as shown on your vehicle’s ad valorem tax receipt. Please do not show a combined gross weight for trailers.

6.Vehicle’s Purchase Price: Record the price the current owner paid for the vehicle minus any trade-in, sales or use tax and finance charges.

7.Factory List Price: Record the vehicle’s factory list price. Please do not include cents.

8.Owner’s Name: Record the vehicle owners’ names as they appear on the vehicle’s title. For vehicles under a lease, enter the leasing company’s name as it appears on the vehicle’s title.

9.GA Title #: Record the vehicle’s valid Georgia title number in this field. Out-of-state title numbers are not acceptable.

10.Short Term Lease: Record a ‘Y’ for ‘Yes’ if the vehicle will be rented or leased for less than thirty (30) days to a Motor Carrier.

11.Motor Carrier’s Federal Employer Identification Number (FEIN): Record Motor Carrier’s Federal Employer Identification Number (F.E.I.N).

12.U.S. D.O.T. Number: Record the Carrier’s U.S. D.O.T. Number. The Motor Carrier is required to up-date their Motor Carrier Identification Report (Form MCS-150) annually. A U.S. D.O.T. number can be applied for or a Motor Carrier Services Identification Report (Form T-MCS-150) updated from the Federal Motor Carriers Safety Administration’s website, http://safer.fmcsa.dot.gov/. From their website, click on ‘FMCSA Registration & Updates’. Motor carrier forms not updated within the last year will not be accepted.

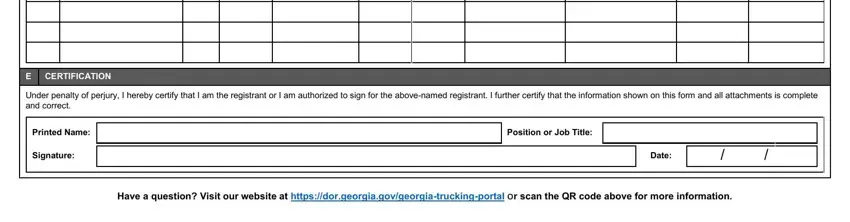

Section 4

1.Signature, Printed Name, Position or Job Title & Date: The Registrant/Carrier or his/her authorized agent is required to sign this completed application, type or print his/her name, enter his/her position or job title with the company, and record the date (month, day and year) signed.

Please do not remit money with this application. You will be billed later.

Applications for Georgia IRP registration may be submitted by mail or in-person as follows:

Mailing Address: ATTN: Commercial Vehicle - IRP Section, Department of Revenue, Motor Vehicle Division, P. O. Box 740382, Atlanta, Georgia 30374-0382

In-Person Address: Commercial Vehicle – IRP Section Window, Department of Revenue, Motor Vehicle Division, 4125 Welcome All Rd, Atlanta, Georgia 30349 Office open from 7:30 a.m. to 4:30 p.m. Monday through Friday, excluding state holidays.

Georgia IRP Section’s Telephone Number: 1-855-406-5221

E-Mail Address: commercial.vehicles@dor.ga.gov

Department of Revenue’s Website: https://etax.dor.ga.gov