You could prepare ftc complaint id theft easily with our online tool for PDF editing. Our team is aimed at providing you the best possible experience with our tool by constantly introducing new capabilities and improvements. Our editor is now even more helpful thanks to the latest updates! At this point, editing PDF files is a lot easier and faster than ever before. By taking a few simple steps, you may start your PDF editing:

Step 1: Click the orange "Get Form" button above. It is going to open our pdf tool so you can start filling in your form.

Step 2: The editor grants the opportunity to modify the majority of PDF forms in a range of ways. Transform it by adding customized text, adjust existing content, and add a signature - all manageable within minutes!

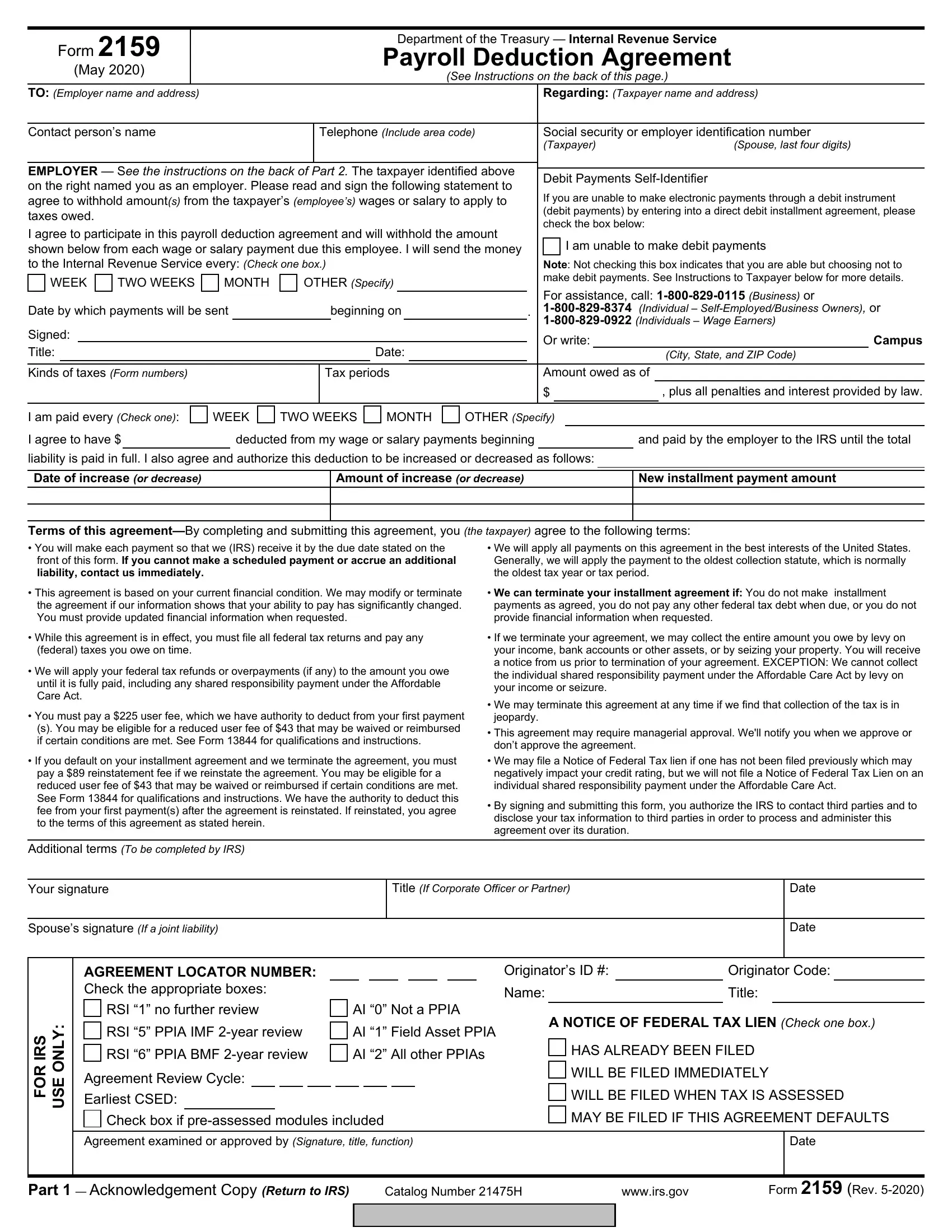

This document will require specific data to be typed in, so you should definitely take your time to enter precisely what is required:

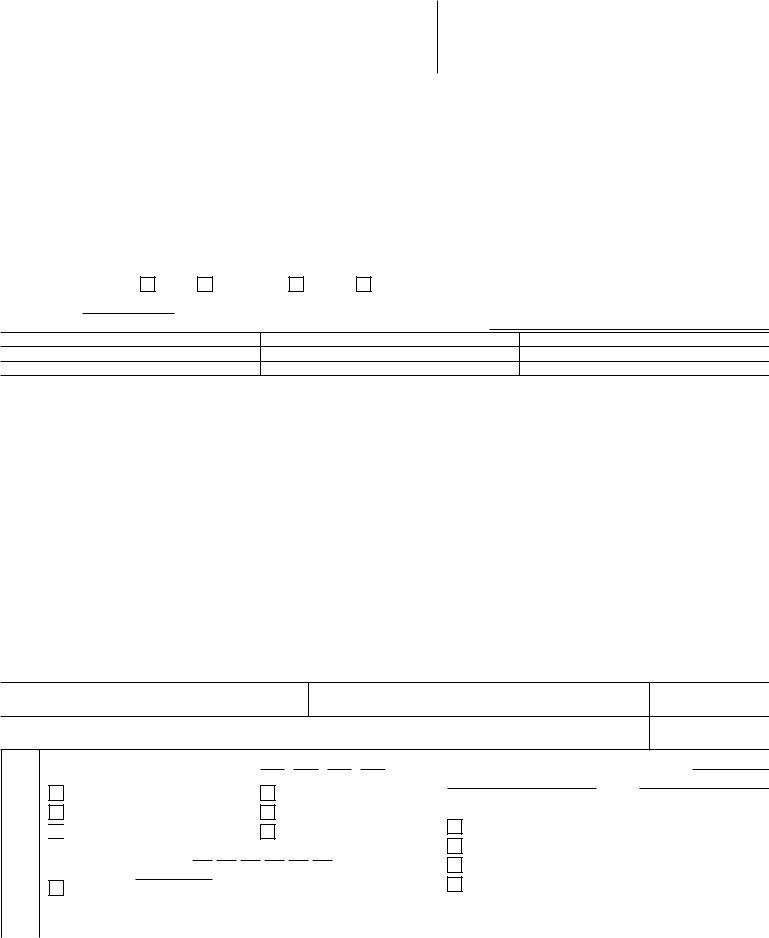

1. Begin filling out the ftc complaint id theft with a selection of major fields. Note all of the required information and ensure not a single thing missed!

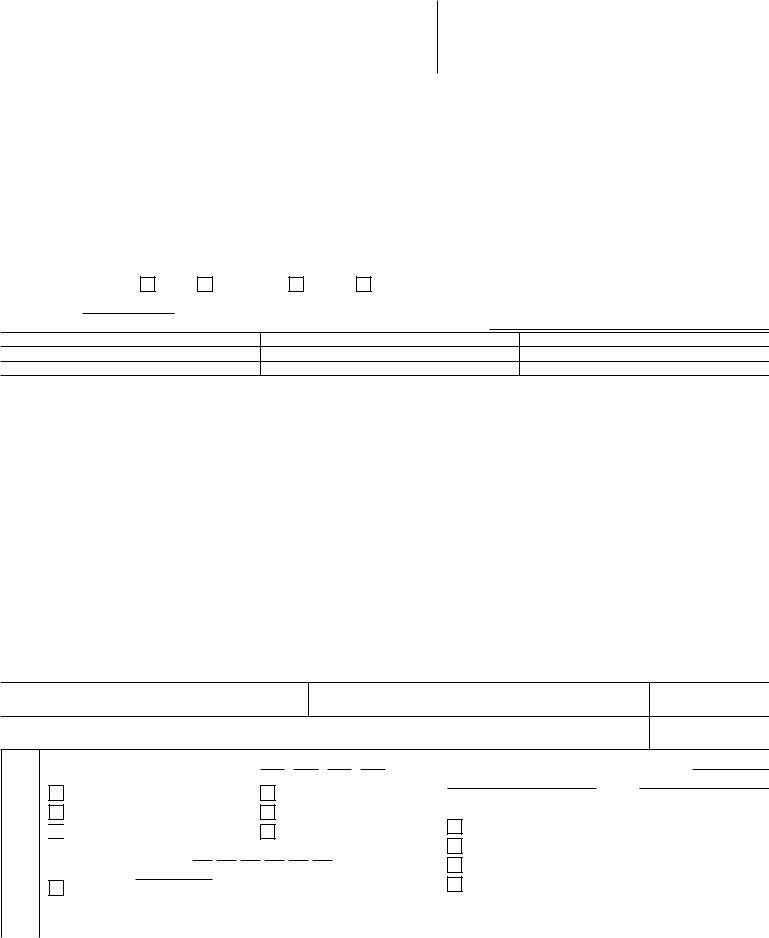

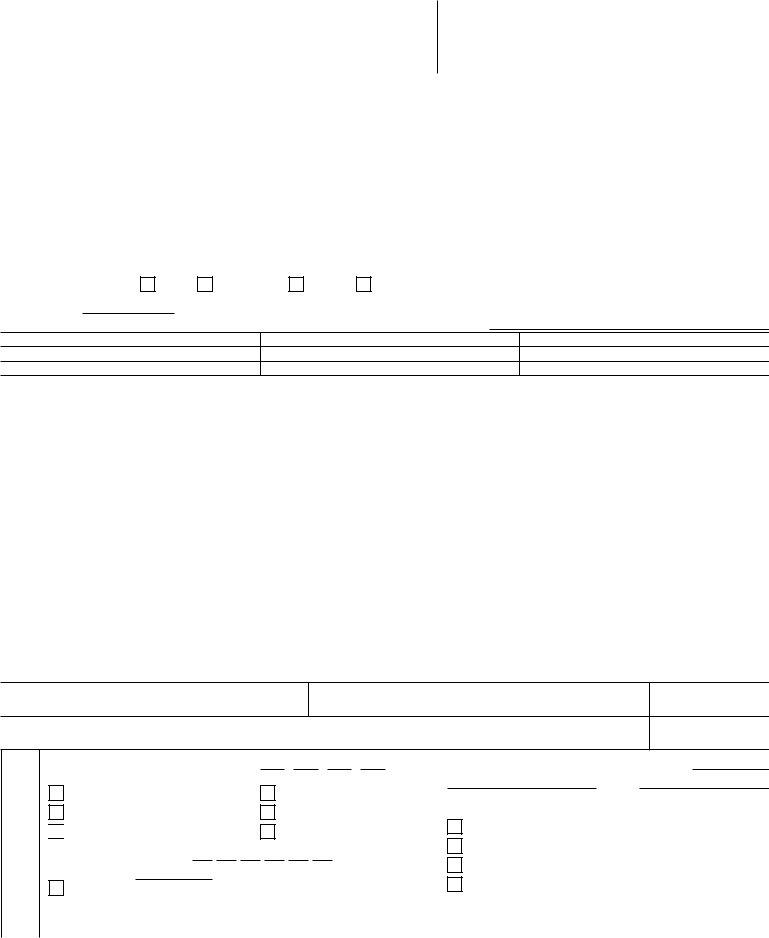

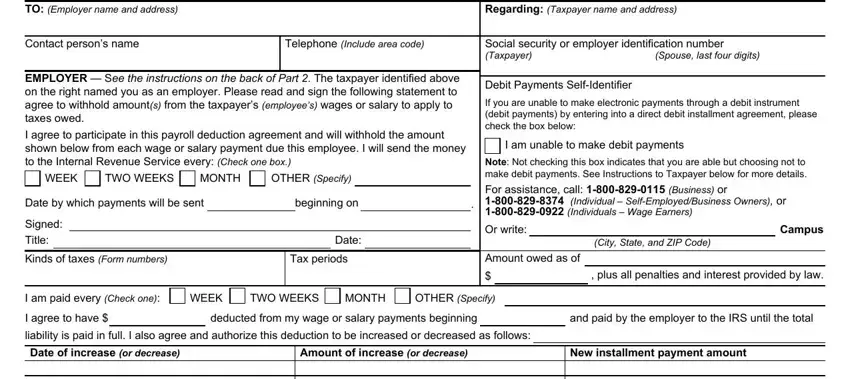

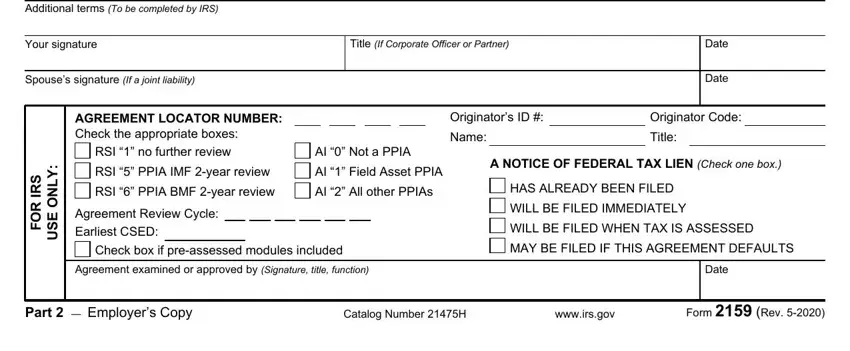

2. The subsequent stage is to fill in all of the following blank fields: Additional terms To be completed, Your signature, Title If Corporate Officer or, Spouses signature If a joint, Date, Date, AGREEMENT LOCATOR NUMBER Check the, Originators ID, Originator Code, Name, Title, S R, R O F, Y L N O E S U, and RSI no further review.

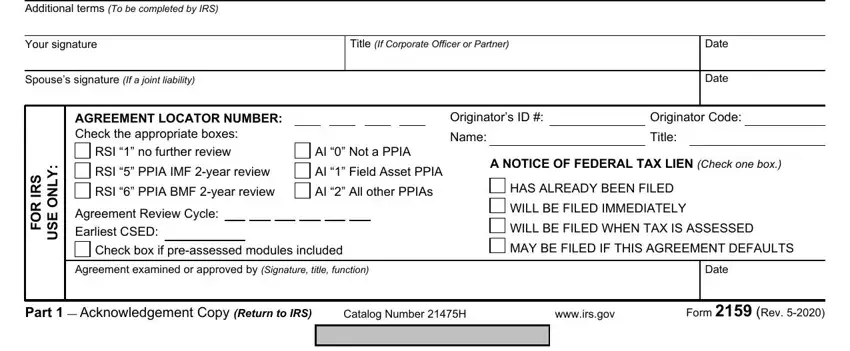

3. Completing TO Employer name and address, See Instructions on the back of, Regarding Taxpayer name and address, Contact persons name, Telephone Include area code, Social security or employer, Spouse last four digits, EMPLOYER See the instructions on, WEEK, TWO WEEKS, MONTH, OTHER Specify, Date by which payments will be sent, beginning on, and Signed Title is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Always be very attentive while filling in MONTH and TO Employer name and address, since this is the section where a lot of people make a few mistakes.

4. The form's fourth paragraph arrives with the following blank fields to type in your details in: Additional terms To be completed, Your signature, Title If Corporate Officer or, Spouses signature If a joint, Date, Date, AGREEMENT LOCATOR NUMBER Check the, Originators ID, Originator Code, Name, Title, S R, R O F, Y L N O E S U, and RSI no further review.

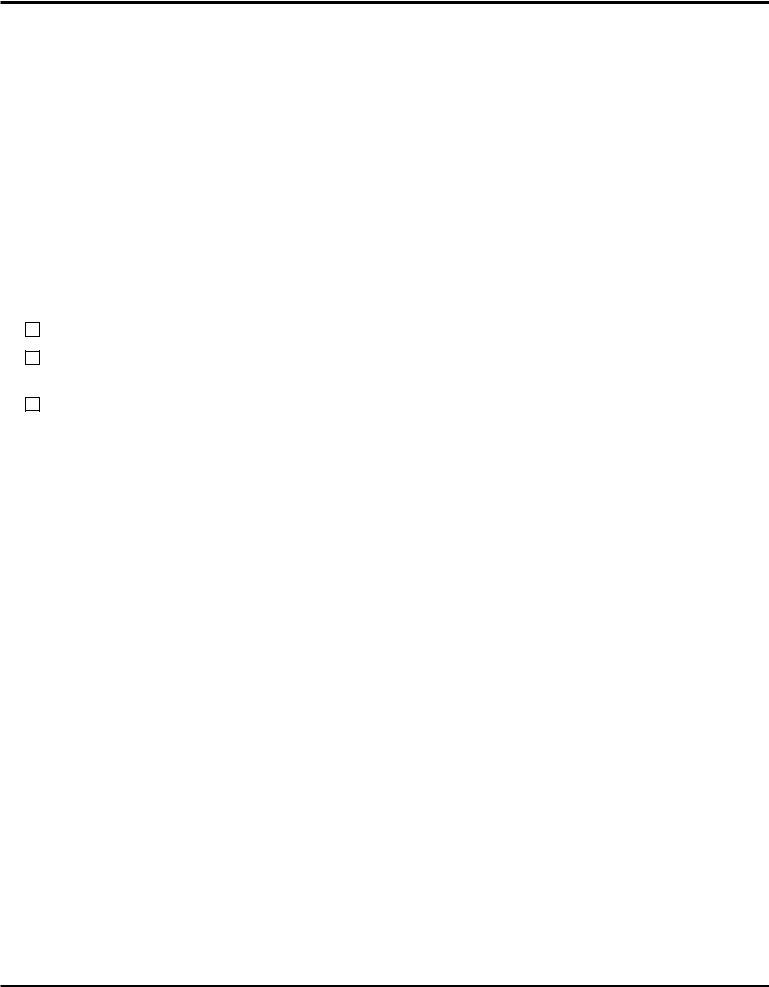

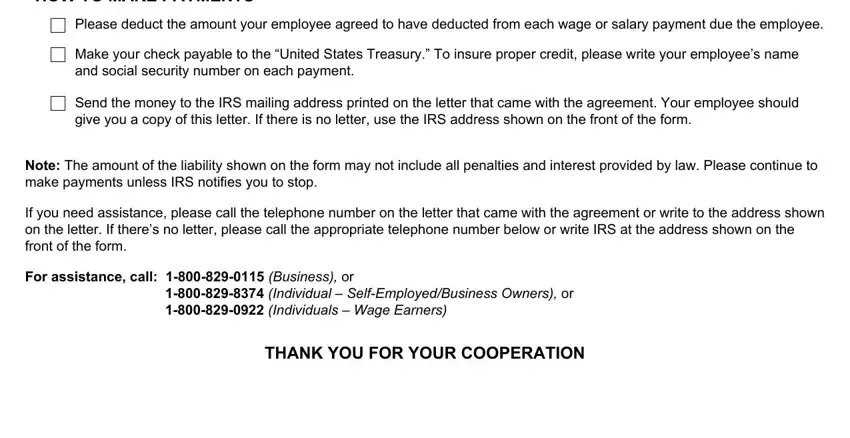

5. Because you get close to the finalization of your file, you'll notice a couple extra requirements that have to be satisfied. In particular, HOW TO MAKE PAYMENTS, Please deduct the amount your, Make your check payable to the, Send the money to the IRS mailing, Note The amount of the liability, If you need assistance please call, For assistance call Business or, Individual SelfEmployedBusiness, and THANK YOU FOR YOUR COOPERATION must all be done.

Step 3: Once you've looked over the information you filled in, click on "Done" to finalize your form. Try a 7-day free trial plan at FormsPal and get instant access to ftc complaint id theft - which you'll be able to then begin using as you want from your personal cabinet. FormsPal guarantees your data privacy by using a protected method that never saves or shares any type of private data used. Rest assured knowing your files are kept confidential each time you work with our tools!