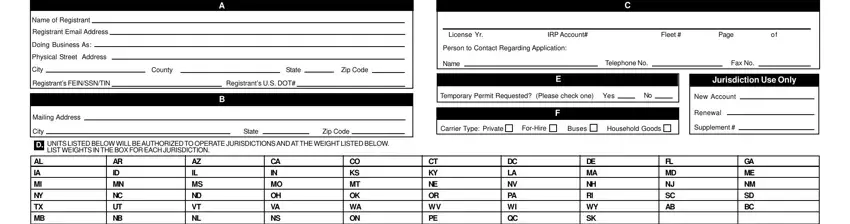

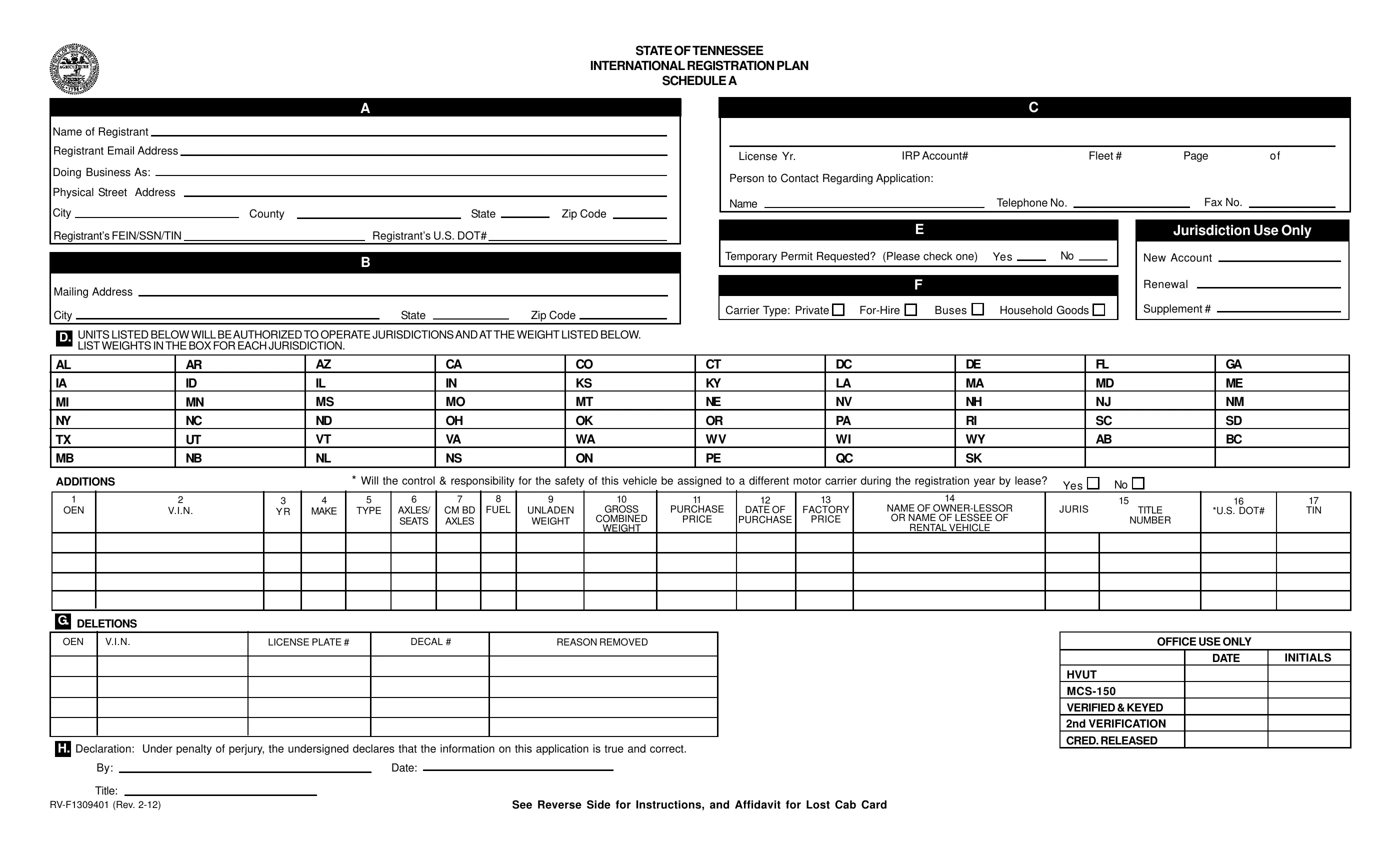

Item D: |

|

1. |

Determine the different gross/combined gross weight for your account. |

|

(Example - 5 vehicles @ 56,000 and 5 vehicles @ 80,000) |

2. |

Complete 1 Schedule A for a new account or an established account for each group of vehicles defined in Item #1. |

3. |

If you require a special weight for a particular jurisdiction, write the desired weight in the jurisdictional box. |

|

(Example: Tennessee @ 56,000 and Kentucky @ 55,000 lbs.) |

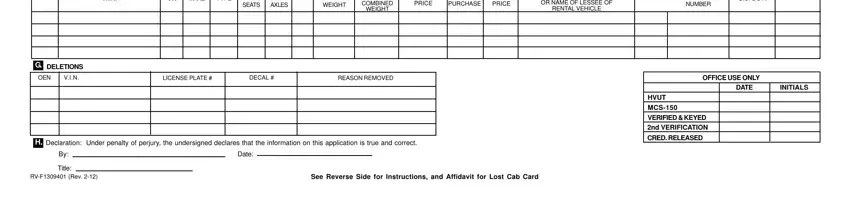

The following columns must be completed:

Column 1 - Assigned owner Equipment number (1-999999999) Column 2 - Vehicle identification number

Column 3 - Year of vehicle

Column 4 - Make of vehicle - Example: Dodge = Dodg, Ford = Ford, Freightliner = FRHT, GMC = GMC, International = INTL

Column 5 - Type: TT = Truck Tractor, TK = Single Truck, TR = Tractor, BS = Bus Column 6 - Number of axles for trucks. Number of seats for buses.

Column 7 - Number of combined axles. Column 8 - Fuel Type - D = Diesel, G = Gas Column 9 - Unladen weight = Empty weight

Column 10 - Gross/combined weight = Registered weight

Column 11 - Purchase price = Purchase price of vehicle. (Excluding trade-in and sales tax, but including accessories or modifications).

Column 12 - Purchase Date - Date vehicle was purchased.

Column 13 - Factory Price - The manufacturer’s list price of the vehicle when new, including all improvements and modifications attached to the vehicle. Trade-in and sales or use tax should be excluded.

Column 14 - Name of Owner (Lessor) or Name of Lessee of rental vehicle.

Column 15 - Title number - Enter the jurisdiction and the title number of the vehicle being added.

Column 16 - U.S. DOT# - The motor carrier responsible for the safety of each unit, if different from the registrant.

If you have multiple vehicles using the same U.S. DOT number, record the number in the first U.S. DOT number field for the first vehicle, then record “same” in the second vehicle’s U.S. DOT number field. If all subsequent fields are using the same U.S. DOT number, you can draw a line through the remaining U.S. DOT number fields.

Column 17 - Tennessee Identification Number (TIN) - The motor carrier responsible for the safety of each OEN, if different from the registrant.

Item E - Temporary Permit Requested - Place a √ in the appropriate box. Item F - Carrier Type: Place an X in the appropriate box.

Item G - Deletions - Complete all information requested.

Note: The original cab card and license plate must accompany an upgrade/downgrade transaction.

The original cab card must accompany a tag reassignment, change of ownership, weight increase/decrease transaction.

If the cab card cannot be returned, complete the affidavit for lost cab card Item I. Item H - Declaration: Signature, date and title of preparer must be completed.

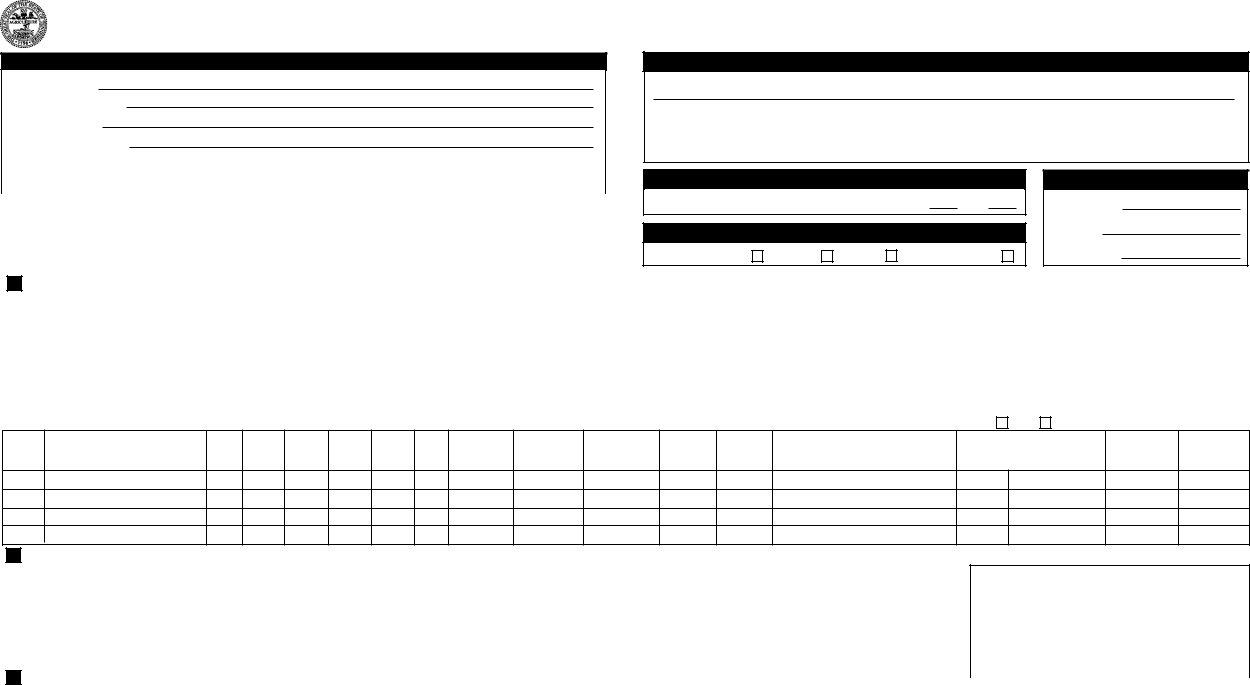

Item I - Affidavit for Lost Cab Card.

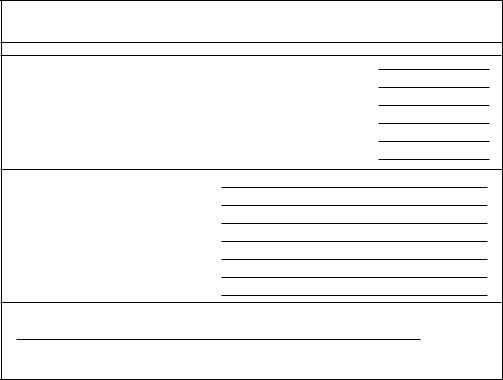

ITEM I

I certify that the International Registration Plan Apportioned Cab Card(s) issued for the owner equipment number(s) listed below have been lost.

OEN |

|

MAKE |

|

YEAR |

|

|

OEN |

|

MAKE |

|

YEAR |

|

|

OEN |

|

MAKE |

|

YEAR |

|

|

OEN |

|

MAKE |

|

YEAR |

|

|

OEN |

|

MAKE |

|

YEAR |

|

|

OEN |

|

MAKE |

|

YEAR |

|

|

Manufacturers Identification Number

Manufacturers Identification Number

Manufacturers Identification Number

Manufacturers Identification Number

Manufacturers Identification Number

Manufacturers Identification Number

Manufacturers Identification Number

Registrant/Representative Signature

In the event I locate the above mentioned cab card(s), I will immediately forward them to the Department of Revenue, International Registration Plan Office.