General Instructions

Section references are to the Internal Revenue Code unless otherwise noted.

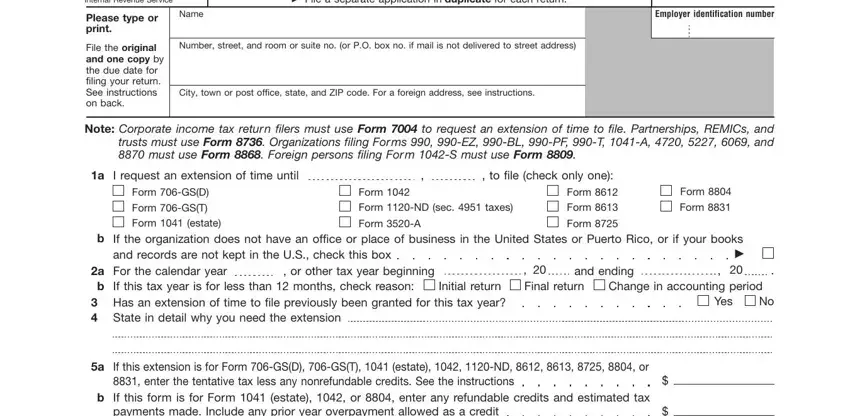

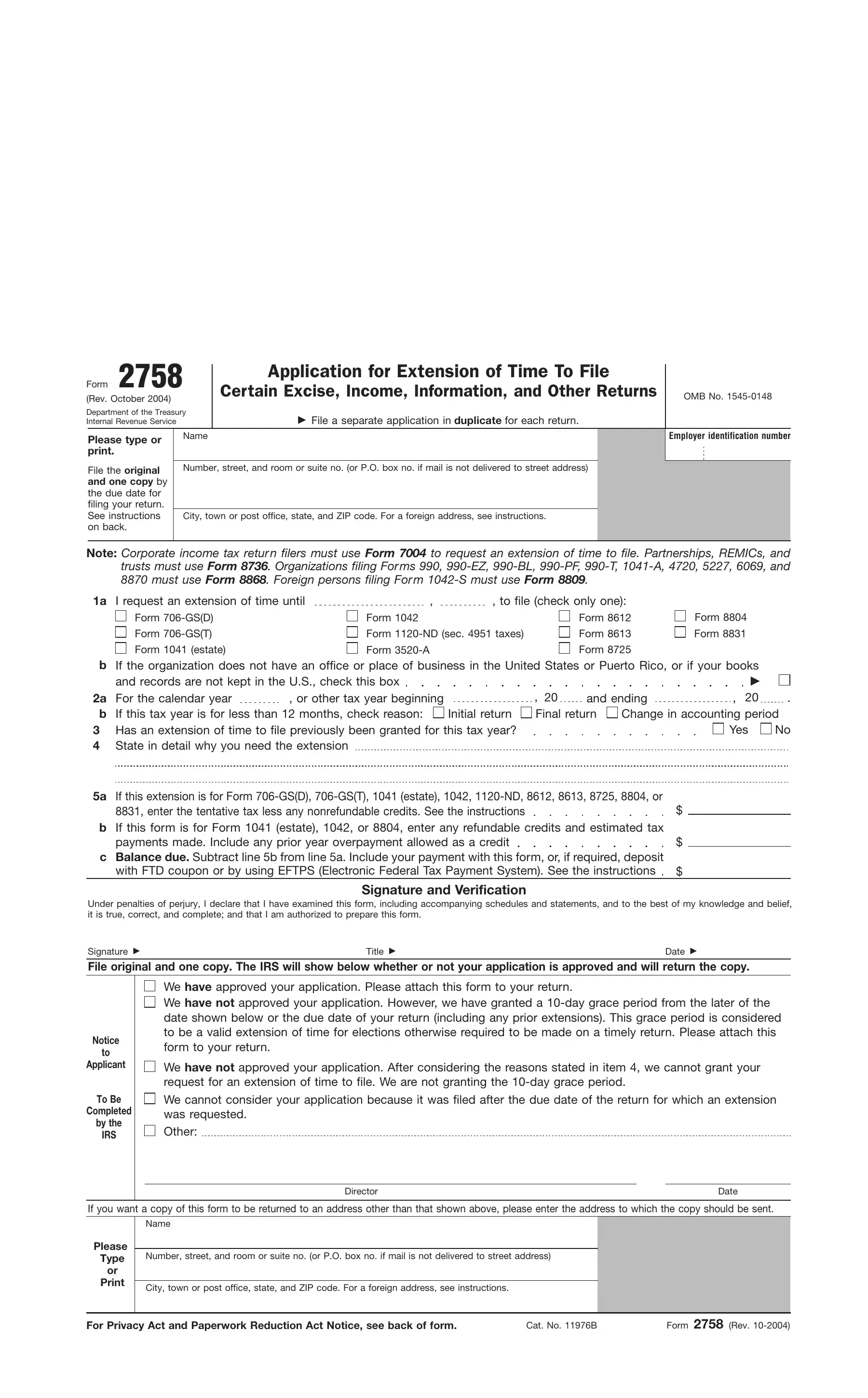

Purpose of form. Use Form 2758 to request an extension of time to file any of the returns listed under line 1a, page 1.

When to file. File Form 2758 by the regular due date (or the extended due date if a previous extension was granted) of the return for which an extension is needed. However, to avoid a possible late filing penalty in case your request for an extension is not granted, you should file Form 2758 early enough to allow the IRS to consider your application and reply before the return’s regular or extended due date.

Where to file. Generally, file the original and one copy of this form with the Internal Revenue Service Center serving the taxpayer’s address.

However, file this form with the Internal Revenue Service Center, Philadelphia, PA 19255, if you are requesting an extension for Form 1042, 3520-A, 8804, or if you do not have a principal office or place of business in the United States.

No blanket requests. File a separate

Form 2758 for each return for which you are requesting an extension of time to file. This extension will apply only to the specific return checked on line 1a. It does not extend the time for filing any related returns. For example, an extension of time for filing an estate’s income tax return will not apply to the individual income tax returns of the beneficiaries.

Also, trustees and disqualified persons filing Form 1120-ND to report section 4951 taxes must each file separate applications.

Reasons for extension. The IRS will grant a reasonable extension of time for filing a return. You must file an application on time and show reasonable cause why the return cannot be filed by the due date. Generally, we will consider the application based on your efforts to fulfill the filing requirements, rather than on the convenience of your tax return preparer. However, if your tax return preparer is not able to complete the return by the due date for reasons beyond his or her control or, in spite of reasonable efforts, you are not able to get professional help in time to file, the IRS will generally grant the extension.

Caution: If an extension is granted and the IRS later determines that the statements made on this form are false and misleading, the extension is null and void. You will be subject to the late filing penalty explained below.

Extension period. Generally, we will not grant an extension of time for more than 90 days unless sufficient need for an extended period is clearly shown. If you need an additional extension of time, file a second Form 2758 before the original extension expires. The total extension may not be for more than 6 months except for taxpayers who are abroad.

Interest. Interest is charged on any tax not paid by the regular due date of the return from the due date until the tax is paid. It will be charged even if you have been granted an extension or have shown reasonable cause for not paying on time.

Late payment penalty. Generally, a penalty of 1⁄2 of 1% of any tax not paid by the due date is charged for each month or part of a month that the tax remains unpaid. The penalty cannot exceed 25% of the amount due. The penalty will not be charged if you can show reasonable cause for not paying on time.

Late filing penalty. A penalty is charged if the return is filed after the due date (including extensions) unless you can show reasonable cause for not filing on time. The penalty is generally 5% of the tax not paid by the regular due date (even if an extension of time to pay has been granted) for each month or part of a month that the return is late, up to a maximum of 25% of the unpaid tax. For an income tax return filed more than 60 days late, the minimum penalty is $100 or the balance of the tax due on the return, whichever is smaller.

Different late filing penalties apply to information returns. See the specific form instructions for details.

Specific Instructions

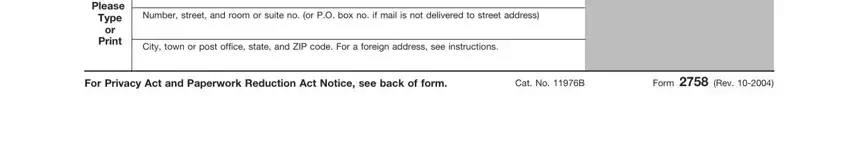

Address. If your address is outside the United States, or its possessions or territories, enter the information on the line for “City, town or post office, state, and ZIP code” in the following order: city, province or state, and the name of the country. Follow the foreign country’s practice in placing the postal code in the address. Do not abbreviate the country’s name.

If your mailing address has changed since you filed your last return, use Form 8822, Change of Address, to notify the IRS of the change. A new address shown on Form 2758 will not update your record.

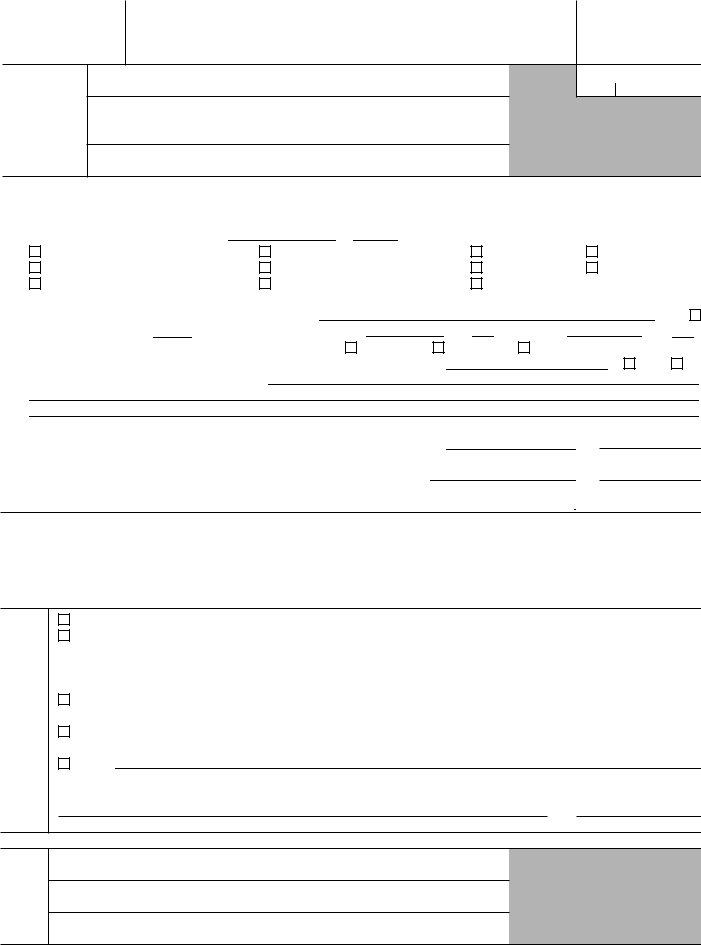

Line 1a. Check only one box. You must file a separate Form 2758 for each return for which you are requesting an extension.

Line 1b. If the box on line 1b is checked and your partnership’s books and records are kept outside of the United States and Puerto Rico, Form 8804 is due by the 15th day of the 6th month from the end of the partnership’s tax year. Otherwise, Form 8804 is due on the 15th day of the 4th month from the end of the partnership’s tax year.

Line 4. Describe in detail the reasons causing delay in your filing the return. We cannot approve applications that give incomplete reasons, such as “illness” or “practitioner too busy,” without adequate explanations. If a request for an extension is made only to gain time, we will deny both the extension request and the 10-day grace period. If you are requesting an extension for filing your initial return (i.e., you are adopting a tax year) state “Adoption of Tax Year” on line 4; no further explanation is required.

Line 5a. See the specific form and instructions to estimate the amount of the tentative tax, reduced by any nonrefundable credits. If you expect this amount to be zero, enter -0-.

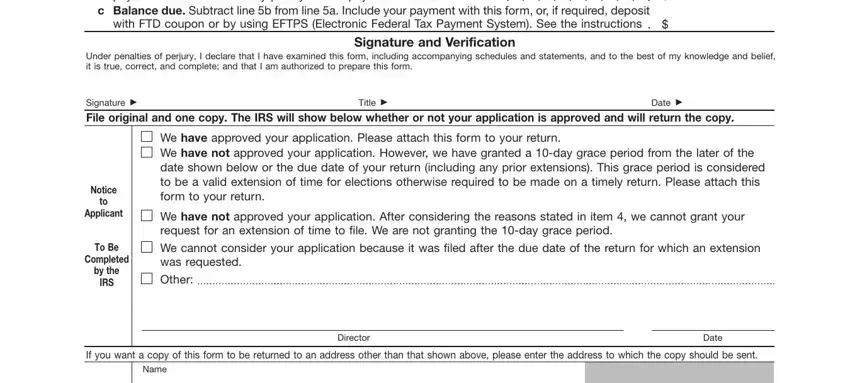

Line 5c—Balance due. Form 2758 does not extend the time to pay tax. To avoid interest and penalties, send the full balance due with Form 2758.

Caution: If you are requesting an extension of time to file Form 1042, see the deposit rules in the instructions for that form to determine how payment must be made.

Signature. The person who signs this form may be:

●A distributee, or an authorized representative of a distributee, filing Form 706-GS(D).

●A trustee filing Form 706-GS(T) or 3520-A.

●A principal officer of a corporate organization filing Form 8612 or 8613.

●A trustee or disqualified person filing Form 1120-ND for their own liability.

●A fiduciary, trustee, executor, administrator, or an officer representing the fiduciary or trustee filing Form 1041 for an estate.

●A withholding agent filing Form 1042.

●A person filing Form 8725 or 8831.

●A general partner or limited liability company member of a partnership filing Form 8804.

●An attorney or certified public accountant qualified to practice before the IRS.

●A person enrolled to practice before the IRS.

●A person holding a power of attorney.

Privacy Act and Paperwork Reduction Act Notices. For the Privacy Act Notice regarding extensions of forms which may be filed by individuals, see the separate instructions for those forms. We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

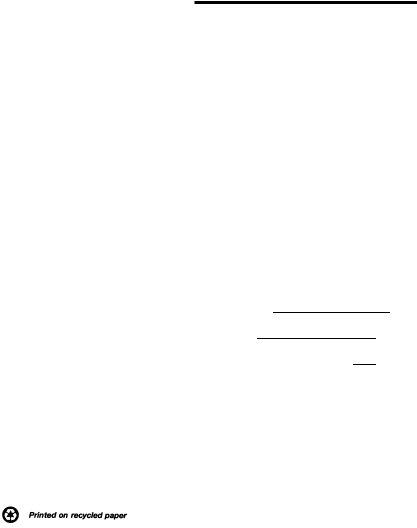

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is:

Recordkeeping |

5 hr. |

Learning about the law |

|

or the form |

12 min. |

Preparing and |

|

sending the form to the IRS |

16 min. |

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. You can write to the Internal Revenue Service, Tax Products Coordinating Committee, SE:W:CAR:MP:T:T:SP, 1111 Constitution Ave. NW, Washington, DC 20224. Do not send the tax form to this address. Instead, see Where to file above.