Using PDF documents online can be easy using our PDF editor. You can fill out irs 706 na here within minutes. The tool is continually upgraded by us, receiving powerful functions and becoming better. Getting underway is simple! Everything you need to do is take the following easy steps down below:

Step 1: Click on the "Get Form" button above. It will open our editor so you can start completing your form.

Step 2: Using this handy PDF file editor, you are able to do more than merely complete forms. Edit away and make your docs look high-quality with custom textual content incorporated, or fine-tune the original input to perfection - all supported by an ability to add just about any pictures and sign the PDF off.

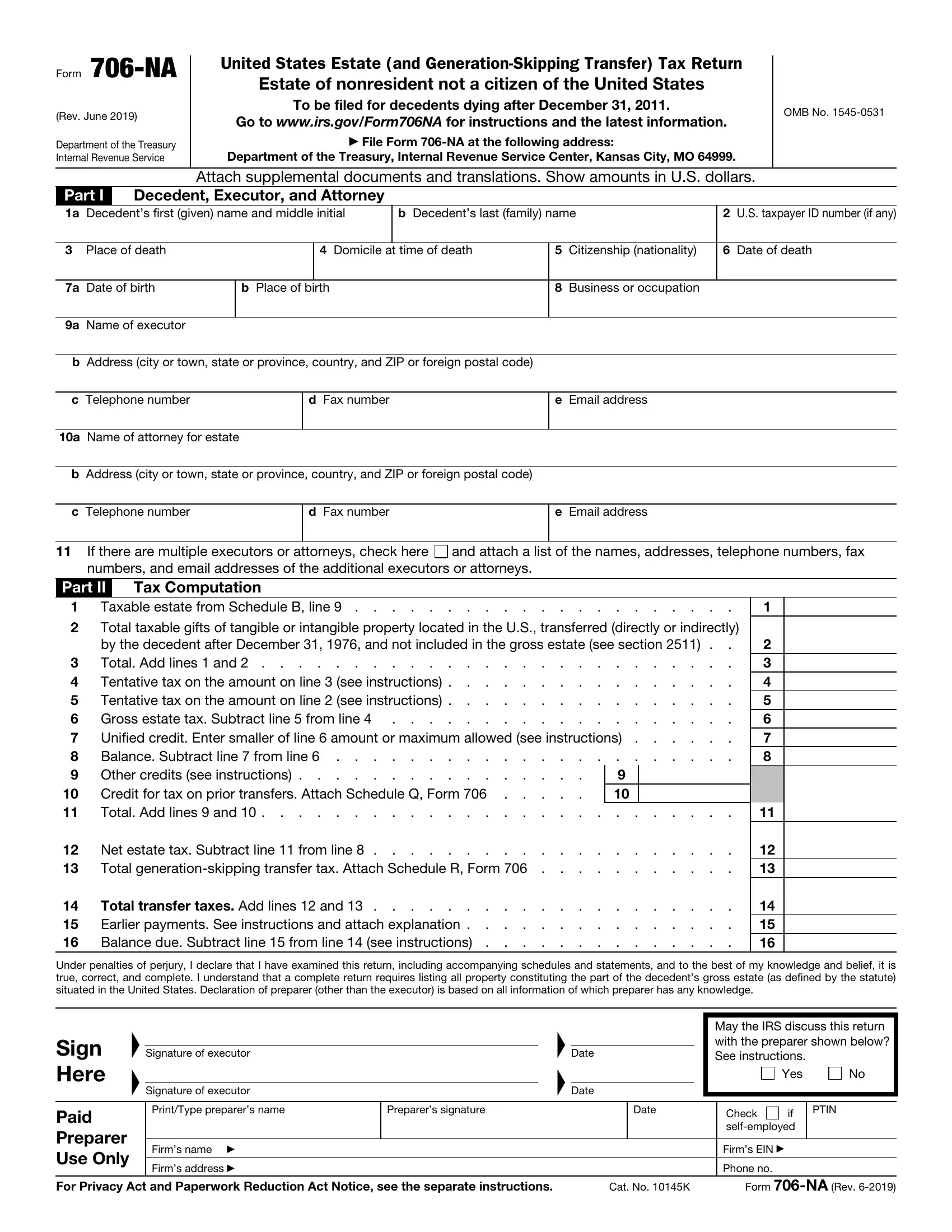

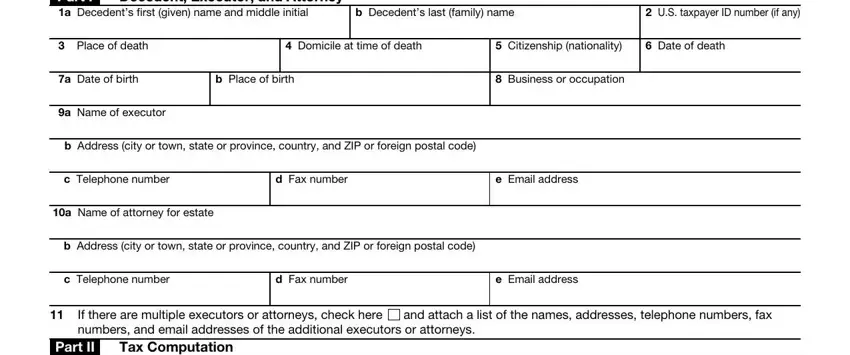

When it comes to blank fields of this specific document, this is what you want to do:

1. The irs 706 na will require certain information to be typed in. Ensure that the subsequent blank fields are completed:

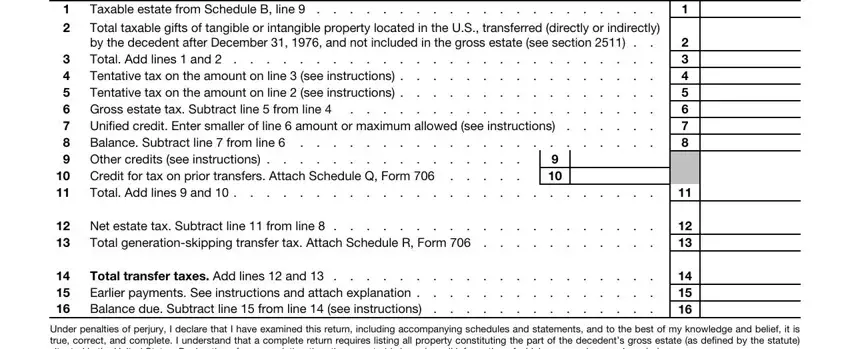

2. Once your current task is complete, take the next step – fill out all of these fields - Taxable estate from Schedule B, Total taxable gifts of tangible or, Gross estate tax Subtract, Credit for tax on prior, Total Add lines and, Net estate tax Subtract line, Total generationskipping transfer, Total transfer taxes Add lines, and Under penalties of perjury I with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

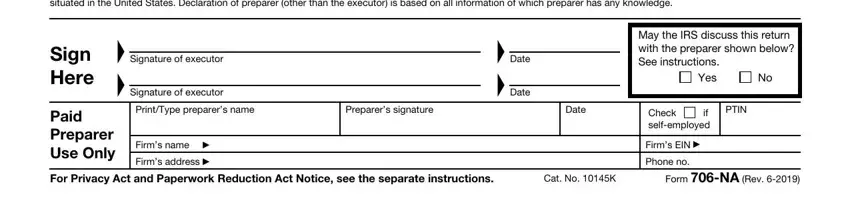

3. Through this step, check out Under penalties of perjury I, Sign Here, Signature of executor Signature, Date Date, Paid Preparer Use Only, PrintType preparers name, Preparers signature, Date, Firms name, Firms address, May the IRS discuss this return, Yes, Check if selfemployed, PTIN, and Firms EIN. All these must be taken care of with utmost precision.

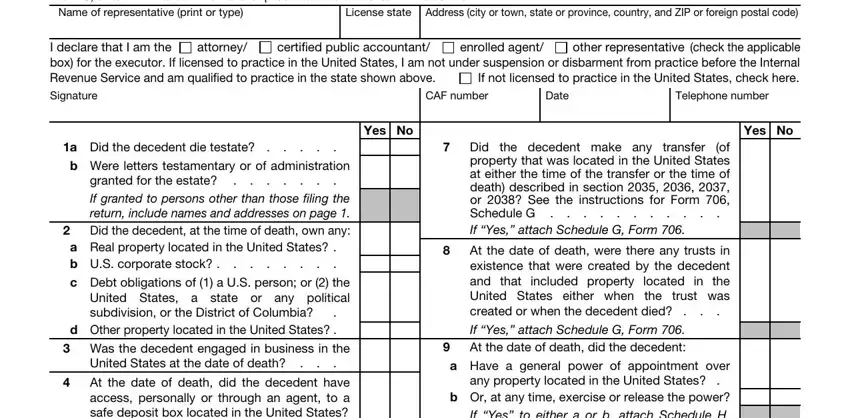

4. This part comes next with the next few fields to complete: Part III Authorization to receive, Name of representative print or, License state, Address city or town state or, I declare that I am the other, certified public accountant, enrolled agent, attorney, Signature, CAF number, Date, Telephone number, Yes No, Yes No, and a Did the decedent die testate.

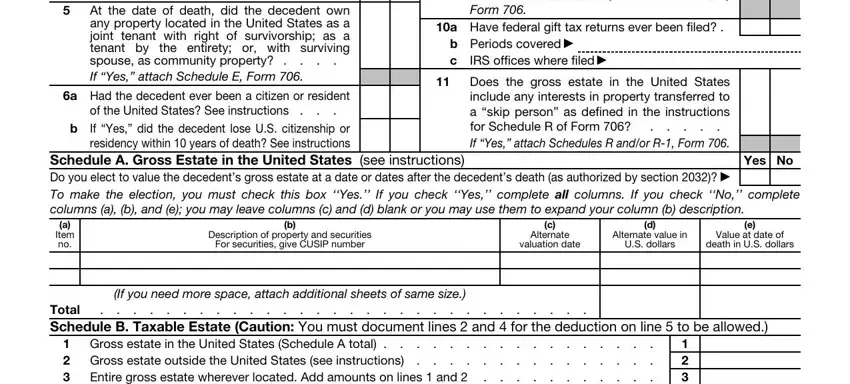

5. To finish your document, this final section involves several extra blank fields. Filling out At the date of death did the, a Had the decedent ever been a, of the United States See, b Or at any time exercise or, a Have federal gift tax returns, b Periods covered c IRS offices, Does the gross estate in the, Schedule A Gross Estate in the, Yes No, a Item no, Description of property and, For securities give CUSIP number, Alternate, valuation date, and Alternate value in should wrap up the process and you will be done in no time at all!

You can potentially make a mistake while completing the Alternate, for that reason make sure that you reread it before you decide to finalize the form.

Step 3: After you have reviewed the information entered, click on "Done" to finalize your document creation. Get the irs 706 na as soon as you subscribe to a 7-day free trial. Easily view the pdf form within your personal account page, along with any modifications and adjustments conveniently kept! With FormsPal, you can complete documents without worrying about information breaches or data entries getting shared. Our protected system makes sure that your private information is kept safe.