irs power of attorney can be filled out effortlessly. Simply open FormsPal PDF editor to get the job done in a timely fashion. We are committed to giving you the ideal experience with our editor by regularly releasing new capabilities and improvements. Our tool is now much more helpful with the most recent updates! Now, working with PDF forms is a lot easier and faster than before. To get the process started, go through these simple steps:

Step 1: Click on the orange "Get Form" button above. It will open our tool so that you can start filling in your form.

Step 2: The editor will let you change most PDF documents in a range of ways. Improve it by adding personalized text, correct what's already in the file, and add a signature - all at your convenience!

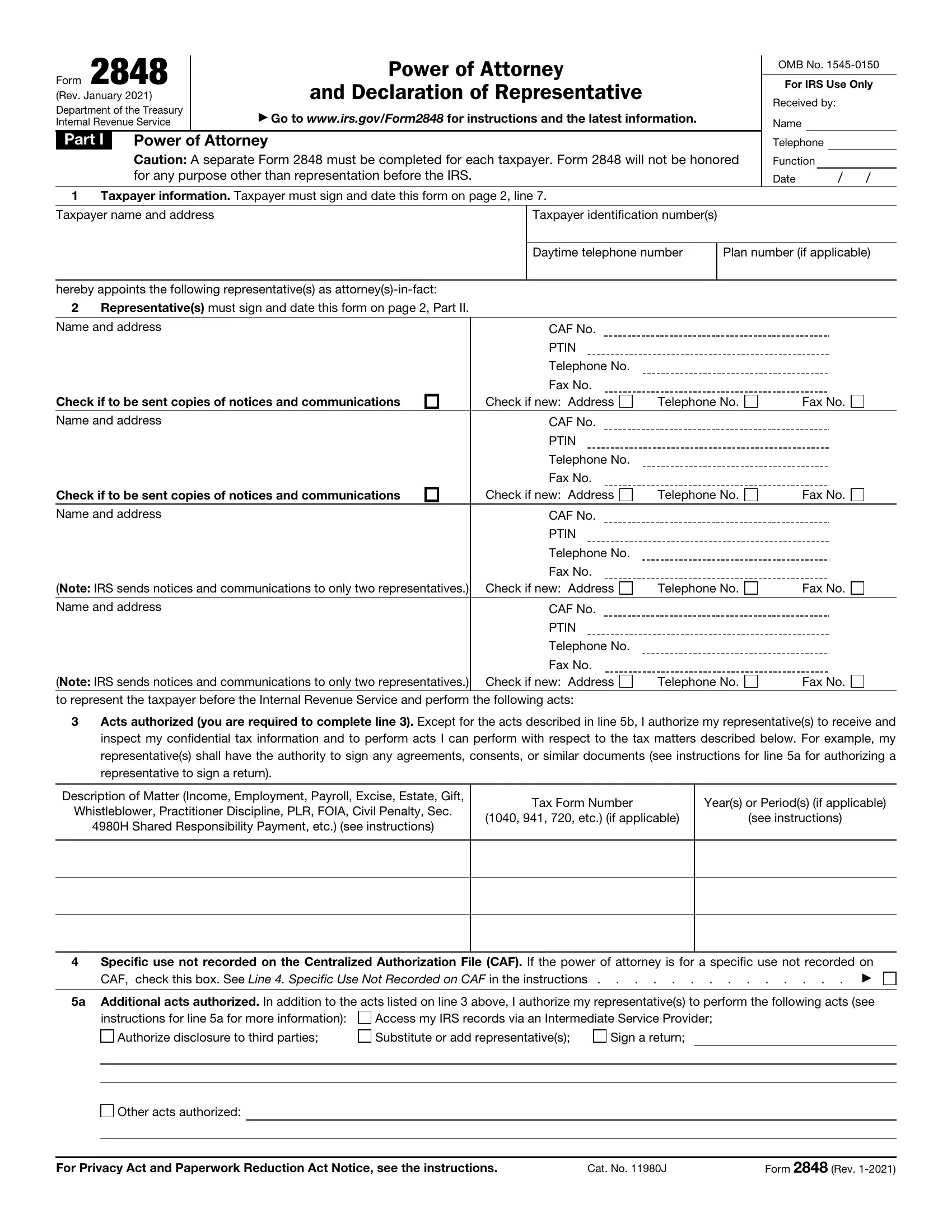

This PDF form will require specific information to be entered, so you should definitely take whatever time to type in what is expected:

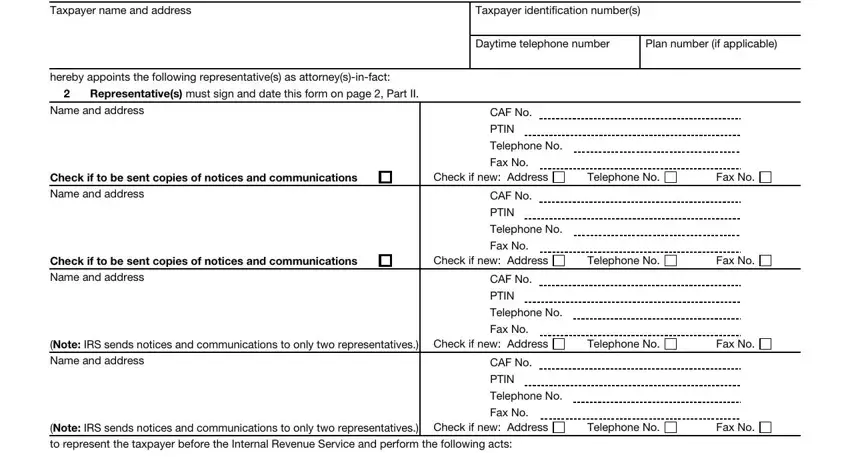

1. The irs power of attorney will require specific information to be entered. Be sure the subsequent fields are filled out:

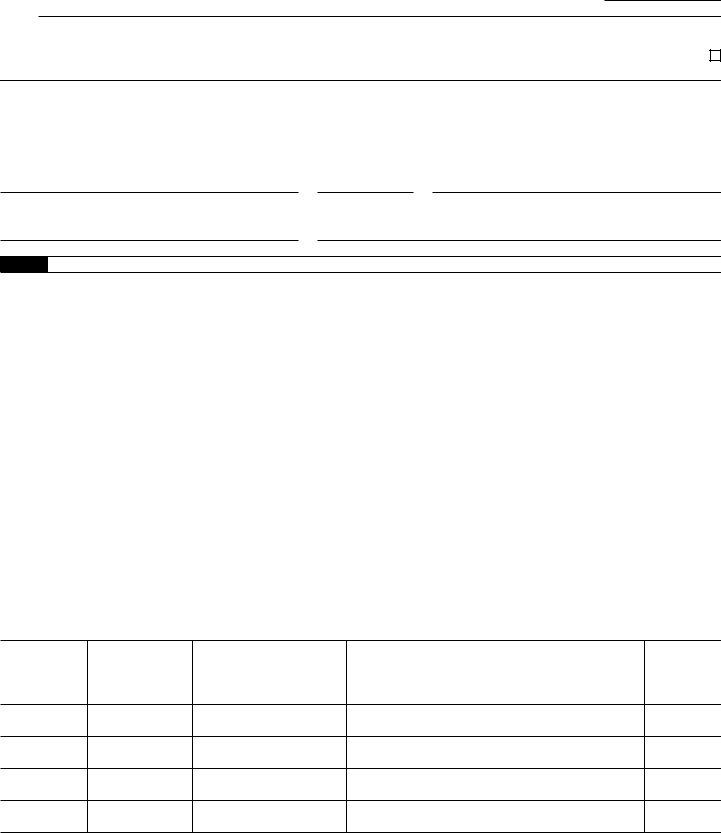

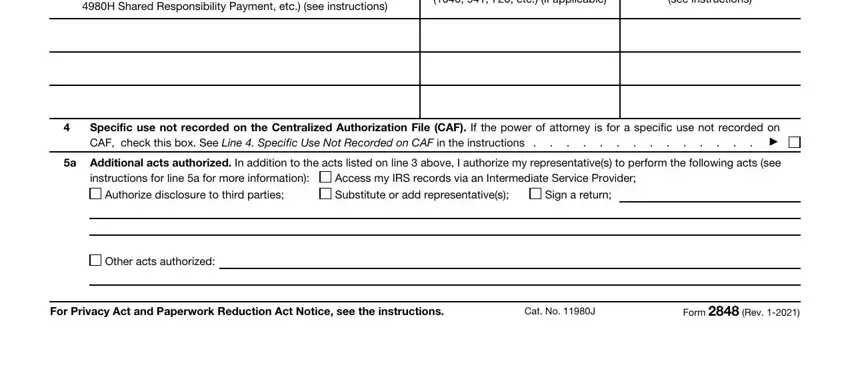

2. Right after performing this section, head on to the subsequent stage and enter all required particulars in these fields - H Shared Responsibility Payment, etc if applicable, see instructions, Specific use not recorded on the, Additional acts authorized In, Access my IRS records via an, Authorize disclosure to third, Substitute or add representatives, Sign a return, Other acts authorized, For Privacy Act and Paperwork, Cat No J, and Form Rev.

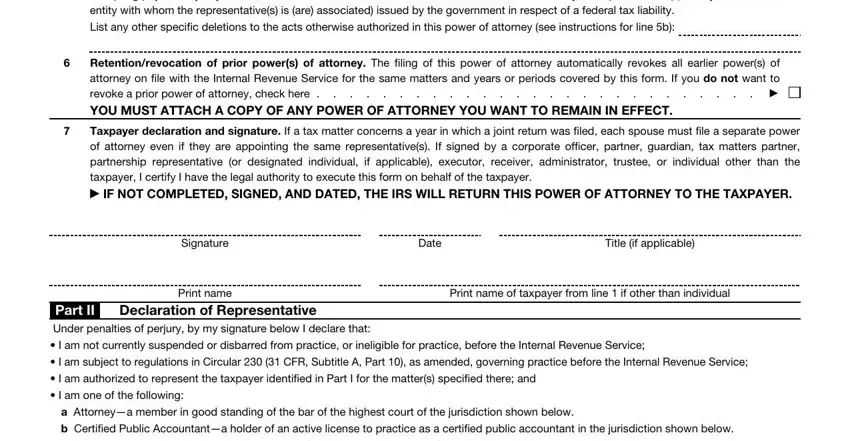

3. This next section is all about Specific acts not authorized My, List any other specific deletions, Retentionrevocation of prior, YOU MUST ATTACH A COPY OF ANY, Taxpayer declaration and signature, Signature, Print name, Date, Title if applicable, Print name of taxpayer from line, Part II, Declaration of Representative, Under penalties of perjury by my, I am not currently suspended or, and I am subject to regulations in - type in every one of these blank fields.

4. It's time to start working on this fourth segment! In this case you will have all of these Designation Insert above letter ar, if applicable, number if applicable, and Form Rev form blanks to complete.

Those who use this form frequently make some errors while completing if applicable in this section. Remember to read twice everything you type in here.

Step 3: When you've reviewed the information entered, just click "Done" to complete your document creation. Join us now and instantly access irs power of attorney, ready for downloading. Every single modification you make is conveniently saved , meaning you can customize the pdf later if required. FormsPal is devoted to the confidentiality of all our users; we make sure all information coming through our system stays secure.