Making use of the online tool for PDF editing by FormsPal, you are able to fill out or modify subject 27779k here and now. To make our tool better and less complicated to work with, we constantly come up with new features, bearing in mind suggestions from our users. Starting is effortless! All you have to do is adhere to the following easy steps below:

Step 1: Just hit the "Get Form Button" at the top of this page to launch our pdf form editor. This way, you'll find everything that is necessary to work with your file.

Step 2: With the help of our handy PDF file editor, you'll be able to do more than merely fill in blank form fields. Edit away and make your forms seem perfect with custom text incorporated, or adjust the file's original content to perfection - all that supported by an ability to insert your own photos and sign the file off.

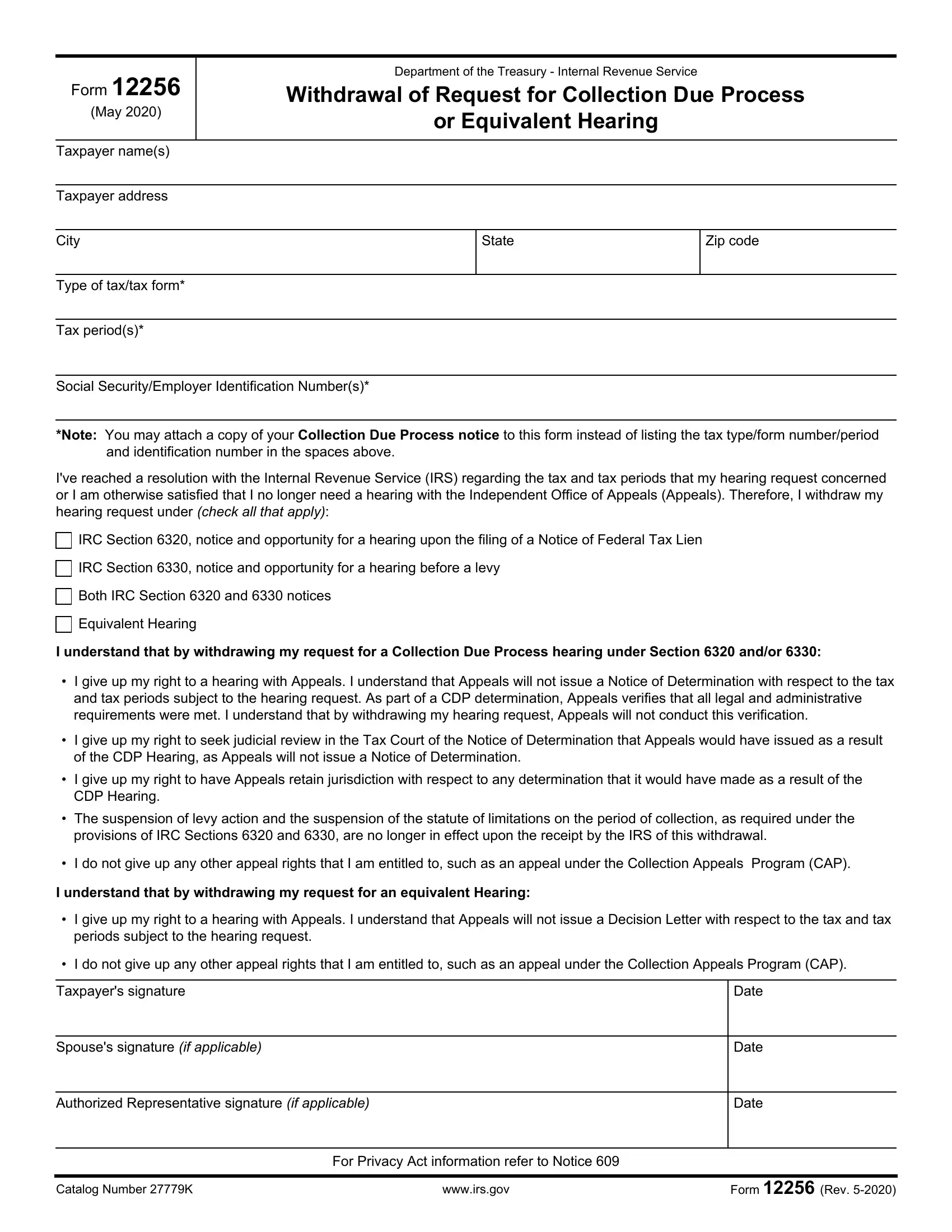

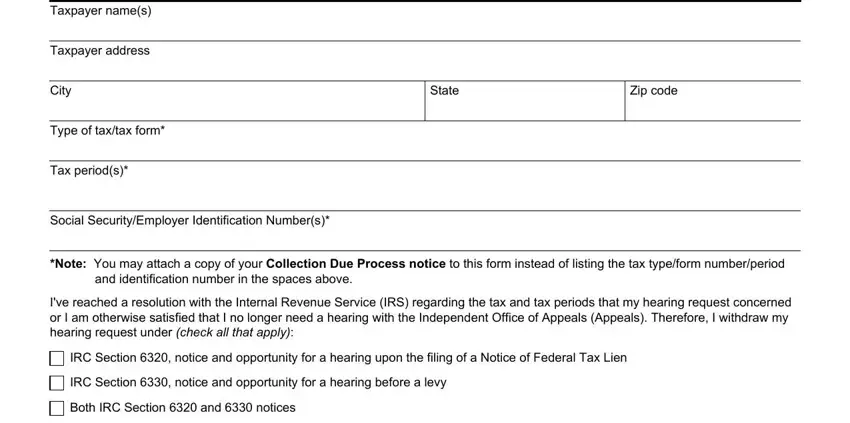

In order to fill out this form, be certain to provide the necessary details in each and every blank field:

1. While submitting the subject 27779k, be sure to complete all of the necessary blanks in their relevant area. It will help speed up the work, making it possible for your information to be processed quickly and accurately.

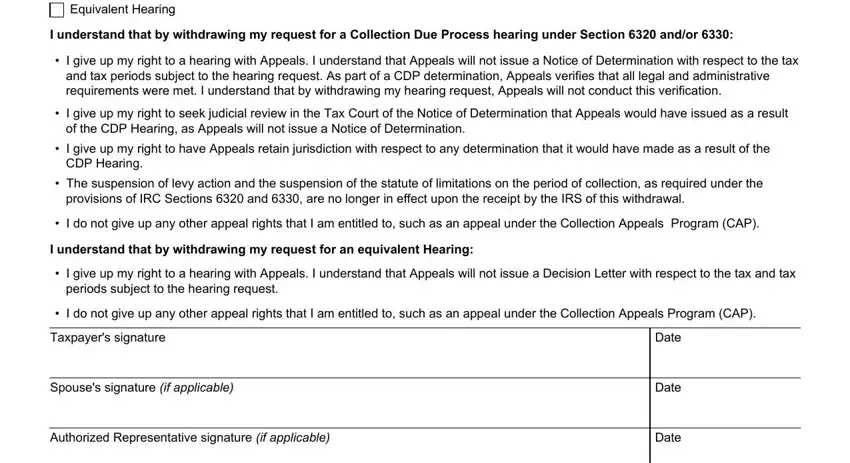

2. After this section is complete, it is time to include the essential details in Equivalent Hearing, I understand that by withdrawing, I give up my right to a hearing, and tax periods subject to the, I give up my right to seek, of the CDP Hearing as Appeals will, I give up my right to have, CDP Hearing, The suspension of levy action and, provisions of IRC Sections and, I do not give up any other appeal, I understand that by withdrawing, I give up my right to a hearing, periods subject to the hearing, and I do not give up any other appeal so you're able to move forward to the next step.

In terms of provisions of IRC Sections and and CDP Hearing, be certain that you don't make any mistakes in this current part. The two of these could be the most significant ones in this document.

Step 3: Prior to moving forward, you should make sure that blanks are filled in properly. When you think it's all good, click on “Done." Create a free trial option with us and obtain instant access to subject 27779k - download or modify from your personal account. FormsPal guarantees your information confidentiality with a protected method that never records or distributes any sort of private data involved in the process. Be assured knowing your files are kept safe whenever you use our tools!